When your startup grows, your accounting software needs to keep up. Scalable solutions help manage increasing transactions, automate tasks, and handle complexities like multi-entity operations or compliance. Choosing the right software early saves time, money, and headaches later.

Key Features to Look For:

- Real-Time Integrations: Sync with banking, payroll, and communication tools like Slack for instant updates.

- Automated Financial Reporting: Generate profit/loss statements, cash flow tracking, and investor-ready reports effortlessly.

- Multi-Entity & Multi-Currency Support: Manage global operations and subsidiaries with ease.

- Cloud-Based Architecture: Access secure, scalable systems from anywhere with automatic updates.

- Compliance Tools: Ensure U.S. GAAP alignment, audit readiness, and tax automation.

Why It Matters:

The right platform, such as Lucid Financials (starting at $150/month), combines AI-driven automation with expert support, offering faster bookkeeping, tax services, and CFO insights. This ensures your startup scales smoothly without disruptions.

Pro Tip: Evaluate scalability, API quality, and support options to choose a system that grows with your business. Avoid costly migrations by planning ahead.

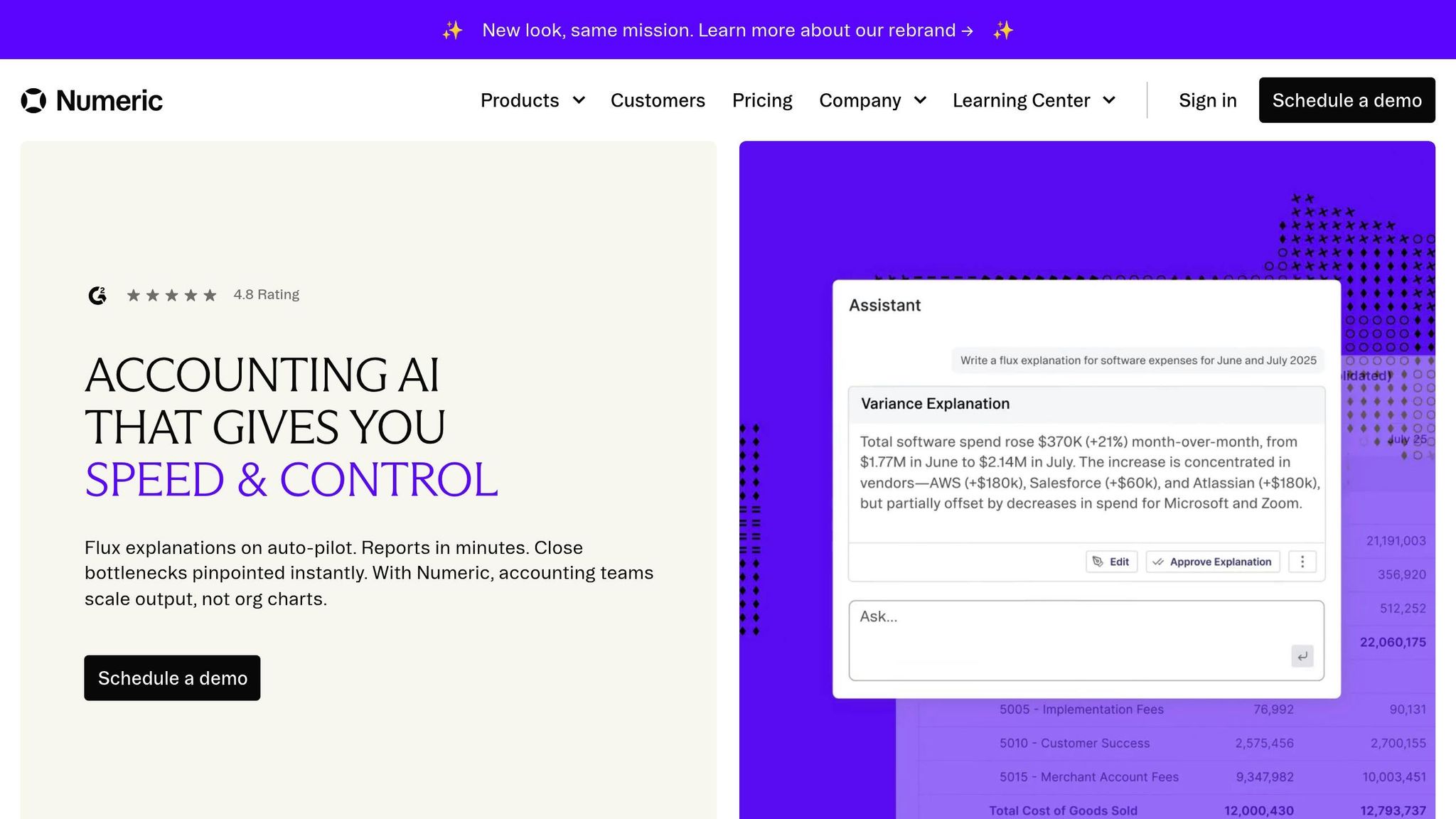

Numeric CTO Andrew Bihl: Building AI-Powered Accounting Automation

Key Features of Scalable Accounting Software

The right accounting software is essential for supporting growth. These features ensure your system can keep up as your business evolves.

Real-Time Integrations with Business Tools

To keep your operations running smoothly, your accounting software should integrate effortlessly with your everyday tools. For example, banking integrations can automatically import transactions, reducing manual entry and minimizing errors. With direct bank feeds, you get an instant view of your cash flow and spending.

Payroll integrations are another must-have, simplifying payroll processes and ensuring accuracy as your team grows. Additionally, communication platform integrations can boost efficiency. A great example is Lucid Financials, which connects directly with Slack. This allows founders to access real-time financial updates without juggling multiple apps. You can check metrics like burn rate, runway, or monthly recurring revenue right from your team chat.

These integrations are the backbone of automated, real-time financial insights that make managing your finances easier.

Automated Financial Reporting Features

As your transaction volume grows, manual reporting becomes a time sink. Automated financial reporting features solve this problem. With real-time profit and loss statements, you gain instant insight into your financial health, while automated cash flow tracking keeps tabs on critical metrics like burn rate and runway.

In fact, modern platforms can cut bookkeeping time by up to 75% through automation. Customizable dashboards let you focus on the metrics that matter most to your business, whether it’s customer acquisition costs, monthly recurring revenue, or gross margins.

