AI is transforming how startups manage financial challenges by offering faster, smarter solutions to balance growth, cash flow, and risk. Instead of relying on fragmented tools or manual processes, AI enables real-time financial insights, scenario modeling, and automation. Here's what you need to know:

- Growth vs. Liquidity: AI helps startups weigh trade-offs, like hiring new talent versus maintaining cash reserves, by analyzing multiple objectives simultaneously.

- Data Integration: It eliminates fragmented data by centralizing financial information, improving forecasting accuracy.

- Automation: Tasks like bookkeeping, reconciliation, and compliance are streamlined, saving time and reducing errors.

- Scenario Modeling: AI provides instant "what-if" analyses, helping businesses prepare for market changes or unexpected events.

- Proven Results: Companies using AI report faster processes, reduced errors, and better financial visibility.

Startups like Letos and Dukapaq have streamlined operations and improved decision-making with AI-driven tools like Lucid Financials, which integrates bookkeeping, tax services, and CFO support into one platform. With AI, you can focus on scaling your business while staying financially secure.

Common Financial Challenges for Startups

Growth vs. Liquidity Trade-Offs

Startups often face tough choices when balancing growth and liquidity. Do you hire that much-needed engineer or hold onto enough cash to cover six months of expenses? Should you pour money into marketing to hit ambitious growth goals, or keep reserves for unexpected setbacks?

These decisions are deeply interconnected. Spending on growth today reduces the cash available for future opportunities or emergencies. Yet, traditional approaches often treat growth and stability as separate priorities, even though both are critical for long-term success. This constant juggling act can lead to further complications in forecasting and financial management.

Data Gaps and Forecasting Uncertainty

For many startups, financial data lives in silos. Revenue might be tracked in one spreadsheet, expenses in another, and cash flow somewhere else entirely. When it’s time to create forecasts, finance teams scramble to piece everything together. This process often reveals gaps or inconsistencies, making it hard to trust the numbers.

Without a single, reliable source of financial truth, forecasts can feel more like educated guesses. Fragmented data doesn’t just hurt projections - it also adds complexity to already time-consuming manual processes.

Manual Financial Management Problems

Manual bookkeeping can be a major drain on time and resources, not to mention a hotbed for errors. A simple mistake, like a misplaced decimal or a missed transaction, can lead to serious miscalculations that ripple through the business.

Even worse, delayed financial visibility means problems may not be spotted until it’s too late. For startups with limited cash reserves, this delay can spell disaster. A preventable cash flow crisis could cripple operations. As startups grow and operations become more complex, moving from manual processes to real-time financial insights isn’t just helpful - it’s essential.

sbb-itb-17e8ec9

How AI Optimizes Multi-Objective Financial Scenarios

AI Methods for Multi-Objective Optimization

Startups often grapple with balancing growth and liquidity - a challenge that involves making trade-offs between competing financial goals. This is where AI steps in, using Multi-Objective Optimization (MOO) to find Pareto optimal solutions. These solutions ensure that improving one objective, like revenue growth, doesn't happen at the expense of another, such as maintaining cash reserves.

Advanced techniques like gradient descent with automatic differentiation play a key role here. These methods adjust financial variables step by step, helping to strike a balance between conflicting objectives, such as minimizing risk while maximizing returns. In portfolio construction, tools like the sparsemax activation function focus on high-impact investments, ensuring that resources are allocated where they can make the most difference.

A compelling example of this comes from the SecureFinAI Lab at Columbia University. Between April 2024 and December 2024, researchers tested an AI-driven framework for stock trading. Using a seven-stock universe (AAPL, MSFT, GOOGL, JPM, TSLA, NVDA, META), the system delivered a 20.42% total return with a Sharpe ratio of 2.63, outperforming the S&P 500's 15.97% return. This was achieved by coordinating specialized AI agents - "Alpha", "Risk", and "Portfolio" - to manage execution and enforce drawdown constraints.

