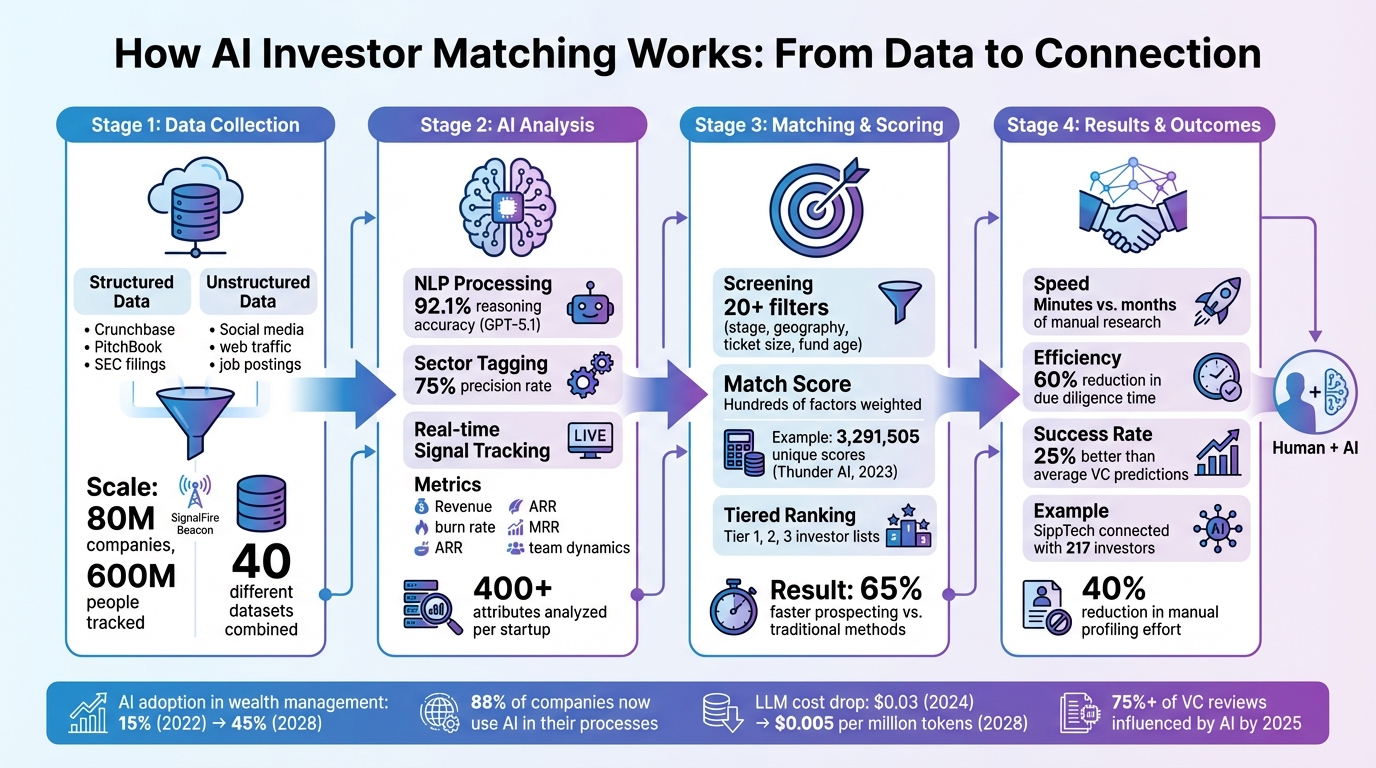

AI-driven investor matching is transforming how startups connect with potential investors. By analyzing structured and unstructured data, such as investment histories, market trends, and real-time signals, AI tools identify the most relevant investors for startups. These systems save time, improve targeting, and increase engagement rates by focusing on factors like industry, funding stage, and geographic preferences.

Key highlights:

- Speed: AI narrows thousands of options to a shortlist in minutes.

- Data Sources: Combines platforms like Crunchbase and SEC filings with real-time signals.

