When every dollar counts, startups need to focus on cutting waste, automating processes, and improving cash flow management. Poor financial planning, manual workflows, and missed tax opportunities are common pitfalls that drain resources and shorten runway. Here's how to make smarter financial decisions:

- Automate Key Processes: Start with accounts payable (AP), accounts receivable (AR), and month-end close to save time and reduce errors.

- Claim Tax Credits: Leverage the Federal R&D Tax Credit and other deductions to recover thousands of dollars.

- Improve Visibility: Use AI tools for real-time insights into cash flow, burn rate, and runway.

- Scenario Modeling: Test "what-if" situations to guide hiring, marketing, and spending decisions.

AI-powered platforms like Lucid Financials combine bookkeeping, tax planning, and forecasting, saving startups time and money while providing actionable insights. Starting at $150/month, these tools help founders focus on growth, not back-office tasks. By optimizing financial operations, startups can stretch their runway and avoid common cash flow pitfalls.

How to Plan Your Startup's Budget as a Tech Founder

Common Financial Inefficiencies That Drain Startup Budgets

Startups often lose money through three major pitfalls: time-consuming manual processes, missed tax opportunities, and poor financial visibility. These inefficiencies can mean the difference between extending your runway or running out of cash too soon. Let’s break down how these issues impact your budget and what you can do about them.

Manual Processes and Wasted Time

Manual bookkeeping eats up valuable hours that founders could spend on activities that drive revenue. Finance teams often get bogged down tracking unexplained charges on shared company cards, adding unnecessary complexity to their workflows. On top of that, manual processes are prone to human error, which can skew profit margins and other critical metrics. Automating these tasks is essential for saving time and improving accuracy.

"If you don't know last month's cash and profit by the 15th, you're flying blind." - Chase Spenst, GoodOperator

Shared company cards also pose security risks. If the card is compromised, it can disrupt recurring payments for essential tools and subscriptions, creating administrative headaches. For startups that allocate 12–20% of gross revenue to marketing, even a brief interruption in ad spend or SaaS tools can derail growth efforts.

Missed Tax Credits and Deductions

Many startups overlook valuable tax credits, leaving thousands - or even hundreds of thousands - of dollars unclaimed. For example, the Federal R&D Tax Credit allows startups to offset up to $250,000 annually in payroll taxes (up to $1.25 million over five years) for eligible activities like software development and algorithm design, as long as proper documentation is maintained.

A common misconception is that R&D credits are only available to industries like pharmaceuticals or hardware manufacturing. In reality, activities such as prototyping and software engineering often qualify. However, the IRS requires detailed records - such as time logs and project timelines - to validate these claims during audits.

Consider this example: In 2025, a Bay Area SaaS startup partnered with Asnani CPA and uncovered $180,000 in unclaimed R&D tax credits. By spending $24,000 on professional accounting services to document and claim these credits, the company gained a net benefit of $156,000. This extra cash extended their runway by four months, giving them the breathing room to close an $8 million Series A funding round.

"This is the startup accounting paradox: you're busy building a company and can't afford to waste time on back-office functions, but neglecting those functions creates problems that can derail funding, delay exits, or cost you hundreds of thousands in missed tax opportunities." - Rachel Asnani, Founder, Asnani CPA

Beyond R&D credits, startups also miss deductions like Section 179, which allows for immediate expensing of up to $1,220,000 on qualified equipment purchases. Strategic tax planning from the beginning can preserve capital and ensure compliance, which is critical given that 90% of startups fail, often due to running out of cash. Combining tax planning with modern, AI-driven tools can help maintain accurate records and identify opportunities in real time.

Poor Forecasting and Limited Cash Flow Visibility

Cash shortages are responsible for nearly one-third of startup failures. Often, the root cause lies in poor financial visibility and inaccurate burn rate calculations. Many founders rely on bank account balances instead of accrual-basis accounting, which fails to account for irregular or annual expenses.

For SaaS startups, recording revenue on cash receipt instead of accrual can distort key metrics like Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR), leading to misguided decisions about hiring, marketing, and product investment. This is particularly concerning when 73% of B2B startups that stall before Series B cite flawed unit economics as a major factor.

