Startups thrive on speed, but outdated financial data can hold you back. Real-time financial insights solve this by offering instant updates on key metrics like cash flow, burn rate, and runway. Here’s why it matters:

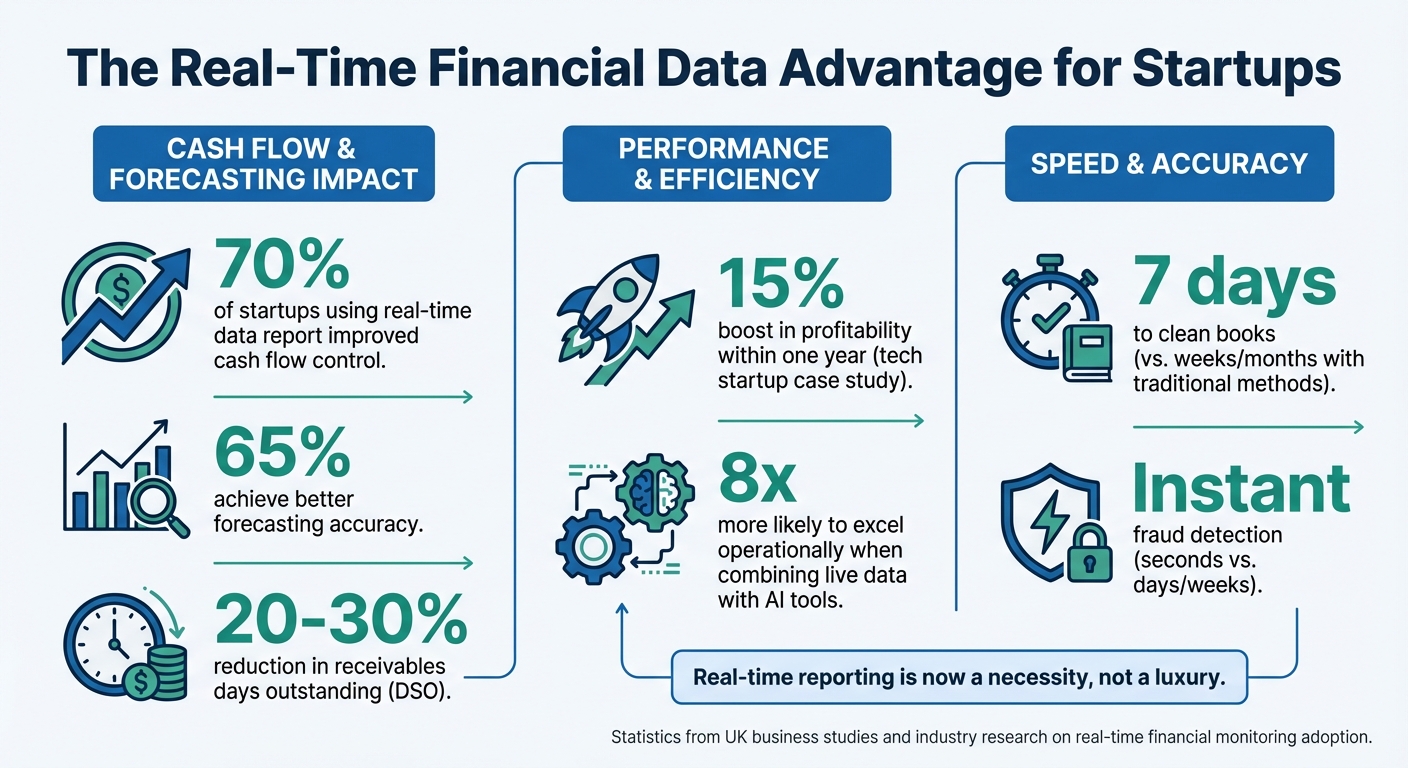

- 70% of startups using real-time data report improved cash flow, while 65% achieve better forecasting accuracy.

- Delayed reports lead to reactive decisions, missed opportunities, and potential financial risks.

- Real-time dashboards help track expenses, detect fraud, and provide live updates for investors.

