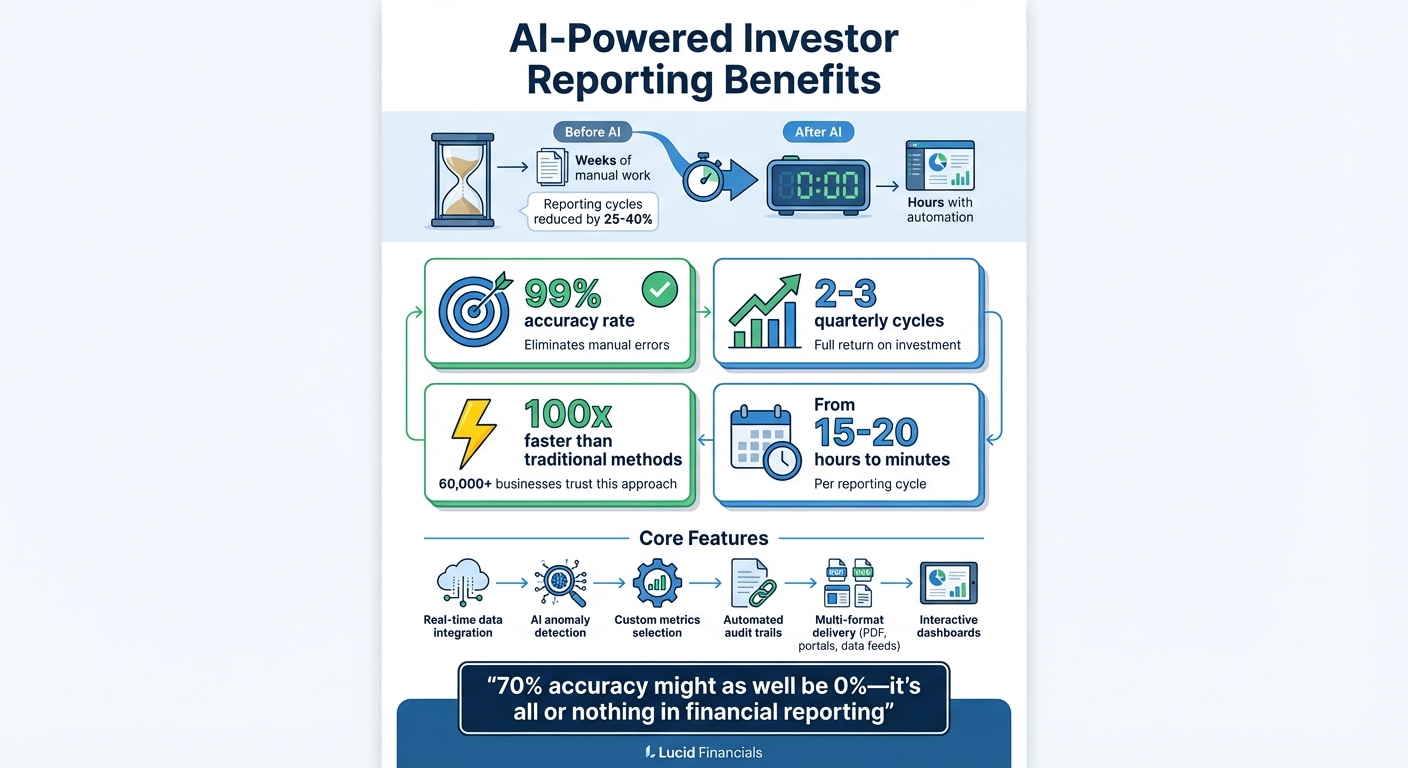

Investor reporting has always been time-consuming and error-prone, but AI-powered custom templates are transforming the process. Here's what you need to know:

- Time Saved: AI reduces reporting time from weeks to hours by automating data gathering, formatting, and report generation.

- Accuracy: Reports achieve 99% accuracy by eliminating manual errors and flagging anomalies in real-time.

- Customization: Tailor reports to focus on metrics that matter to specific investors, like liquidity for VCs or growth KPIs for board members.

- Real-Time Insights: Live dashboards and instant updates ensure stakeholders have access to the latest financial data anytime.

