AI-driven financial planning simplifies managing finances for startups by automating tasks, providing real-time insights, and enabling smarter decision-making. Here's why it matters and how it works:

- Why It’s Important: Startups face challenges like tracking cash flow, managing burn rate, and preparing for funding. Traditional methods (spreadsheets, manual bookkeeping) are slow, error-prone, and costly. AI tools streamline these processes, saving time and reducing errors.

- Key Benefits: AI tools automate bookkeeping, tax prep, and reporting, while offering dynamic forecasts and scenario modeling. They provide real-time dashboards for metrics like runway and revenue, helping founders make informed choices quickly.

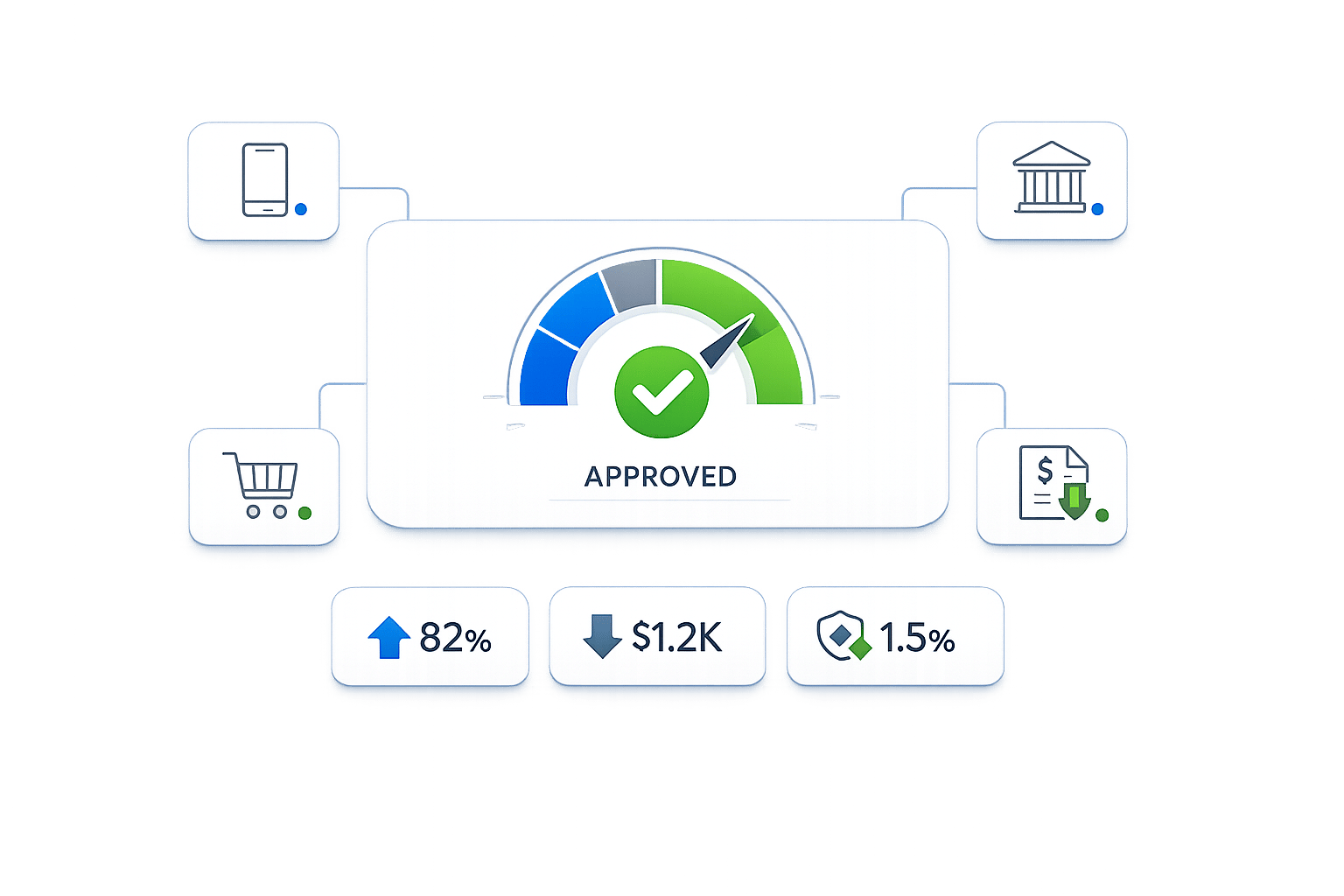

- How It Works: These platforms integrate with accounting software, bank accounts, and payment systems to pull data automatically. They analyze this data to create forecasts, detect anomalies, and generate investor-ready reports.

- Cost-Effectiveness: AI tools often replace the need for full-time finance teams, which can cost $80,000 or more annually. Many startups see ROI within 60-90 days, with plans starting as low as $150/month.

AI financial tools are reshaping how startups manage money, offering speed, accuracy, and insights that were once out of reach. Whether you're managing cash flow or preparing for a funding round, these tools can help you stay ahead.

How AI Is Revolutionizing Finance for Startups

Benefits of AI-Driven Financial Planning

For startups operating with limited resources, AI-driven financial planning changes the game. It turns financial management from a reactive, time-consuming task into a proactive tool that directly supports growth, funding efforts, and cash flow stability.

Real-Time Data for Smarter Decisions

Traditional financial management often relies on periodic reviews and static reports that can quickly become outdated. In contrast, AI-powered platforms continuously pull data from sources like bank accounts, payment processors, and accounting software. This creates dynamic dashboards that reflect your current financial reality.

Take this example: an AI-powered dashboard can update projections for revenue, expenses, and cash flow in real time. This means startups can identify risks early and adjust their strategies faster. Imagine seeing how yesterday's sales or this morning's expenses affect your runway and burn rate. With such insights, you can model scenarios - like hiring decisions or scaling plans - and make informed adjustments.

