AI financial automation transforms how businesses handle bookkeeping, reporting, and forecasting by using advanced tools like OCR, machine learning, and RPA. Startups and small businesses save time and reduce errors, with tasks like month-end closes cut from weeks to days and manual work reduced by up to 90%. Key benefits include real-time financial insights, automated reconciliation, and polished investor-ready reports - all at a fraction of traditional costs.

- Save time: Automate repetitive tasks like transaction categorization and bank reconciliation.

- Reduce errors: AI minimizes manual mistakes, improving accuracy by up to 39%.

- Boost efficiency: Access real-time dashboards and scenario modeling for better decisions.

- Affordable solutions: Platforms like Lucid Financials offer flat-rate pricing starting at $150/month, covering bookkeeping, tax services, and CFO-level support.

With AI, startups can focus on growth while maintaining precise, up-to-date financial records essential for scaling and attracting investors.

Benefits of AI Financial Automation

Real-Time Financial Data

AI tools integrate with your bank accounts, credit cards, and payment platforms to deliver real-time insights into critical metrics like cash flow, profit and loss, and working capital. Dashboards refresh every 90 seconds, offering founders a level of visibility that mirrors what enterprise CFOs rely on.

This speed is a game-changer when making decisions about hiring, marketing budgets, or pricing strategies. Take the example of a global biotech company in 2025: they implemented an AI system to monitor invoice-to-contract compliance. The system uncovered contract leakage amounting to 4% of total spending. That translated into a recurring margin improvement of $40 million for every $1 billion in expenses. Access to immediate data like this not only supports better decision-making but also lays the groundwork for automating more tasks down the line.

Less Manual Work and Fewer Errors

AI-powered automation can cut manual work by as much as 50% to 90%. Tasks like logging bank transactions, matching invoices with purchase orders, and categorizing expenses are seamlessly handled by AI systems. For example, in Q2 2024, Notion Labs transitioned to an AI-supported ledger. This switch reduced their monthly manual bank reconciliation tickets from 450 to just 75 - an 83% drop - saving the company $58,000 annually in contractor fees.

Beyond reducing workload, AI also minimizes common human errors, such as rekeying mistakes. Over time, as the system learns, error rates drop even further. In fact, a study involving 260,000 businesses showed a 39% reduction in manual matching errors. These efficiencies not only save time but also ensure that financial reports are more accurate and dependable.

Investor-Ready Reports

AI platforms simplify the creation of polished financial statements tailored for board meetings and fundraising efforts. By pulling data from a unified source, these systems ensure that your balance sheet, income statement, and cash flow statement are always aligned. They even allow you to switch between accounting views to meet varying reporting needs.

For instance, Brooklinen managed to cut their month-end close time in half while also significantly reducing errors. This kind of speed and precision reassures investors, providing them with reliable financial data - an essential factor during capital raises or due diligence processes. By showcasing financial discipline and transparency, these reports help build trust and support growth.

Together, these advancements turn financial processes into a strategic advantage, empowering businesses to operate more efficiently and confidently.

Core Features of AI Financial Automation Tools

AI-Powered Bookkeeping and Reconciliation

AI tools have revolutionized bookkeeping by automating the categorization of transactions and aligning them with your chart of accounts. Thanks to machine learning, these systems adapt to spending habits, minimizing manual work and reducing errors. Using Optical Character Recognition (OCR) technology, they can extract data from receipts and invoices with an impressive 97% accuracy rate as of 2024.

These tools integrate directly with bank feeds through platforms like Plaid or Codat, enabling real-time reconciliation. This keeps your financial records up to date while maintaining a low error rate - below 0.5% for accounts payable data capture. They can also spot irregularities, such as duplicate vendors or unusual spending patterns, which may indicate errors or fraud. For instance, one company reported cutting its month-end close time in half, from 10 days to just 5, after adopting advanced OCR and reconciliation tools. At the same time, their accounts payable error rate dropped from 3.8% to 0.6%.

By integrating with communication platforms like Slack, these tools further enhance efficiency. Real-time alerts notify you about missing receipts or transactions requiring review. You can even query financial data in plain language without toggling between apps. Beyond accurate bookkeeping, these systems also deliver adaptable forecasting features to meet evolving business needs.

Forecasting and Scenario Modeling

AI-driven forecasting tools take historical data and current trends to create dynamic projections. Unlike static spreadsheets, these tools continuously update forecasts and allow you to simulate various scenarios - like changes in vendor pricing or team growth - helping you make better strategic decisions.

Some tools include "what-if" features, enabling you to test different business strategies before committing resources. Additionally, many solutions generate plain-language narrative reports to explain trends and deviations, making complex financial data easier to understand.

