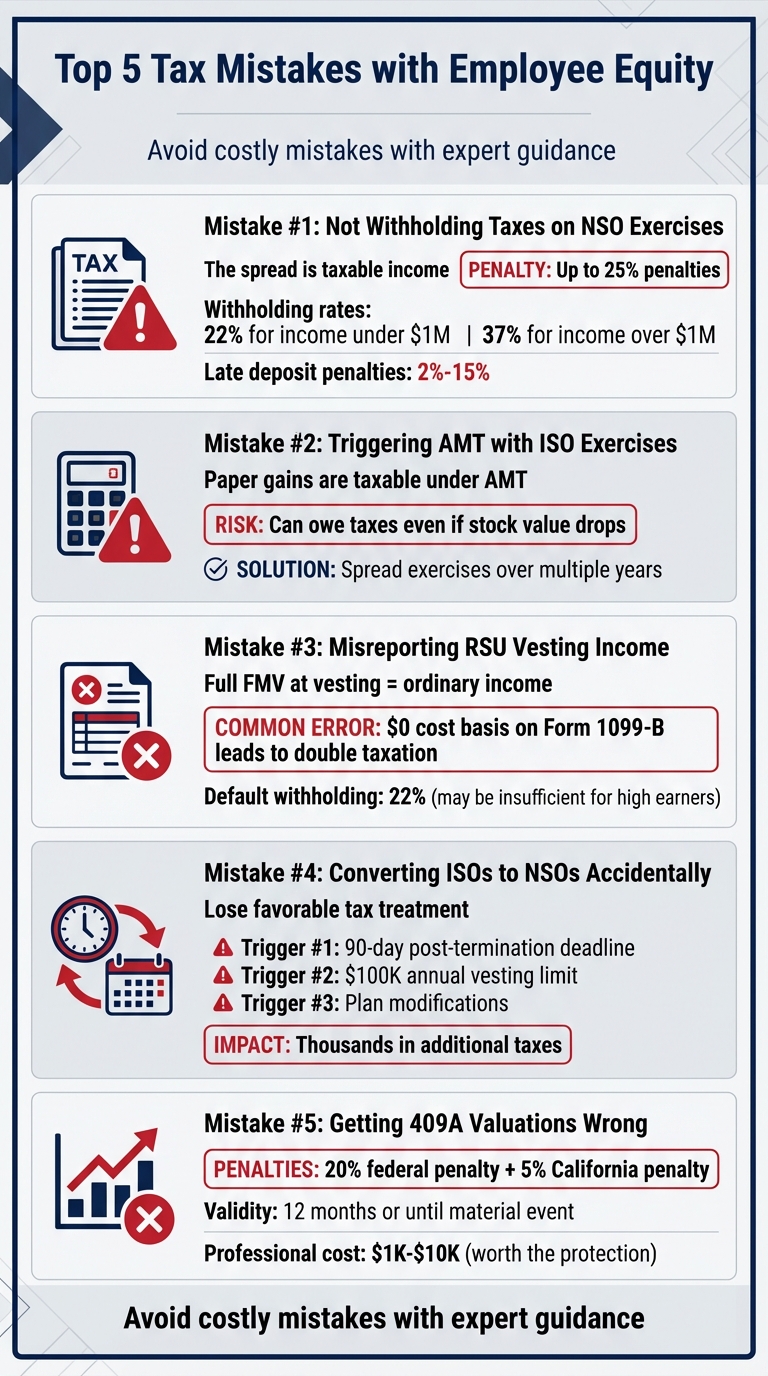

When it comes to employee equity, tax mistakes can cost you big - whether you're an employee or an employer. Missteps like missing deadlines, misreporting income, or undervaluing stock can lead to penalties, unexpected tax bills, and compliance headaches. Here's a quick rundown of the five most common tax errors and how to avoid them:

- Failing to withhold taxes on NSO exercises: The IRS treats the difference between the stock's market value and exercise price as taxable income. Forgetting to withhold can result in penalties of up to 25%.

- Triggering AMT with ISO exercises: Exercising Incentive Stock Options (ISOs) can lead to Alternative Minimum Tax on paper gains, even if you don’t sell the stock.