Real-Time Financial Data Impact on Startup Performance Statistics

The Importance of KPI Dashboards for Continuous Business Improvement

Why Startups Need Real-Time Financial Data

Startups often operate on tight budgets and limited timelines, where every dollar counts, and mistakes can have costly consequences. If your financial data is outdated by weeks or months, you're essentially making decisions based on yesterday's news - an approach that can lead to serious setbacks.

The Dangers of Delayed Financial Information

Relying on traditional monthly or quarterly financial reports creates a dangerous gap in visibility. These delays can leave you blind to your current cash flow and financial health, which is a risky position for any startup. As Charles Mason III points out:

Traditional financial reports are often outdated by the time they're reviewed, limiting their effectiveness for forward-looking decisions.

This lack of timely information forces startups into a reactive mode, scrambling to address issues after they've already snowballed. For instance, you could miss a critical payment deadline, discover a cash shortfall too late, or fail to pivot when a product line underperforms. Manual data entry only compounds the problem, increasing the likelihood of errors and compliance risks while pulling attention away from strategic priorities.

The consequences extend beyond your internal operations. Investors and board members demand transparency, and presenting outdated financial reports during fundraising can signal poor operational control. This erodes trust and confidence in your leadership, which could impact your ability to secure funding.

By eliminating delays in financial reporting, startups can stay ahead of challenges, make proactive adjustments, and maintain smoother operations.

How Real-Time Data Improves Decision-Making

Real-time financial data changes the game for startups, enabling faster, smarter decisions in a constantly shifting market.

With real-time insights, startups no longer need to wait for end-of-month reports to understand their financial position. Instead, they gain continuous visibility into cash flow, expenses, and runway. This allows for early identification of potential cash shortages, enabling proactive adjustments to spending, hiring, marketing, or pricing strategies.

As Charles Mason III explains:

With immediate access to data, business leaders can make decisions based on the most current information, rather than relying on outdated reports that may no longer reflect the company's true financial position.

Integrating financial systems with tools like CRM and ERP platforms takes this a step further. It creates a unified data source, breaking down silos and reducing the need for manual spreadsheet exports. This clarity helps you see exactly how marketing spend or other investments impact your bottom line, freeing your team to focus on growth while automated systems handle the heavy lifting.

Real-time financial data isn’t just a tool - it’s a competitive advantage that keeps startups agile and prepared for whatever comes next.

Financial KPIs to Track in Real Time

Keeping a close eye on key financial metrics is crucial for both survival and growth. Real-time monitoring of these KPIs gives you the ability to respond quickly to opportunities or challenges as they arise.

Cash Flow and Burn Rate

Two numbers matter more than anything for startups: cash position and burn rate. Tracking cash flow helps you understand how money moves in and out of your business - whether it’s revenue, funding, expenses, payroll, or equipment costs. Burn rate, on the other hand, measures how much cash your business uses each month.

Real-time insights into these metrics can help you avoid cash shortages that could disrupt operations. For instance, noticing delayed customer payments or a dip in sales early allows you to act fast - tightening payment terms or cutting non-essential expenses. One tech startup struggling with cash flow implemented a real-time financial dashboard, and by closely monitoring its expenses and revenue, it was able to restructure budgets and improve profitability.

The secret lies in tracking both the big picture (like your overall cash position) and the finer details (like receivables, payables, and inventory). Real-time systems use automated variance analysis to flag potential issues, giving you the chance to address risks before they spiral out of control.

By staying on top of cash flow and burn rate, you’ll be better prepared to evaluate your runway and revenue trends.

Runway and Revenue Growth

Building on cash flow insights, real-time tracking of runway and revenue enables more adaptive financial planning. Runway is a straightforward calculation: divide your current cash by your monthly burn rate. For example, if you have $500,000 in cash and burn $50,000 per month, you’ve got 10 months of runway. But with real-time data, this number adjusts instantly as revenue or expenses shift.

This dynamic tracking is invaluable when it comes to fundraising. If your runway is shrinking faster than expected, you can prioritize raising funds sooner. On the flip side, if revenue growth picks up, you might extend your runway without needing fresh capital. Real-time revenue updates also boost investor confidence, showing that your business is financially stable and resourceful - key factors in negotiating better terms and securing funding.

