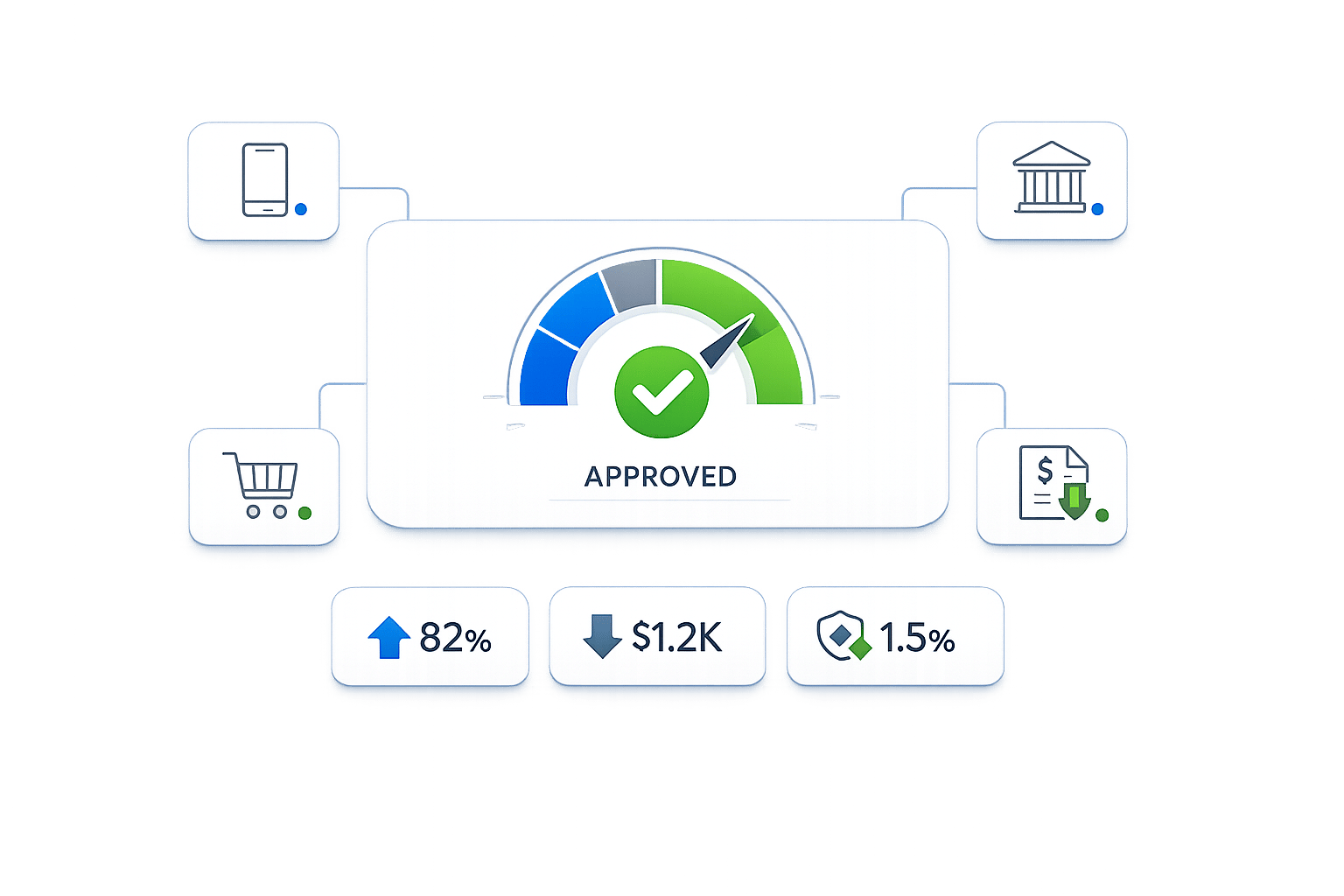

AI is helping SaaS companies tackle customer churn by predicting it before it happens. Instead of relying on outdated methods like surveys or renewal dates, AI analyzes user behavior - such as login frequency, feature usage, and support tickets - to flag at-risk customers early. This proactive approach helps businesses retain more customers, reduce revenue loss, and improve profitability. For example:

- 5% increase in retention can boost profits by 25–95%.