- Misreporting RSU vesting income: RSUs are taxed as ordinary income when they vest. Reporting errors can lead to double taxation or IRS audits.

- Converting ISOs to NSOs accidentally: Missing the 90-day exercise window after leaving a job or exceeding the $100,000 annual vesting limit can strip ISOs of their tax benefits.

- Getting 409A valuations wrong: Incorrect valuations can trigger immediate taxes, a 20% penalty, and additional state penalties.

Mistakes like these can derail your finances, but careful planning and professional advice can help you stay compliant and avoid costly errors.

5 Common Tax Mistakes with Employee Equity and How to Avoid Them

7 DUMB RSU mistakes keeping you POOR

1. Not Withholding Taxes on NSO Exercises

When an employee exercises a Non-Qualified Stock Option (NSO), the IRS considers the "spread" - the difference between the stock's fair market value and the exercise price - as regular compensation income. This income is subject to federal income tax and FICA (which includes Social Security and Medicare) withholding requirements.

For supplemental wages under $1 million, the federal withholding rate is typically 22%. However, if the total supplemental payments exceed $1 million in a year, the withholding rate jumps to 37%. Employers are also responsible for withholding Social Security and Medicare taxes on this income, whether the employee is current or former - and even if the employee doesn’t sell the shares to generate cash.

Failing to comply with these requirements can lead to hefty penalties. Late deposit penalties range from 2% to 15%, while underpayment penalties accrue at 0.5% per month, capped at 25%. Additionally, if cumulative withholding exceeds $100,000, the deposit must be made by the next business day.

To ensure compliance, it’s essential to coordinate with payroll teams, especially during periods of heavy NSO exercises. Using cash or sell-to-cover arrangements can help secure the necessary withholding funds. Keep in mind that state and local tax rules can vary significantly, adding another layer of complexity for remote employees. For high earners, the standard 22% withholding may fall short of their actual tax liability, so they may need to make quarterly estimated payments.

An integrated accounting tool like Lucid Financials can make this process more manageable by automatically tracking withholding thresholds and ensuring timely tax deposits.

2. Triggering AMT with ISO Exercises

Exercising Incentive Stock Options (ISOs) can be a smart tax move, but it also comes with potential pitfalls - especially when it comes to the Alternative Minimum Tax (AMT). One of the biggest perks of ISOs is that you don’t owe regular income tax at the time of exercise. However, the catch lies in the spread between your strike price and the stock’s fair market value. This difference is treated as income under the AMT system, a parallel tax designed to ensure higher earners pay a minimum tax amount. The result? A hefty, and often unexpected, tax bill.

Here’s the tricky part: you can owe taxes on "paper gains" even if you haven’t sold the stock or received any cash from the transaction. As Ryan Wang, CPA, MBT, explains: “Under the AMT rules, this spread is treated as income for AMT purposes. It doesn’t appear on your regular return but may trigger an AMT bill in the exercise year”.

What makes it worse is that AMT liability is locked in based on the stock’s value on the day of exercise, even if the stock price drops later. Wang highlights this risk: “In past downturns, people who exercised a lot of options and held the stock saw the value plummet, yet they still owed AMT on the value at time of exercise, forcing some into bankruptcy”.

To avoid falling into this situation, consider running an AMT calculation before exercising a large number of ISOs. Spreading out your exercises over several years and staying below the AMT exemption threshold can help minimize your risk. If you’ve already exercised and find yourself facing an overwhelming AMT bill, there’s still an option: sell the shares before December 31 of the same year. This move can shift the tax treatment, eliminating the AMT requirement, though you’ll pay ordinary income tax on the spread instead.

Another important note: if you end up paying AMT, you may be eligible for an AMT credit to offset future tax liabilities. Additionally, ISO exercises must be reported using Form 3921, which is required to be issued by January 31.

3. Misreporting RSU Vesting Income

RSUs (Restricted Stock Units) are taxed as ordinary income when they vest, and mistakes in reporting can lead to IRS audits, penalties, or unexpected tax bills.