Real-Time Insights and Scenario Modeling

AI doesn’t just optimize; it also provides real-time insights through dynamic scenario modeling. Traditional financial models often rely on fixed assumptions, which can quickly become outdated. AI flips this script by offering live insights that adapt as market conditions shift. As Matthew Finio, Staff Writer at IBM, explains:

"AI models power real-time 'what-if' simulations that test how shifts in demand, pricing or external shocks might affect outcomes, offering a broader view of possible futures."

This adaptability is a game changer for scenario modeling. For instance, in December 2025, NVIDIA researchers showcased a quantitative portfolio optimization framework using GPU acceleration. Working with a 397-stock subset of the S&P 500 and 20,000 return scenarios, the system achieved a staggering 167.4x speedup - cutting solve time from 75.50 seconds on a CPU to just 0.45 seconds on a GPU. This speed allowed for real-time portfolio rebalancing as allocations drifted from their targets.

Automated Financial Processes

AI also streamlines routine financial tasks, automating processes that were once time-consuming and prone to errors. Tasks like data reconciliation and categorization, which often involve delays, are now handled seamlessly by AI-driven pipelines. These systems pull data from multiple sources, standardize it, and even use Natural Language Processing (NLP) to extract insights from unstructured text, ensuring no critical information is overlooked.

Efficiency is further boosted by GPU-accelerated solvers, which can speed up large-scale optimization problems by as much as 160x. What once took days can now be completed in minutes. This shift allows startups to make decisions based on the most current information rather than relying on outdated reports. Notably, 69% of CFOs now see AI as a key driver in reshaping the finance sector.

Lucid Financials: AI-Powered Solutions for Startups

AI-Driven Financial Management

Lucid Financials showcases how artificial intelligence can simplify and transform financial management for startups. Designed with startups in mind, the platform combines bookkeeping, tax services, tax credits, and CFO support into a unified, AI-powered system. It even integrates with Slack, offering instant financial insights right where teams communicate.

By bringing these essential financial functions together, Lucid Financials addresses the tricky balance startups face between growth and liquidity. The platform automates tasks like transaction matching, reconciliation, and categorization, effectively streamlining processes that were once time-consuming and error-prone. This isn't just about speeding things up - it's about rethinking how financial operations are handled. As Aviv Farhi, Founder and CEO at Showcase, explains:

"Lucid's CFO insights give us clarity to plan growth with confidence - it feels like having a full finance team on demand."

The results speak for themselves. Lucid Financials now supports 60,000 small businesses, delivering results 100× faster than traditional methods while adhering to SOC 2 compliance standards. This efficiency lays the groundwork for smarter, more dynamic financial planning.

What-If Scenario Analysis and Forecasting

Lucid goes beyond day-to-day financial management by helping startups prepare for the unexpected. Its AI generates real-time best-case, worst-case, and actual financial scenarios, allowing founders to explore different paths and understand their impact on critical metrics like runway, burn rate, and growth.

The platform also provides tailored benchmarks, such as customer acquisition costs and valuation comparisons, to give startups an edge. When it’s time to meet with investors, Lucid can instantly create professional, board-ready reports and fundraising plans with just one click - saving time and reducing stress.

Clean Books and Investor-Ready Reporting in 7 Days

Traditional accounting firms can take weeks to organize financial records, but Lucid Financials promises clean, investor-ready books in just seven days. Its AI handles the heavy lifting - automating transaction matching and reconciliation - while a dedicated finance team ensures accuracy and compliance with investor expectations. Erez Lugashi, Founder and CEO at Abilisense, shares his experience:

"With Lucid handling bookkeeping, taxes, and CFO support in one place, everything is organized and automated."

Starting at $150 per month, Lucid offers straightforward, flat-rate pricing with no surprise fees - perfect for early-stage startups operating on tight budgets.

