AI is transforming how businesses manage Customer Acquisition Cost (CAC). Instead of relying on outdated spreadsheets or delayed insights, companies can now use AI for real-time data, predictive analytics, and automated optimization. Here’s what you need to know:

- CAC Basics: CAC is the total cost to acquire a new customer, calculated as total spend divided by new customers. Mismanaging CAC can hurt profitability, especially for startups.

- AI’s Role: AI provides real-time metrics, predictive analytics, and improved attribution models, helping businesses make faster, smarter decisions.

- Key Technologies:

- Predictive analytics: Scores leads and identifies the best channels.

- AI chatbots: Qualify leads and engage customers 24/7.

- Real-time reporting: Tracks CAC instantly and forecasts trends.

- Benefits: AI reduces costs, improves marketing efficiency, and provides actionable insights for better resource allocation.

- Metrics to Track: Focus on CAC payback period and LTV:CAC ratio to measure efficiency and long-term profitability.

- Example Solution: Platforms like Lucid Financials automate CAC tracking, provide predictive modeling, and ensure accurate financial records.

AI-powered CAC management is helping businesses cut costs, improve ROI, and scale effectively by offering smarter tools and faster insights. It’s a game-changer for startups aiming to grow sustainably.

The AI creative trick that will slash your customer acquisition cost by 46% - and when NOT to use it

AI Technologies That Improve CAC

AI-driven customer acquisition cost (CAC) management hinges on three key technologies that work together to reduce expenses and increase conversion rates. These tools create a streamlined system that helps businesses make smarter decisions while staying cost-efficient.

Predictive Analytics for Lead Scoring and Channel Optimization

Predictive analytics leverages machine learning to sift through historical customer data, uncovering patterns that highlight which leads are most likely to convert. Instead of treating all leads the same, AI assigns scores based on factors like demographics, behavior, and engagement levels.

These scoring algorithms analyze a wide range of data points. For instance, they might reveal that leads from specific regions, particular industries, or those interacting with certain types of content are more likely to become customers. This allows sales teams to focus their efforts on high-priority leads, while automated systems nurture lower-priority ones until they’re ready for direct outreach.

The benefits don’t stop there. Predictive analytics also shines in channel optimization. AI evaluates performance across various marketing channels - like social media, email campaigns, paid ads, and referral programs - to identify which ones yield the best results for different customer segments. Instead of evenly spreading the marketing budget, businesses can concentrate resources on high-performing channels that deliver quality leads at a lower cost.

These machine learning models improve over time. For example, a B2B software company might learn that advertising in niche industry publications leads to better long-term customers than running LinkedIn ads. AI also provides advanced attribution modeling, helping businesses better understand complex customer journeys and refine their CAC calculations.

Next, let’s see how chatbots elevate customer engagement.

AI Chatbots for Customer Engagement

AI-powered chatbots have come a long way from basic automated replies. Today’s chatbots use natural language processing to hold meaningful conversations, qualify leads, and guide prospects through the early sales stages - all without human involvement.

These chatbots ask targeted questions to assess visitor needs, qualify leads, and route promising prospects to sales teams while filtering out less valuable interactions. This ensures sales teams spend their time on leads with the highest potential to convert.

One standout feature is their ability to operate 24/7. This means businesses can capture leads outside regular working hours, tapping into international traffic or after-hours visitors that human representatives might miss. Many startups find that a significant share of their qualified leads comes from these off-hours engagements.

Personalization is another game-changer. Chatbots tailor their conversations based on visitor behavior, referral sources, or past interactions. For example, someone landing on a pricing blog might receive different messaging than someone arriving via a social media ad. Advanced chatbots also integrate seamlessly with customer relationship management (CRM) tools, ensuring that conversation history is retained. When a handoff to a human agent is needed, the transition is smooth, creating a better experience for the customer and helping reduce acquisition costs.

At the same time, real-time reporting tools ensure every campaign adjustment is backed by data.

