Managing expenses manually? That’s outdated. Startups in 2025 rely on AI tools to categorize expenses with precision, saving time and avoiding costly errors. These tools integrate with popular accounting software, provide real-time insights, and eliminate manual tracking hassles. Here's a quick look at the top 7 AI-powered expense categorization tools:

- Lucid Financials: Full-stack accounting for startups, offering AI-driven categorization, real-time forecasts, and Slack integration. Starts at $150/month.

- Ramp: Combines corporate cards with automated expense tracking and policy enforcement. Free with their card.

- Pilot: AI-assisted bookkeeping with human oversight, syncing with QuickBooks and Xero. Pricing starts around $500/month.

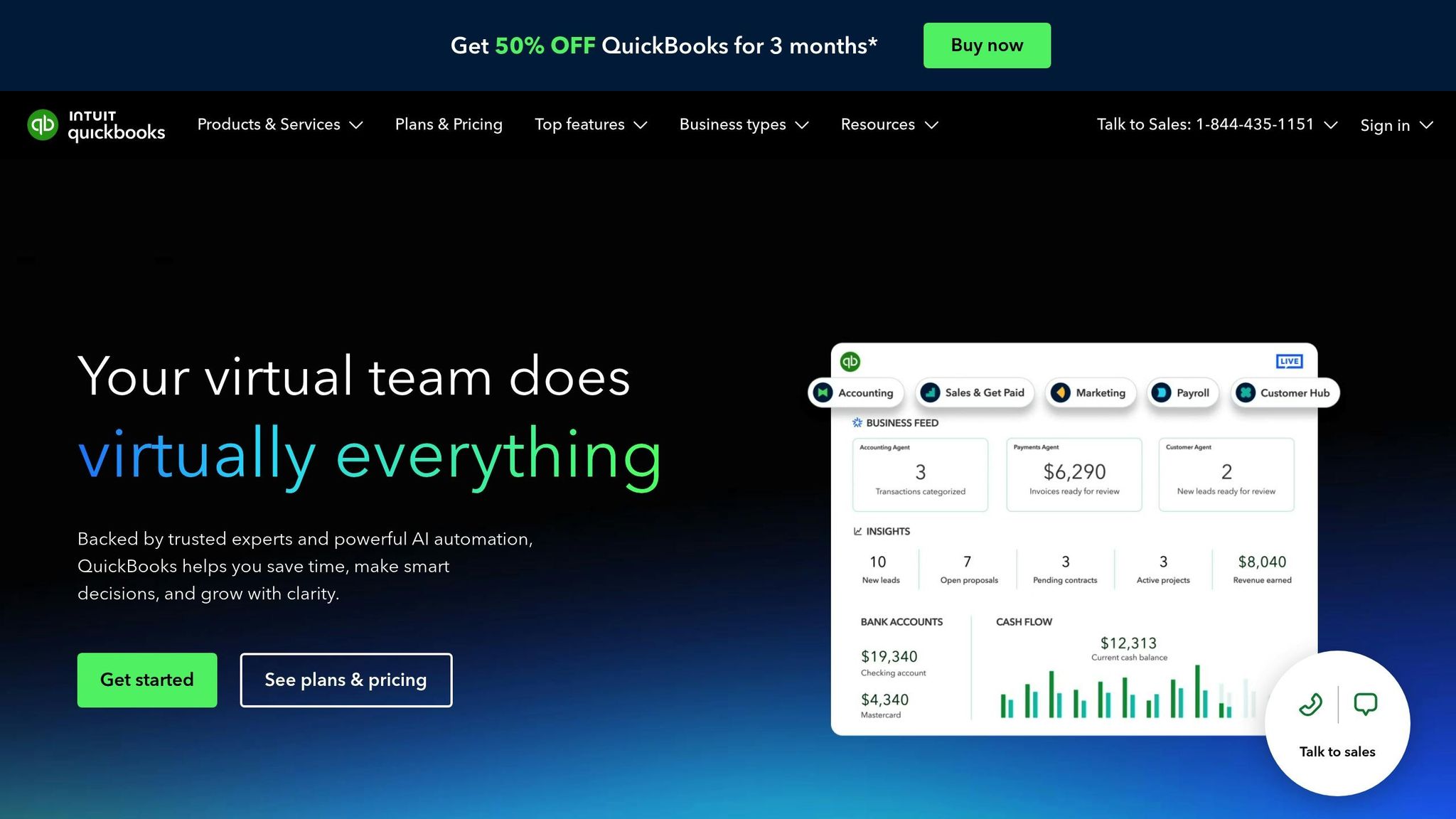

- QuickBooks: Machine learning for categorization, receipt capture, and custom reporting. Plans start at $30/month.