Slack Integration for Real-Time Support

Seamless access to financial insights without leaving your workflow is a game-changer for busy professionals. With Slack integration, you can ask straightforward questions like, "What’s our current burn rate?" or "How much did we spend on software last month?" and get instant answers - no need to switch apps or wait for emails. These tools can also send missing receipt alerts within 30 minutes of a transaction being detected on a corporate card, keeping your records organized and compliant.

Lucid Financials goes a step further by blending AI-driven insights with human expertise directly in Slack. Routine queries are handled instantly by AI, while more complex issues are escalated to finance professionals - all within the same conversation thread. This ChatOps approach transforms your financial tools into a proactive advisor, ready to deliver critical insights whenever you need them.

How to Implement AI Financial Automation

Assess Your Startup's Needs

Before diving into AI tools, it’s crucial to identify the manual tasks eating up your time. Think about activities like chasing down receipts, reconciling bank accounts, or manually entering invoices. If these tasks dominate your day, it’s time to prioritize automation. In fact, 44% of finance leaders have reported spending too much time on administrative tasks.

Next, evaluate how often errors find their way into your financial records. Mistakes in tax withholdings, payroll, or reporting are common with manual processes. Also, check if your existing systems - like QuickBooks, your ERP software, or banking platforms - offer API integrations. These integrations are key for smooth data flow between your tools and AI solutions. Don’t forget to document your workflows and approval processes to uncover areas ripe for automation.

Start by targeting high-volume, rule-based tasks that are easier to automate. For instance, manual bank reconciliations can take up to 20 hours a week for some finance teams. Use the table below as a guide to assess your processes:

| Assessment Step | Key Questions to Ask |

|---|---|

| Process Audit | Which tasks consume the most hours? Are they repetitive and rule-based? |

| Error Analysis | How often do discrepancies show up in payroll or financial records? |

| Tech Readiness | Can our current tools integrate via APIs? |

| Strategic Value | Will automating this task free time for more impactful work? |

| Scalability | Can this solution handle a 5x increase in transactions as the business grows? |

Instead of overhauling everything at once, start small. Automate one or two tasks, like invoice capture, before moving on to more complex processes like cash flow forecasting. Assign a project lead who understands both technical systems and financial operations to ensure smooth communication between IT and finance teams.

Once you’ve mapped out your needs, it’s time to move to onboarding and integration.

Onboarding and Integration

Adopting AI tools requires a structured, phased approach. Most startups begin by connecting through native app marketplaces (like the QuickBooks App Store), low-code platforms like Zapier for custom workflows, or direct APIs for real-time data integration with tools like Plaid.

Start by cleaning up your data. Export your chart of accounts and vendor lists, eliminate duplicates, and standardize everything before loading it into your new system. For example, pre-loading a clean vendor list into OCR tools can cut down name mismatches by up to 62%. Test the waters with a small pilot - focus on a single entity and a workflow with fewer than 1,000 transactions. This helps build confidence in the system before scaling up.

Successful pilots often result in faster month-end closings and fewer reconciliation errors. During the trial phase, run manual and automated processes side by side to confirm accuracy. Ensure security by enabling SSO and MFA, and review SOC 2 Type II compliance reports for all AI vendors before going live. Train your team to embrace AI tools and avoid falling back on manual "shadow spreadsheets", which can undermine automation efforts.

Scaling AI as Your Startup Grows

As your startup expands, financial operations become more complex - more entities, currencies, and transactions. Your AI tools must keep pace. The best approach is to consolidate your financial processes into a single platform that supports interconnected workflows and advanced automation, eliminating the need for manual data entry.

Keep human oversight for strategic decisions like capital allocation, while letting AI handle repetitive tasks. To manage growth effectively, set up an "automation approval board" with representatives from Finance, IT, and Compliance to oversee scaling efforts. Track metrics like cycle time, error rates, and hours saved to measure the return on investment.

Make sure to retrain your AI models quarterly to account for seasonal trends or operational changes that could impact accuracy. Advanced automation can cut month-end close times by 30% to 40%, freeing your team to focus on tasks like financial planning and scenario modeling. Companies like Lucid Financials offer AI-driven automation combined with expert guidance to grow with your business, whether you’re handling $500,000 or $50 million in annual revenue.

"Finance automation modernizes manual processes and legacy systems, transforming them into technology-driven operations that can help shift staff focus from data processing to high-value activities." - Kristina Russo, CPA, MBA

The key to success lies in patience and iteration. Don’t try to replace all your legacy systems overnight. Start with high-impact areas, measure the results, and expand gradually as your confidence - and transaction volume - grows.