In fast-moving environments, having real-time financial data is crucial. It ensures every strategic discussion is backed by the latest insights, allowing you to seize opportunities quickly or address potential problems before they escalate. This constant access to updated data also sets the stage for further efficiencies through automation.

Automation That Saves Time

Manual bookkeeping can eat up hours better spent on growth-focused activities. AI takes over these repetitive tasks, saving time and reducing the chances of error.

For example, AI-powered ERP systems can achieve 95% accuracy in financial reconciliations, cutting down on data entry workloads and minimizing the need for error corrections. Similarly, generative AI solutions have processed millions of documents with 99.9% accuracy, slashing operational costs by 60% and saving organizations millions annually in manual data entry expenses. By automating these tedious processes, your team can focus on high-priority goals like product development, customer acquisition, and securing funding.

"With Lucid, managing bookkeeping, taxes, and claiming tax credits is effortless. The platform saves us hours every month, and their expert team makes sure nothing slips through the cracks." - Refael Shamir, Founder and CEO @Letos

Beyond saving time, automation also improves data reliability, making it easier to identify risks and maintain oversight.

Improved Accuracy and Risk Management

Human errors in financial data entry or analysis can lead to flawed forecasts, compliance headaches, and poor decision-making. AI significantly reduces these risks by automating processes and applying consistent logic to every transaction.

For instance, financial institutions using AI tools have strengthened risk management strategies while cutting down research time. AI can also detect unusual transactions or spending patterns, flagging potential issues before they grow into larger problems.

Scenario modeling is another powerful feature. It allows startups to test different financial outcomes - like rising customer acquisition costs or delaying a key hire - and see how these changes affect cash flow and runway. This results in more accurate, real-time insights, enabling smarter decisions about pricing, fundraising, and resource allocation.

Features of AI-Powered Financial Tools

AI-powered financial platforms are designed to tackle some of the biggest challenges startups face. These tools use intelligent systems to analyze your business data, provide actionable insights, and handle tasks that would typically require an entire finance team.