- AI can prevent up to 71% of churn when combined with human efforts.

- Tools like Gainsight and Salesforce Einstein offer automated workflows to act on these insights.

By integrating churn predictions into financial planning, companies can also adjust forecasts and make better decisions faster. AI-powered tools like Lucid Financials even allow teams to model how churn impacts revenue in real-time.

The bottom line? AI shifts churn management from reactive to predictive, saving costs and protecting growth.

AI/ML Customer Churn Prediction (XGBoost + OpenAI)

sbb-itb-17e8ec9

How AI Predicts Customer Churn in SaaS

AI Algorithms for SaaS Churn Prediction: Comparison Guide

AI takes a proactive approach to predicting churn, focusing on early behavioral changes that hint at potential cancellations, rather than relying on lagging indicators like NPS surveys or renewal notices, which reflect past experiences.

"Traditional methods rely on lagging indicators. An NPS survey only tells you how a customer felt weeks ago... AI-powered approaches use leading indicators." - Team Mosaic, Ask-AI

Machine learning models analyze historical churn data alongside customer behaviors, such as login frequency, feature usage, and support ticket activity, to uncover patterns that signal churn risk. Beyond structured data, AI leverages Natural Language Processing (NLP) to sift through unstructured sources like emails, call transcripts, and support tickets, identifying negative sentiment or mentions of competitors.

What sets AI apart is its ability to monitor individual baselines. For example, if a user who typically logs in daily suddenly switches to weekly logins, the system flags them as high-risk - even if their overall usage still appears normal. AI models also continuously improve through automated feedback loops. If a customer predicted to churn ends up renewing, the system adjusts its parameters to refine future predictions.

Let’s dive into how customer data and advanced algorithms work together to power these insights.

Using Customer Behavior Data in AI Models

AI churn models utilize a broad range of customer interaction data to identify early warning signs. Key metrics like login frequency, session depth, feature usage, and deviations - such as cart abandonment or extended inactivity - can indicate a heightened risk of churn. For instance, if a customer stops using a feature that’s typically linked to long-term retention, the system raises an alert, even if their overall activity hasn’t dropped significantly.

Rather than simply counting these events, AI assigns weight to each based on how strongly it correlates with past churn trends within a specific customer base. To maximize effectiveness, companies must consolidate data from various sources - CRM systems, support desks, and product analytics - into a unified view of the customer journey.

This behavioral data directly shapes the choice of algorithms, as different models are better suited to specific data types and patterns.

