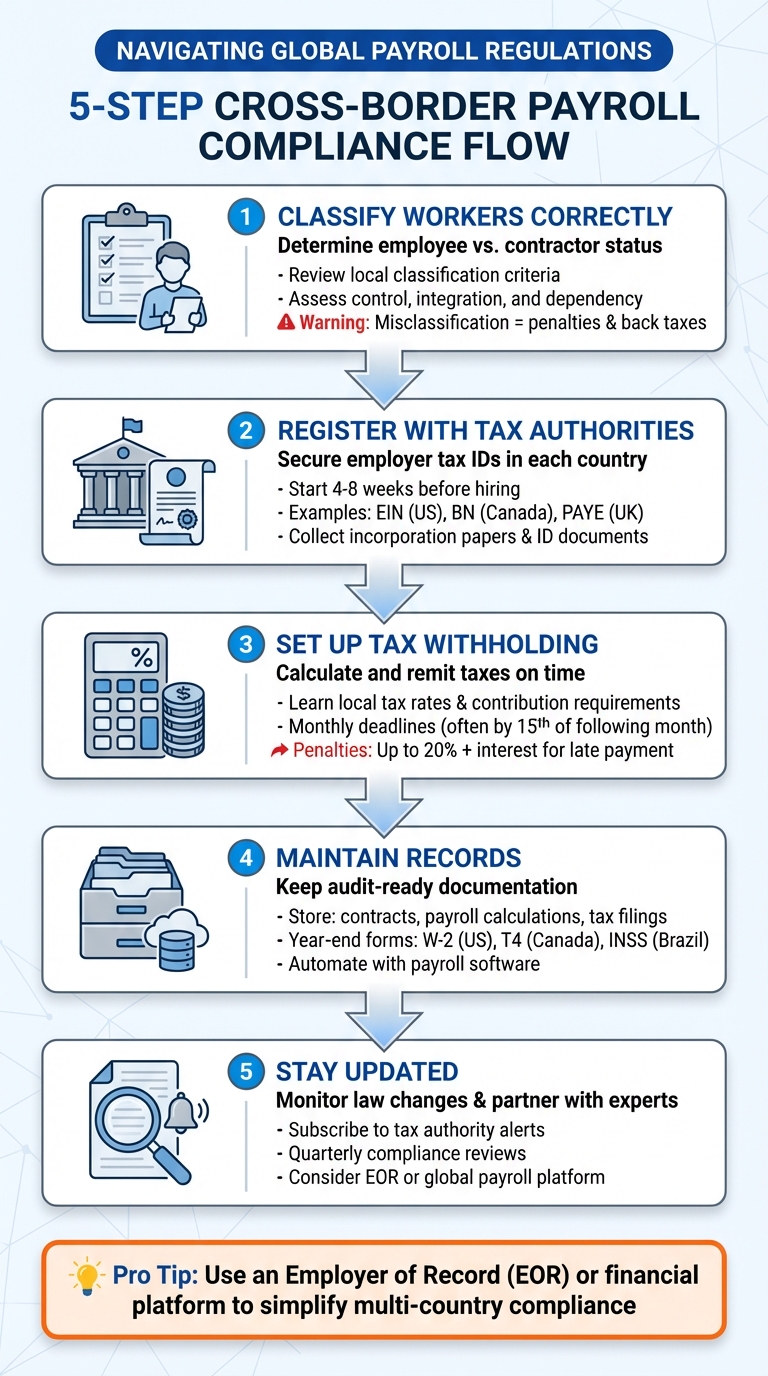

Managing payroll across borders can be tricky, but getting it wrong can cost you - fines, audits, and even legal trouble. Here’s how to stay compliant when paying employees internationally:

- Classify Workers Correctly: Determine if they’re employees or contractors based on local laws. Misclassification can lead to penalties and back taxes.

- Register with Tax Authorities: Secure employer tax IDs and payroll accounts in each country before hiring.

- Set Up Tax Withholding: Learn local tax rates and deadlines to ensure accurate deductions and timely payments.