AI-Driven Scenario Generation | Exclusive Lesson

Measuring the Impact of AI on Financial Outcomes

Before and After AI Implementation in Startup Financial Management

Measurable Improvements with AI

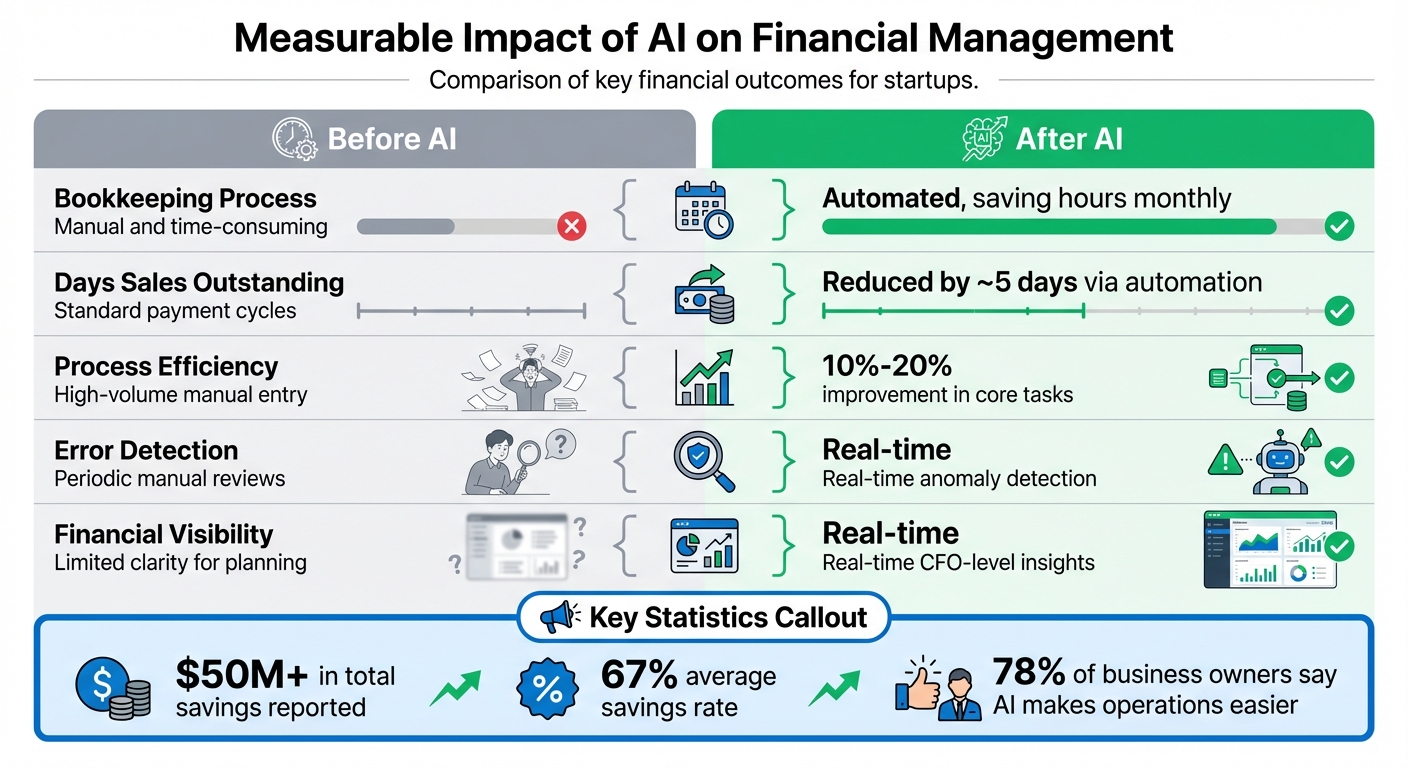

Switching from manual processes to AI-driven financial management has brought clear, measurable benefits. For instance, studies reveal that AI-powered automated reminders can shorten payment delays by about 5 days, giving businesses a noticeable boost in cash flow. Additionally, when AI assistants are introduced, they often improve specific finance processes by 10% to 20% in terms of efficiency.