Platforms like Lucid Financials integrate with tools like QuickBooks and Slack to streamline the entire process. These templates not only save time but also improve investor trust by delivering polished, professional reports with minimal effort.

Bottom Line: AI-driven templates simplify investor reporting, allowing startups to focus on growth instead of tedious administrative tasks.

AI-Powered Investor Reporting: Key Benefits and Time Savings

Automating Investor Communication with AI Agents | Investor Relations Agent

sbb-itb-17e8ec9

What Are AI-Powered Custom Templates for Investor Reporting?

AI-powered custom templates streamline the creation of investor-ready financial reports by automating the entire process. These templates connect directly to your financial systems through APIs and integrations, pulling live data - such as revenue, expenses, and cash flow - and automatically organizing and formatting it into polished, professional reports.

The standout advantage here is the combination of speed and precision. Using machine learning, these templates standardize data from various formats, identify quality issues like missing entries or inconsistencies, and produce reports with 99% accuracy. What used to take weeks can now be done in hours. Plus, this approach eliminates manual errors from copy-pasting and provides a clear audit trail for every calculation.

What makes them "custom" is their flexibility. Users can tailor report layouts, choose key metrics (like net asset value or performance deltas), and apply specific formatting. Whether it's a property-specific report for real estate investors or a fund-level overview for venture capitalists, these templates adapt to fit the need.

Core Features of Custom Templates

One of the most powerful features is real-time data integration. These templates link directly to accounting software, banking platforms, and other data sources to pull live metrics automatically. For example, tools like Lucid Financials sync with Slack and accounting software, keeping dashboards updated with the latest financial data for continuous investor reporting.

Customization options let users define layouts, select metrics, and cater to stakeholder preferences. Reports can be delivered in multiple formats - PDFs via email, interactive portals, or direct data feeds - depending on what investors prefer. Natural language generation (NLG) adds a professional touch by creating narratives that explain the numbers, while automated audit trails ensure compliance by documenting every data source and calculation.

Another key feature is AI anomaly detection, which flags discrepancies in the data before reports are finalized. By using retrieval-augmented generation (RAG), the system ensures that all figures come from verified documents, not generated content, maintaining transparency in both data sourcing and reasoning. Additionally, interactive dashboards let investors access the data themselves, cutting down on one-off information requests.

These features offer tangible advantages, especially for startups and fast-growing teams.

Benefits for Startups and High-Growth Teams

By integrating real-time data and automating quality checks, these templates slash reporting time. Tasks that used to take 15–20 hours now take just a fraction of that, freeing finance teams to focus on strategic initiatives instead of administrative work. Many businesses see a full return on investment within two to three reporting cycles, thanks to reduced manual labor and fewer ad hoc investor requests.

Improved accuracy is another game-changer. With 99% accuracy and no manual errors, these reports inspire greater confidence among investors. Real-time dashboards provide instant portfolio updates and continuous KPI tracking, giving stakeholders immediate insights without waiting for scheduled reports. This level of transparency strengthens relationships with investors and makes it easier to raise capital by showcasing operational efficiency.

For rapidly growing teams, these templates ensure consistency across every reporting cycle. Standardized formats maintain a high level of professionalism, even as the business scales its metrics or adds new investors. By combining AI-driven automation with human oversight - where experts review reports for deeper, company-specific insights - teams can deliver reports that meet both technical requirements and strategic goals.

How Custom Templates Work in Lucid Financials

Lucid Financials simplifies investor reporting by creating tailored reports that align with specific investor requirements. From gathering data to generating the final report, the platform combines AI-powered automation with expert oversight to deliver precise and professional results.

Data Integration and Automation

The process begins with direct integrations to your existing financial tools. Lucid seamlessly connects to software like QuickBooks and communication platforms such as Slack, automatically pulling live financial data.

Once connected, the platform's AI anomaly detection scans the data for issues like missing transactions, duplicate entries, or inconsistent figures, flagging them before they can affect your reports. This ensures the integrity of your investor reporting. Beyond this, the AI processes raw data into clear financial visualizations, including dashboards and charts that effectively illustrate performance. This comprehensive data management forms the foundation for customizing reports to align with your needs.