- Maintain Records: Keep detailed, audit-ready documentation for wages, taxes, and benefits.

- Stay Updated: Monitor changes in laws and partner with experts or tools to simplify compliance.

Mistakes in cross-border payroll can hurt your business, but following these steps reduces risks and ensures smooth operations. If managing it all feels overwhelming, consider using a global payroll provider or Employer of Record (EOR) for support.

5 Steps to Cross-Border Payroll Compliance for International Teams

Working Across Borders: Navigating Global Mobility and Cross-Border Payments

Step 1: Classify Workers and Research Local Laws

Getting worker classification right is the foundation of compliant cross-border payroll. Whether someone is an employee or an independent contractor affects how you handle payroll, taxes, social security contributions, and statutory benefits in their country of residence. Misclassification can lead to serious consequences like back taxes, unpaid social insurance, penalties, and even bans on hiring in that region.

Employee vs. Contractor Classification

Most countries use specific criteria to differentiate between employees and contractors. These factors often include the level of control over work, integration into the business, dependency on the employer, who provides tools and equipment, the ability to subcontract, and mutual obligations. A quick way to assess: Does the worker follow a set schedule, work exclusively for your company, and use your systems? If the answer is mostly "yes", they are likely an employee. Warning signs of an employee relationship include using a company email, fixed hours, regular performance reviews, and consistent salary payments.

For employees, you’ll need to register with local tax and social security authorities. This involves withholding income tax and employee contributions, paying employer-side contributions (e.g., pensions, health insurance, unemployment), and providing statutory benefits like paid leave, sick days, and possibly bonuses or a 13th-month salary. On the other hand, contractors are typically paid gross invoices without tax withholding, leaving them responsible for their own tax and social contributions. However, some countries may still require you to withhold or report payments to nonresident contractors. Avoid misclassification to save costs - it’s a legal gamble that can backfire.

The next steps will help you navigate classification criteria and research local requirements effectively.

How to Research Country-Specific Rules

After determining the correct classification, dive into the specific regulations for that worker status in the relevant country. Start by visiting the official labor and tax authority websites to verify rules on things like minimum wage, mandatory benefits, and required contributions. For example, check employer and employee social security rates, such as Brazil’s INSS or Mexico’s IMSS. Also, review foreign employer registration requirements if applicable.

To ensure accuracy, consult global payroll guides and local experts for additional insights. Compile your findings into a country-specific payroll guide that outlines classification rules, registration processes, contribution rates, and deadlines. Share this resource with your finance and HR teams for smooth implementation. Lastly, explore tax treaties or totalization agreements that can help you avoid double taxation. If this step feels complex, platforms like Lucid Financials or expert advisors can provide valuable support.

Step 2: Register with Tax Authorities in Each Country

After classifying your workers and understanding local labor laws, the next step is to register with the appropriate tax and social security authorities in each country where you plan to hire. This is a critical move to ensure compliance with payroll regulations. Failing to register on time can result in fines, delayed payments, or an inability to file mandatory reports.

Timing is key here. Start the registration process 4–8 weeks before hiring your first employee in a new country. Some tax authorities may take several weeks to issue the necessary identifiers. If you're setting up a local entity, you'll need to complete registrations for income tax, payroll or social security, and any other local obligations. For instance, in Canada, you must first secure a Business Number (BN) before opening a payroll account with the Canada Revenue Agency. Similarly, other jurisdictions may require a national business number or corporate registration before you can proceed with payroll setup.

How to Obtain Tax Identifiers

Every country has its own requirements for employer tax identifiers, which are essential for payroll compliance. Here are some examples:

- United States: You’ll need an Employer Identification Number (EIN) from the IRS. This identifier is used for payroll tax deposits and filings.

- Canada: Businesses must obtain a Business Number (BN) along with a payroll program account (identified by the "RP" suffix) from the Canada Revenue Agency.

- United Kingdom: Employers must register with HMRC to set up PAYE (Pay As You Earn) before processing their first payroll.

To secure these identifiers, follow these steps:

- Research the specific registration requirements using official tax authority websites or consult local advisors.