Common AI Algorithms for Churn Prediction

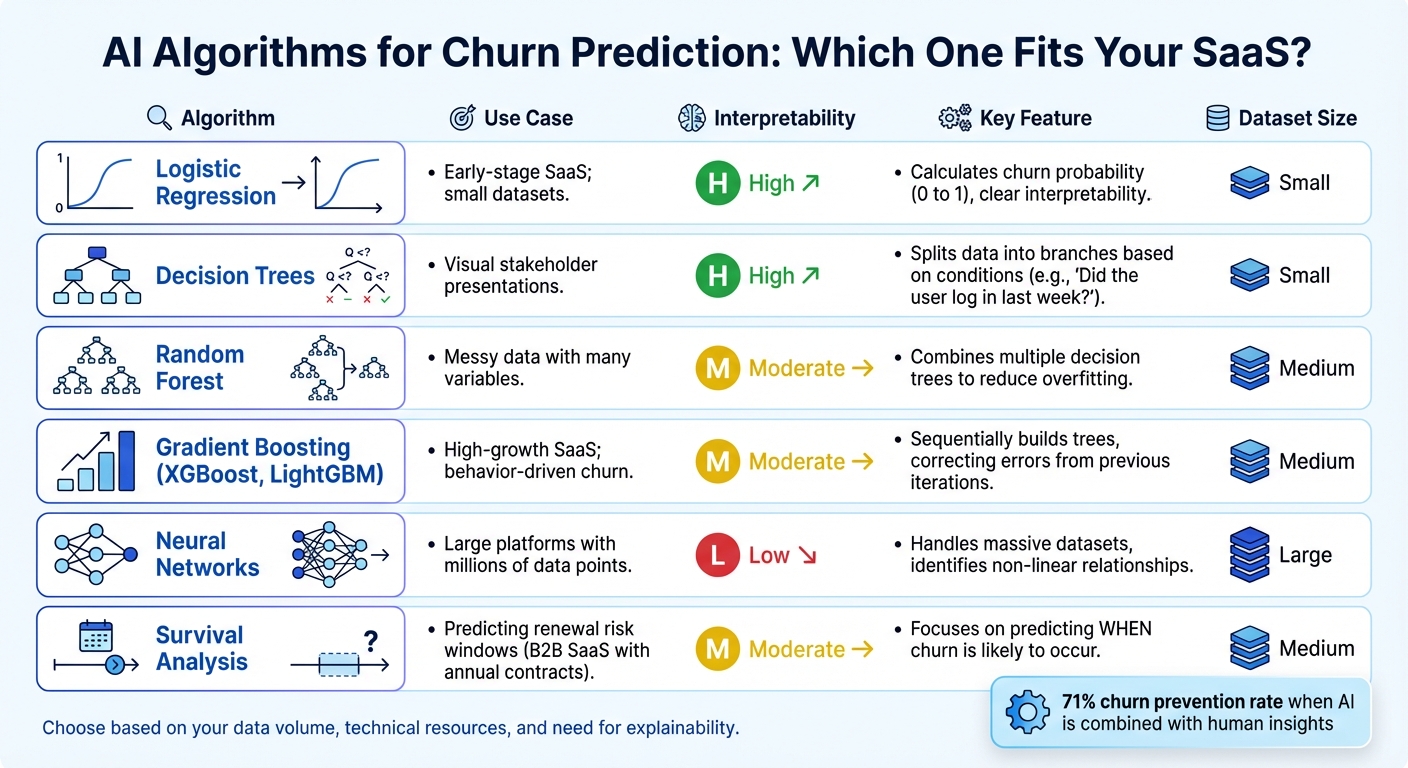

Various machine learning algorithms excel in different aspects of churn prediction. For example:

- Logistic Regression: Calculates churn probability (0 to 1) and is ideal for smaller datasets due to its clear interpretability - you can easily explain why a customer was flagged.

- Decision Trees: Splits data into branches based on specific conditions (e.g., "Did the user log in last week?"), making it easy to visualize for stakeholders.

- Random Forests: Combines multiple decision trees to reduce overfitting and improve stability, making it suitable for messy datasets with numerous variables.

- Gradient Boosting Models (e.g., XGBoost, LightGBM): Sequentially build trees, correcting errors from previous iterations, to achieve high accuracy with complex datasets.

- Neural Networks: Handle massive datasets, identifying non-linear relationships that simpler models might miss, though they lack interpretability.

- Survival Analysis: Focuses on predicting when churn is likely to occur, which is particularly useful for B2B SaaS companies with annual contracts.

| Algorithm | Use Case | Interpretability |

|---|---|---|

| Logistic Regression | Early-stage SaaS; small datasets | High |

| Random Forest | Messy data with many variables | Moderate |

| Gradient Boosting | High-growth SaaS; behavior-driven churn | Moderate |

| Neural Networks | Large platforms with millions of points | Low |

| Survival Analysis | Predicting renewal risk windows | Moderate |

Neural networks stand out for their ability to process vast, complex datasets, though they often function as "black boxes", making their results harder to interpret. Survival analysis, on the other hand, is particularly effective at pinpointing the timing of churn - a critical insight for businesses with fixed-term contracts.

Understanding these algorithms helps highlight why AI outshines manual churn analysis.

