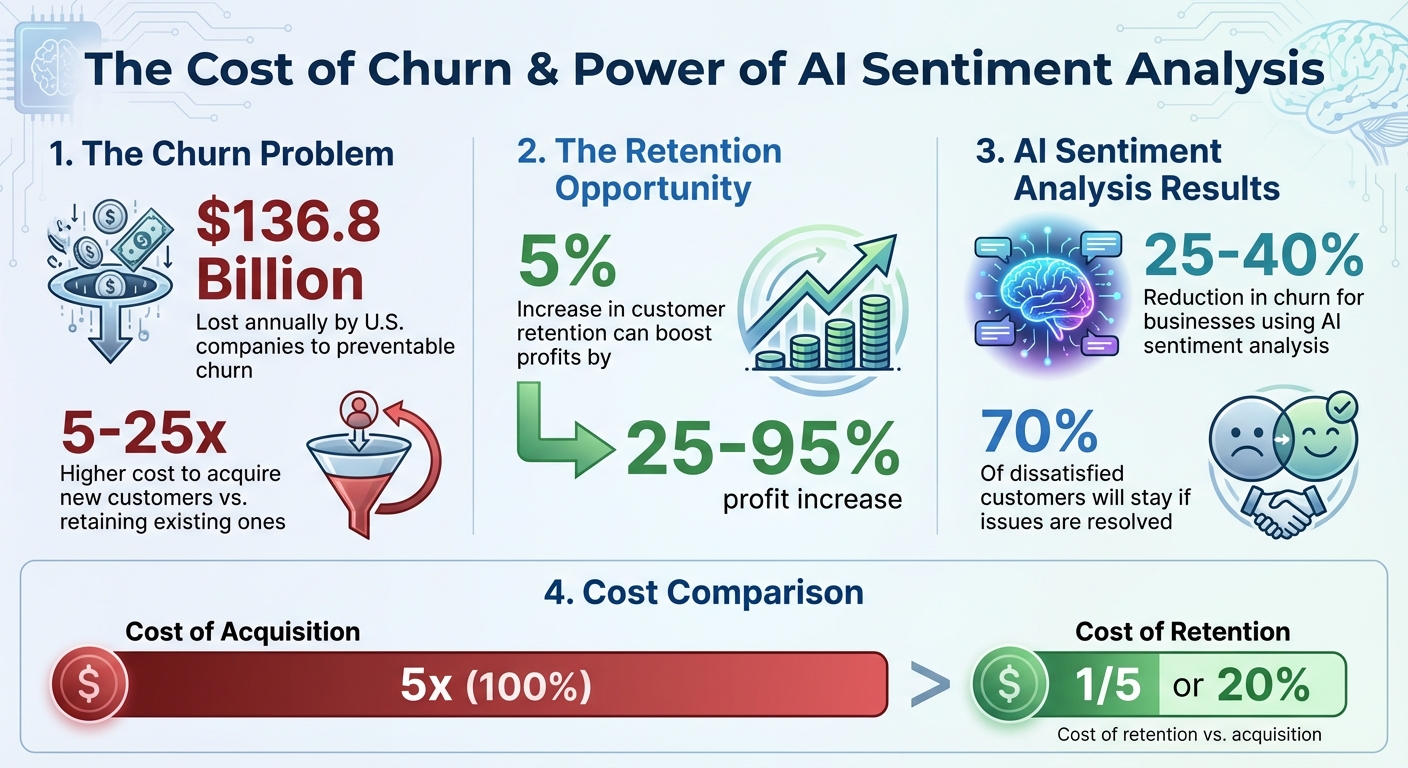

Losing customers is expensive. U.S. companies lose $136.8 billion annually to preventable churn, and acquiring new customers costs 5–25x more than keeping existing ones. For startups, even a small 5% boost in retention can drive profits up by 25–95%.

AI sentiment analysis helps predict churn early by analyzing customer feedback - emails, chat logs, social media posts - for emotional cues like frustration or dissatisfaction. Unlike traditional metrics like CSAT or NPS, it detects subtle shifts in tone weeks or months before a customer leaves. Businesses using these tools reduce churn by 25–40% and gain actionable insights to address problems proactively.

Here’s how it works:

- Gather customer feedback from all channels (emails, chats, reviews).

- Use sentiment analysis tools to classify tone (positive, negative, neutral).

- Combine sentiment scores with other data (usage trends, support history) for accurate churn prediction.

- Monitor and act on churn risks in real time.

AI Sentiment Analysis Impact on Customer Churn Reduction

What is Sentiment Analysis and How Does It Predict Churn?

Defining Sentiment Analysis

Sentiment analysis, also known as opinion mining or emotion AI, is a method that uses artificial intelligence to examine large amounts of text and determine the emotional tone behind it. Essentially, it enables computers to interpret human emotions. By analyzing language, the AI determines whether the tone is positive, negative, or neutral, providing a clearer understanding of how customers feel about your brand, product, or service.