- Xero: Smart categorization rules and bank integrations with a user-friendly interface. Starts at $13/month.

- FreshBooks: Simplifies expenses for freelancers and service-based startups with project-specific tracking. Starts at $17/month.

- NetSuite: Enterprise-level AI categorization and predictive analytics for larger businesses. Custom pricing.

Why it matters: AI tools reduce errors, provide real-time insights, and ensure accurate, audit-ready financial records. For startups, they’re a must-have to stay competitive and investor-ready.

How to Automate Expense and Income Categorization with AI and Automations

1. Lucid Financials

Lucid Financials is breaking new ground as the first AI-powered full-stack accounting firm tailored for startups and fast-growing businesses. Unlike traditional tools that merely sort transactions, Lucid offers a complete financial solution, blending smart expense management with scalable financial services. Let’s take a closer look at how its automation redefines expense categorization.

Smarter Expense Categorization with AI

Lucid’s advanced AI doesn’t just categorize transactions - it learns. It automates transaction matching, handles reconciliation, and even identifies opportunities for R&D tax credits. For startups, it simplifies complex financial scenarios, including managing founder expenses like equity grants and unique tax deductions.

Seamless Integration with Your Tools

Lucid connects directly with QuickBooks, ensuring your categorized expenses integrate smoothly into your existing accounting processes. Need quick answers? The platform also syncs with Slack, allowing you to get real-time insights on expenses, runway, or spending patterns through AI-powered responses.

Insights and Reporting in Real Time

Lucid delivers more than just numbers - it provides actionable insights. From board-ready reports to investor-grade forecasts, the platform equips you with polished financial data. It also generates cash flow projections, spending analyses, and real-time runway visibility by comparing your current cash position to projected income. This level of clarity can be a game-changer during fundraising efforts.

Built for Startups, Ready to Scale

Starting at just $150 per month (with discounts for early-stage companies), Lucid makes professional-grade financial tools accessible to startups. As your business grows, you can add modules for bookkeeping, tax services, and CFO-level financial planning. Promising “clean books in 7 days,” Lucid ensures you have accurate records fast. It also manages founder-specific tax scenarios and uncovers potential savings opportunities, making it a reliable partner for scaling businesses.

2. Ramp

Ramp is a corporate card and expense management tool designed to simplify financial tracking for startups. By combining corporate cards with automated expense management, Ramp helps businesses control spending while keeping detailed financial records.

Smarter Expense Tracking with Automation

Ramp uses AI to categorize transactions instantly by analyzing spending patterns and vendor details. When employees use their Ramp cards, the system automatically captures receipt data, matches it to transactions, and enforces spending policies on the spot - blocking any purchases that violate company rules. This hands-off approach allows startups to maintain strong financial oversight without constant manual intervention.

Seamless Integration with Accounting Tools and Banks

Ramp integrates directly with popular accounting platforms like QuickBooks, Xero, and NetSuite, ensuring that transaction details, categories, and documentation are uploaded into your accounting system within minutes.

It also connects with business bank accounts, pulling in transactions and applying the same AI-powered categorization to non-card expenses. This ensures all spending - whether on Ramp cards or through other payment methods - is consolidated into one organized system.

Real-Time Dashboards and Insights

Ramp provides live dashboards that update instantly, allowing businesses to monitor spending against budgets in real time. Managers receive alerts when budgets are nearing their limits, keeping spending in check.

The platform’s reporting tools generate in-depth analytics, highlighting spending patterns, potential areas for savings, and unusual transactions that may need attention. It also automates monthly financial reports, offering insights into trends, top vendors, and category-specific spending to aid in smarter budgeting.

Tailored for Startups with Room to Grow

Ramp offers its core features without annual fees and provides higher credit limits by analyzing real-time business data. It’s built to scale, allowing startups to easily add team members and cards as they grow. With customizable approval workflows and department-specific budgets, Ramp ensures spending controls adapt to a company’s evolving needs.