Why AI Outperforms Manual Churn Analysis

Manual churn analysis has its limits. Tracking customer behavior in spreadsheets or relying on intuition might work for a small customer base, but as businesses grow, these methods become inefficient. Customer Success Managers can end up spending hours each week manually updating records - time that could be better spent elsewhere.

AI, by contrast, processes thousands of variables at once, spotting subtle patterns that manual methods often miss. It combines structured data (like login metrics) with unstructured data (like sentiment from support tickets) to provide a comprehensive view of customer health. Despite this potential, only 23% of Customer Experience teams currently use AI, giving early adopters a competitive edge.

As AI continues to learn and refine its predictions, it becomes even more effective. When paired with human insights, AI has been shown to achieve a 71% churn prevention rate - far surpassing the results of manual methods.

How to Build an AI Churn Prediction Model

Creating an AI churn prediction model doesn’t have to be overly complicated. You can start with the data you already have and improve the model as you go. The goal is to begin with a simple framework and refine it over time, using real-world results to enhance accuracy.

1. Collect and Organize Customer Data

To build a solid model, you’ll need to gather four main types of data:

- Behavioral Data: Think login frequency, session duration, and feature usage.

- Financial Data: Subscription plans, payment history, and any downgrades.

- Support Data: Ticket volume and the sentiment of customer emails.

- Contextual Data: Details like company size, industry, and account age.

You can pull this information from tools like your CRM, product analytics platforms, customer support systems, and billing software. Once you’ve gathered the data, clean it up. This means filling in missing values, removing duplicates, and standardizing formats. For example, one company used over 260 million behavioral records from more than 234,000 SaaS users to train a predictive model. While modern AI can handle some imperfections in your dataset, improving data quality will always pay off.

"Product data tells you what's happening in real time. CRM data gives you the context to interpret it correctly." - Alberto Incisa, Product and Growth, June

Once your data is ready, focus on identifying patterns that indicate churn.

2. Identify Key Churn Indicators

Your next step is to zero in on the signals that suggest a customer might leave. For example, if users don’t engage with core features during their first 30 days, they’re 60% more likely to churn. Similarly, changes in behavior - like a daily user suddenly logging in only once a week - can serve as an early warning.

Start simple. Use a scorecard to track a handful of key metrics, such as login frequency, billing status, and feature adoption. This approach helps you identify the top 10–20% of accounts most at risk. Over time, you’ll get a clearer picture of which factors are the strongest predictors of churn.

3. Train and Test Your AI Model

Begin with a straightforward algorithm like logistic regression. It’s easy to interpret and works well for initial models. As you gain experience, consider more advanced techniques like random forests or gradient boosting (e.g., XGBoost) to boost accuracy.

Divide your data into two groups: 70% for training and 30% for testing. Label churned customers as "1" and retained customers as "0", and normalize numeric features to a 0–1 range. Once your model is trained, evaluate its performance using metrics like:

- Precision: What percentage of flagged users actually churned?

- Recall: How many churners did the model correctly identify?

For deeper insights, use SHAP values to understand which features are driving the predictions.

4. Monitor and Update Your Model

Deploying the model is just the beginning. Customer behavior changes over time, so it’s essential to keep your model updated. Retrain it monthly and set up automated predictions - ideally, nightly updates with CRM alerts - to stay ahead of potential churn.

Regularly review which features are most important to your model’s predictions. Combining AI insights with human judgment can make a big difference. For instance, businesses that integrate this approach often achieve churn prevention rates around 71%. The idea isn’t to build a perfect system right away but to create one that gets smarter with every customer interaction.

Connecting Churn Predictions to Financial Planning

How Churn Reduction Impacts Revenue Retention

Churn prediction isn't just a customer success metric - it’s a critical financial planning tool. While traditional churn rates simply reveal past losses, AI-driven predictions serve as early warning signs, offering a glimpse into potential future challenges. This shift allows finance teams to address revenue gaps proactively, rather than scrambling to recover after the damage is done. By incorporating predictive insights, financial forecasts and strategies can be far more precise and forward-looking.