Here’s how it works: the AI scans customer emails, support tickets, chat logs, social media posts, and reviews to identify attitudes and opinions. Instead of manually reviewing each piece of feedback, the system detects patterns in language that reveal satisfaction, frustration, or disappointment. This way, you gain insights not just into what customers are saying but also into the emotions driving their words.

By understanding these emotions, businesses can build a foundation for identifying and addressing churn risks early.

How Sentiment Analysis Identifies Early Churn Signals

When it comes to predicting churn, sentiment analysis offers a proactive approach by catching issues before they escalate. Metrics like CSAT (Customer Satisfaction Score) or NPS (Net Promoter Score) only provide snapshots of customer sentiment, often missing the bigger picture of how emotions evolve over time. Sentiment analysis, on the other hand, continuously tracks interactions across all channels in real time.

The AI excels at spotting subtle changes in tone that might otherwise slip through the cracks. For instance, a customer who previously wrote enthusiastic and friendly messages might shift to shorter, more formal communication. Their support tickets may begin to include words like "frustrated", "disappointed", or even hints that they’re "considering alternatives." These subtle changes are early warning signs that something isn’t right.

AI-powered tools analyze all customer interactions - not just the limited data from surveys - giving you a complete, real-time view of customer sentiment. This comprehensive perspective makes it easier to identify and address churn risks before they become major problems.

Why Startups Should Use Sentiment Analysis for Churn Prediction

Early Intervention and Retention

For startups operating on limited resources, keeping existing customers is far more cost-effective than trying to attract new ones. In fact, boosting customer retention by just 5% can significantly increase profits. Sentiment analysis offers a way to identify customers who might be on the verge of leaving - sometimes weeks or even months ahead of time. This gives your team a chance to step in and address their concerns before it's too late.

The value of acting early can't be overstated. Studies show that 70% of dissatisfied customers are willing to stay if their issues are resolved by customer service. By detecting shifts in sentiment before customers mentally check out, you create opportunities to fix problems, rebuild trust, and ultimately keep them engaged. This proactive approach not only improves retention but also strengthens your ability to make informed decisions through consistent monitoring.

Continuous Monitoring and Faster Decisions

Traditional surveys often fall short - they provide only a limited view and can be influenced by biases. Sentiment analysis, on the other hand, offers a continuous, real-time look into customer interactions. Whether it’s through support tickets, emails, social media, or chat logs, this method gives startups the ability to respond quickly to changes in customer behavior.

For startups, especially those with smaller teams, automation through sentiment analysis is a game changer. AI tools can process vast amounts of customer feedback without requiring a large workforce to sift through it manually. This means you get actionable insights in real time, helping you make quicker decisions about improving your product, prioritizing support efforts, and refining retention strategies. With your team freed up to focus on growth, you can adapt to customer needs and market shifts more efficiently.

Better Customer Understanding

Sentiment analysis doesn’t just help with early intervention or quick decision-making - it also reveals the deeper issues driving customer dissatisfaction. By analyzing language patterns across all customer interactions, you can pinpoint the exact problems that lead to churn. Whether it’s clunky workflows, slow response times, unclear instructions, or missing features, these pain points often surface in everyday conversations long before a customer decides to cancel.

When you understand why customers feel frustrated, you can make targeted improvements that truly matter. Instead of guessing which features to add or processes to streamline, you’ll have clear data highlighting what’s working and what’s causing friction. This sharper focus allows you to enhance the customer experience in meaningful ways, addressing the root causes of churn and creating a stronger foundation for long-term loyalty.

How to Implement Sentiment Analysis for Churn Prediction

Step 1: Gather and Organize Customer Feedback

Start by collecting customer feedback from every possible touchpoint: support tickets, emails, chat conversations, social media interactions, reviews, and surveys. The idea is to capture a wide range of customer sentiment, not just the opinions shared through formal surveys.

To make this data manageable, centralize it in one system. Tag each piece of feedback with relevant metadata, like customer ID, date, channel, and product. If you're a small startup with limited resources, even a well-organized spreadsheet can do the job for now.

Step 2: Use Sentiment Analysis Tools

Once your feedback is organized, it’s time to analyze it. Sentiment analysis tools classify feedback as positive, negative, or neutral. Some tools use lexicon-based methods, while others rely on machine learning, which is better at understanding context, sarcasm, and industry-specific language.

Choose tools that integrate seamlessly with your current systems, like your CRM, support platform, or communication tools. This integration allows sentiment analysis to run automatically in the background, identifying concerning patterns without requiring constant manual input.

Step 3: Combine Sentiment Data with Predictive Models

Next, bring all your data together. Combine sentiment scores with other customer data, such as demographics, purchase history, product usage, support interactions, and engagement metrics. This creates a more complete picture for a churn prediction model.

For example, if a customer shows declining sentiment, reduced product usage, and low email engagement, it’s a strong indicator of churn risk. By merging these data points, predictive models can uncover trends that might go unnoticed through manual analysis, leading to more accurate predictions.

Step 4: Deploy and Improve the Model

Now, put your model to work. Use it to monitor customer behavior in real time and flag high-risk individuals. Automate alerts for drops in sentiment or overlapping risk factors so your team can take quick action.