Next, we’ll explore how Pilot takes expense management to the next level with its distinct features.

3. Pilot

Pilot simplifies bookkeeping and expense categorization for startups by automating transaction coding, managing approvals, and syncing data in real time. This becomes even more effective when paired with tools like Ramp.

Integration with Accounting Platforms and Banks

Pilot works seamlessly with both QuickBooks Online and Xero, offering businesses the flexibility to choose their preferred accounting software. While most users rely on QuickBooks Online as Pilot's primary platform, the service also supports those who opt for Xero. This integration ensures a smooth process from capturing expenses to categorizing them.

These integrations lay the groundwork for advancements in AI-powered expense management.

4. QuickBooks

QuickBooks continues to be a go-to accounting platform in the United States, especially for businesses aiming to streamline their financial processes. With the addition of AI-driven tools, its expense categorization features have become even more efficient.

Smarter Expense Categorization

QuickBooks leverages machine learning to automatically sort expenses based on transaction patterns and merchant details. Over time, the system improves its accuracy by learning from prior user inputs. Once you connect your bank accounts and credit cards, QuickBooks imports transactions and suggests categories using details like merchant names and amounts.

The Smart Rules feature takes automation further by letting users create custom rules. For example, you can set a rule to automatically categorize payments to a recurring vendor, cutting down on manual effort. Plus, the mobile app includes receipt capture functionality. Just snap a photo of a receipt, and the AI extracts key details - such as date, amount, and vendor - while recommending the right expense category.

These time-saving tools seamlessly integrate with the platform's broader features.

Easy Integration with Banks and Business Tools

QuickBooks connects with a wide range of financial institutions in the U.S., making it simple for startups to sync their accounts. This ensures real-time transaction imports and categorization. It also integrates with popular tools like PayPal, Square, and Stripe, along with major credit card providers, enhancing its functionality for businesses relying on multiple payment systems.

Real-Time Insights and Reporting

With its automatic data imports, QuickBooks provides real-time insights into spending trends. The interactive dashboard breaks down expenses by category, offering a clear picture of where money is going each month. Users can also generate detailed reports, such as profit and loss statements, cash flow projections, and expense analyses.

The comparative reporting feature is particularly useful, as it visually tracks spending trends over time, helping businesses identify unusual expenses or adjust their budgets. For added flexibility, QuickBooks allows custom reports tailored for tax preparation, investor updates, or internal reviews. These can even be scheduled for automatic delivery, ensuring that stakeholders always have the latest financial data.

Tailored for Startups and Growth

QuickBooks offers multiple pricing tiers designed to meet the needs of early-stage startups and growing businesses. The basic plan covers essential expense categorization, while advanced plans include extras like bill management, time tracking, inventory tracking, and project profitability tools. For startups operating internationally, QuickBooks supports multi-currency transactions, handling conversions and generating separate reports for different currencies.

To support growing teams, QuickBooks includes a user permission system, allowing founders to control access to sensitive financial information. This ensures secure collaboration as the business scales.

sbb-itb-17e8ec9

5. Xero

Xero has made a name for itself as a cloud-based accounting platform that uses AI-driven tools to simplify expense management for businesses across the United States. Its machine learning capabilities are particularly useful for startups aiming to streamline financial processes while maintaining precision. By focusing on automation, Xero complements the integrated financial systems we've previously discussed.

Smarter Expense Categorization

Xero's AI takes the hassle out of categorizing transactions. It uses merchant details, transaction amounts, and historical data to automatically assign categories. For example, when bank transactions are imported, its Smart Categorization and custom Bank Rules can automatically classify office supply purchases as "Office Expenses", saving time on repetitive tasks.

The platform also offers Receipt Capture via its mobile app. Simply snap a photo of a receipt, and the AI extracts key details like the date, amount, and vendor. These details are then matched to existing transactions or used to create new expense entries with suggested categories. This feature is particularly handy for keeping records organized on the go.

Seamless Integration with Banks and Payment Platforms

Xero connects to over 1,000 financial institutions in the United States, offering daily automatic bank feeds that keep your transaction data up to date. It also integrates smoothly with major payment processors like Stripe, PayPal, and Square, importing transaction data and applying the correct categories without requiring manual input.