Real-Time Reporting and Forecasting

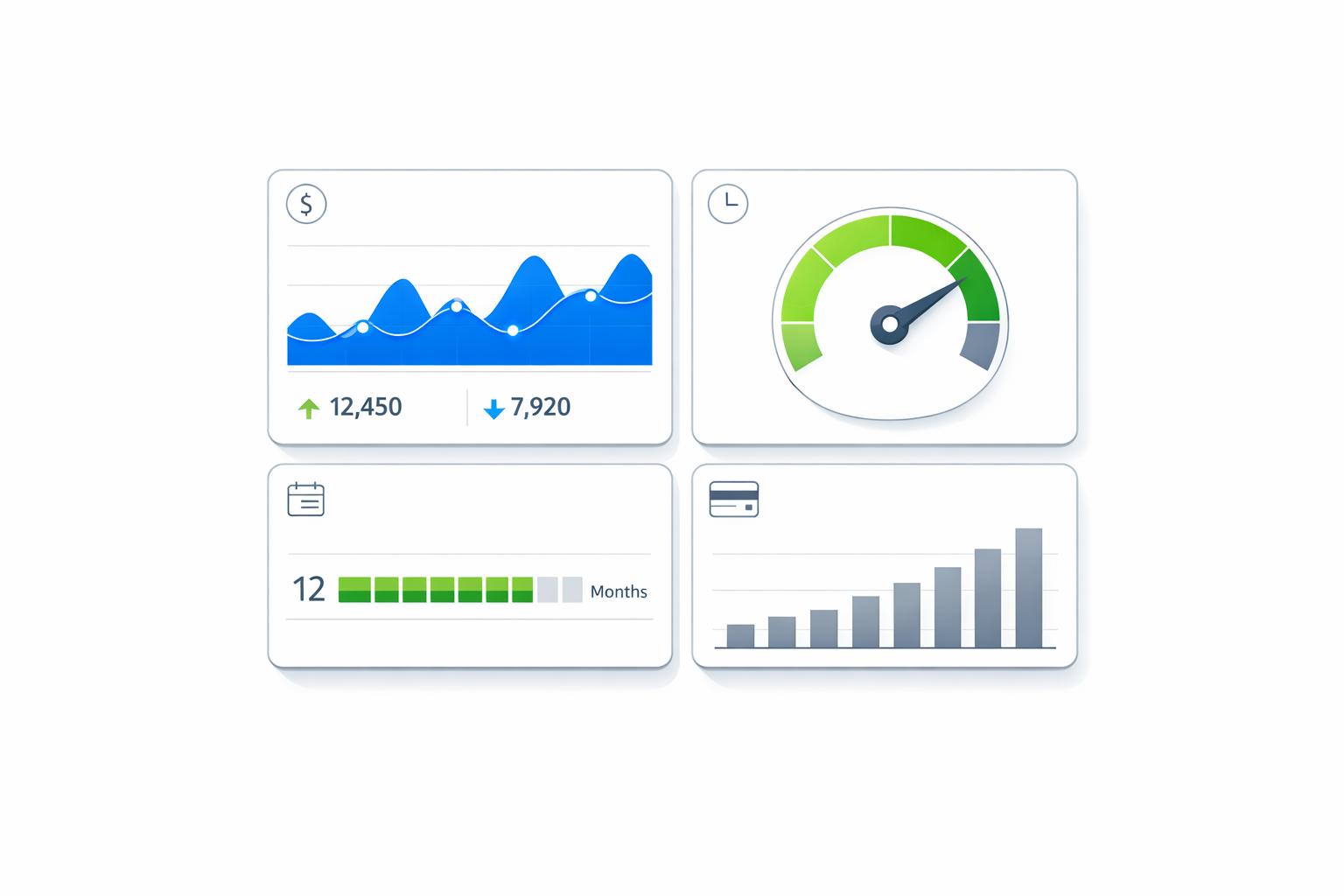

Traditional CAC reporting often involves manual data collection from multiple sources, which can delay insights and hinder decision-making. AI-powered reporting systems solve this by automatically pulling data from all acquisition channels, providing real-time insights that enable quick optimizations.

These systems integrate data from marketing platforms, sales tools, customer support software, and financial systems, offering a complete view of acquisition costs. Real-time monitoring allows teams to pause underperforming campaigns or scale successful ones instantly.

