Investor relations reporting is about keeping investors informed with clear, consistent updates on your company’s performance and future plans. It’s more than just numbers; it builds trust and strengthens relationships with stakeholders. Regular reports - monthly for startups, quarterly for established businesses - can double your chances of securing follow-on funding. Here’s what to focus on:

- Key Components: Include an executive summary, financial metrics (e.g., MRR, ARR, burn rate), operational updates (team, product, market traction), and future projections.

- Best Practices: Stick to a set schedule, keep reports concise and visually clear, and balance transparency with confidentiality.

- Tools: Platforms like Lucid Financials can simplify reporting with one-click summaries, real-time insights, and Slack integration.

Clear, timely reporting not only aligns investors with your vision but also helps identify issues before they escalate. Done right, it turns investors into active partners, offering guidance, connections, and funding.

Creating Investor Reports People will Love

sbb-itb-17e8ec9

What Goes Into an Investor Relations Report

Key Financial Metrics and KPIs for Investor Relations Reporting

A solid investor relations report combines financial data with operational insights, presenting a clear and concise picture of your company’s performance and direction. It’s not just about numbers - it’s about telling the story behind them. Start with an executive summary, then delve into key metrics, operational updates, and future projections.

The best reports follow the SMART framework: Simple (avoiding unnecessary complexity), Meaningful (focusing on metrics that matter), Accurate, Robust (covering all critical areas), and Timely. Every section should answer three essential questions: Where are we now? How did we get here? Where are we going?

"The most successful companies provide enough visibility that investors know if you're executing against the narrative you sold them on." - Bryan Vaniman, SVP Corporate Development, Investor Relations and Treasury, Twilio

Additionally, include an "Ask" section - be specific about the support you need, whether it’s introductions, strategic advice, or fundraising assistance.

Executive Summary

Think of the executive summary as the “TL;DR” of your report. It’s where you highlight the most important updates, knowing this might be the only section some investors read. This is your chance to showcase key wins, strategic shifts, and major developments like customer acquisitions or leadership changes.

Start with headline metrics like Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), growth rates, and runway. Then, touch on operational highlights - new product launches, partnerships, or user growth. If there are challenges, acknowledge them briefly and outline your plan to address them.

The tone should be conversational but focused, answering: What happened this period? What does it mean for our trajectory? What do we need from you? This section sets the stage for the deeper dive into metrics and updates.

Financial Metrics and KPIs

Your financial metrics are the backbone of the report, offering quantifiable evidence of progress. Select KPIs that align with your business model and stage. For instance, a SaaS company’s metrics will differ from those of an e-commerce business.