For startups, the ability to create investor-ready reports on demand is a game-changer. Whether you're preparing for a board meeting or a fundraising round, automated reporting ensures your financial data is always up-to-date and professionally formatted - no more last-minute scrambling.

"With Lucid, managing bookkeeping, taxes, and claiming tax credits is effortless. The platform saves us hours every month, and their expert team makes sure nothing slips through the cracks."

– Refael Shamir, Founder and CEO @Letos

Scalable software also needs to handle more complex demands, like supporting multiple entities and currencies.

Multi-Entity and Multi-Currency Support

As your business grows, you might operate across multiple legal entities or serve customers worldwide. Multi-entity support helps consolidate data from different entities, while multi-currency functionality automatically handles conversions, ensuring accurate financial reporting.

Unified dashboards bring all this data together in one place, making it easier to manage your finances. These capabilities are crucial for startups eyeing international expansion or managing multiple subsidiaries. They provide the infrastructure needed to scale efficiently without requiring a complete overhaul of your systems.

Assessing Scalability and Performance

When choosing accounting software, it’s crucial to ensure it can keep up as your business grows. The ideal platform should manage increasing complexity without breaking down or forcing you into costly migrations later. Scalability and performance are just as important as the core features we’ve already discussed.

Handling Increased Transaction Volumes

As your startup grows, so will the number of transactions you process. What starts as a few hundred monthly transactions can quickly escalate to thousands. Your accounting software needs a robust database and sufficient processing power to handle this growth seamlessly.

Features like batch processing and automated workflows are key to maintaining performance during high transaction loads. These tools help avoid bottlenecks when managing large volumes of data. Additionally, multi-user access is essential so your expanding team can work efficiently without system slowdowns.

For example, modern platforms like Lucid Financials use AI-driven automation to speed up financial management tasks. This efficiency becomes critical as transaction volumes increase, ensuring your operations don’t grind to a halt.

Before committing to a platform, ask vendors about their uptime history, error rates, and how they handle complex tasks like consolidations or multi-currency transactions. Case studies from businesses similar to yours can offer valuable insights into how the software performs under pressure. Strong system architecture is another non-negotiable requirement for smooth scaling.