Automated Bookkeeping and Tax Prep

Manual bookkeeping can be a major time sink, not to mention a source of costly errors. AI-powered bookkeeping tools simplify this process by syncing with your bank accounts and payment platforms to automatically reconcile transactions, categorize expenses, and flag anything unusual. This eliminates tedious data entry and minimizes the chances of misclassified transactions that could skew your financial records.

For startups in the U.S., tax compliance is another hurdle. AI tax tools gather financial data automatically, apply the latest IRS regulations, and generate accurate forms. This not only reduces the risk of audits but also helps you meet federal and state tax deadlines without the usual last-minute panic. On top of that, AI systems can uncover tax credit opportunities - like R&D credits - that many startups miss simply because they don’t have the time or resources to dig into them.

"With Lucid, managing bookkeeping, taxes, and claiming tax credits is effortless. The platform saves us hours every month, and their expert team makes sure nothing slips through the cracks." - Refael Shamir, Founder and CEO @Letos

By combining automated reconciliation with intelligent tax preparation, these tools keep your books accurate and compliant without the need for a dedicated finance team. Some platforms can even deliver fully reconciled books within a week of onboarding - something that would be nearly impossible with manual methods. This speed and precision lay the groundwork for other critical activities like forecasting, reporting, and strategic planning, all of which depend on having reliable, up-to-date financial data.

Once your data is in order, advanced forecasting tools take your financial planning to the next level.

Financial Forecasting That Adapts

Static financial forecasts quickly become outdated when market conditions change or your business hits unexpected milestones. AI-powered forecasting tools solve this problem by continuously updating projections with real-time data, allowing you to model different scenarios on the spot. This ensures your forecasts reflect the current state of your business, not outdated assumptions.

With these tools, you can create best-case, worst-case, and baseline scenarios to see how decisions - like hiring new team members or delaying a product launch - might impact your finances. Some platforms even achieve up to 93% accuracy for 90-day cash flow projections when fully integrated with your financial systems. This level of precision helps you stay agile and make informed strategic choices.

AI dashboards also provide instant visibility into key metrics like burn rate, runway, and customer acquisition costs. You can compare your performance against industry benchmarks to understand where you stand and what metrics investors are likely to prioritize. Whether you’re planning your next hire, negotiating with vendors, or gearing up for a funding round, these insights give you the confidence to act decisively.

In 2024, a fast-growing B2B SaaS company used AI-powered scenario modeling to create a 12-month financial plan. The detailed projections and resource allocation analysis helped them secure a $2 million funding round by demonstrating clear runway visibility and a strong strategic approach to investors.

The ability to adjust assumptions and see immediate results during meetings or strategy sessions speeds up decision-making. Instead of waiting days for a finance team to crunch the numbers, you can test different scenarios in real time.

Alongside automated bookkeeping and adaptive forecasting, investor-ready reporting completes the toolkit offered by AI-powered financial platforms.

Investor-Ready Reports Instantly

AI tools make generating professional financial reports quick and hassle-free. By pulling data from integrated systems, these platforms create balance sheets, income statements, and cash flow reports that comply with US GAAP standards and meet investor expectations. The reports are formatted for polished presentations, making them perfect for board meetings, fundraising, or due diligence reviews.

Need updated reports on short notice? No problem. These tools let you generate them anytime, ensuring stakeholders always have access to the latest financial information. Some platforms even integrate with tools like Slack, so you can request reports or metrics with a simple command. This eliminates the need to switch between systems and reduces delays, keeping your workflow smooth and efficient.

Beyond traditional financial statements, AI platforms can produce custom dashboards and visualizations tailored to specific audiences. Whether it’s a high-level summary for board members or a detailed breakdown for operational decisions, these tools adapt to your needs. Their speed, accuracy, and flexibility mean you spend less time preparing reports and more time acting on the insights they provide.

For startups with lean teams, these capabilities can effectively replace the need for dedicated financial reporting staff. Many AI financial tools pay for themselves within 60 to 90 days by identifying ways to recover lost revenue, improve margins, or optimize taxes.