When RSUs vest and shares are delivered, the entire fair market value (FMV) of those shares at the time of vesting is considered ordinary income. Ryan Wang, CPA, MBT, puts it this way:

The moment your RSU award vests and you get the shares, the entire value of those shares is treated as ordinary income to you. It's just like a cash bonus, taxed at your income tax rate.

This income is reported in Box 1 of your W-2 and is subject to federal and state income taxes, along with Social Security and Medicare taxes. However, there are key reporting issues to watch out for - and ways to fix them.

One common mistake happens when brokerages list a $0 cost basis on Form 1099-B. If you don’t adjust Schedule D to reflect the FMV of the shares at vesting, the IRS may tax the entire sale price, leading to double taxation. Derek Jess, CFP at Plancorp, explains:

If you don't report the $50,000 FMV as your cost basis on Schedule D (Capital Gains and Losses), the IRS assumes you owe capital gains taxes on the full $60,000, rather than the actual $10,000 gain.

Another issue is under-withholding. Employers typically withhold 22% for RSUs, but high earners might need to adjust by increasing paycheck withholding or making quarterly estimated tax payments to avoid a shortfall.

To stay ahead of these challenges, consider integrating your payroll system with an equity management platform. This can help automate tax withholding and reporting. A sell-to-cover strategy can also be useful for managing cash flow. Finally, double-check that your W-2 accurately reflects the FMV at vesting to avoid unwanted IRS notices.

sbb-itb-17e8ec9

4. Accidentally Converting ISOs to NSOs

Incentive Stock Options (ISOs) come with tax perks that can save you a lot of money - but they’re surprisingly easy to lose. A single mistake can turn your ISOs into Non-Qualified Stock Options (NSOs). This change means you’ll face ordinary income tax on the spread at exercise, instead of benefiting from the more favorable long-term capital gains rates.

CJ Stermetz, Founder of Equity For The Win, has witnessed how costly this can be:

"We've worked with people who have had their valuable grants of ISOs convert to NSOs without realizing that this conversion had already taken place. This seemingly small event ended up costing them thousands of dollars in taxes."

There are several ways this conversion can happen. Let’s break down the most common scenarios that could cause ISOs to lose their status.

The 90-day post-termination window is one of the biggest culprits. If you leave your job, you have exactly 90 days to exercise your ISOs. Miss that deadline - even by a single day - and your ISOs automatically convert to NSOs. While some companies, like Coinbase, Carta, Pinterest, and Expensify, offer extended exercise periods, the tax benefits tied to ISO status only apply during that initial 90-day window. The same rule applies if you transition from being a W-2 employee to working as a contractor or consultant - your 90-day clock starts immediately.

The $100,000 annual vesting limit is another potential trap. The IRS limits the fair market value of ISOs that can first become exercisable in any calendar year to $100,000 (calculated at the grant date). Any excess automatically gets treated as NSOs. This can catch startups off guard, especially during events like layoffs or acquisitions, where accelerated vesting might push grants over the limit.

Plan modifications can also cause trouble. For instance, extending the expiration date of your options will instantly convert ISOs into NSOs. If your employer accidentally makes this change, they can fix it before you exercise or by December 31 of that year. However, if the issue goes unnoticed, the tax consequences can be significant.

Understanding these triggers is crucial if you want to preserve the tax benefits of your ISOs. A small oversight can lead to big tax bills, so staying informed and proactive is key.

5. Getting 409A Valuations Wrong

After addressing common tax pitfalls with stock options and RSUs, it's time to focus on another crucial area - 409A valuations. These valuations determine the fair market value (FMV) of your company's common stock and are the foundation for setting compliant strike prices on employee stock options. Getting this wrong can lead to hefty IRS penalties.

If strike prices are set below the FMV, the difference (or "spread") becomes immediately taxable. On top of that, the IRS can impose a 20% federal penalty, with California adding an additional 5% penalty for state taxes. As with NSOs and ISOs, precision in 409A valuations is critical to avoid unexpected tax complications.