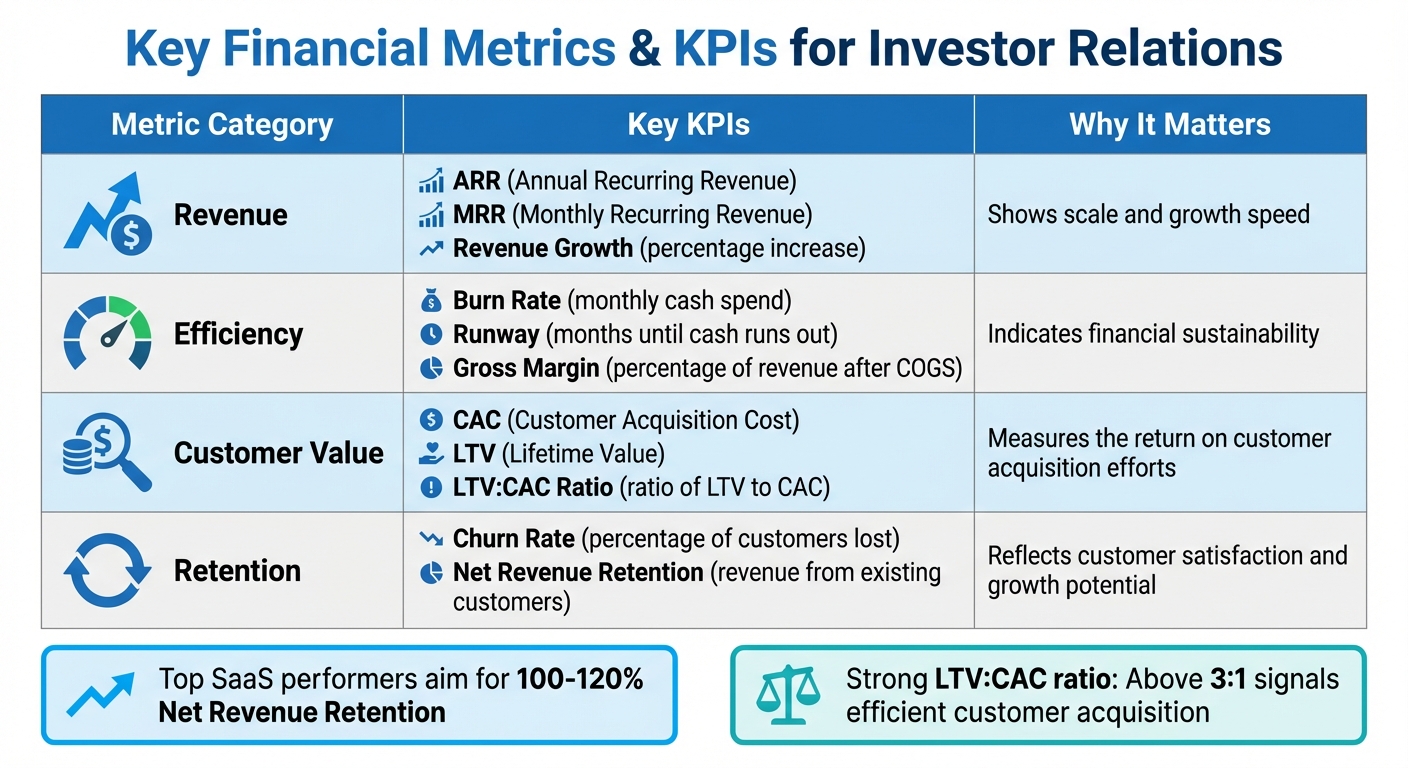

| Metric Category | Key KPIs | Why It Matters |

|---|---|---|

| Revenue | ARR, MRR, Revenue Growth | Shows scale and growth speed |

| Efficiency | Burn Rate, Runway, Gross Margin | Indicates financial sustainability |

| Customer Value | CAC, LTV, LTV:CAC Ratio | Measures the return on customer acquisition efforts |

| Retention | Churn Rate, Net Revenue Retention | Reflects customer satisfaction and growth potential |

For SaaS companies, Net Revenue Retention is particularly critical - top performers aim for 100–120%. Similarly, a strong LTV:CAC ratio (above 3:1) signals efficient customer acquisition. Compare these KPIs to past performance, projections, and industry benchmarks, and use visuals like charts to make trends clear.

"Metrics are nothing more than mile markers in your startup journey - small, but relevant indicators of how the company is progressing." - Graphite Financial

While metrics provide the numbers, operational updates add the context.

Operational Updates and Growth Metrics

Operational updates explain the “why” behind your financial numbers. They show how your team is driving progress and executing strategy. Focus on three key areas: team growth, product development, and market traction.

For team updates, highlight impactful hires or promotions that enhance your capabilities. In product development, discuss roadmap milestones, feature launches, and strategic pivots. When covering market traction, share insights on customer acquisition trends, new segments, or competitive positioning.

Specificity is key. Instead of saying, “We improved customer retention,” explain how churn dropped from 5.2% to 3.8% thanks to a revamped onboarding process that increased early feature adoption. This level of detail demonstrates strategic execution and builds investor confidence.

"Startup metrics need context. Numbers alone don't tell the story. Pair your startup metrics with insights, lessons learned, and how they tie back to your strategy." - Steven Plappert, CEO, Forecastr

Forecasts and Future Plans

Forward-looking projections give investors a glimpse into your growth potential and capital needs. Cover revenue forecasts, hiring plans, product roadmap milestones, and projected runway.

Start with financial projections for the next 6–12 months, including revenue, burn rate, and key milestones. Be realistic - overpromising can hurt credibility. If you’re planning major hires or product launches, outline their expected impact on growth.

Address potential challenges directly. For example, if increased competition or regulatory changes are concerns, explain your strategies to navigate them. This transparency shows maturity and readiness.