- Gather necessary documents, such as incorporation papers, proof of address, director identification, and details of any required local representatives.

- Submit the appropriate forms to apply for the tax ID and payroll account.

Once you've applied, monitor the status of your application closely. Respond promptly to any requests for additional information to avoid delays. Partnering with a global payroll provider, an Employer of Record, or a service like Lucid Financials can simplify this process by helping you collect documents, track applications, and manage country-specific requirements all in one place.

Collecting Employee Documentation During Onboarding

Once your employer registrations are complete, the focus shifts to onboarding employees and collecting the required tax and identification documents. These documents are crucial for accurate tax withholding and reporting. For example:

- In the United States, collect Form W‑4 to determine federal income tax withholding, along with any required state forms, and Form I‑9 with supporting identification to confirm work authorization.

- In Canada, employees must complete federal Form TD1 (and provincial TD1 forms, if applicable) to set withholding credits. They’ll also need to provide their Social Insurance Number (SIN) for reporting purposes.

To keep things organized, use country-specific onboarding checklists that ensure all required forms and details - like full legal name, address, date of birth, tax ID, social security number, and bank account information - are collected before issuing the first paycheck. This prevents issues like under‑ or over‑withholding and delays in registrations. Directly integrating this data into your payroll system can also minimize manual errors.

If you’re working with an Employer of Record, they’ll handle local registrations, filings, and provide streamlined onboarding workflows, making the entire process much smoother.

Step 3: Set Up Tax Withholding and Payment Processes

Now that you've tackled registrations and documentation, it's time to focus on the nuts and bolts of payroll: calculating withholdings and ensuring funds are remitted on time. This step is all about accuracy and timeliness to steer clear of fines, interest charges, or audits.

How to Calculate and Withhold Taxes

Tax rules vary widely across countries, covering income tax, social security, pensions, health insurance, and unemployment contributions. Each country has its own set of deductions, so you'll need to familiarize yourself with the specific requirements where your employees are based. For instance:

- Brazil: Employers must withhold INSS social contributions (roughly 20–28% total for both employer and employee) and progressive income tax (IRRF) up to 27.5%.

- Mexico: Contributions to the IMSS social security system total about 34.55%, with income tax withholding reaching up to 35%.

- Chile: Deductions include AFP pension fund contributions, health insurance, and income tax rates as high as 40%.

To calculate payroll accurately, follow a gross-to-net approach:

- Start with the employee's gross pay.

- Adjust for what counts as taxable income (some bonuses or allowances might be exempt).

- Apply the local income tax brackets.

- Deduct social contributions and other mandatory withholdings.

- Arrive at the net pay figure.

It's crucial to stay on top of legal updates in each country and document any changes to your payroll formulas. Many businesses rely on payroll software with built-in compliance tools or partner with an Employer of Record (EOR) to manage these calculations. An EOR can also provide detailed, itemized pay statements in both local currency and U.S. dollars, simplifying reporting.

When it comes to paying employees, using their local currency isn’t just a convenience - it’s a compliance requirement. Tax calculations depend on domestic rates, and remittances to local authorities must be in the local currency. Mistakes here can lead to penalties, extra fees, and an increased risk of audits.

Once your calculations are spot-on, the next step is ensuring you meet every deadline for remitting taxes and contributions.

Meeting Payment Deadlines

Tax authorities are strict about deadlines for remitting withheld taxes and social contributions. In most countries, these payments are due monthly, often by the 15th of the following month. For example, Brazil, Mexico, and Argentina all have specific monthly deadlines. Missing these deadlines can result in penalties of up to 20% of the unpaid amount, along with compounding interest.

To avoid this, align your payroll schedule with remittance deadlines. Set pay dates that give your team enough time to handle calculations, approve payroll, and transfer funds to the appropriate tax authorities. Using tools that automate currency conversions and local payouts can make this process much smoother. If you're working with an EOR, they’ll take care of the monthly remittances and provide transparent reporting, saving you the hassle of setting up this infrastructure yourself.