When customer retention improves, it safeguards high-margin revenue streams that grow over time. AI tools also differentiate between two critical metrics: customer churn (the number of accounts lost) and revenue churn (the dollar value of those losses). For instance, losing a major enterprise client can be far more damaging than losing multiple smaller accounts.

"Your business isn't a schoolhouse; it's a bucket full of revenue, and churn means it has holes. Staring at the puddle on the floor doesn't fix the leaks." - Gustav Westman, Niora

Take Salesforce as an example. They implemented a churn prediction system capable of analyzing over 300 variables to flag at-risk accounts up to six months before renewal. This system boosted their gross retention rate by 3 percentage points over 18 months, ultimately preserving hundreds of millions of dollars in revenue.

Using Lucid Financials for AI-Driven Financial Planning

This level of predictive insight transforms how businesses approach financial planning. Advanced tools now integrate churn data directly into budgeting and forecasting, enabling finance teams to respond to real-time retention trends instead of relying on outdated historical data.

For example, when a spike in churn risk is detected in a specific customer segment, finance teams can adjust forecasts and scenario models based on these live retention signals. This approach eliminates guesswork, replacing it with probabilities rooted in actual customer behavior, giving companies a more accurate view of their cash flow and financial runway.

Lucid Financials takes this a step further by embedding churn insights into your financial planning process. Through AI-powered tools, the platform provides real-time, adaptive forecasts tied to customer health scores. Need quick answers? Simply ask Slack something like, "How would a 10% churn spike impact our runway?" and get instant, data-backed insights. Lucid Financials connects your CRM, billing systems, and product analytics, creating a unified view of customer health. This ensures revenue projections align with current retention trends, not outdated assumptions. Plus, with board-ready reports generated in a single click, you’ll always be prepared to demonstrate how your company is protecting and growing its revenue - a testament to how predictive analytics can drive both customer success and financial resilience.

SaaS Companies Using AI to Reduce Churn

Gainsight: Monitoring Customer Health

Gainsight uses Explainable Boosting Machines (EBM) to calculate risk scores by analyzing factors like survey responses, call-to-action (CTA) engagement, and meeting frequency. Its "Optimize with AI" feature digs into historical renewal patterns and customer behavior to refine health scorecards. This approach is particularly effective in addressing "unexpected churn" - when seemingly healthy accounts suddenly decide to cancel.

With Gainsight AI, companies report 95% accuracy in renewal forecasts and save 25% of customer success manager (CSM) time through automation. Additionally, natural language processing (NLP) tools analyze unstructured data from emails, support tickets, and call transcripts to spot early signs of dissatisfaction.

Similarly, Salesforce Einstein offers predictive insights integrated directly into CRM workflows, enabling businesses to take swift, data-driven actions to retain customers.

Salesforce Einstein: Proactive CRM Insights

Salesforce Einstein embeds AI-powered risk alerts into CRM workflows, helping sales and support teams act on predictions. By evaluating factors like contract values, renewal timelines, and customer interactions, the platform flags accounts that may be at risk. When a potential issue is detected, Einstein triggers automated playbooks designed for outreach, health checks, or executive involvement, depending on the severity of the risk.

This proactive approach to customer retention has proven highly effective. Considering that 73% of B2B revenue comes from existing customers, tools like Einstein not only improve retention but also have a direct impact on revenue growth.

Lucid Financials: Linking Churn to Financial Planning

While tools like Gainsight and Salesforce Einstein focus on customer engagement, Lucid Financials bridges the gap by turning churn data into actionable financial insights. By syncing with your CRM, billing systems, and product analytics, Lucid builds dynamic revenue models that reflect current retention trends rather than outdated projections.

For instance, through Slack, you can ask questions like, "What happens to Q2 revenue if enterprise churn increases by 15%?" and instantly receive accurate, data-driven answers. Lucid's AI-powered forecasting adjusts in real time as customer health scores evolve, ensuring that financial planning, hiring decisions, and investor reports are based on actual customer behavior rather than speculation. This allows finance teams to model various retention scenarios, adapt plans to mitigate risks, and provide stakeholders with reliable forecasts grounded in real-world data.