How to Maximize ROI with AI Financial Planning

Getting the most out of AI financial tools isn't just about picking the right platform - it's about using them strategically. Most AI financial tools can deliver notable returns within 60 to 90 days and come with pricing designed to suit startups. The secret lies in aligning these tools with your business needs, integrating them seamlessly into your workflows, and adjusting them as your company evolves. By following these strategies, you can set the stage for smooth integration and effective performance tracking.

Align AI Tools with Business Priorities

Before diving into AI tools, it's essential to pinpoint your primary financial challenges. For early-stage founders worried about cash flow, tools that monitor burn rate and calculate runway are invaluable. These tools pull data from bank accounts and payment processors to show exactly how long your cash reserves will last. For example, they can model how hiring decisions impact your runway.

For growth-stage startups with 10–50 employees, the focus shifts to unit economics, customer acquisition costs, and optimizing margins. Tools like MarginMax AI, for instance, analyze SKU-level profitability and can improve gross margins by 3–6% for product-focused businesses.

One common mistake is choosing tools based on their features rather than how well they address your specific needs. A better approach? Write down your top three financial priorities and evaluate tools based on how directly they tackle those issues. This ensures your AI investment directly supports better financial planning and resource allocation.

Connect AI with Your Current Workflows

AI tools are only as effective as their integration with your existing systems. The most impactful tools connect seamlessly with the platforms where your transaction data originates - like QuickBooks, Xero, Stripe, or your business bank accounts.

Check whether a tool can automatically pull data from your systems without requiring manual exports. The best platforms update forecasts in real time as transactions flow through your accounting software.

Setup time can vary widely depending on the tool's complexity. Simple solutions like Zeni or Fathom can be up and running in under a week. Mid-level tools such as ForecastMaster Pro may take 1–2 weeks to set up. Enterprise-grade platforms like GrowthPlan AI and Stratify could require 3–6 weeks, often involving dedicated onboarding support. If you're a solo founder without a background in finance, look for tools that offer white-glove onboarding to simplify the process.

Another key feature to consider is anomaly detection. AI systems can monitor for fraud and compliance issues, flagging potential problems before they escalate. Set up alerts so your team can promptly review flagged transactions. While AI handles routine approvals, human oversight is essential for addressing exceptions. Proper integration ensures that AI-generated insights feed directly into your decision-making process, maximizing the tool's value.

Once the tool is integrated, it’s important to regularly monitor and fine-tune its outputs to keep improving ROI.

Monitor and Adjust Regularly

AI models get smarter with more data, but they still require regular oversight. Set up a monthly or quarterly schedule to review AI-generated forecasts against actual results. Look for patterns where predictions diverge from reality and adjust the tool's assumptions if needed.

Track specific ROI metrics like reductions in manual reconciliation time, fewer accounting errors, and faster financial reporting cycles. For example, ForecastMaster Pro can achieve up to 93% accuracy for 90-day cash flow projections when fully integrated. Beyond operational improvements, assess how AI insights influence business decisions, such as better spending strategies or improved cash reserve management.

As your startup grows, your financial priorities will shift. A pre-revenue company focused on burn rate management might later prioritize metrics like customer lifetime value or payback periods. Update your AI tool's configuration to reflect these evolving priorities, ensuring it continues to support your changing needs. Most platforms allow you to customize dashboards and scenario modeling to keep pace with your goals.

Speaking of scenario modeling, it’s a powerful feature for making high-stakes decisions. Whether you're considering a new market, opening another office, or launching a product, AI tools can run dozens of financial scenarios in minutes - far faster than traditional spreadsheets.

Remember, AI is a tool to enhance your decision-making, not replace it. While it excels at crunching numbers and spotting patterns, strategic decisions still require your business expertise. Use AI for data-driven insights, but combine them with your understanding of market trends, customer behavior, and competition to make informed choices.