After deployment, regularly check the model’s accuracy by comparing predictions to actual churn outcomes. Use A/B testing to refine how you respond to flagged risks. Consistent updates ensure the model stays aligned with shifting customer behaviors and market trends, helping you reduce churn and optimize service costs over time.

sbb-itb-17e8ec9

How Lucid Financials Supports Churn Prediction Strategies

Real-Time Financial Impact Analysis

After identifying customers at risk of leaving through sentiment analysis, the next step is figuring out how their potential departure could impact your company's finances. This is where Lucid Financials steps in, offering real-time insights into vital metrics like cash flow and runway. Forget about waiting for end-of-month reports - Lucid’s dynamic dashboards provide up-to-the-minute updates, so you can keep a close eye on your startup's financial health. This immediacy lets you act swiftly when changes in customer behavior start affecting your revenue.

Seamless Financial Updates via Slack

Lucid Financials makes tracking financial data even easier by integrating directly with Slack. This means your team can access critical financial updates without hopping between tools. Simply ask Lucid’s AI assistant for updates on key metrics like runway or overall performance, and you’ll get the answers you need right in Slack. This integration keeps your team nimble, enabling quick adjustments to retention strategies, smooth collaboration with finance, and smarter decision-making - all without missing a beat.

How to Use AI for Sentiment & Predictive Analysis in Customer Support Tickets (Step-by-Step Guide)

Conclusion

Churn poses a serious threat to your startup’s revenue and growth. In fact, U.S. companies lose a staggering $136.8 billion every year to avoidable churn, while retaining a customer costs just a fraction - about one-fifth - of what it takes to acquire a new one. This is where AI-driven sentiment analysis steps in, offering a modern alternative to outdated surveys and reactive strategies. By analyzing customer interactions, purchase histories, and even social media activity, it helps identify churn risks before they turn into actual losses.

Consider this: improving customer retention by just 5% can increase profits by 25–95%. To tackle churn effectively, startups need more than just predictions - they need to understand the financial implications of losing a customer. Connecting customer sentiment with real-time financial data empowers businesses to take proactive measures before churn eats into their revenue.

The combination of sentiment analysis and real-time financial tracking is a game-changer. Tools like Lucid Financials provide instant access to key metrics such as Annual Recurring Revenue (ARR) and Net Revenue Retention (NRR). With Slack integration, your team can monitor how shifts in customer behavior impact your bottom line in real time, allowing you to fine-tune retention strategies when it matters most.

FAQs

What makes AI-powered sentiment analysis different from traditional customer satisfaction methods?

AI-powered sentiment analysis leverages advanced natural language processing (NLP) to interpret unstructured text - think customer reviews, social media updates, or chat messages. It goes beyond simply categorizing emotions as positive, negative, or neutral. These systems can even pick up on subtleties like sarcasm, all in real time and on a large scale.

On the other hand, traditional methods for gauging customer satisfaction often depend on structured tools like surveys or rating systems. While these can be useful, they tend to be slower, narrower in focus, and susceptible to biases from respondents. Sentiment analysis dives deeper by examining real customer conversations and feedback, giving businesses the ability to make quicker, more informed decisions.

What types of customer feedback work best for AI sentiment analysis in predicting churn?

The best insights for AI-driven sentiment analysis come from unstructured, text-based sources that reveal genuine customer emotions and motivations. Open-ended survey responses, product reviews, support tickets, and live-chat transcripts are especially useful because they showcase the customer’s authentic voice within real-life contexts.

For startups, focusing on high-volume, direct-to-customer channels is key. Here are some valuable sources to prioritize:

- Product reviews: These often shed light on specific likes, dislikes, and pain points - critical for spotting potential churn risks.

- Support tickets and help-desk logs: Complaints and escalation patterns can uncover dissatisfaction trends.

- Survey comments: Open-ended feedback provides context and depth that simple numerical scores can’t offer.

- Chat and messaging transcripts: Real-time conversations often reveal shifts in tone or urgency, signaling frustration or unmet needs.

By applying AI to these rich text sources, startups can detect early warning signs, address issues proactively, and refine their strategies to retain more customers.

How can startups use sentiment analysis to predict churn and improve retention?

Startups can take advantage of AI-driven sentiment analysis by examining customer interactions, including support tickets, chat logs, emails, and social media mentions. These tools analyze the data to assign scores (e.g., -1 to +1) and emotion tags, which can then be stored in a CRM or data warehouse. This information provides valuable insights into how customers feel about your product or service.

You can integrate these insights directly into your workflows. For instance, set up alerts in platforms like Slack to notify your team whenever negative sentiment is detected. This allows your team to respond quickly and address customer concerns. Lucid Financials even offers a Slack integration that seamlessly combines sentiment alerts with financial updates, making it easier to act on data without interrupting daily operations.

When paired with other metrics, such as purchase history or product usage, sentiment data can strengthen churn prediction models. Automating feedback loops - like logging resolved issues - ensures the system keeps learning and improving. This approach helps retain customers and supports business growth.