In addition to bank connections, Xero's App Marketplace supports integrations with popular expense management tools like Expensify and Receipt Bank. These integrations allow expense reports to flow directly into your accounting system, already categorized. The platform also supports business credit cards from major providers, ensuring corporate spending is tracked and categorized automatically.

Real-Time Expense Tracking and Reporting

Thanks to its cloud-based setup, Xero provides real-time spending summaries broken down by category. The platform's Dashboard gives you a quick overview of where your money is going each month. It also generates essential reports like Profit & Loss statements and Cash Flow summaries, which update automatically as new expenses are logged.

Xero’s Budget Manager feature helps you stay on top of your finances by setting spending limits for different categories. You'll get alerts when you're nearing those limits, and the system tracks your actual expenses against budgeted amounts. For deeper insights, you can create custom reports focusing on specific categories or time periods, and even schedule these reports to be delivered automatically to your team or stakeholders.

Tailored Features for Startups

Xero’s flexible pricing makes it a great choice for startups, offering plans that grow alongside your business. The Early plan is ideal for smaller operations, supporting up to 20 invoices and 5 bills per month. As your needs expand, the Growing plan removes these limits and adds features like multi-currency support for handling international transactions.

For growing teams, Xero includes user permissions to ensure secure collaboration and supports Multi-Entity Management, allowing you to oversee multiple businesses or subsidiaries from one account. This is especially useful for startups managing separate legal entities under one umbrella.

If you're preparing for investment rounds, Xero's Management Reporting tool can generate investor-ready financial statements with properly categorized expenses that meet professional accounting standards. Detailed audit trails track how expenses were categorized and by whom, offering the transparency that investors and auditors expect.

6. FreshBooks

FreshBooks is a user-friendly tool designed to simplify expense management for service-based startups and freelancers. It makes handling receipts and keeping track of finances easier and more efficient.

Automated Expense Categorization

With FreshBooks, managing receipts is a breeze. Just upload them using the mobile app, and the platform takes care of the rest. It automatically pulls key details like the merchant name, date, and amount. Over time, it learns from your inputs to suggest the right categories, saving you from repetitive manual work. Plus, batch updates make handling multiple entries faster and smoother.

Integration and Connectivity

FreshBooks connects with major U.S. banks and payment platforms, automatically syncing transactions to keep your expense records up to date. It also lets you link expenses directly to specific projects, which helps ensure accurate client billing and keeps costs organized.

Real-Time Reporting and Financial Insights

The dashboard offers a clear view of your categorized expenses at a glance. You can track spending by category, vendor, or time frame and create detailed, up-to-the-minute reports. These tools make it easier to spot spending trends and manage your cash flow effectively. As your startup grows, this real-time data ensures your financial picture stays organized and easy to understand.

Scalable Features for Growing Startups

FreshBooks offers flexible pricing plans that grow with your business. Whether you’re working solo or managing a team, you can benefit from features like multi-user access with role-based permissions and detailed audit trails. These tools make collaboration, financial reviews, and tax preparation less of a hassle.

7. NetSuite

NetSuite wraps up our list with its enterprise-level tools tailored for managing expenses in larger businesses. It stands out by offering advanced integration features that simplify expense categorization. With the help of AI, NetSuite automates this process, ensuring consistent data and providing real-time insights. Its robust design not only handles categorization but also keeps your accounting systems effortlessly in sync.

Integration with Accounting Platforms and Banks

NetSuite connects directly with thousands of financial institutions through its Bank Feeds SuiteApp. This feature automatically imports data from bank accounts and credit cards, using AI to categorize expenses with impressive accuracy. These capabilities make NetSuite a reliable choice for businesses needing scalable and precise financial tracking.

Tool Comparison Table

Here's a quick snapshot of the key features offered by each tool discussed earlier:

| Tool | Key AI Features | Automation Level | Bank Integrations | Reporting Options | Starting Price (USD/month) | Startup Suitability |

|---|---|---|---|---|---|---|

| Lucid Financials | AI-driven bookkeeping, real-time forecasting, Slack integration | Fully automated categorization and reconciliation | QuickBooks integration, multi-entity support | Board-ready reports, investor-grade forecasts | $150 | Excellent – tailored for startups |

| Ramp | Smart expense categorization, receipt scanning, policy enforcement | High automation with real-time categorization | Direct bank feeds, credit card integration | Custom dashboards, spend analytics | $0* | Very Good – startup-friendly features |