Cloud-Based Architecture Benefits

Cloud-based accounting solutions provide a range of advantages for growing startups. Unlike traditional desktop systems, cloud platforms offer automatic updates, remote access, and elastic resource allocation. This means your system can scale up or down based on demand without manual intervention or downtime.

Cloud systems also make it easy to add users, expand storage, and access new features instantly. They support real-time collaboration, enabling your team to work together seamlessly, whether in the same office or across the globe - a must-have for modern startups.

Security is another strong point of cloud-based platforms. Top providers offer advanced encryption, regular security updates, and certifications like SOC 2 to keep your data safe and accessible to authorized users at all times.

Additionally, cloud solutions integrate smoothly with other business tools, reducing manual data entry and enabling workflows that adapt as your business evolves. This creates a streamlined, error-free financial management system that grows with you.

Startup-Focused Features and Quick Setup

Startups need accounting software that can hit the ground running and deliver results fast. Look for platforms built with startup growth in mind, offering rapid deployment and immediate impact. For instance, Lucid Financials promises clean books within seven days, demonstrating the speed modern startups demand.

An intuitive interface with customizable dashboards can make a big difference. It minimizes training time and lets you focus on key metrics like burn rate, runway, monthly recurring revenue, and customer acquisition costs.

Your software should also be flexible enough to adapt to changes, whether it’s a new business model, funding round, or international expansion. The ability to handle shifts in entity structure or revenue streams without requiring a system overhaul is critical.

"Tracking finances used to be overwhelming. With Lucid handling bookkeeping, taxes, and CFO support in one place, everything is organized, automated, and easy to manage. It's given me real peace of mind."

– Erez Lugashi, Founder and CEO @Abilisense

Automation should grow with your needs, too. While basic features like expense categorization and invoice generation are a good start, the platform should also offer advanced capabilities like bank reconciliation, recurring billing, and financial reporting as your operations become more complex. This reduces manual errors and frees up your team to focus on scaling the business.

Finally, consider pricing. Models like pay-per-user or modular pricing allow you to add features and users as needed, so you’re only paying for what your business requires at each stage of growth.

sbb-itb-17e8ec9

Customization and Integration Options

Tailor your accounting software to grow with your business, whether you're a small team or a multi-department operation. The right tools should not only scale with your needs but also adapt seamlessly to keep your financial processes efficient as your startup evolves.

Integration with Communication Platforms

Integrating your accounting software with platforms like Slack can simplify how financial updates are shared and acted upon. By connecting your financial data directly to your team's main communication hub, you eliminate the back-and-forth of switching between apps to find answers.

With real-time financial updates delivered via Slack, decision-making becomes quicker, and collaboration between founders, finance teams, and external advisors improves. No more waiting for weekly reports or scheduling meetings to review cash flow - team members can get instant notifications about key transactions, overdue invoices, or budget alerts right in their workflow.

Take Lucid Financials as an example. Their Slack integration lets founders receive instant updates on critical transactions and answers to financial questions. Alerts about large transactions or unusual spending patterns are sent directly to the relevant team members, ensuring swift action when it matters most. This proactive approach helps startups stay on top of cash flow, track expenses, and quickly address anomalies, minimizing the risk of financial oversights.

Flexible Features for Changing Needs

Great accounting software combines ready-to-use functionality with the ability to adapt as your business changes. Whether you're pivoting from B2C to B2B, expanding into new markets, or introducing new revenue streams, your software should evolve with you.

Customizable dashboards and modular features make it easy to track the metrics that matter most to your business. As you grow, you can add capabilities like payroll management or multi-entity reporting without overhauling your entire system. This flexibility allows you to create workflows and views that align with your priorities - without requiring a complex setup.

For example, as your team expands, simple expense approvals may need to shift into multi-level authorization workflows. Your accounting software should handle these changes smoothly, saving you from rebuilding your financial management processes from scratch.

"Lucid turned our bookkeeping and taxes from a headache into a simple, reliable process. Their CFO insights give us clarity to plan growth with confidence - it feels like having a full finance team on demand."

– Aviv Farhi, Founder and CEO @Showcase

API Quality and Documentation

Strong API capabilities are essential for integrating your accounting software with other tools as your startup scales. Whether it's connecting to CRM platforms, payroll systems, inventory management tools, or business intelligence software, a robust API ensures these integrations are efficient and cost-effective.