Another issue is "MarTech bloat", where up to 30% of software spending is wasted. Marketing technology often accounts for 25–30% of a startup’s marketing budget. Without real-time cash flow visibility, startups may resort to reactive cost-cutting, potentially targeting critical functions while leaving unused licenses or ineffective tools untouched. Shifting from manual tracking to automated systems that provide real-time financial insights can help startups make smarter, more strategic decisions and maximize their ROI.

Using AI and Automation to Improve ROI

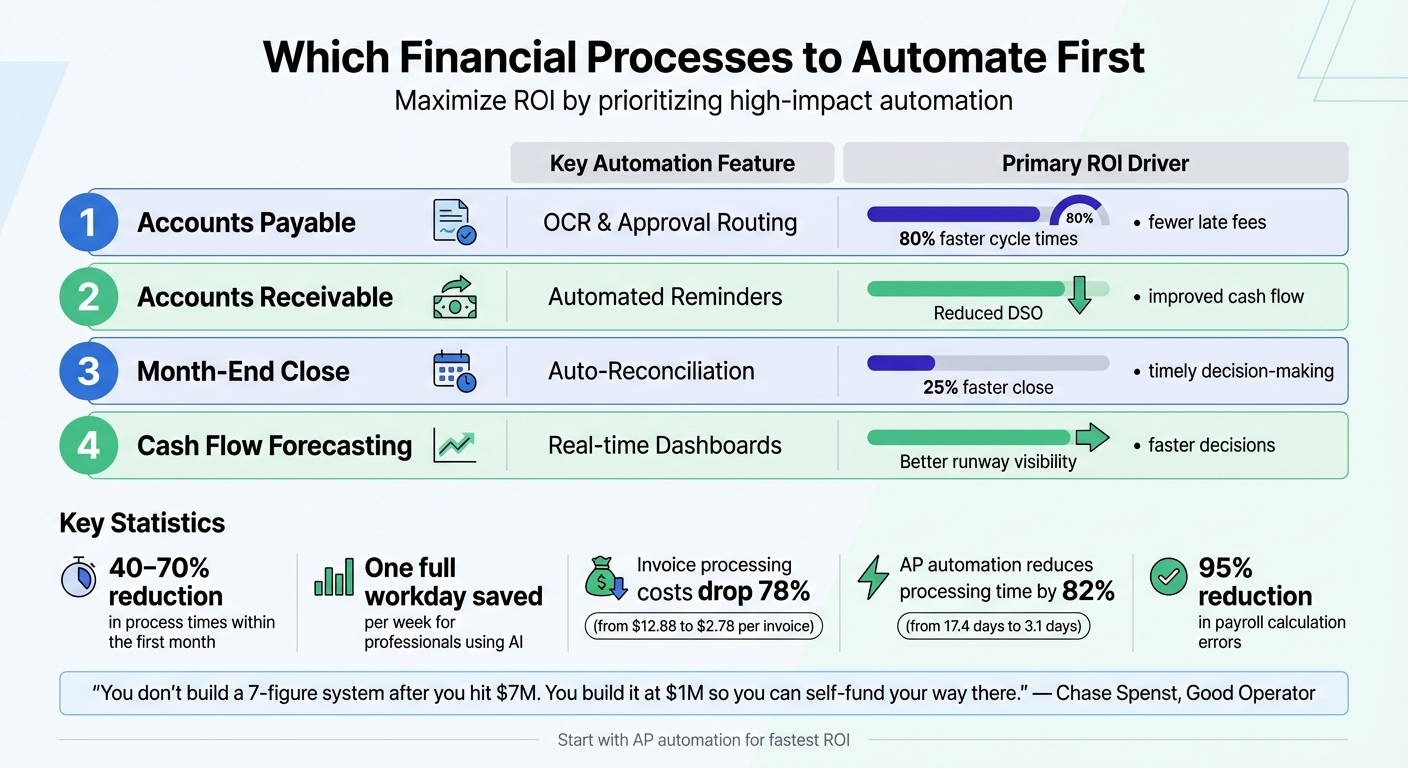

Which Financial Processes Startups Should Automate First for Maximum ROI

AI automation isn't just about cutting costs - it’s about freeing up time and resources for growth. For startups working with tight budgets, manual bookkeeping can drain hours that could be better spent on activities that drive revenue. By integrating AI, startups can stretch every dollar further, which is critical for staying afloat and thriving in the long run.