| Pilot | AI-assisted bookkeeping, transaction matching | Semi-automated with human oversight | Multiple bank connections, accounting sync | Monthly financials, tax-ready reports | ~$500 | Good – service-based approach |

| QuickBooks | AI-powered categorization, receipt capture | Moderate automation with user confirmation | Extensive bank connections | Standard financial reports, custom reporting | $30 | Good – scalable with customization |

| Xero | Bank feed learning, smart categorization rules | Moderate automation with rule-based learning | Wide range of financial institution integrations | Real-time reporting, customizable dashboards | $13 | Very Good – user-friendly interface |

| FreshBooks | Automated expense tracking, receipt scanning | Basic automation with manual review options | Integration with major banks and credit cards | Project-based reporting, time tracking | $17 | Good – ideal for service businesses |

| NetSuite | Advanced AI categorization, predictive analytics | High automation with enterprise-level accuracy | Extensive bank connectivity | Comprehensive ERP reporting, real-time insights | Custom pricing | Fair – suited for larger organizations |

*Ramp is typically free when using their associated card; details may vary.

Each tool brings a unique mix of features, pricing, and automation levels. For startups, Lucid Financials stands out with its focus on real-time insights and deep integrations. Tools like Ramp and Xero offer user-friendly options with robust automation, while Pilot provides a service-oriented approach for those needing human oversight.

When choosing a tool, consider how well its integrations, automation, and reporting match your startup's needs. The next section will explore how these tools can streamline expense management for growing businesses.

Conclusion

Selecting the right AI-powered expense categorization tool can revolutionize how your startup manages its finances. This shift isn’t just about saving time - it’s about eliminating tedious tasks so you can focus on growth.

The benefits are clear and measurable. With AI handling expense automation, startups have reported up to a 70% reduction in administrative workload. Additionally, some businesses have seen expense reimbursement times improve up to 5x faster after adopting these tools. For startups, where every minute counts, these time savings translate into more hours for critical activities like product development, customer engagement, and strategic planning.

Another major advantage is the ability to gain real-time insights. Instead of waiting for monthly reports, founders can instantly identify spending trends, spot duplicate subscriptions, and address budget issues. AI tools even flag overpriced vendors, giving you the chance to optimize costs and extend your financial runway.

Modern AI expense tools also simplify your financial systems by seamlessly integrating with other platforms. This eliminates data silos, ensures smooth data flow, and reduces reconciliation time - leaving your books always ready for investors.

Operating in the competitive U.S. market means compliance and audit readiness are non-negotiable. AI-powered categorization ensures your records align with accounting standards while maintaining detailed audit trails that meet investor and auditor expectations. According to IBM research, businesses using AI for budgeting and forecasting have cut errors by at least 20%, providing the precision and dependability that stakeholders rely on.

FAQs

How can AI tools help startups improve expense categorization and financial accuracy?

AI-powered tools simplify the process of expense categorization for startups by automating tedious tasks like data entry and minimizing the risk of human error. Leveraging machine learning and natural language processing (NLP), these tools can classify transactions with precision and even flag unusual activity that might slip through unnoticed.

When expenses are categorized accurately, startups benefit from clearer financial reports, better compliance, and smarter decision-making. This automation doesn’t just save valuable time - it frees up founders to concentrate on scaling their business instead of being tied up with financial admin work.

What features should startups prioritize when selecting an AI tool for expense categorization?

Startups should focus on AI tools that work well with their current financial systems, like QuickBooks or Xero. This can make day-to-day tasks easier by cutting down on manual work. Pairing these tools with communication platforms like Slack for instant updates and notifications can further boost productivity.

Key features to consider include automated receipt capture, real-time transaction tracking, and policy enforcement. These tools not only streamline operations but also ensure financial records stay accurate and well-organized. This way, startups can spend less time on admin tasks and more time growing their business.

How do AI tools help startups track and improve their financial health in real time?

AI tools give startups the ability to keep a close eye on their financial health by automating data analysis from sources such as bank accounts, accounting software, and payment platforms. They deliver real-time insights into key areas like cash flow, spending habits, and future financial projections, helping startups make quick, informed decisions.

These tools can also identify trends, flag potential risks, and suggest strategic changes when needed. By relying on AI for financial management, startups can stay nimble, maintain accurate records, and concentrate on growing their business without getting stuck in the weeds of manual bookkeeping.