Customizing Templates to Your Needs

Lucid provides a variety of flexible templates designed for industries like startups, e-commerce, medical groups, real estate, and professional services. After selecting the template that fits your business, you can customize it to focus on metrics that matter to your investors, such as burn rate, runway, Customer Acquisition Cost (CAC), or valuation.

The platform's AI-driven scenario modeling allows you to create "Instant Financial Plans" that display best-case, worst-case, and actual scenarios side by side. It also incorporates industry-specific benchmarks to give investors a clear context for your performance. Since the platform syncs data in real time, your reports always reflect the most current figures rather than outdated information.

"We pulled up the Lucid platform in a meeting with a VC and they were extremely impressed. His jaw just about dropped when he saw October was even up to date." - Giorgio Riccio, Founder, Lumino Technologies

Once customized, these templates transform real-time data into polished, investor-ready reports effortlessly.

Generating Investor-Ready Reports

After configuring your templates, generating reports is as simple as a one-click process. The platform compiles the latest financial data, applies your chosen formatting and metrics, and produces professional reports in just minutes. Whether it’s for monthly closes, investor updates, or fundraising, Lucid ensures consistent, board-ready documentation.

Lucid also integrates with Slack to provide instant financial insights around the clock. Need to check your runway before a meeting? Want to review October’s numbers during a VC call? The AI delivers immediate answers, while expert support is available for deeper strategic insights. This blend of speed and precision has made Lucid a go-to tool for over 60,000 small businesses, offering financial management that's 100x faster than traditional methods.

Key Use Cases for AI-Driven Investor Reporting Templates

AI-powered templates are transforming investor reporting by addressing common hurdles faced by startups and high-growth companies. From speeding up monthly financial closes to streamlining board reports and improving forecasting, these templates provide practical solutions that save time and reduce errors.

Monthly Financial Closes and Dashboards

Closing the books each month often involves hours - if not days - of manual effort. Teams must pull data from multiple systems, reconcile accounts, and double-check for errors. AI-driven templates can automate this entire process, pulling and standardizing data from various sources while flagging any discrepancies early. This reduces the time needed for monthly closes from days to just a few hours, allowing finance teams to focus on more strategic tasks.

Real-time dashboards generated from these templates are another game-changer. They offer continuous updates on critical metrics like cash burn rate, monthly recurring revenue (MRR), and runway. No more waiting for month-end reports - these dashboards provide instant insights. For example, you could track MRR growth from $150,000 to $250,000 alongside an 18-month runway, all in real time and displayed in clear USD figures.

This level of efficiency extends seamlessly into board and investor reporting.

Board and Investor Reporting

Creating polished reports for board meetings or fundraising presentations has traditionally been a labor-intensive process, requiring extensive formatting, narrative drafting, and error-checking. AI templates simplify this by automatically generating professional reports that highlight key financial metrics like IRR and TVPI, while tailoring insights to meet investor expectations. These templates also support multi-channel distribution, whether through PDF files or secure portals, all while maintaining an audit trail for compliance purposes.

By automating these tasks, report delivery speeds up significantly, with data accuracy rates reaching as high as 99%. Startups can provide board-ready snapshots with ease, while private equity firms can consolidate performance metrics across multiple investments. This transparency not only builds trust during due diligence but also shortens funding timelines, as investors can access real-time updates through self-service portals, reducing the need for follow-up questions.

The same precision that enhances reporting also fuels better forecasting and scenario planning.

Forecasting and Scenario Planning

AI templates take the guesswork out of financial forecasting by integrating historical data into predictive models. They allow for "what-if" scenarios, comparing best-, worst-, and actual-case outcomes side by side. For instance, a 12-month projection might show a projected burn of $5.2M, while also simulating how changes in market conditions or funding delays could impact EBITDA, valuation multiples, or runway.

These templates are especially valuable during investor pitches. They create forward-looking visuals that help build confidence, even in uncertain markets. By analyzing historical patterns, the AI generates objective baseline forecasts, reducing the risk of founder bias. Additional insights - like sales pipeline velocity - can also be included, offering a well-rounded view of potential growth and performance.

AI templates are reshaping investor reporting, making processes faster, more accurate, and far more insightful for everyone involved.