"Investor confidence is the lubricant that keeps capital flowing at a competitive cost, and confidence thrives on two tightly coupled disciplines: Investor relations shapes the narrative... and external reporting supplies the proof." - Umbrex

Include a capital allocation plan that details how funds will be used - whether for reinvestment, acquisitions, or maintaining flexibility. While forecasts don’t need to be flawless, they should reflect a well-thought-out plan and the ability to adapt as needed. These projections reinforce the strategic vision laid out in the report.

Best Practices for Investor Reporting

After covering the essential components of investor reports, let’s dive into some effective practices that can elevate your communication game. Clear and consistent updates are the backbone of investor confidence, and top-performing startups follow specific habits that strengthen these relationships.

Set a Regular Reporting Schedule

When it comes to investor updates, consistency outweighs perfection. Early-stage startups should aim for monthly reports, while more established businesses typically stick to quarterly updates. The critical part? Pick a schedule and stick to it. Consistent reporting creates what investors often call a "rhythm of accountability", showing that you’re in control of your business data rather than relying on guesswork. In fact, startups that maintain regular, high-quality communication are 40% more likely to secure follow-on funding with better terms.

"These practices not only meet compliance but also enhance investor confidence."

– Maurina Venturelli, Head of Go-to-Market, OpStart

Assign one person to oversee the reporting process. A well-organized reporting calendar - with set dates for collecting data, drafting, and distributing updates - helps avoid last-minute errors. Start gathering content one to two weeks in advance to ensure everything runs smoothly.

Once you’ve nailed down the schedule, focus on making your reports easy to read and understand.

Write Clear and Scannable Reports

Investors are busy people, so your reports should be quick to digest. Many top-tier VCs prefer concise updates - think 250 words - broken into sections like Executive Summary, Metrics, Strategic Highlights, and Challenges/Asks.

Stick to consistent formatting across all your reports. Use the same colors for data points and standardize the terminology for metrics. This uniformity makes it easier for investors to track trends without extra effort. Incorporating charts and visuals can also help simplify complex data.

Make your reports visually appealing by breaking up dense text with subheadings, bolded metrics, and plenty of white space. The executive summary should answer three key questions: Where are we now? How did we get here? Where are we going? Avoid technical jargon or overly detailed explanations - remember, not every investor is an expert in your industry.

The next step is finding the right balance between openness and protecting your competitive edge.

Balance Transparency with Confidentiality

While transparency fosters trust, it doesn’t mean you need to share every trade secret. The goal is to be honest about your performance while safeguarding sensitive details that might put your business at risk.

Before sharing proprietary data or product roadmaps, ensure all parties have signed Non-Disclosure Agreements (NDAs). Use secure investor portals or encrypted file-sharing platforms instead of email for sensitive documents. This not only provides an audit trail but also controls who can access your information. With the global cost of cybercrime projected to hit $23.84 trillion by 2027, secure communication channels are more important than ever.

When setbacks occur, address them head-on. Acknowledge the issue, explain the reasoning behind it, and share your plan to move forward. For instance, if you miss a revenue target, clarify whether it was due to a strategic shift toward higher-value customers or temporary market conditions, and outline your recovery strategy.

"Material information must be disseminated simultaneously to all investors through recognized channels."

– Umbrex

Share critical performance data through secure platforms and limit access to sensitive information. Designate specific spokespeople - such as the CEO, CFO, or Head of Investor Relations - to handle communication, ensuring your message stays controlled and consistent. This approach not only protects your business but also reinforces investor trust.

How Lucid Financials Simplifies Investor Relations Reporting

Managing investor relations can be a headache, especially for startup founders juggling endless priorities. Tasks like compiling financial reports often take days, pulling focus away from critical areas like product development and fundraising. Lucid Financials (https://lucid.now) aims to change that. As the first AI-driven full-stack accounting platform designed specifically for startups, it combines essential accounting services into one seamless solution. With clean, accurate books delivered in just seven days, founders can shift their attention back to growth while Lucid handles the numbers.

Here’s a closer look at how its features simplify investor reporting.

One-Click Investor-Ready Reports

Imagine generating polished, board-ready reports with a single click. That’s exactly what Lucid’s One-Click feature does. By pulling live data, it creates both high-level overviews and detailed breakdowns, formatted for easy reading. For example, a monthly investor update might include metrics like $500,000 in MRR, 1,200 new users, an 18-month runway forecast, milestone progress, and even challenges with mitigation strategies. Everything is presented in U.S. formatting conventions, such as MM/DD/YYYY dates and comma-separated numbers. What used to take days can now be done in seconds, freeing founders to focus on strategy instead of spreadsheets.