Expense Tracking and Fraud Detection

Monitoring expenses in real time serves two critical purposes: preventing overspending and spotting fraud. With real-time expense tracking, you gain immediate control over spending and can allocate resources more effectively.

Advanced systems flag unusual transactions instantly, such as expenses that exceed historical norms or occur at odd hours. For example, JPMorgan Chase’s machine-learning platform can detect fraud in seconds, identifying suspicious patterns like multiple $20,000 withdrawals in Singapore followed by smaller transactions in Dubai. Instead of relying on static reports, modern tools provide live dashboards that allow constant oversight and quick cost adjustments. This level of monitoring not only prevents small errors from escalating into major problems but also helps catch fraudulent activity before it causes significant harm.

sbb-itb-17e8ec9

Benefits of Real-Time Financial Monitoring

Real-time financial monitoring brings a host of advantages, including quicker decision-making, stronger risk management, and more transparent communication with investors.

Faster and More Accurate Decisions

Relying on outdated reports can hinder timely decision-making. As Jason Berwanger from HubiFi aptly notes:

Relying on a month-old report undermines timely decision-making.

With real-time dashboards, businesses gain an up-to-the-minute view of performance metrics. These tools provide instant access to critical data like cash flow, revenue, and expenses, helping streamline processes like month-end closings. Tailored dashboards ensure that each team - whether it’s leadership, sales, or finance - focuses on the key performance indicators (KPIs) most relevant to their role.

Better Risk Management and Operational Efficiency

Real-time monitoring allows businesses to tackle risks head-on by spotting issues as they arise. Whether it’s fluctuating exchange rates or supply chain hiccups, immediate visibility lets teams take swift action to prevent problems from escalating. For example, tracking cash flow and overdue invoices in real time makes it easier to adjust spending or follow up on payments, ensuring liquidity is maintained.

Additionally, instant alerts about market changes - like rising interest rates or new competitors entering the field - help teams prepare for potential challenges. Automated systems also create transparent audit trails, reducing compliance risks while improving operational efficiency. This level of agility enhances not only internal processes but also communications with investors.

Improved Reporting for Investors and Stakeholders

Real-time financial data revolutionizes how companies engage with investors and stakeholders. Instead of relying on static quarterly reports, startups can present live dashboards that showcase current performance. Berwanger highlights the impact of this approach:

Walking into a meeting with a live dashboard that shows your performance in real time demonstrates a high level of sophistication and transparency.

This transparency signals a deep understanding of the business and supports agile, data-driven decision-making. During critical moments like fundraising or due diligence, startups can generate detailed, investor-ready reports on demand. Customizable views further ensure that stakeholders - whether they need a high-level overview or an in-depth breakdown - get the specific insights they require. As HFS Research points out:

Real-time reporting is now a necessity, not a luxury.

How Lucid Financials Delivers Real-Time Financial Management

Lucid Financials tackles the financial hurdles startups face by blending AI-driven automation with expert human support. The platform integrates directly with tools like QuickBooks, payroll systems, and banking platforms to streamline data collection and provide a comprehensive financial view. With these connections, transaction records, invoices, cash flow, and account balances are automatically pulled into one centralized system. From there, AI takes over - handling categorization, reconciliation, monitoring, and even fraud detection. This seamless integration is the backbone of Lucid Financials’ standout features.

AI-Powered Insights and Slack Integration

Lucid Financials delivers instant financial insights directly through Slack. The platform tracks spending habits, flags unusual transactions, and suggests policy adjustments based on current trends. Whether you need a quick update on your runway, a breakdown of expenses, or cash flow projections, the AI has you covered. For more complex questions or strategic advice, Lucid's finance team is just a Slack message away, ensuring a smooth blend of speed and expertise.

Clean Books in 7 Days

Lucid’s automated reconciliation process pulls data from your accounting, banking, and payroll systems, ensuring your financial records are both accurate and consistent. The AI simplifies onboarding by matching transactions and spotting discrepancies, delivering clean, up-to-date books in just seven days. This fast turnaround moves you from playing catch-up to planning ahead, giving you the tools to identify growth opportunities and make smarter decisions right from the start.