- Precision: Uses advanced algorithms to score and rank investor matches.

- Insights: Tracks financial metrics, team dynamics, and market fit to refine matches.

- Challenges: Struggles with qualitative factors like leadership potential; human input remains essential.

The combination of AI and human expertise ensures smarter, faster, and more accurate investor connections. With tools like GPT-5.1 and platforms such as SignalFire’s Beacon, startups can focus on building relationships while AI handles the heavy data analysis.

How AI Investor Matching Works: 4-Stage Process from Data Collection to Final Match

Reimagining Private Investing with AI-Powered Matchmaking

sbb-itb-17e8ec9

How AI Collects and Analyzes Investor Data

AI systems gather information from a variety of sources to create detailed investor profiles. These profiles are built using structured data from platforms like PitchBook, Crunchbase, and SEC EDGAR filings, which provide concrete details such as past deals, exit values, and portfolio activities. At the same time, unstructured data - like investment theses, social media activity, web traffic trends, and job postings - offers insights into current investor interests and priorities. By combining these two types of data, AI sets the foundation for deeper analysis.

Take SignalFire’s Beacon AI platform, for example. In January 2026, the company revealed that Beacon tracks 80 million companies and 600 million people using 40 different datasets. It employs language models (LLMs) to analyze company websites and documents, identifying competitors and building market maps. Impressively, it achieves a 75% precision rate in tagging sectors, rivaling human-curated datasets. This enables SignalFire to direct promising startups to the right investment team members based on their expertise.

At the heart of this process is Natural Language Processing (NLP). NLP tools extract valuable insights from complex documents like pitch decks, due diligence questionnaires, and limited partnership agreements. Advanced models, such as GPT-5.1, boast a 92.1% reasoning accuracy, allowing them to interpret nuanced investor preferences through conversation rather than static forms. These tools can also analyze policy documents, asset and liability models, and regulatory texts, pulling out critical details like liquidity limits, solvency rules, and capital budgets.

Real-time signal tracking takes this a step further. Instead of working with outdated information, AI now monitors live data - such as recent investments, portfolio changes, and emerging sector trends. In 2025, Raisi used this capability to help SippTech connect with 217 investors and arrange meetings with top-tier venture capital firms. By identifying investors most likely to engage based on their current activity, the platform reduced manual profiling efforts by 40% and is predicted to cut acquisition costs by 50% by 2028.

The adoption of AI in wealth management is growing rapidly, climbing from 15% in 2022 to an expected 45% by 2028. Beyond saving time, AI reveals patterns that might escape human analysis, such as links between investment strategies and geographic regions or shifts in sentiment that hint at evolving priorities. With the cost of LLM inference dropping from $0.03 per million tokens in 2024 to a projected $0.005 by 2028, this technology is becoming increasingly accessible.

Startup Data Used in AI Matching

Core Data Inputs

AI matching begins with foundational data like firmographics - details about a company's industry, size, and location - as well as key fundraising parameters, including the funding stage, target amount, and preferred investor type.

These inputs act as an initial filter. For instance, if a California-based Climate Tech startup is seeking a $2 million seed round, the AI focuses on investors who prioritize early-stage, sustainability-focused opportunities. This data-driven method has become the norm, with 88% of companies now incorporating AI into their processes.

The system also evaluates traction metrics, such as revenue growth, customer retention, and user engagement. These signals are converted into actionable insights, allowing AI models to outperform the average venture capitalist by 25% while reducing due diligence time by 60%.

But the analysis doesn’t stop there. AI goes beyond these core inputs to deliver deeper, more nuanced insights.

Deeper Analysis from AI

AI doesn’t just look at the numbers; it also examines team dynamics and founder backgrounds. Platforms like Hatcher+ analyze over 400 attributes, ranging from team expertise to specific industry knowledge, to determine how well a startup aligns with what investors value. Essentially, the system evaluates not just the product or service but also the people behind it.