With these strategies in place, the next step is to analyze cost efficiency.

How AI Is Revolutionizing Finance for Startups

sbb-itb-17e8ec9

Cost Efficiency of AI Financial Automation

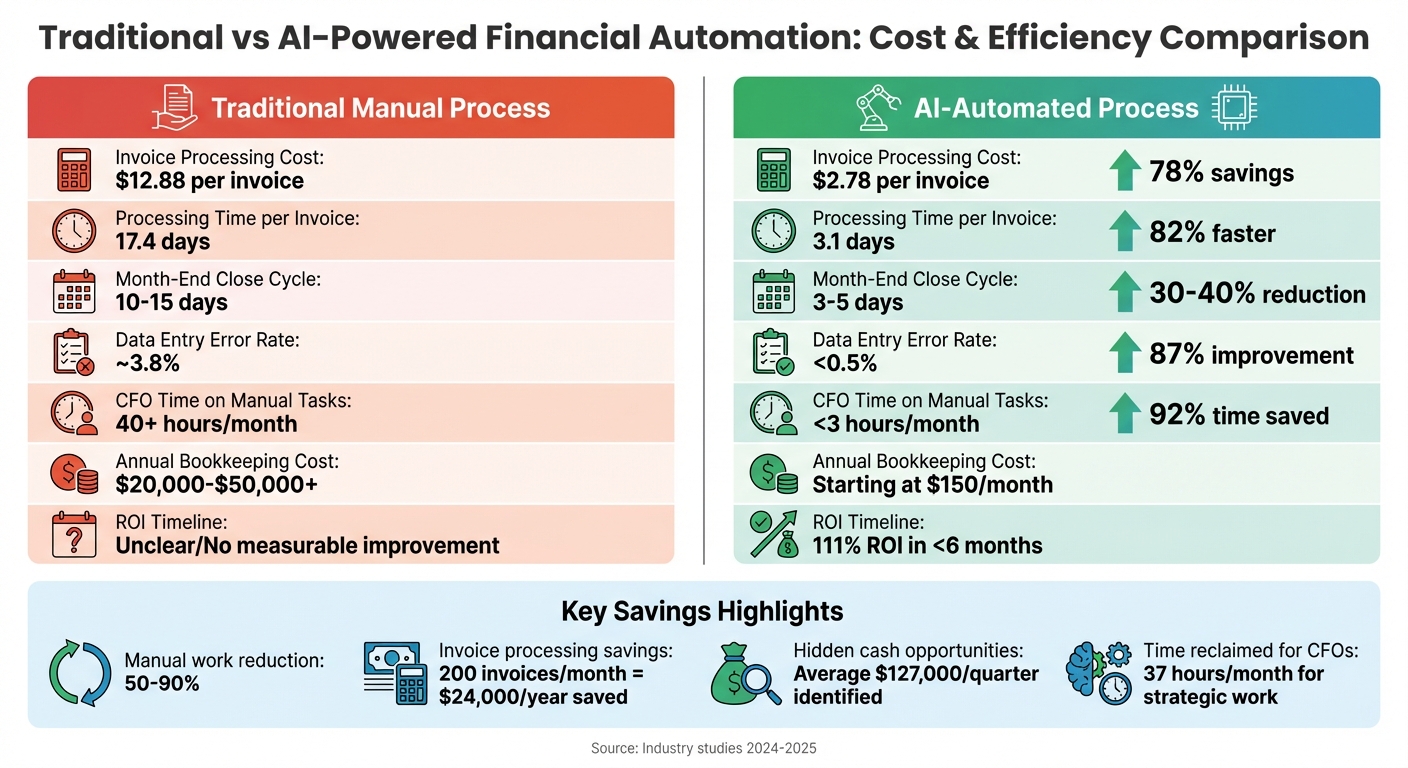

Traditional vs AI-Powered Financial Automation Cost and Efficiency Comparison

Savings from Automation

AI-powered automation is a game-changer when it comes to cutting costs and reducing errors in financial processes. For small and medium-sized businesses (SMBs), the savings can be substantial, ranging from $20,000 to $50,000 annually in bookkeeping expenses. For startups working with limited budgets, this could mean funding an additional hire or extending their financial runway.

The largest cost reductions come from automating repetitive, high-volume tasks. For instance, processing invoices manually costs around $12.88 per invoice, but AI reduces that expense to just $2.78 - a 78% savings. If your business processes 200 invoices monthly, you could save over $24,000 a year on accounts payable alone. Similarly, automating bank reconciliation can save mid-sized businesses approximately 20 hours of manual work each week.