For startups managing everything in-house, platforms like Lucid Financials can help automate tax submissions and track financial data in real time. This ensures you have the funds ready for timely payments, keeps you compliant, and provides investor-friendly financial reports.

sbb-itb-17e8ec9

Step 4: Set Up Reporting and Record-Keeping Systems

Once you've finalized tax withholding and payments, it's time to establish a reliable system for reporting and record-keeping. Tax authorities and labor regulators require detailed documentation of wages, taxes, and benefits - often for several years. This documentation is crucial for audits and resolving any employee-related disputes. Be sure to include records like employee identities, work authorizations, contracts, attendance logs, payroll calculations, tax filings, benefits data, and any communications with authorities.

If you're managing a cross-border team, you'll also need to account for country-specific reporting formats, deadlines, and retention requirements.

Year-End Reporting Requirements

Year-end reporting can be a major challenge, especially for startups with employees across different countries. Each jurisdiction has unique forms and deadlines, and missing these can lead to costly penalties. For example, in the U.S., W-2 forms must be filed by January 31, though extensions are available for electronic filings. In Canada, T4 slips are due by late February for paper submissions or by March 31 for electronic filings.

In LATAM countries like Brazil and Mexico, year-end filings often include details on social security contributions and the 13th-month salary. These are typically due between January and March. Brazil requires annual INSS summaries, while Mexico mandates IMSS reports. If you're using an EOR (Employer of Record), they’ll handle these monthly-to-annual rollups for audits. However, if you're managing payroll in-house, it’s crucial to create a year-end reporting calendar that outlines the key forms and deadlines for every country where you have employees.

To stay on top of these requirements and avoid missing deadlines, consider automating your reporting processes with payroll software.

Using Payroll Software for Automation

Payroll software can take a lot of the heavy lifting off your plate. These tools consolidate multi-country data into compliant formats and schedule filings to align with local deadlines. They also handle multi-currency conversions - for example, converting USD to BRL or MXN - and integrate directly with tax authorities to streamline submissions, significantly reducing manual errors.

In addition to simplifying compliance, payroll software provides audit-ready exports and timely alerts to help you meet reporting requirements. For startups expanding internationally, platforms like Lucid Financials offer centralized solutions for bookkeeping, tax filings, and even CFO-level insights. This kind of real-time visibility into your financials - such as burn rates and runway - is invaluable when making decisions about hiring and scaling. With AI-driven automation, these tools can make financial management up to 100x faster than manual methods, all while maintaining SOC 2 compliance for enterprise-grade security.

Step 5: Monitor Changes and Work with Experts

Managing cross-border payroll compliance is not a one-and-done task - it demands constant vigilance. Tax rates fluctuate, social security thresholds shift, and labor laws evolve. What worked smoothly last quarter could lead to serious compliance issues today. That’s why staying updated and collaborating with experts is crucial for startups handling international teams.

How to Stay Updated on Regulatory Changes

Once you have reliable reporting systems in place, the next step is keeping up with regulatory updates. Payroll laws can change quickly, so it’s important to stay proactive. One way is to set up alerts from official tax authorities in every country where you employ workers. For example, subscribe to updates from the IRS in the US, the CRA in Canada, or the SAT in Mexico. Governments often release annual tax calendars and bulletins detailing changes to withholding rates, contribution limits, and filing deadlines.

In addition to government sources, industry forums and newsletters focused on international employment law can be incredibly helpful. These resources break down complicated updates into straightforward summaries, highlighting what startups need to address immediately. To ensure compliance, schedule quarterly internal reviews to compare your payroll setup with the latest requirements. If you spot inconsistencies, it’s a clear signal to bring in an expert for a deeper look.

Working with EOR Providers and Financial Platforms

Navigating these constant changes can be overwhelming, which is why partnering with local experts and leveraging digital financial tools can make all the difference. An Employer of Record (EOR) acts as a local entity that officially employs workers on your behalf. While you manage the day-to-day operations, the EOR handles critical compliance tasks like registering employees with local authorities, enrolling them in systems like INSS in Brazil or IMSS in Mexico, and ensuring accurate payroll processing and reporting. This setup shifts the burden of monitoring legal updates, adjusting payroll parameters, and maintaining audit-ready records to professionals who specialize in these areas.