Pitch decks are another area of focus. AI scrutinizes them for essential elements such as the problem being solved, the proposed solution, market size, and competitive advantage. It then pairs this information with real-time signals, like recent investments in similar startups, changes in investor portfolios, and public activity, to pinpoint the investors most likely to engage.

Some platforms even consider factors like "fund age", prioritizing investors in the first one to two years of their fund's lifecycle when they are most active in making investments. These advanced capabilities help startups better articulate their funding needs and connect with sector-specific investors, improving the chances of a successful match.

How AI Algorithms Perform the Matching

Screening and Filtering

The matching process kicks off with baseline screening, where AI sifts through investors based on firmographics like industry, stage, geography, and ticket size. This step quickly eliminates investors who aren't a fit.

More advanced platforms take this further by using over 20 detailed filters. These include criteria like fund size (targeting check sizes of 1–2%), recent activity (investments made in the last 3–6 months), and lead status. The system also tracks real-time signals - such as portfolio changes, public announcements, and sector trends - to zero in on investors who are most likely to engage.

What would take months of manual research is reduced to mere hours with AI-driven discovery.

Relevancy Scoring and Ranking

After initial screening, the system moves to relevancy scoring, a process designed to refine the matches even further.

AI assigns a Match Score to each investor, weighing hundreds of factors. The focus is on how well the investor's historical investment patterns align with the startup's characteristics. For example, the system might analyze two decades of an investor's deal history, looking at sector preferences and geographic focus. It combines this with live data, such as recent investments, to create a more precise match.

"Our system creates a ranked list of investors and provides an 'Investor Match' score based on hundreds of factors, the most important of which are whether or not the investor is a match for the stage the company is at." - John Carolus Sharp, Hatcher+

In March 2023, Thunder's AI produced over 3,291,505 unique match scores for a network of 24,847 startups and 2,738 investors. The system uses a bell-curve distribution to evaluate company scores, identifying standout matches. Around 20% of the variability in these scores is explained by the "Company Score" itself. The AI then generates a tiered ranking - like Tier 1 for the best matches - helping founders prioritize their outreach efforts. This streamlined approach can cut prospecting time by up to 65% compared to traditional methods.

Key Factors That Impact Match Quality

The effectiveness of AI-driven matchmaking depends on several core elements that shape the strength of the connections it creates.

Data quality and freshness are absolutely critical. The accuracy of matches starts with reliable, up-to-date data. When training data is incomplete, outdated, or insufficient, the results will mirror those shortcomings. Direct integrations with tools like bank feeds and accounting software allow AI systems to access real-time financial insights, bypassing outdated spreadsheets. This real-time access significantly boosts the precision of matches. For example, platforms like Lucid Financials help startups by providing accurate, investor-ready financials, ensuring that matching systems are working with the most current data available.

Alignment on financial metrics is another key factor. Building on the startup data mentioned earlier, AI systems track critical indicators such as burn rate, runway, annual recurring revenue (ARR), monthly recurring revenue (MRR), and cash flow. These metrics help ensure that a startup’s financial trajectory aligns with an investor’s risk tolerance. Investors are particularly drawn to startups with controlled burn rates and steady, predictable cash flow.

Sector and market fit also plays a significant role. Advanced AI tools go beyond generic industry labels, diving deep into market trends, customer behaviors, and competitor activities. This allows them to pinpoint a startup’s specific niche within the broader market.

However, while AI excels at processing large datasets, it often struggles with more qualitative aspects like team dynamics, leadership quality, and founder motivation. For instance, one venture capital firm reported cutting due diligence time by 60% using an AI platform. Still, even with standardized criteria and reduced bias, human judgment remains vital for interpreting these qualitative signals.