Conclusion

AI is reshaping how SaaS companies approach customer retention. By analyzing behavioral patterns - like reduced login frequency, lower feature usage, or negative sentiment in support interactions - businesses can now identify at-risk customers weeks before they churn. This shift from reactive problem-solving to proactive prevention safeguards the significant investment made in acquiring customers, especially since retention is far more cost-effective than acquisition.

Research shows that even a 5% increase in customer retention can lead to a 25% to 95% boost in profitability. Combine that with the fact that 80% of growth for expanding companies comes from upselling or retaining existing customers, and it’s clear that AI-driven churn prediction is a game-changer for long-term revenue stability. When predictive insights are paired with action - through automated workflows, personalized outreach, and strategic playbooks - churn prevention becomes a powerful financial tool.

"Retention is no longer a passive outcome of good service. It is an active strategy that starts with knowing your customers better than they know themselves."

- Akshay G Bhat, Technical Content Writer, Saaslogic

For finance teams, these insights also transform revenue forecasting. By integrating churn predictions into financial planning, companies can replace guesswork with real-time data. Tools like Lucid Financials make this possible by syncing with CRMs, billing platforms, and product analytics. Imagine asking, "How will a 15% rise in enterprise churn affect Q2 revenue?" and instantly getting an accurate answer via Slack. This level of precision ensures decisions are based on actual customer behavior, not outdated assumptions.

This alignment between customer health data and financial forecasting is crucial. By 2026, the most successful startups will be those that act swiftly on real-time insights. Leveraging AI-powered churn prediction alongside intelligent financial planning turns retention into a strategic growth driver - one that protects revenue, sharpens forecasting, and provides the clarity needed to scale with confidence.

FAQs

How do SaaS companies use AI to predict customer churn?

AI empowers SaaS companies to anticipate customer churn by diving deep into historical data such as login habits, feature usage, purchase trends, demographics, and customer sentiment drawn from emails, chats, and social media. By spotting patterns and unusual shifts in user behavior, AI can identify customers at risk of leaving - often weeks before they actually do - giving businesses a chance to step in and address the issue.

For instance, a noticeable drop in activity or a surge in negative sentiment in customer interactions can act as red flags for potential churn. What’s more, machine learning models continuously fine-tune their predictions, becoming increasingly precise over time. This allows SaaS startups to zero in on retention strategies that genuinely make a difference.

What makes AI better than traditional methods for predicting customer churn?

AI provides a more efficient and intelligent way to anticipate customer churn by processing vast amounts of data from various sources, including user behavior, engagement patterns, and even customer sentiment. This enables businesses to pinpoint at-risk customers earlier and with much more precision compared to traditional rule-based methods.

For SaaS startups, using AI means they can act quickly to minimize churn, boost customer retention, and ultimately increase revenue. Unlike older techniques, AI delivers personalized insights and timely actions, allowing businesses to reduce acquisition expenses while fostering stronger, lasting customer relationships.

How can SaaS startups use AI to predict and manage customer churn in their financial planning?

AI-powered churn predictions give SaaS startups a way to transform potential customer losses into actionable financial insights. By examining structured data like login frequency, feature usage, and support interactions, alongside unstructured data such as email or chat sentiment, machine learning models can estimate how likely a customer is to churn. These predictions are then woven into monthly recurring revenue (MRR) or annual recurring revenue (ARR) forecasts, helping finance teams understand how churn affects cash flow, runway, and overall profitability.

Tools like Lucid Financials make this process effortless. Lucid continuously integrates churn data to update revenue forecasts in real time. This allows founders to model scenarios - like what happens if churn drops by 5% - and make informed decisions about budgets, hiring plans, or fundraising strategies. With integrations into accounting systems and Slack, Lucid ensures founders always have investor-ready reports that reflect the latest churn-adjusted revenue projections. This turns churn management into a strategic tool for driving sustainable growth.