"As we scaled, budgeting and cash flow became critical. Lucid's CFO services give us the visibility we need, while their bookkeeping and tax support keep everything accurate and stress‐free. It's been a game‐changer for our operations." - Luka Mutinda, Founder and CEO @Dukapaq

sbb-itb-17e8ec9

Best Practices for Implementing AI Financial Tools

Selecting the right AI financial tool is just the beginning. To truly benefit, you need to focus on maintaining high-quality data, striking the right balance between automation and human expertise, and equipping your team with the skills to make the most of these tools. A strong data foundation is essential to ensure your AI investment pays off.

Keep Data Accurate and Secure

AI systems rely entirely on the quality of the data they process. If your data is flawed, the insights and predictions will be too. Start by implementing automated reconciliation systems that match transactions across your accounts. These systems can flag issues like duplicate entries, suspicious transactions, and misclassifications using AI-powered anomaly detection. Standardizing data from all sources - whether it's your accounting software, payment processors, or bank feeds - ensures your financial insights remain consistent and reliable.

Security is equally critical. Choose providers that meet standards like SOC 2 and offer enterprise-grade protection. Secure API-first banking integrations and role-based access controls are key to limiting sensitive data access to authorized team members. Features like continuous anomaly detection, automatic alerts, and robust audit trails not only reduce risks but also provide investor-ready records, which are invaluable during fundraising. Once your data is secure and accurate, the next step is integrating human expertise with AI capabilities.

Combine AI with Human Expertise

AI excels at processing large datasets, spotting patterns, and automating repetitive tasks. However, it lacks the strategic thinking and contextual understanding that experienced financial professionals bring to the table. A hybrid approach - combining AI with human insight - works best. For example, JPMorgan Chase's IndexGPT uses AI to select financial securities based on client profiles, but investment professionals validate and contextualize these recommendations. Similarly, Finpilot combines AI-driven retirement planning with human oversight, achieving an 18% higher return compared to self-directed investments.

For startups, this hybrid approach means using AI for tasks like anomaly detection, scenario modeling, and routine analyses, while reserving strategic decisions - such as market expansion or cost management - for human judgment. AI can handle the heavy lifting, like updating cash flow projections or flagging unusual transactions, but financial professionals are still needed to interpret these insights and make informed decisions.

Platforms that integrate AI automation with expert support offer the best of both worlds. While AI delivers efficiency, human oversight ensures sound decision-making, especially for complex tasks like optimizing R&D tax credits, addressing founder taxes, or preparing for funding rounds.

Train Your Team to Use AI

Even the most advanced AI tool is ineffective if your team doesn’t know how to use it. Training your team to interpret and act on AI outputs is critical for successful adoption. Structured training programs and clear protocols help distinguish when to follow AI recommendations and when human judgment is required.

Finance teams should focus on understanding forecasting models, scenario planning, and how to adjust AI assumptions as business conditions evolve. Operational leaders must learn to trust AI outputs for decisions related to hiring, cash flow, and marketing budgets. Tailored training ensures that each role understands how to leverage AI effectively.

Practical demonstrations using real data can build trust in AI tools. For instance, showing your team how the AI flagged a potential cash flow issue or identified a pricing error can illustrate its value. Start with pilot projects on low-risk decisions to build confidence, and establish feedback loops where team members document how AI forecasts align or deviate from actual outcomes. Regular reviews of these results will help refine the system and strengthen trust in its capabilities.

"With Lucid, managing bookkeeping, taxes, and claiming tax credits is effortless. The platform saves us hours every month, and their expert team makes sure nothing slips through the cracks." - Refael Shamir, Founder and CEO @Letos

Lucid Financials: AI-Powered Financial Management

Lucid Financials brings together the best of AI-driven automation and experienced financial professionals to offer a tailored financial management solution. Designed specifically for startups and fast-growing companies, it simplifies complex processes and keeps you focused on growth.