Predictive forecasting adds another layer of value. By analyzing past and current data, AI can estimate future CAC trends. For example, it can predict how seasonal changes, market shifts, or competitor actions might affect acquisition costs. This helps businesses plan budgets more effectively and adjust strategies ahead of time.

Anomaly detection is another powerful feature. If CAC unexpectedly spikes on a particular channel or conversion rates drop, the system flags these changes, allowing teams to respond quickly. Real-time reporting also enables dynamic budget allocation, where AI redistributes resources to better-performing channels, further reducing costs and improving returns.

Together, these three AI technologies create a robust CAC management system that learns and adapts over time. For startups with limited budgets, these tools are essential for staying competitive and achieving growth.

AI Methods to Lower Customer Acquisition Costs

Leveraging AI technologies can significantly reduce customer acquisition costs while maintaining the quality of customers brought in. Here's how AI-driven strategies can help streamline and optimize your efforts.

Using Product-Led Growth

Product-led growth (PLG) shifts the focus from traditional sales tactics to letting the product itself attract and convert customers. AI plays a key role in personalizing this experience and automating the user journey from trial to conversion.

Smart onboarding sequences utilize AI to analyze user behavior and tailor the experience to individual needs. For instance, a marketing manager might be shown campaign analytics, while a developer might see API documentation. This level of customization ensures users quickly see the product's value in a way that resonates with their goals.

Freemium optimization uses machine learning to identify the "aha moments" - those points when users are most engaged. AI triggers personalized upgrade prompts during these moments, avoiding generic, poorly timed messages and increasing the likelihood of conversion.

Self-service automation minimizes the need for manual sales interactions by offering AI-powered help systems. These systems can answer common questions, guide users through setup, and troubleshoot issues, all of which reduce acquisition costs while improving the user experience.

Additionally, satisfied users often become advocates for your product. AI can identify engaged customers and prompt them to leave reviews, refer others, or participate in case studies, fueling organic growth.

Improving Marketing and Advertising Spend

AI takes the guesswork out of marketing by enabling precise targeting and efficient budget allocation. Instead of spreading resources thin, AI helps identify the most effective channels and strategies.

Campaign performance analysis happens in real time, with AI tracking metrics like click-through rates, conversion rates, and cost per acquisition. If a campaign underperforms - say, on Facebook - AI can automatically pause it and reallocate the budget to better-performing platforms like Google Ads or LinkedIn, often within hours.

Audience segmentation becomes highly precise with machine learning. AI can analyze vast amounts of data to create micro-segments within your audience. For example, one group might respond better to technical blogs, while another prefers video testimonials. This precision reduces wasted ad spend and improves conversion rates.

Dynamic bidding strategies allow AI to adjust ad bids in real time based on the likelihood of conversion. It increases bids for high-value prospects during peak engagement times and lowers them for less promising traffic, ensuring optimal use of your advertising budget.

Attribution modeling powered by AI tracks the full customer journey across multiple touchpoints. Unlike traditional last-click attribution, AI reveals how various interactions contribute to conversions - for instance, showing how a podcast ad might set the stage for an email campaign that ultimately drives a sale.

These AI-driven adjustments make marketing spend more efficient and measurable, delivering better results over time.

Tracking Key Metrics: CAC Payback Period and LTV:CAC Ratio

Managing customer acquisition costs effectively requires tracking the right metrics, and AI makes this process both seamless and actionable. Two key metrics to focus on are the CAC payback period and the lifetime value to CAC ratio (LTV:CAC).

CAC payback period measures how quickly you recover your acquisition investment. AI calculates this by comparing acquisition costs to monthly recurring revenue per customer. A shorter payback period indicates efficiency, and AI can alert you if recovery times start to increase, signaling rising costs or declining value.

LTV:CAC ratio highlights the profitability of your acquisition efforts. A strong ratio means customers generate significantly more revenue over their lifetime than it costs to acquire them. AI tracks this ratio across different customer segments, channels, and time periods, helping you identify which strategies yield the best long-term returns.

| Metric | Healthy Indicator | What It Tells You | AI Advantage |

|---|---|---|---|

| CAC Payback Period | Shorter period is better | Speed of investment recovery | Real-time alerts for extended payback times |

| LTV:CAC Ratio | Higher ratio is ideal | Long-term profitability and efficiency | Granular analysis and predictive insights |

Cohort analysis powered by AI uncovers trends in customer behavior over time. For example, customers acquired through content marketing may show a different value trajectory than those gained via paid ads. These insights help balance short-term revenue needs with long-term growth.