Look for APIs that are RESTful and support secure authentication methods like OAuth 2.0. Good documentation is key - it should include clear explanations, code samples, and practical use cases to make implementation straightforward for developers. Platforms with active developer communities and regular updates signal a commitment to maintaining and improving integration capabilities.

Webhooks and event-driven integrations are especially useful for real-time data synchronization. These features allow your accounting software to automatically update other systems when transactions occur, eliminating manual data entry and reducing errors. For instance, when a new invoice is created, the system can automatically update your CRM and trigger follow-up workflows.

Also, prioritize platforms that offer versioning policies and backward compatibility. This ensures your integrations remain functional as the software evolves. Clear migration paths and advance notice of API updates help you avoid disruptions, so your custom setups stay intact as your business grows.

Investing in quality APIs gives you the freedom to choose the best tools for each aspect of your business while keeping your financial data centralized and accurate. You're not locked into a single vendor's ecosystem, which means you can adapt and thrive as your needs change.

Setup, Support, and Compliance Requirements

When choosing scalable accounting software, it’s not just about handling large volumes of data - setup, support, and compliance are equally critical. The ideal platform should be easy to implement, offer dependable support, and meet strict compliance standards. You want software that gets up and running quickly without needing a full IT team, letting you focus on growing your business rather than troubleshooting financial tools.

Onboarding and Data Migration Process

Getting started with new accounting software should be fast and straightforward. Look for platforms that simplify migration through automated tools and access to specialists who manage the technical side while you stay focused on your company’s operations.

One key aspect is ensuring the accuracy of your data during the migration. Financial records, transaction histories, and audit trails must transfer correctly to avoid compliance risks or errors in reporting. The best platforms offer trial migrations with a small data set, so you can verify everything is accurate before fully transitioning to the new system.

Security is another priority. Make sure the platform uses advanced encryption and secure cloud transfer methods to protect your financial information. For example, some platforms rely on enterprise-grade infrastructure like Microsoft Azure to ensure data safety during migration.

An example worth noting is Lucid Financials. They promise clean books within a week by combining AI-driven automation with human expertise, ensuring a smooth and accurate migration. This speed is especially helpful for startups that can’t afford prolonged downtime.

To double-check everything, consider running your old and new systems in parallel for a short period. This allows you to compare data, conduct sample audits, and address any discrepancies before fully committing. Scheduling migrations during quieter business periods and involving both IT and finance teams can also help ensure a seamless transition.

A smooth onboarding process sets the stage for reliable support and compliance down the road.

Expert Support Availability

High-quality support is a blend of AI and human expertise. AI can handle routine questions - like how to categorize transactions or generate reports - while certified accountants and financial advisors tackle more complex issues, such as regulatory compliance or strategic financial planning.

When evaluating support, pay attention to service level agreements (SLAs). These outline response times, resolution rates, and whether you’ll have access to dedicated account managers. During trial periods, test the support channels and check customer reviews for insights into the quality of service.

"It feels like having a full finance team on demand." – Aviv Farhi, Founder and CEO @Showcase

"The platform saves us hours every month, and their expert team makes sure nothing slips through the cracks." – Refael Shamir, Founder and CEO @Letos

Lucid Financials stands out here, offering real-time support via Slack integration alongside access to seasoned financial professionals. Their services extend beyond basic troubleshooting, providing CFO-level insights for budgeting, cash flow management, and growth strategies.

Additionally, platforms with robust knowledge bases and active user communities empower your team to solve common issues independently while ensuring expert help is available when needed. Strong support systems also play a direct role in maintaining compliance.

U.S. Regulatory Compliance

Accounting software must adhere to U.S. GAAP (Generally Accepted Accounting Principles) and federal and state tax regulations while keeping you audit-ready at all times.

Look for features like detailed audit trails, role-based access controls, version tracking for financial documents, and automated backups. These tools ensure every transaction is traceable, and supporting documentation is always accessible for auditors, investors, or regulatory reviews.

Tax compliance is another critical area. The best platforms provide regular updates to reflect changing tax codes, automate tax form generation, and include checklists to help you stay on top of regulations. Alerts for tax law updates and access to compliance experts who understand startup-specific challenges are also valuable.

Audit readiness shouldn’t be an afterthought. Choose software that offers comprehensive audit logs, compliance dashboards, and automated checks to reduce the workload on your team. Features like secure document storage and detailed transaction histories ensure you’re always prepared for audits or investor scrutiny.