What Lucid Financials Offers

Lucid Financials provides an all-in-one financial management platform that combines bookkeeping, tax services, tax credit identification, and CFO-level support. The system ensures clean financial records within seven days and delivers investor-ready reports on demand.

The platform’s AI-powered bookkeeping uses machine learning to adapt to your business over time, improving the accuracy of transaction categorization and reducing errors. It automates posting entries while maintaining compliance and accuracy through intelligent oversight. As it processes more data, it gains a deeper understanding of your financial patterns, making manual corrections a thing of the past.

Tax services analyze your financial data to uncover opportunities like R&D credits, startup deductions, and other incentives. The platform handles federal and state filings, tracks tax liabilities across multiple entities, and manages equity and grant-related complexities.

For strategic planning, Lucid Financials offers CFO-level forecasting. This feature reviews historical data, identifies market trends, and highlights potential risks. You'll receive financial plans with scenarios ranging from best-case to worst-case, along with what-if modeling to test decisions before acting. Real-time insights into metrics like burn rate and cash runway help you stay proactive and scale effectively.

The platform also integrates seamlessly with Slack, giving you instant access to financial insights. Instead of navigating dashboards or waiting for reports, you can ask questions directly in Slack and get immediate answers. This always-available support - powered by AI and financial experts - ensures you have the information needed to make quick, informed decisions.

By combining these features, Lucid Financials equips startups with the agility and clarity necessary to navigate their financial journey confidently.

How Startups Benefit from Lucid Financials

Lucid Financials eliminates the delays and errors often associated with manual bookkeeping and forecasting. It empowers startups to make informed decisions quickly and maintain strategic oversight.

The platform grows with your business. Whether you're in the early stages (Day 1–60) or scaling operations, Lucid adapts to your needs. From maintaining clean books to advanced forecasting and financial planning, it provides the tools you need - without requiring a full-time CFO.

Automated bookkeeping and reconciliation ensure your financial records are always up-to-date and audit-ready. Real-time dashboards offer a clear view of critical metrics like revenue, burn rate, cash runway, and unit economics, making it easier to respond to investor inquiries or market changes.

Lucid’s hybrid approach combines AI efficiency with human expertise. Routine tasks like categorizing transactions and detecting anomalies are automated, while financial professionals review insights and provide strategic advice. This blend ensures that complex decisions, such as optimizing tax credits or preparing for fundraising, are handled with precision.

"With Lucid, managing bookkeeping, taxes, and claiming tax credits is effortless. The platform saves us hours every month, and their expert team makes sure nothing slips through the cracks." - Refael Shamir, Founder and CEO @Letos

Pricing and Plans

Lucid Financials offers transparent, startup-friendly pricing designed to scale with your business. Plans start at $150 per month, providing affordable access to professional financial management.

-

Bookkeeping Plan

This plan includes AI-driven bookkeeping, reconciliation, clean books within seven days, monthly financial reporting, real-time Slack support, QuickBooks integration, and multi-entity support. It covers the essential financial management needs for startups. -

Tax Plan

Ideal for founders navigating complex tax situations, this plan includes annual federal and state filings, tax preparation for equity and grants, R&D credit discovery and optimization, ongoing tax liability tracking, and support for multi-entity structures. -

CFO/Fundraising Plan

Designed for startups preparing to raise capital and scale, this plan offers AI-powered financial forecasts, hiring plans, cash flow and runway visibility, scenario modeling, investor-ready reports, and strategic guidance from the CFO team through Slack. It provides the strategic support of a CFO at a fraction of the cost.

You can mix and match plans to suit your needs, ensuring professional financial management is accessible at any stage of your startup’s journey.

Conclusion: AI and the Future of Financial Planning

AI is reshaping financial management, turning what was once a tedious process of manual bookkeeping into a system powered by real-time data and dynamic scenario planning. Startups no longer need to rely on outdated spreadsheets or scattered tools. Instead, they can tap into instant insights that drive smarter decisions and help mitigate risks.