Always-On Reporting for Growth and Fundraising

Lucid Financials keeps a constant eye on key metrics, using predictive modeling to generate precise revenue forecasts and maintain due diligence-ready data. With just one click, you can produce board-ready reports and investor-grade forecasts that reflect your company’s current performance - not outdated quarterly numbers. The platform also offers scenario modeling, allowing you to test different budget plans, investment strategies, and growth paths by analyzing market impacts and weighing risks. This real-time visibility ensures you’re always ready for fundraising discussions, equipped with the clarity and transparency investors expect for confident decision-making.

Conclusion

Real-time financial data is changing the game for startups, moving them from reactive problem-solving to proactive planning. With instant visibility into metrics like cash flow, burn rate, and runway, businesses can make quicker, smarter decisions that directly impact their bottom line. For example, a UK study found that 70% of businesses using real-time data reported better cash flow control, and 65% experienced more accurate forecasting. This shift replaces guesswork with informed decision-making.

The results speak for themselves. One tech startup used real-time dashboards to monitor expenses and revenue, enabling them to restructure their budget efficiently. The outcome? A 15% boost in profitability within just one year. These aren't isolated success stories - they highlight what's achievable when businesses stop relying on outdated monthly reports.

Startups moving at high speed gain significant advantages with real-time monitoring. It can reduce receivables days outstanding (DSO) by 20-30%, detect fraud early, and keep investor-ready reports available on demand. This isn't just about tracking numbers - it's about spotting opportunities, managing risks, and demonstrating financial health to stakeholders without delay.

Lucid Financials makes this level of insight accessible with its AI-powered platform and expert support. From cleaning up your books in just seven days to providing Slack-based updates and always-on reporting, the platform ensures you have the financial clarity to streamline operations and scale effectively. Tasks like reconciliation, compliance, and forecasting are handled seamlessly, freeing you to focus on growth.

In today’s fast-paced markets, real-time financial data isn’t a luxury - it’s a necessity. Companies that combine live data with AI tools are eight times more likely to excel operationally. The ability to pivot quickly based on accurate, up-to-date information is what separates thriving startups from those struggling to keep up. With real-time insights, you're always ready for what’s next.

FAQs

How can real-time financial data help startups manage cash flow more effectively?

Startups now have the ability to access cash flow, burn rate, and revenue trends instantly through real-time financial data. This quick access means they can make smarter decisions faster. Spotting potential cash shortages early allows founders to adjust plans in time, avoiding disruptions and keeping operations running smoothly.

This instant insight also improves forecasting accuracy, giving founders the tools they need to plan for growth and present solid financial data to investors. With real-time updates, startups can stay flexible and ahead of challenges, ensuring steady cash flow and a healthier financial outlook.

What are the dangers of using outdated financial reports in a startup?

Using outdated financial reports can seriously impact decision-making. When financial insights fail to reflect your startup’s current situation, you risk overlooking critical issues like cash flow shortages or unexpected expenses. These oversights can threaten your company’s stability and growth.

On top of that, relying on outdated data can harm investor confidence. Investors expect accurate, up-to-date financial reports to evaluate your startup’s performance and potential. If you can’t provide real-time data, it may raise doubts about your transparency and adaptability - qualities that are essential for securing funding and building trust.

Access to real-time financial insights empowers startups to navigate risks, make smarter decisions, and adapt quickly in today’s fast-paced business world.

How does real-time financial data improve investor relations and support fundraising?

Real-time financial data empowers startups to enhance investor relationships and simplify the fundraising process by ensuring clarity, precision, and timely updates. With continuously updated performance metrics at their fingertips, founders can share financial insights that foster trust and highlight their commitment to accountability.

Having instant access to dependable data means startups can respond promptly to investor questions and support smarter decision-making. This ability to showcase transparent, real-time financial health not only strengthens investor confidence but also helps startups stand out during funding rounds, speeding up their path to securing investments.