Comparison of Factors

The table below illustrates how basic criteria evolve when analyzed through AI-enhanced systems:

| Factor | Basic Criteria | AI-Enhanced Analysis |

|---|---|---|

| Sector Fit | Industry codes (e.g., "Fintech") | Dynamic AI-identified market segments and product-level analysis |

| Funding Stage | Broad categories (Seed, Series A) | Historical deal patterns and "investor readiness" benchmarks |

| Location | Country or region | City-level proximity and behavioral analysis |

| Data Source | Static databases and manual research | Real-time aggregation of news, LinkedIn, and portfolio activity |

| Match Logic | Keyword/filter matching | Multi-factor ranking with explained "Match Reasons" |

| Efficiency | Slow, manual research and dead-end emails | 20x faster analysis with automated shortlisting |

Ensuring Accuracy and Transparency in Matches

Building on earlier discussions about AI match scoring, this section dives into how accuracy and transparency are maintained in these systems. AI matching platforms use multiple validation methods to catch errors, minimize bias, and make the reasoning behind matches clearer.

Key to this process are techniques like backtesting and sensitivity analysis. These methods rely on massive datasets - such as Evalyze's database of 8,000 successful funding applications - and involve tweaking variables by ±20% to identify what truly drives quality matches. This rigorous testing ensures that AI models learn from actual outcomes, making their predictions more reliable.

To address concerns about AI's "black box" nature, explainable models are employed. These models use rule-based logic to clarify how matches are made. For instance, Evalyze provides investor-readiness scores paired with detailed feedback on areas like pitch deck clarity, market size presentation, and go-to-market strategy. As Vahid Fakhr, Founder and CEO of Evalyze, puts it:

"Founders should spend more of their time building and less of their time guessing which investors to contact next".

This level of transparency not only helps founders identify the right investors but also explains why those investors are a good fit and how to improve their chances of success. While algorithmic transparency is essential, expert human review remains a critical component.

A hybrid approach, blending AI with human expertise, is proving to be the most effective. For example, an XGBoost model outperformed the median venture capitalist by 25% in its predictions. However, as Kshitiz Agrawal from Qubit Capital highlights:

"The best process is human plus machine, not machine alone".

This approach ensures that while AI handles the heavy data crunching, experienced professionals step in to make nuanced decisions, especially in high-stakes scenarios where AI might falter.

Moreover, measures like blind screening and ongoing bias testing are crucial for reducing discrimination in the matching process. AI systems can evaluate text-based inputs, focusing solely on merit and behavioral traits while excluding demographic factors like race, gender, or appearance. These efforts are vital, especially in light of persistent inequities - such as the fact that in 2023, startups founded exclusively by women received just 2% of total venture capital funding in the U.S.. Continuous bias testing ensures that AI systems don’t perpetuate historical biases, creating a fairer playing field for all.

Benefits and Limitations of AI Matching

AI matching offers speed and efficiency that traditional methods simply can't replicate. By 2025, over 75% of venture capital (VC) investor reviews are expected to be influenced by AI and data analytics. This technology can process massive datasets, uncover patterns across millions of startups, and analyze thousands of investors - tasks that would take months to complete manually.

However, while AI brings undeniable advantages, it also comes with certain limitations. For instance, AI thrives in crunching numbers but struggles to grasp qualitative nuances. It often misses critical "soft signals" like team chemistry and leadership potential, which are key to a startup's long-term success. Another challenge is data quality - outdated or biased training data can skew results, undervaluing unconventional founders or overlooking emerging trends. There's also the risk of founders gaming the system by tailoring their pitch decks to score well with algorithms rather than focusing on real value creation.

The best results come from blending AI's efficiency with human expertise. As Qubit Capital aptly puts it:

"The best process is human plus machine, not machine alone".

This hybrid method leverages AI for large-scale screening and data analysis, while human professionals handle the nuanced, final decision-making process.