The precision and speed of AI tools are game-changers, particularly in forecasting. For example, AI-powered financial tools can deliver up to 93% accuracy for 90-day cash flow projections, giving startups the ability to plan ahead with confidence rather than constantly reacting to unexpected challenges. These tools aren't just accurate - they're impactful. Many startups have used AI-driven models to secure major funding, and the investment in these tools often pays off within just a few months, even at costs ranging from $200 to $1,000 per month.

Looking ahead, financial planning will become faster, more predictive, and smarter. AI tools can instantly generate detailed financial plans, compare best- and worst-case scenarios in real time, and provide access to industry benchmarks that were once only available to large corporations. Features like continuous anomaly detection work in the background, identifying potential fraud or compliance issues before they escalate. As AI continues to evolve, these capabilities will only grow, giving startups access to the same level of financial intelligence that big enterprises enjoy.

Now is the time to embrace AI. It’s affordable, scalable, and fits startups at every stage - from those just getting started to those scaling beyond 50 employees. Whether it’s basic bookkeeping or advanced forecasting with CFO-level insights, AI tools can adapt to your needs. Early adoption isn’t just a smart move - it’s a competitive advantage. It enables quicker decision-making, better cash flow management, and investor-ready reports that build trust with stakeholders.

However, successful AI financial planning requires more than just the tools. Clean data is critical - AI is only as effective as the information it processes. Pairing automation with the expertise of seasoned financial professionals ensures that complex tasks, like optimizing tax credits or preparing for fundraising, are handled with care. Training your team to interpret AI-driven insights further maximizes your investment, creating a powerful blend of technology and human expertise that drives smarter financial management.

The trend is clear: AI is becoming essential in financial management. Over 80% of WealthTech vendors already consider AI agents and copilots key to their strategies. Additionally, eleven companies on the 2025 Fintech 100 list are leveraging AI to streamline tasks like fraud detection, financial planning, and compliance. Startups that integrate AI into their financial operations now will be better positioned to stay ahead, while those that delay risk falling behind more efficient, better-informed competitors. AI isn’t just the future of financial planning - it’s the present. Don’t wait to make it part of your strategy.

FAQs

How can AI-powered financial planning tools help startups handle unexpected financial challenges?

AI-driven financial planning tools are changing the game for startups, offering the ability to tackle financial uncertainties with a level of precision that was once out of reach. By leveraging real-time data, these tools can pinpoint potential risks, predict cash flow trends, and deliver actionable insights to keep businesses ahead of the curve.

With features like automated reporting and predictive analytics, startups can make faster, smarter decisions. This ensures they stay responsive and ready for unexpected challenges. Plus, these tools free up founders to concentrate on scaling their operations without losing sight of their financial well-being.

How can startups seamlessly integrate AI financial tools into their existing systems?

Startups looking to integrate AI financial tools can take a few straightforward steps to make the process smoother and more effective. First, take a close look at your current systems and pinpoint where AI could make a difference. This might include automating repetitive tasks like bookkeeping, simplifying tax preparation, or improving the accuracy of financial reporting.

Next, check that your existing tools and the AI platform work well together. Compatibility is key to avoiding unnecessary headaches, which could mean updating software or organizing your data sources to ensure everything runs seamlessly.

Once you've got compatibility sorted, focus on creating a clear plan for implementation. This includes training your team to use the new tools confidently and setting measurable goals to evaluate how well the AI is improving your financial processes. By following these steps, startups can tap into the advantages of AI-powered financial tools without disrupting their day-to-day operations.

How does AI improve the accuracy and reliability of financial forecasts compared to traditional methods?

AI is transforming financial forecasting by processing massive datasets at incredible speed and spotting patterns that traditional methods might overlook. Its ability to respond to real-time changes means businesses get more accurate and current predictions, enabling smarter decision-making.

On top of that, AI minimizes human error and takes over repetitive tasks, freeing up financial teams to concentrate on strategic planning instead of crunching numbers. The result? Faster, dependable insights that fuel growth and help make the best use of resources.