Real-Time Financial Insights and Forecasts

Lucid keeps you ahead of the curve with live updates on key metrics like revenue, churn, burn rate, and runway. These insights are always accessible, making it easier to communicate proactively with investors. Its AI also generates forecasts, using historical data - like ARR growth from $100,000 to $500,000 quarterly - and operational metrics such as CAC:LTV ratios. Need to model scenarios? Lucid predicts outcomes like an 18-month runway at the current burn rate and flags any unusual deviations early. This level of precision gives investors the confidence they’re looking for.

Slack Integration for Instant Updates

Lucid takes convenience a step further with its Slack integration. Founders can query financial data in plain language - no need to switch platforms. Ask about "current runway" or "Q1 revenue forecast", and you’ll receive instant charts, metrics, or reports directly in Slack. Setup is simple: connect your accounting data via API, invite team members or investors to a dedicated Slack channel, enable AI-powered queries, and schedule automated updates. This approach turns reporting from a time-consuming chore into a quick, transparent process, building trust and keeping everyone on the same page.

Conclusion

Investor relations reporting serves as a powerful way to align your startup's performance with its future funding goals. When approached thoughtfully, timely and transparent reports can turn passive investors into active allies - offering introductions, strategic advice, and even follow-on funding. As 3one4 Capital aptly states: "Transparency today builds trust for tomorrow, laying a stronger foundation for growth."

To recap the key points: stick to a consistent reporting schedule (monthly for early-stage startups), balance data-driven metrics with insightful narratives, and always include a clear "ask" to tap into your investors' networks. Address challenges head-on with actionable plans - this not only showcases leadership but also strengthens your credibility.

Consistent reporting reflects professional discipline and strong internal controls. Startups that treat reporting as a strategic tool rather than a chore often enjoy better relationships with investors and achieve higher valuations. Regular reporting also forces you to assess your business objectively, helping you identify potential issues - like increasing churn or a dwindling cash runway - before they escalate into larger problems. Tools like Lucid Financials can simplify this process, ensuring both accuracy and investor trust.

With Lucid Financials, you can create investor-ready reports in seconds. The platform offers features like one-click reporting, clean books in just seven days, and real-time insights via Slack, reinforcing the transparency that fuels growth. As Qubit Capital puts it: "Great reporting buys you confidence when markets are calm and grace when they are not."

FAQs

What should I include in an investor update each month?

A solid monthly investor update should cover the essentials: key metrics (like revenue, MRR, or burn rate), highlights (such as new partnerships or milestones achieved), challenges (setbacks and the lessons they brought), goals for the upcoming month, and specific requests (like introductions or help with hiring). Aim to keep it clear, honest, and to the point - this builds trust and keeps your investors engaged.

Which KPIs matter most for my startup stage?

The most important metrics for your startup will shift as your business evolves. For early-stage startups, it's all about proving potential and efficiency. Focus on:

- Revenue Growth Rate: This shows how quickly your business is expanding.

- Customer Acquisition Cost (CAC): Tracks how much you're spending to gain new customers.

- Customer Lifetime Value (LTV): Measures the total revenue a customer brings in over their relationship with your business.

As your startup matures, you'll need to prioritize metrics that highlight scalability and financial health. These include:

- Monthly Recurring Revenue (MRR): A key indicator of predictable, consistent income.

- Churn Rate: Helps you understand customer retention by showing the percentage of customers leaving over a given period.

- Burn Rate: Tracks how quickly you're spending cash, ensuring you manage your runway effectively.

By focusing on the right KPIs at each stage, you can better navigate your startup's growth journey.

How do I share bad news without losing investor trust?

To deliver bad news effectively, prioritize honesty, speed, and clear communication. Share the information as soon as possible - delaying can erode trust. Be upfront and stick to the facts, avoiding unnecessary justifications or excuses. It's also important to take ownership of the situation and outline a clear plan to address the problem. Using a professional yet empathetic tone can go a long way in maintaining trust and understanding, even in challenging circumstances.