The benefits don’t stop at direct labor savings. AI tools can uncover hidden opportunities to improve cash flow. For example, modern accounts payable automation speeds up invoice processing by 82%, allowing businesses to take advantage of early payment discounts. Additionally, AI-driven treasury tools have identified an average of $127,000 per quarter in idle cash and tax savings for mid-sized companies.

Time savings also lead to better strategic focus. CFOs using AI automation report reclaiming an average of 37 hours per month previously spent on manual modeling and reporting tasks. With these hours freed up, finance teams can shift their attention to activities like forecasting, scenario planning, and supporting fundraising efforts. On top of that, advanced automation can shorten monthly close cycles by 30% to 40%, giving businesses quicker access to the insights they need to grow. These examples highlight how AI transforms financial operations, making it easy to see the advantages over traditional methods.

Cost Comparison: Traditional vs. AI Accounting

The contrast between traditional accounting methods and AI-driven automation is stark across every key metric. Traditional approaches often rely on costly hourly billing or outsourced services, while AI platforms typically offer predictable, flat-rate pricing. This not only simplifies budgeting but also eliminates unexpected charges.

| Metric | Traditional Manual Process | AI-Automated Process |

|---|---|---|

| Invoice Processing Cost | $12.88 per invoice | $2.78 per invoice |

| Processing Time per Invoice | 17.4 days | 3.1 days |

| Month-End Close Cycle | 10–15 days | 3–5 days |

| Data Entry Error Rate | ~3.8% | <0.5% |

| CFO Time on Manual Tasks | 40+ hours/month | <3 hours/month |

AI platforms also deliver a faster return on investment (ROI). Accounts payable automation, for example, can achieve an ROI of 111% with a payback period of less than six months. In contrast, traditional accounting services often charge based on labor hours without offering measurable efficiency improvements or cost reductions.

For startups, platforms like Lucid Financials provide a clear example of cost-effective AI solutions. Their flat-rate pricing starts at $150 per month and includes bookkeeping, tax services, and CFO support - all powered by AI automation and backed by expert oversight. This predictable pricing model not only lowers costs but also ensures financial clarity that’s ready for investors. Services include clean books delivered in just seven days, real-time Slack support, and investor-ready reports - all without the expense of hiring a full-time controller or CFO.

"AI bookkeeping automation is no longer optional. Whether you operate a 5-person e-commerce start-up or a multinational finance department, the ROI in 2025 is immediate - shorter close cycles, sharper insights, and leaner cost structures." – Claude AI (Verified Content), aibookkeepingtools.com

These efficiencies demonstrate how platforms like Lucid Financials are reshaping financial operations with predictable pricing and streamlined processes.

Lucid Financials: AI-Powered Accounting for Startups

Full-Stack Financial Management

Lucid Financials offers a comprehensive, AI-driven platform that simplifies financial management for startups and fast-growing businesses. By combining bookkeeping, tax services, R&D credits, and CFO support into a single solution, it eliminates the need for juggling multiple vendors. Founders can access everything from daily transaction reconciliation to long-term strategic planning in one place.

The platform tackles the full range of financial tasks startups encounter. It automates bookkeeping, reconciliation, and R&D tax credit discovery, handles tax filings, and provides real-time forecasting through scenario modeling. While AI takes care of repetitive tasks, financial professionals oversee the strategic aspects. Plus, Lucid integrates directly with Slack, making it easy for founders to get instant answers about their burn rate, runway, or overall financial health.

"Lucid has made it incredibly easy to track spending, plan ahead, and handle our growth. It's straightforward and effective." – Aviv Farhi, Founder and CEO, Showcase

Lucid also generates detailed, professional reports automatically, offering startups the financial clarity they need to make informed decisions. Its all-in-one approach, combined with simple pricing and fast onboarding, ensures startups can focus on scaling their business without financial headaches.

Flat-Rate Pricing for Startups

Lucid Financials stands out with its transparent, flat-rate pricing tailored for startups. Plans start at $150 per month, with no hidden charges or hourly fees. This predictable pricing model simplifies budgeting and eliminates unexpected costs. Startups can choose from three core service tiers - Bookkeeping, Tax, and CFO/Fundraising - or combine them based on their needs.

- Bookkeeping Tier: Includes AI-powered reconciliation, monthly financial close, detailed reporting, and real-time Slack support.

- Tax Tier: Covers federal and state tax filings, personalized tax preparation for founders, and R&D credit optimization.

- CFO/Fundraising Tier: Offers AI-driven forecasts, cash flow tracking, scenario modeling, and board-ready reports, all backed by Lucid's CFO team for strategic guidance.