Predictive modeling takes this a step further by forecasting future trends. AI can identify customers at risk of churning, enabling you to adjust retention strategies. It can also simulate the impact of pricing changes, new product features, or market shifts on both CAC and LTV, offering critical insights for fine-tuning strategies.

AI-powered dashboards consolidate data from tools like CRMs, payment processors, and marketing platforms, providing real-time insights. This allows for quick adjustments and ensures sustained growth and efficiency.

sbb-itb-17e8ec9

How Lucid Financials Makes CAC Management Easier

Managing customer acquisition costs (CAC) can be a tricky balancing act, especially for fast-growing startups. Lucid Financials simplifies this process by combining AI-driven automation with expert financial guidance, creating a solid foundation for businesses to track, analyze, and refine their CAC strategies. This approach ensures startups have the financial clarity needed to scale efficiently.

Traditional methods often lead to delays in financial insights, making it harder to optimize CAC in real-time. Lucid Financials addresses this challenge with a unified platform that delivers accurate, timely financial insights using advanced reporting tools.

Real-Time CAC Tracking and Reporting

With Lucid Financials, you get immediate access to your customer acquisition metrics. The platform integrates directly with your existing business tools, offering real-time updates instead of outdated monthly reports. This means you can see how your acquisition spending is performing right now.

For example, Lucid’s Slack integration delivers CAC data directly to your team, giving you actionable insights exactly when you need them. Additionally, the platform automatically generates investor-ready analyses and forecasts. It tracks acquisition costs across multiple channels, calculates payback periods, and monitors LTV:CAC ratios - all in real time. This ensures you're prepared for investor meetings or strategic planning without scrambling for data.

Lucid’s AI doesn’t just report numbers; it actively monitors your financial data streams. By categorizing acquisition-related expenses and reconciling transactions automatically, it keeps your CAC calculations accurate and up to date. This eliminates manual errors and ensures your growth decisions are based on reliable data.

Clean Books and Accurate CAC in 7 Days

Accurate CAC starts with clean financial records, and Lucid Financials ensures your books are in order within just seven days. The platform’s automated matching and reconciliation processes deliver reliable financial data, which is crucial for precise CAC calculations. Without this foundation, you risk basing decisions on flawed metrics, potentially leading to wasted marketing spend or poor investment choices.

For startups operating across multiple entities or subsidiaries, Lucid’s multi-entity support is a game-changer. It consolidates data from various legal structures into a single, unified CAC report. This gives you a clear view of your acquisition efficiency across the entire organization, no matter how complex your setup might be.

AI-Powered Insights for Better Decision-Making

Lucid Financials doesn’t stop at tracking; it helps you optimize. By combining predictive AI with expert human oversight, the platform provides actionable insights that go beyond historical data. It identifies trends and offers forward-looking recommendations, allowing you to adjust strategies proactively.

One standout feature is the “what-if” scenario modeling. This tool lets you test different acquisition strategies before committing your budget. For instance, you can explore how reallocating funds from paid search to content marketing might impact your CAC. These simulations enable you to make informed, data-backed decisions with confidence.

To ensure these insights align with real-world dynamics, Lucid’s dedicated finance team reviews the AI-generated data. The platform also sends alerts when CAC metrics deviate from target ranges or when specific channels underperform, helping you address issues quickly and protect your marketing investments.

Additionally, Lucid ties your CAC strategy directly to cash flow and runway visibility. By modeling different scenarios, you can see how acquisition spending affects your overall financial health. This helps you strike the right balance between aggressive growth and sustainable operations, ensuring you have the runway needed to keep scaling.

Conclusion: Growing Your Business with AI-Powered CAC Management

AI has reshaped customer acquisition cost (CAC) management, turning it into a highly efficient and precise process. For startups in the U.S., this shift can mean the difference between burning through limited funds and achieving sustainable growth that scales.