Pros and Cons of AI Matching

Here’s a breakdown of the main advantages and challenges of AI matching, along with strategies to address its limitations:

| Benefit | Limitation | Mitigation |

|---|---|---|

| Speed: Cuts due diligence time by up to 60%, analyzing vast amounts of data in minutes. | Data Quality: Outdated or incomplete data can lead to inaccurate matches. | Regularly update and verify data, and use platforms that monitor live market signals instead of relying on static databases. |

| Objectivity: Standardizes evaluation criteria, reducing reliance on subjective judgments or biased introductions. | Algorithmic Bias: Historical data can reflect past prejudices, such as women-led startups receiving only 2% of U.S. VC funding in 2023. | Introduce blind screening, conduct regular bias testing, and maintain human oversight to identify and correct skewed results. |

| Scalability: Tracks millions of companies and investors globally, identifying patterns that manual research would overlook. | Qualitative Blind Spots: AI struggles to assess traits like resilience, team dynamics, or leadership potential. | Use AI for initial screenings and quantitative analysis, but rely on human interviews for evaluating qualitative factors. |

| Predictive Power: Evaluates hundreds of attributes to produce match scores and pinpoint investors most likely to engage. | Gaming Risk: Founders may manipulate pitch decks to achieve high algorithmic scores without focusing on genuine value. | Combine automated scoring with qualitative reviews and thorough due diligence to prevent manipulation. |

This combination of AI-driven insights and human judgment ensures a more balanced and effective approach to decision-making in the fast-paced world of venture capital.

Conclusion: The Future of AI in Investor Matching

AI is reshaping how startups and investors connect, moving beyond simple tools that assist humans to autonomous systems capable of handling entire due diligence and screening processes. Recent data highlights a growing trend of AI adoption across various business areas, with reports showing that AI can reduce due diligence time by as much as 60%.

The next big leap in this space will focus on real-time signal analysis, shifting away from static databases. These advanced systems will use live market data to identify the most relevant investors. Additionally, AI platforms are becoming smarter through compounding network effects, improving with every deal processed, which makes future matches quicker and more accurate. As Kshitiz Agrawal of Qubit Capital aptly notes:

"If you ignore [AI], you will still compete, just at a slower clock speed".

Despite these advancements, technology alone isn’t enough to secure funding. With only 1 in 400 startups successfully raising capital, having investor-ready financials remains a critical differentiator. Tools like Lucid Financials play a vital role in bridging the gap between AI insights and successful funding outcomes. Lucid helps startups prepare by delivering polished financials in just seven days, offering continuous investor-ready reporting, and providing AI-driven forecasts - all supported by experienced professionals. When AI identifies the right investor, having clear, board-ready financials can turn a potential opportunity into a closed deal.

FAQs

How does AI make investor matching faster and more accurate?

AI has transformed investor matching by taking over tasks that once consumed a lot of time, such as conducting research, reviewing opportunities, and handling compliance checks. This automation means decisions can now be made much faster than with traditional methods.

Beyond speed, AI brings a level of precision to the table. By analyzing massive datasets, tracking historical trends, and processing real-time data, it identifies ideal matches between investors and startups. Using advanced algorithms, AI can spot connections that might have been overlooked, making the entire matching process smarter and more efficient.

What challenges does AI face in assessing leadership potential?

AI faces challenges when it comes to assessing qualities like leadership potential, largely because these traits are subjective and difficult to measure. Its effectiveness is tied to the quality and variety of the data it’s trained on, which often falls short in representing less tangible attributes like emotional intelligence, motivation, or alignment with a company’s values.

While AI excels at spotting patterns and analyzing structured data, it struggles with the nuances of human behavior, vision, and team dynamics - elements that seasoned evaluators can often discern through direct interaction. This is why human judgment remains a crucial part of evaluating leadership potential, working alongside AI to provide a more complete picture.

How do AI platforms ensure accurate data and avoid bias in decision-making?

AI platforms work hard to deliver reliable data and reduce bias through a few important steps. First, they rely on high-quality, current datasets and use thorough data cleaning methods to fix errors and inconsistencies. This makes sure the system is working with dependable and relevant information.

To tackle bias, these platforms carefully review training data for any imbalances and use algorithms designed to encourage fairness in outcomes. Regular audits and testing with a variety of datasets further help spot and address unintended biases. Together, these efforts create AI systems that provide dependable and impartial recommendations, building trust in their decision-making processes.