The trick is figuring out which tasks to automate first. Using too many tools without a plan can lead to data silos and inefficiencies. Start with areas that have the biggest impact, such as accounts payable (AP), accounts receivable (AR), and month-end close processes. These are often the most time-consuming, error-prone, and closely tied to your cash flow. Once these essentials are automated, you can layer in tools for forecasting and reporting to maintain real-time visibility into key metrics like runway and burn rate. This approach ensures your automation efforts deliver maximum ROI.

Which Financial Processes to Automate First

Accounts payable (AP) is a logical starting point. Manual invoice entry is slow, prone to errors, and expensive. Technologies like Optical Character Recognition (OCR) can extract data from invoices automatically, cutting out the need for manual entry. Automated approval workflows also speed up processing, reducing cycle times by as much as 80%. This not only eliminates late fees and strengthens vendor relationships but also frees up your team for more strategic work.

For example, in 2025, the Hospital Association of Oregon implemented AP automation, slashing their bill pay processing time from 10 hours per batch to just a few minutes. Similarly, Skin Pharm, a skincare company, transitioned from a weeks-long manual invoice process to approvals completed within 48 hours by adopting AI-driven workflows. These cases highlight how treating AP as a strategic function rather than a back-office chore can transform operations.

Accounts receivable (AR) is just as critical, especially for startups trying to extend their runway without seeking additional funding. Automating collection reminders and using AI-driven workflows can reduce Days Sales Outstanding (DSO), speeding up cash inflows.

"You don't build a 7-figure system after you hit $7M. You build it at $1M so you can self-fund your way there." - Chase Spenst, founder of Good Operator

Standardizing invoice schedules and automating AR follow-ups can mean the difference between struggling for cash and having the funds to fuel growth.

Month-end close processes are another area where automation shines. Manual reconciliations and journal entry approvals can take weeks, leaving leadership without the timely financial insights needed for decision-making. Automating these tasks can cut close times by 25% or more. For instance, one manufacturing company reduced its month-end close from two weeks to just three days by using OCR and AI-powered matching. That’s not just a time saver - it’s a competitive edge.

Finally, prioritize cash flow forecasting. Real-time dashboards powered by AI can sync with your existing tools, providing instant access to critical metrics. This enables faster, data-backed decisions, which is essential when every dollar counts. On average, AI-driven automation can reduce process times by 40% to 70% within the first month, and professionals using AI save at least one full workday each week.

| Process to Automate | Key Automation Feature | Primary ROI Driver |

|---|---|---|

| Accounts Payable | OCR & Approval Routing | 80% faster cycle times; fewer late fees |

| Accounts Receivable | Automated Reminders | Reduced DSO; improved cash flow |

| Month-End Close | Auto-Reconciliation | 25% faster close; timely decision-making |

| Cash Flow Forecasting | Real-time Dashboards | Better runway visibility; faster decisions |