"As our company grows, budgeting and cash flow management have become crucial. The features provided are essential and have greatly streamlined these processes for us." – Luka Mutinda, Founder and CEO, Dukapaq

This pricing approach gives startups access to a full suite of financial tools at a fraction of the cost of traditional accounting firms, which often charge $150 to $300 per hour. It’s an affordable, all-inclusive solution for early-stage companies aiming to manage their finances efficiently.

Clean Books in 7 Days

Lucid Financials ensures investor-ready, error-free financial records within just seven days. The platform uses AI to match transactions, detect anomalies, and produce accurate reports, all of which are reviewed by experienced accountants to guarantee compliance and precision.

With rapid onboarding, startups can quickly access real-time financial insights, including burn rate tracking, runway calculations, and key performance metrics. These tools keep your books ready for investors at all times, while 24/7 support ensures any questions are addressed promptly. By taking the stress out of financial management, Lucid lets you focus on growing your business.

Conclusion

AI-powered financial automation is reshaping how startups handle their finances, offering instant insights, improved accuracy, and a clearer view of their financial health. Instead of waiting for lengthy month-end reports, founders can now access real-time data on burn rate, cash flow, and runway - empowering them to make quick, informed decisions that drive growth. Tasks that once took hours are completed in minutes, with automation reducing the risk of costly errors.

By cutting down on inefficiencies, startups can redirect resources toward strategic priorities. With AI systems, everything from bookkeeping to tax filings, R&D credits, and CFO-level support is available for a flat $150 monthly fee. This eliminates the need for multiple high-cost consultants, making professional financial management accessible even for early-stage companies.

But it’s not just about saving money. Automation allows founders to focus on what truly matters: building great products, closing deals, and scaling their teams. Features like automated scenario modeling let you weigh financial decisions instantly, while real-time Slack integration provides quick answers without disrupting your workflow.

Lucid Financials brings all these tools together in one streamlined platform. From delivering clean books in just seven days to providing investor-ready reports and 24/7 expert support, it grows alongside your startup - from pre-seed to Series C - while keeping things simple and fast. Every feature is designed to ensure your financial operations align seamlessly with your growth goals.

FAQs

How does AI help reduce bookkeeping errors?

AI-driven financial automation takes the guesswork out of bookkeeping by leveraging tools like OCR (Optical Character Recognition) and NLP (Natural Language Processing). These technologies work together to extract and organize transaction data with precision, ensuring every entry is categorized correctly.

What’s more, the system keeps a constant eye on the data, identifying inconsistencies or unusual patterns in real time. This ensures your records remain consistent and reliable throughout your workflows.

The results speak for themselves: automated processes can reduce reporting errors by about 40% and bring error rates down to as little as 0.5%. Beyond just accuracy, this approach saves you valuable time - time you can reinvest into growing and managing your business.

What are the cost savings of using AI for financial management?

Using AI for financial management can dramatically cut costs. For instance, instead of hiring a full-time finance team, which can cost upwards of $80,000 per year, businesses can rely on AI tools to handle many of the same tasks. These tools also slash invoice processing costs from $10.18 per invoice to just $2.14 - a reduction of about 79%. On top of that, AI can free up as much as 200 hours annually by automating repetitive tasks. With subscription plans starting at just $150 per month, businesses can see a return on investment in as little as 60 to 90 days. This means companies can manage their finances more efficiently while channeling their energy into growth.

What are the best steps for startups to implement AI financial automation?

Startups can make AI financial automation work for them by taking a few straightforward steps. First, bring all your financial data together in one place. This means linking up tools like accounting software, bank accounts, and payroll systems. Doing this not only simplifies your processes but also eliminates the need for manual data entry, giving you a single, reliable source of financial truth.

Next, pick an AI-powered platform that’s built with startups in mind. For example, platforms like Lucid Financials offer an all-in-one solution combining bookkeeping, tax services, and real-time financial insights. Once you’ve got your platform, set up a financial dashboard with clear goals and key metrics. Focus on essential figures like cash runway, burn rate, and gross margin to keep a close eye on your financial health.

Take advantage of automation for repetitive tasks like bookkeeping, invoice processing, and tax compliance. This not only saves time but also cuts down on costs. You can also use AI for forecasting, helping you plan for scenarios like hiring new employees or securing funding. Just make sure to keep strategic decisions under human oversight - AI can crunch numbers, but it can’t replace good judgment.

As your business grows, track the return on investment (ROI) from automation and scale up where it makes sense. This approach ensures your financial management stays accurate, efficient, and aligned with your startup’s unique needs.