EORs are particularly useful when you're entering a new country, working with a small team, or trying to avoid the time and expense of setting up a local entity. As your operations grow, financial platforms like Lucid Financials can take things further by centralizing bookkeeping, tax filings, and providing CFO-level insights. Lucid automates record-keeping and gives you real-time data on burn rates and cash runway - key metrics for planning international hiring. With features like 24/7 Slack support and automation that’s up to 100x faster, you can get answers to complex tax questions instantly, without waiting for emails or scheduled meetings.

"With Lucid handling bookkeeping, taxes, and CFO support in one place, everything is organized, automated, and easy to manage. It's given me real peace of mind." - Erez Lugashi, Founder and CEO, Abilisense

Key Takeaways

Here’s a quick recap of the five-step process: classify workers correctly, register with local authorities, withhold and remit taxes on time, maintain audit-ready records, and monitor changes with expert help. Each step builds on the previous one, creating a system that helps shield your startup from penalties, back pay issues, or operational hiccups. For more details, revisit Steps 1–5.

For example, if a U.S.-based SaaS startup misclassifies a developer working in Mexico, it could lead to retroactive social contributions and penalties. Always prioritize local laws, no matter the country.

Tax rates, social security thresholds, and labor laws are constantly shifting across different regions. Conduct annual reviews of worker classifications and registrations to ensure compliance as roles and regulations evolve. Until you have a sizable team in a specific country, consider using an Employer of Record or a global payroll platform. A clean global payroll setup simplifies IRS reporting and ensures due diligence.

To keep up with changing regulations, platforms like Lucid Financials offer an integrated solution for bookkeeping, tax filings, and CFO-level insights. With real-time data on metrics like burn rate and runway, you can manage multi-country tax payments and international hiring without needing a large in-house finance team. Lucid’s 24/7 Slack support and automation tools - up to 100x faster than manual processes - provide instant answers to complex tax questions, ensuring your global payroll is always accurate and ready for investor scrutiny.

"With Lucid handling bookkeeping, taxes, and CFO support in one place, everything is organized, automated, and easy to manage. It's given me real peace of mind." - Erez Lugashi, Founder and CEO, Abilisense

Next steps: Build a worker inventory by country, including details like classification, hiring entity, and payroll method. Identify high-risk contractor cases that may need attention. Confirm that all necessary registrations and tax IDs are in place for every jurisdiction where you have employees. Finally, map out filing and payment deadlines in your company calendar. By following these steps, you can turn the five-step compliance process into a scalable routine as your team grows.

FAQs

How can I prevent worker misclassification when hiring internationally?

To avoid misclassifying workers across different countries, it's essential to first understand the distinctions between employees and independent contractors in each region. Labor laws vary significantly from one country to another, so researching and adhering to local regulations is a must.

Collaborate with legal or HR experts who specialize in international employment laws to ensure your worker classifications are correct. Make it a habit to periodically review contracts and documentation to ensure they meet the latest legal standards. These practices can help you steer clear of penalties and stay compliant while managing a global workforce.

How do I register with tax authorities when hiring internationally?

To get registered with tax authorities in another country, the first step is understanding the specific requirements for tax registration in the country where you plan to hire. Gather all necessary documents, including your business details and employee information, and submit them to the appropriate tax authority. Once your application is approved, you’ll be issued a Tax Identification Number (TIN) or a similar identifier. Be sure to keep up with local tax reporting and filing deadlines to remain compliant.

How can I keep up with changes in international payroll regulations?

Keeping up with changes in international payroll laws is essential to ensure compliance. To stay on top of these updates, make it a habit to review official government websites, sign up for trusted industry newsletters, and seek advice from payroll or legal experts.

Tools like Lucid Financials can make this process much easier by offering real-time updates and helping you maintain compliance across different countries. This way, you can concentrate on expanding your business while knowing your payroll systems are in line with the latest regulations.