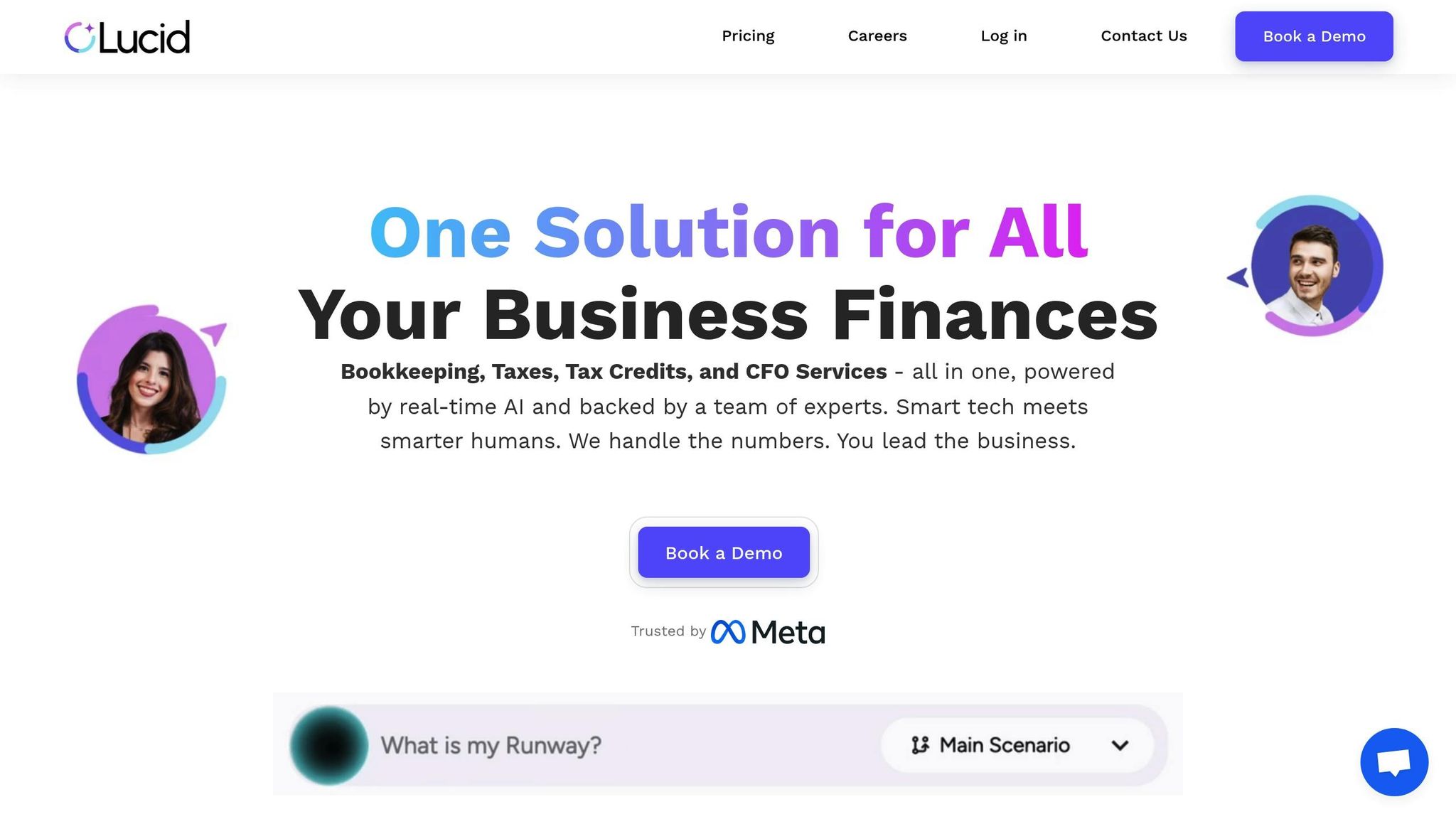

Lucid Financials: Full-Stack AI Solution for Startups

Now that we’ve covered which processes to automate, let’s look at how Lucid Financials integrates these advancements into a single, streamlined solution for startups.

Most startups cobble together their financial tools - one for bookkeeping, another for taxes, yet another for forecasting. This patchwork approach creates data silos, increases errors, and wastes time switching between platforms. Lucid Financials simplifies everything by combining bookkeeping, tax services, tax credits, and CFO support into one AI-powered platform designed specifically for startups.

Lucid ensures clean books in just seven days, using AI-driven transaction matching and reconciliation. This is invaluable when preparing for fundraising or due diligence, as investors expect accurate, investor-ready reports. With Lucid, you can generate board-ready reports with a single click - organized, accurate, and ready for review.

One standout feature is real-time support via Slack. Instead of waiting for email replies or scheduling calls, you can ask questions directly through Slack and get instant answers from Lucid’s AI. Whether you’re checking your runway, reviewing spending, or modeling a hiring plan, the information is right there in your team’s main communication channel. And when you need human expertise, Lucid’s finance team is available in the same thread - no delays, no context-switching.

Lucid also identifies unclaimed tax credits and deductions, helping extend your runway. The platform is equipped to handle complex, founder-specific tax scenarios, including equity, grants, and multi-entity setups, so you’re not leaving money on the table or risking compliance issues.

Lucid’s AI-generated forecasts offer continuous visibility into cash flow, burn rate, and runway. These forecasts pull data in real time, incorporating sales numbers and market trends, so you’re not stuck relying on outdated spreadsheets. You can also run “what-if” scenarios - like hiring a new engineer or increasing ad spend - to see how different decisions impact your runway before making a commitment. When resources are tight, this level of insight is invaluable.