Best Practices for Using Custom Templates Effectively

To make the most of AI-powered custom templates, focus on maintaining precise data, tailoring reports for your audience, and blending automation with human expertise. These practices can significantly boost investor confidence while ensuring reports are both accurate and insightful.

Ensure Data Accuracy and Completeness

Accurate financial data is the backbone of reliable reporting. AI tools can help by flagging anomalies in real time, but the process begins with clean and complete records. Use a validation checklist to ensure your data pipelines, calculation logic, and source information are all sound. Collaboration between finance and technical teams is essential to ensure AI outputs align with financial logic and regulatory requirements. For instance, benchmarking metrics like cost of debt or burn rate against market standards can highlight discrepancies early.

"In financial reporting, 70% accuracy might as well be 0% - it's all or nothing".

Tailor Templates for Stakeholders

Different stakeholders care about different metrics. For example, board members often focus on runway and EBITDA, while early-stage investors are more interested in MRR growth and retention. Customizing your templates to emphasize the most relevant KPIs for each group is crucial. AI-powered visualizations can make complex data easier to digest, turning raw numbers into clear, actionable charts and dashboards. For consumer-focused investors, retention metrics might take center stage, while financial partners may appreciate benchmarks like cost of debt. Adding industry-specific insights - such as AI-driven segmentation for revenue streams - can further demonstrate your understanding of the business and its market.

Combine AI with Expert Oversight

AI excels at automating data aggregation and performing initial calculations, but human oversight is indispensable for refining these outputs. AI models, while efficient, can sometimes generate plausible yet inaccurate results or overlook critical details. This is why expert review is essential for verifying calculations, adjusting tone, and ensuring compliance with regulations. Interestingly, 68% of tax and accounting professionals report feeling optimistic about Generative AI's potential, even as they acknowledge its current limitations.

"The goal isn't to replace human expertise with artificial intelligence - it's to create partnerships where each contributes its unique strengths".

This collaborative approach - combining AI precision with human judgment - can cut reporting cycles by 25% to 40%, all while maintaining the accuracy and strategic depth that investors expect.

Conclusion

AI-powered custom templates are changing the game for investor reporting, turning what used to be a lengthy, tedious process into an efficient, strategic tool. By automating tasks like data aggregation and narrative creation, these tools can shrink the time it takes to produce reports from weeks to just hours - all with 99% accuracy. For startups and fast-growing teams, this means reclaiming valuable hours to focus on analysis and strategies that drive the business forward.

These templates also ensure you're always ready for investors. No more last-minute scrambles to update metrics or cobble together reports. Features like real-time financial insights, audit trails, and standardized formats not only cut down on ad hoc requests but also help build trust with investors. This trust can lead to faster capital raises and stronger relationships.

With Lucid Financials, you get all of this and more: accurate books within seven days, investor-ready reporting that's always up-to-date, and real-time integrations with tools like Slack. The platform pairs AI automation with expert bookkeeping, tax services, and CFO support, ensuring every report meets the standards investors expect.

Most users see a full return on investment within just 2-3 quarterly cycles, and the advantages grow over time. Faster report turnarounds, fewer mistakes, and happier investors all contribute to smoother operations and scalable success. Whether you're gearing up for a funding round or managing routine board reports, AI-powered templates help you stay focused on growth while the platform takes care of the numbers.

FAQs

What data sources can the templates use?

AI-driven templates can gather information from a variety of sources, such as financial systems, live internal data, market trends, regulatory filings, and even unstructured content like financial statements or transcripts from earnings calls. These tools streamline tasks like data extraction, analysis, and compliance checks, making reporting both precise and efficient.

How do I choose the right KPIs for each investor?

To keep investors engaged and informed, center your attention on KPIs that match their priorities and strategies - think metrics like revenue growth, burn rate, and cash runway. Customize your dashboards to provide relevant, real-time insights that directly support their decision-making process. This approach keeps your reporting sharp, focused, and ready to meet investor expectations.

What security controls protect investor data?

Investor information is protected through a combination of multi-factor authentication, TLS 1.2/1.3 and AES-256 encryption, role-based access controls, and ongoing activity monitoring. To maintain transparency, automated reporting includes detailed audit trails. Additionally, compliance with standards such as SOC 2 ensures the security, availability, and confidentiality of the system. Together, these safeguards create a robust defense for sensitive data.