Consider this: companies using AI-driven marketing tools report an average 37% reduction in CAC compared to those sticking with traditional methods. With better targeting (30% improvement) and smarter campaign optimization (15% boost), the total marketing performance often improves by over 50%. These aren't small gains - they're game-changing. And the ripple effect doesn't stop there, as these efficiencies lead to broader operational cost savings.

AI can cut operational expenses by as much as 30%, freeing up resources for growth-focused initiatives. For lean startups, this is a game changer. On top of that, AI saves the average worker around 2.5 hours daily by automating repetitive tasks. This extra time allows teams to focus on strategy and innovation instead of getting bogged down by manual data entry or analysis.

The momentum behind AI-powered CAC management is undeniable. A whopping 80% of B2C marketers report that AI tools have exceeded their ROI expectations, and 95% plan to increase their AI investments due to improved customer acquisition efficiency. The market itself is expanding rapidly, expected to grow from $57.99 billion in 2024 to $240.58 billion by 2030, with a compound annual growth rate of 32.9%.

AI platforms are also delivering real-time insights that startups can act on immediately. Take Lucid Financials, for example. Instead of waiting weeks for financial reports or struggling with inaccurate CAC calculations, you get real-time insights straight to Slack, clean financial books in just seven days, and predictive modeling that helps you adjust strategies before problems arise. This combination of speed, accuracy, and intelligence gives startups the financial clarity they need to grow efficiently without wasting resources.

The competitive edge is clear: startups that embrace AI-powered CAC management can stretch their budgets further, make smarter decisions, and build a foundation for long-term growth. Gartner even predicts that by 2026, 75% of businesses will use AI-driven automation to cut costs and boost agility. Early adopters will be ahead of the curve.

At its core, your CAC strategy is about more than just acquiring customers - it's about creating a growth engine that scales with your business. AI makes that engine faster, smarter, and more profitable. Now is the time to embrace AI-powered CAC management and start seeing the results.

FAQs

What makes AI-powered customer acquisition cost (CAC) management more cost-effective and efficient than traditional methods?

AI-powered CAC (Customer Acquisition Cost) management takes a big leap beyond traditional methods by cutting costs and boosting efficiency. Through data-driven insights, personalized targeting, and automation, AI replaces many of the manual processes and general marketing tactics businesses used to rely on. The result? Resources are allocated smarter, customer engagement becomes more precise, and time-consuming tasks get streamlined.

Research backs this up: AI tools have been shown to reduce customer acquisition costs by as much as 50% while improving efficiency by approximately 30%. This means businesses can attract customers faster and at a lower cost, all while keeping a closer eye on their budgets and focusing on growth.

What AI technologies help reduce customer acquisition costs, and how do they work together?

AI-powered tools like marketing optimization platforms, automation software, and targeted advertising systems can play a major role in cutting down customer acquisition costs (CAC). These tools work hand-in-hand to simplify lead generation, fine-tune ad targeting, and make better use of marketing budgets - all of which help boost conversion rates.

Take AI-based marketing platforms, for instance. They analyze data to pinpoint the most effective campaigns, ensuring every marketing dollar is spent wisely. Automation tools take care of time-consuming tasks like sending follow-ups or nurturing leads, freeing up resources for other priorities. Meanwhile, targeted advertising systems use machine learning to deliver ads to the right audience at the perfect time, increasing engagement while reducing wasted spending.

When these technologies are used together, businesses can not only lower their CAC but also scale their customer acquisition efforts more effectively.

How can startups use AI to manage customer acquisition costs and drive sustainable growth?

Startups have a powerful ally in AI when it comes to managing customer acquisition costs (CAC). By analyzing data, AI can pinpoint which marketing channels are the most cost-effective and even fine-tune campaigns on the fly. The result? Businesses can spend less while still attracting customers who bring real value.

AI also shines in forecasting and decision-making. Startups can use these tools to sharpen their go-to-market strategies, improve cash flow, and focus on sustainable growth. In a competitive landscape, these advantages can make operations more efficient and keep profitability within reach.