Pricing is straightforward and designed with startups in mind, starting at $150 per month with no hidden fees or hourly charges. Whether you need basic bookkeeping or full CFO-level support, Lucid scales with you from pre-seed to Series C. The platform adapts as your business grows, with AI that evolves based on your unique needs. By turning fragmented financial tools into a cohesive system, Lucid helps startups focus on what matters most: growth.

sbb-itb-17e8ec9

ROI Metrics for Financial Tools

Time Savings and Error Reduction

One of the clearest ways to measure ROI from AI-powered financial tools is by looking at time savings and error reduction - both of which directly translate into cost savings and lower risks.

Professionals using AI tools save about one full workday per week, or 20% of their time. For a startup, where every hour is critical, that's a game-changer. A 2023 study found that workers using AI assistants resolved 14% more issues per hour. Knowledge work tasks saw even greater gains, with a 25% speed boost and over 40% improvement in quality. For payroll processing, AI has reduced calculation errors by as much as 95%, while general accounting errors dropped by 70%.

Accuracy is another major win. Manual processes often lead to costly mistakes and penalties. AI-powered transaction matching and reconciliation tools improve data quality significantly, ensuring reliable records. For startups gearing up for fundraising or due diligence, having accurate financials is essential.

To measure these benefits effectively, start by establishing baseline metrics before implementing any tool. Track key indicators like cycle time reduction (how many days it takes to close your books), error rate monitoring (frequency of manual mistakes), and cost per transaction (the direct cost of each workflow). For instance, if your month-end close currently takes 10 days and automation reduces it to 6 days, that’s a 40% improvement - time that can be redirected toward more strategic tasks.

When calculating time savings, use the fully loaded hourly rate of employees, factoring in benefits, overhead, and other related costs, to get a complete picture of the value of those saved hours. Don’t forget to include additional costs like API usage, training, and support in your Total Cost of Ownership (TCO) calculations.

Cost Reductions and Better Runway Visibility

AI tools also shine when it comes to cutting costs and improving financial clarity, both of which are critical for maintaining a startup’s runway.

Take accounts payable as an example. Automated systems allow teams to process invoices 82% faster, reducing the time from 17.4 days for manual processing to just 3.1 days. Even more impressive, automating AP cuts invoice processing costs by 78%, dropping from $12.88 per manual invoice to $2.78 per automated one. For startups handling hundreds of invoices each month, these savings quickly add up to thousands of dollars annually. Companies using structured automation frameworks often see ROI within 9 to 12 months, compared to 18+ months for those without clear metrics.

Real-time cash flow visibility is another area where AI tools deliver big returns. Dashboards powered by AI provide daily updates on burn rate, runway, and cash position, enabling faster, more informed decisions. Whether it’s deciding to hire, adjusting marketing budgets, or preparing for a fundraising round, these insights are invaluable. Tools like Lucid Financials even let you run "what-if" scenarios to see how different decisions could impact your runway before you commit resources.

"Through the automation of routine tasks and the improvement of analytical insights, these technologies can facilitate the smooth execution of financial processes, all the while optimizing costs to maximize value for employees, shareholders, customers, and the broader enterprise." - Steven Krueger, EY Global Finance Technology's services leader

To track ROI, focus on metrics like payback period (how long it takes for benefits to exceed your initial investment), adoption rates (percentage of processes actually using AI), and scalability ratio (how processing costs change as transaction volumes grow). Set thresholds to monitor performance - if adoption drops below 20% or error rates spike, it’s time to reassess. A 2023 MIT study revealed that 95% of AI investments fail to deliver measurable returns, often due to poor tracking frameworks rather than a lack of value. The key is to measure what matters and ensure your tools are delivering tangible results.

Practical Tips for Tax Optimization and Financial Planning

Claiming Tax Credits and Avoiding Compliance Risks

The Federal R&D Tax Credit is one of the most valuable tax incentives available for startups, yet it often goes overlooked. Many activities, such as software development and algorithm testing, qualify for this credit, potentially offering up to $500,000 annually in payroll tax offsets. This is particularly beneficial for startups under five years old with less than $5 million in revenue. In 2024, the tax advisory firm Burkland revealed that its startup clients collectively claimed over $23 million in R&D tax credits by identifying qualified research expenses in areas like AI and software development.