It's important to note that 409A valuations are only valid for 12 months or until a significant event occurs. Using outdated valuations or relying on instruments like SAFEs or convertible notes to establish FMV can lead to trouble. As Tania Huzieran warns:

Shortcuts don't scale. A 'fast and cheap' valuation might check the box today, but it can fall apart under audit or due diligence.

Skipping professional valuations is a risky move. Without a certified valuation, you lose Safe Harbor protection, meaning you'll have to prove your valuation was reasonable - a time-consuming and challenging process. While professional 409A valuations typically cost between $1,000 and $10,000, this expense is minor compared to the penalties you could face.

To stay on the safe side, keep thorough records of your valuation process, including board approvals and any material events that might require an updated valuation. Partnering with experts like Lucid Financials can help ensure your valuation practices remain compliant as your company grows. Solid 409A processes not only protect your company but also safeguard your employees from unnecessary tax burdens.

Conclusion

Mistakes in employee equity taxes - like missed 83(b) elections, inaccurate 409A valuations, or Alternative Minimum Tax (AMT) missteps - can lead to hefty penalties and serious disruptions. For example, the IRS strictly enforces the 30-day deadline for 83(b) elections, with no exceptions. Misjudged 409A valuations can stall funding rounds or mergers, driving up legal costs. And AMT errors? Those have even forced some employees into bankruptcy after exercising Incentive Stock Options (ISOs) without understanding the tax implications.

These challenges highlight the need for careful tax planning. Your equity program should be a tool to attract and retain talent - not a source of financial headaches. Missteps can result in severe financial and legal consequences, which no business can afford.

That’s where expert support becomes crucial. Professional guidance helps you meet IRS deadlines, ensure accurate valuations, and avoid penalties like double taxation or underpayment fines that can climb as high as 15% of what you owe.

Lucid Financials specializes in tax solutions tailored for startups. From handling founder equity scenarios to optimizing R&D credits, our AI-driven platform integrates seamlessly with Slack, offering real-time answers from experienced pros. We’ll help you stay compliant, avoid costly errors, and keep your financials investor-ready - all starting at just $150 per month.

Don’t let equity tax mistakes slow your growth. Focus on building your business, and let us take care of the numbers with our AI-powered platform, starting at just $150 per month.

FAQs

What happens if taxes aren’t withheld on NSO exercises?

Failing to withhold required taxes - like federal and state income taxes, Social Security, and Medicare - on Non-Qualified Stock Option (NSO) exercises can lead to serious repercussions for employers. When taxes aren't properly withheld, the company becomes responsible for the entire unpaid tax amount. On top of that, you could face penalties, interest, and even trust fund recovery penalties.

The best way to steer clear of these risks? Make sure all NSO exercises are handled with accurate tax reporting, withholding, and payment. Staying compliant not only safeguards your business finances but also reinforces trust with your employees and stakeholders.

What steps can I take to avoid the Alternative Minimum Tax (AMT) when exercising ISOs?

When exercising Incentive Stock Options (ISOs), taking a thoughtful approach can help reduce the chances of triggering the Alternative Minimum Tax (AMT). Here are a few strategies to consider:

- Exercise early in the year and in smaller amounts: Doing this can help keep the bargain element - the difference between the exercise price and the stock’s fair market value - at a more manageable level.

- Keep an eye on your company’s 409A valuation: Monitoring this valuation can help you avoid large spreads that might increase your AMT exposure.

- Consider a same-year sale or cashless exercise: These methods can generate regular taxable income, which may help offset any AMT liability.

By planning ahead and consulting a tax professional, you can better navigate the complexities of ISO exercises while adhering to tax regulations.

What should I do if I accidentally reclassify ISOs as NSOs?

If an Incentive Stock Option (ISO) is mistakenly reclassified as a Non-Qualified Stock Option (NSO), addressing the situation quickly is crucial. Start by consulting a tax or legal professional who can help you navigate the potential tax consequences and compliance requirements. They’ll guide you on whether the classification can be corrected or if changes to the option agreement are necessary.

It’s also important to handle any payroll tax withholding immediately to steer clear of penalties. Tackling the issue early reduces potential financial and legal risks for both you and your employees.