"Lucid's CFO services give us the visibility we need, while their bookkeeping and tax support keep everything accurate and stress-free. It's been a game-changer for our operations." – Luka Mutinda, Founder and CEO @Dukapaq

Lucid Financials excels in this area, handling tax filings, offering founder-specific tax advice, and helping startups maximize R&D tax credits. Their platform also adheres to SOC 2 compliance standards, ensuring strict data security and regulatory alignment.

Data protection is equally important. Make sure your platform uses encrypted storage and transmission methods and provides clear documentation of its security protocols. This is essential for safeguarding sensitive financial information and preparing for investor due diligence.

With the right accounting software, compliance becomes part of your daily workflow rather than an added burden. Built-in regulatory features allow you to focus on driving growth while maintaining the financial discipline that investors and auditors expect.

Conclusion: Choosing the Right Scalable Accounting Software

Picking the right accounting software can be a game-changer when it comes to managing growth. As your business expands - whether it’s juggling multiple entities, handling various currencies, or preparing investor reports - a scalable solution is essential.

We’ve covered the must-have features: real-time integrations, automated reporting, multi-entity support, cloud-based architecture, and strong compliance tools. Together, these elements create a system that evolves alongside your business, ensuring smooth operations and accurate financial management.

The ability to integrate seamlessly with your existing tools and process higher transaction volumes without performance hiccups is crucial. These features not only improve efficiency but also ensure accuracy as your business scales.

Compliance becomes even more important as your startup grows. Staying aligned with U.S. GAAP, automating tax forms, and keeping audit-ready documentation aren’t just about meeting regulatory requirements - they also help build trust with investors. Features like these can even simplify complex tasks, such as managing R&D tax credits.

Take Lucid Financials, for example. Starting at $150 per month, their AI-powered platform goes beyond bookkeeping. It offers tax services, CFO support, and real-time financial insights through Slack integration. Promising clean books in just seven days and always-on investor-ready reporting, Lucid addresses two major pain points for growing startups: speed and preparedness.

"As we scaled, budgeting and cash flow became critical. Lucid's CFO services give us the visibility we need, while their bookkeeping and tax support keep everything accurate and stress-free. It's been a game-changer for our operations." – Luka Mutinda, Founder and CEO @Dukapaq

This example highlights how modern, AI-driven platforms can turn financial management into a strategic advantage. By keeping your books up to date, automating compliance, and ensuring investor-ready reporting, the right software frees you to focus on growing your business. Choose a platform that not only meets your current needs but anticipates where your startup is headed.

FAQs

What are the advantages of using cloud-based accounting software for a growing startup?

Cloud-based accounting software offers a smart way for startups to handle their finances with ease and convenience. With real-time access to financial data from anywhere, it eliminates the hassle of manual updates and keeps everything at your fingertips.

By automating essential tasks like bookkeeping, budgeting, and cash flow management, it not only saves time but also minimizes errors. This means your financial records stay accurate and up-to-date - exactly what you need when preparing for investors. It’s a practical solution that lets you focus on growing your business while leaving the numbers in good hands.

Why is multi-entity and multi-currency support important for startups expanding internationally?

For startups operating internationally, managing finances across different countries and currencies can quickly become a challenge. That’s where multi-entity and multi-currency support steps in to make life easier. This functionality allows you to consolidate financial data from various locations while staying compliant with local regulations and tax laws - a must for any growing global business.

On top of that, multi-currency support streamlines handling transactions in different currencies. By reducing the need for manual conversions, it helps cut down on errors and ensures your financial reports are accurate. This clarity not only saves time but also empowers you to make smarter, faster decisions as your startup expands its reach across borders.

How can I ensure a seamless migration to new accounting software?

To make switching to new accounting software hassle-free, begin by taking a close look at your current financial data and workflows. Pinpoint the essential features you’ll need - like ease of use, integration options, and the ability to grow with your business.

Before diving in, back up all your financial records and tidy up any outdated or incorrect information. This step ensures you’re starting off with clean, accurate data. When you’re ready to set up the new software, test it first with a small sample of data to confirm everything works as expected before committing to a full migration.

For those considering Lucid Financials, the platform streamlines this process with its user-friendly design and expert support team. Its AI-driven tools and real-time integration capabilities mean you can have organized, investor-ready financials in just seven days. This allows you to focus on scaling your business while leaving the number-crunching to the experts.