To qualify, your activities must meet four criteria: purpose, technology, resolution of uncertainty, and experimental process. Proper documentation is key - tools like Git, Jira, and time logs can help track these activities. Even tasks like running multiple AI model variations or simulating outcomes are considered part of the "process of experimentation." However, note that the election to apply R&D credits against payroll taxes must be made on your original tax return - amended returns won’t cut it. Missing this step means forfeiting the credit entirely.

Beyond R&D credits, startups can also deduct up to $5,000 in startup costs (e.g., market research, training) and another $5,000 in organizational costs (e.g., legal fees, incorporation) during their first year. Additionally, Section 179 expensing allows you to deduct the full cost of qualifying equipment or software - up to $1.25 million - in the year it's placed in service instead of spreading it out over time. If your business operates as an LLC or S-Corp, you may also qualify for the Qualified Business Income (QBI) deduction, which offers a potential 20% deduction on eligible income through 2025. These deductions can significantly extend your financial runway.

Compliance is equally critical. Every startup with an Employer Identification Number (EIN) must file a tax return, even if no revenue has been generated. To simplify tax preparation and maintain a clean audit trail, use separate business bank accounts and credit cards from the very beginning. If incorporated in Delaware, remember the March 1st franchise tax deadline, which applies regardless of profitability. Also, issue 1099 forms by January 31st to any non-corporate contractor paid over $600 in the previous year. Missing deadlines can lead to penalties that strain your budget. Tools like Lucid Financials can help automate tracking tax liabilities and identify R&D credit opportunities early, saving you from last-minute scrambling.

Pairing tax strategies with proactive financial planning can greatly enhance your startup's financial stability.

Scenario Modeling for Better Spending Decisions

Scenario modeling is a practical way to simulate financial outcomes and guide decisions, whether you're considering hiring new staff or launching a marketing campaign. Experts suggest creating at least three scenarios: best-case, worst-case (base-case), and a "what-if" scenario, such as launching six months late or facing doubled costs. Given that nearly 50% of startups fail within their first five years, often due to cash flow issues, better modeling could help avoid these pitfalls.

The first step is identifying your financial drivers - metrics that significantly impact your business, like website traffic, conversion rates, or average order value. Once identified, focus on five key areas: Revenue, Cost of Goods Sold (COGS), Workforce (hiring or layoffs), Operating Expenses (OpEx), and Capital Expenses (CapEx). For instance, you can model scenarios like operating at 50–75% capacity, achieving 20% monthly revenue growth, or hiring additional engineers. Free templates from tools like Google Sheets or SCORE are excellent starting points. Make multiple copies of your master template to compare different scenarios side by side - for example, one showing "20% revenue growth" and another showing "50% capacity with delayed hiring."

"What if you launch six months later? What if sales do not ramp up as expected? What if your costs turn out to be double of what you expected? Answering such questions helps you anticipate how your cash flow, profitability and funding need are impacted." - EY Analyst

Scenario modeling is particularly effective for refining cash flow projections. Cash flow tracks the timing of funds coming in and going out, including loan payments, owner investments, and receivables. AI-powered tools can sync with your bank data to keep projections updated in real time, reducing manual errors and giving you daily insights into your burn rate, runway, and cash position. For example, Lucid Financials integrates with Slack, allowing you to test scenarios like adjusting your marketing budget or delaying a hire before making any commitments. This approach helps pinpoint the minimum funding needed to stay afloat and estimate when your business will turn profitable - vital information for attracting investors and managing your runway effectively. By modeling potential outcomes, you can ensure every dollar spent delivers maximum impact.

Conclusion

Maximizing ROI on a tight startup budget isn't just about slashing expenses - it’s about making every dollar work smarter. The strategies outlined in this article demonstrate how tackling inefficiencies, automating repetitive tasks, and leveraging AI-driven tools can stretch your runway and help you sidestep the financial pitfalls that lead to nearly 50% of startup failures. From exploring tax credits to using AI-powered forecasting, these approaches can extend your capital and smooth out cash flow challenges.

AI and automation take financial operations to the next level, shifting the focus from reactive bookkeeping to forward-thinking strategy. Tools that seamlessly integrate with accounting software can save finance teams up to 250 hours annually while reducing costly errors. For instance, Lucid Financials combines AI-driven bookkeeping, tax planning, and CFO-level forecasting into one streamlined platform - starting at just $150 per month. Its real-time Slack integration lets you test "what-if" scenarios, monitor your burn rate, and create investor-ready reports with ease.

Another critical factor is maintaining constant visibility into your financial health. As Matthias Steinberg, CFO at MindBridge, wisely notes:

"You can't improve what you can't see - and you can't see without frequency".

AI-powered dashboards, integrated with tools like Slack, provide real-time insights into your cash flow and burn rate. This continuous monitoring allows you to catch vendor overcharges or adjust spending before small issues escalate, turning financial management into a strategic asset rather than just a compliance task.

Whether you’re at the pre-seed stage or preparing for Series C, the core principles remain the same: keep your business finances separate from the start, prioritize automation that delivers the greatest impact, and use predictive tools to evaluate multiple scenarios before making decisions. By embedding these practices early, you’ll set the stage for sustainable growth and ensure your budget delivers the results you need.

FAQs

How can startups use automation to improve financial efficiency and maximize ROI?

Startups can significantly improve their ROI by automating tedious financial tasks, letting technology take over repetitive processes with accuracy and efficiency. AI-driven tools can handle tasks like categorizing transactions, reconciling accounts, preparing tax filings, and creating investor-ready reports - all without requiring manual intervention. This approach not only minimizes errors but also cuts down costs dramatically. For example, hiring a full-time finance team can cost over $80,000 annually, while automation offers a far more budget-friendly alternative.

But automation isn’t just about basic bookkeeping. Startups can take it a step further by streamlining cash flow management. This includes setting up rule-based approvals for expenses, automating accounts payable to save time, and enabling real-time alerts for unusual activity. By integrating these tools with platforms like Slack, startups can access vital financial updates instantly. Plus, AI systems continuously improve their accuracy over time, making them even more reliable.

For a more comprehensive solution, startups can turn to platforms like Lucid Financials. This all-in-one service combines bookkeeping, tax services, tax credit recovery, and CFO support, delivering clean and accurate financial records in just seven days. Such a streamlined approach not only reduces costly errors but also speeds up decision-making and ensures your financial operations remain scalable - setting the stage for long-term growth while maximizing ROI.

What tax credits and deductions do startups often miss out on?

Many startup founders miss out on tax credits and deductions that could stretch their runway and boost cash flow. Here are a few that often fly under the radar:

- R&D tax credit: If your startup invests in qualified research activities - like software development or creating prototypes - you could use this credit to offset payroll taxes. It's a great way to reclaim some of those early-stage expenses.

- Startup-cost deduction: You can deduct up to $5,000 in initial business expenses right away. Any additional costs can be spread out over 15 years, easing the financial burden of getting started.

- Section 179 and bonus depreciation: Instead of waiting years to depreciate qualifying equipment, software, or certain leasehold improvements, these rules let you expense them upfront.

Managing these opportunities can get tricky, but Lucid Financials makes it easier. Their automated bookkeeping, real-time Slack updates, and investor-ready reports help ensure you capture every tax benefit while staying focused on scaling your business.

How can scenario modeling help startups make smarter financial decisions?

Scenario modeling is a powerful tool for startups navigating uncertainty. It involves crafting multiple financial projections - like best-case, worst-case, and base-case scenarios - based on different assumptions about critical factors such as market size, customer acquisition costs (CAC), and growth rates. By analyzing these scenarios, founders can pinpoint potential risks, explore growth possibilities, and present a realistic range of outcomes to investors.

Built on real metrics like churn and CAC, scenario modeling equips startups to make smarter decisions about spending, hiring, and prioritizing key initiatives. This method helps extend cash runway, allocate resources effectively, and zero in on strategies that deliver strong returns, even in tough times.

Tools like Lucid Financials make scenario modeling more efficient. By automating data integration and updates, it provides a dynamic, real-time dashboard that allows founders to quickly adapt plans and make decisions backed by data, all with greater confidence.