AI doesn’t just speed things up - it also enhances accuracy. It can spot anomalies that might escape human reviewers, flagging potential issues before they snowball into bigger problems. For example, an AI system once flagged ten questionable entries in a general ledger, leading to the correction of five significant errors before they could affect financial reporting. This proactive risk management approach helps catch duplicate payments, fraudulent invoices, and compliance issues long before audits uncover them.

These tangible improvements lay the groundwork for impressive success stories.

| Financial Metric | Before AI | After AI |

|---|---|---|

| Bookkeeping Process | Manual and time-consuming | Automated, saving hours monthly |

| Days Sales Outstanding | Standard payment cycles | Reduced by ~5 days via automation |

| Process Efficiency | High-volume manual entry | 10%–20% improvement in core tasks |

| Error Detection | Periodic manual reviews | Real-time anomaly detection |

| Financial Visibility | Limited clarity for planning | Real-time CFO-level insights |

Case Study: Startup Success with AI

Real-world examples highlight the impact of these advancements.

Refael Shamir, Founder and CEO of Letos, transformed his startup’s financial systems by embracing AI. His team now saves significant time each month thanks to automated processes. Tasks like transaction matching and categorization are handled seamlessly by AI, freeing up his team to concentrate on scaling the business.

Similarly, Luka Mutinda, CEO at Dukapaq, credits AI-driven CFO services for giving him better budgeting insights and reducing the stress tied to compliance. Real-time updates and automated compliance have proven invaluable, especially during investor meetings, where well-organized financials help build trust. Supporting this, an industry survey found that 78% of business owners believe AI tools make running their operations easier.

Conclusion

Startups often face a balancing act between growth, cash flow, and time-consuming manual tasks - problems that traditional methods struggle to solve in today’s fast-changing markets. AI-powered tools are stepping in to fill this gap by automating repetitive processes, providing real-time insights, and enabling businesses to model various scenarios with ease. This shift transforms financial management from being purely reactive to a more strategic and forward-thinking approach.

By simplifying financial workflows and improving decision-making, AI is reshaping how startups handle their finances. For example, companies using AI in financial operations have reported impressive results, including over $50 million in total savings and an average savings rate of 67%. These advancements give founders the ability to move beyond quick fixes and focus on long-term planning.

Lucid Financials takes these innovations further by combining bookkeeping, tax services, and CFO support into a single, streamlined platform. With features like clean books completed in just seven days, real-time support via Slack, and on-demand investor reports, founders gain the clarity and tools they need to scale their businesses effectively. AI handles the heavy lifting - ensuring accuracy, compliance, and up-to-date records - while experienced professionals oversee the process to maintain high standards.

The landscape of startup finance is changing - becoming smarter, faster, and always active. With the right AI-driven solutions, you can spend less time worrying about the numbers and more time growing your business with confidence.

FAQs

How does AI help startups balance growth and cash flow effectively?

AI helps startups make better financial decisions by offering real-time insights into cash flow and predictive modeling. With these tools, founders can clearly understand how their growth strategies affect liquidity and runway. This clarity makes it easier to allocate resources wisely and steer clear of potential cash flow issues.

By using AI, startups can strike the right balance between pursuing ambitious growth and maintaining enough cash reserves to stay financially secure over the long term.

How does AI improve financial forecasting and visibility?

AI is transforming financial forecasting by processing massive amounts of real-time data, identifying patterns that might slip past human analysis, and continuously refining models to cut errors by 20–50% or even more. This allows businesses to make predictions they can trust and adapt swiftly to shifting market conditions.

But AI's benefits don't stop at forecasting. It delivers precise, real-time financial insights, giving companies a clearer view of their performance. With this improved transparency, founders and teams can make smarter decisions, confidently prepare for investor meetings, and concentrate on growing their business effectively.

How can AI-powered scenario modeling help startups adapt to market changes?

AI-driven scenario modeling allows startups to anticipate market shifts by analyzing real-time data and creating multiple "what-if" scenarios. This approach helps founders spot potential risks, allocate resources effectively, and make well-informed decisions before market dynamics change.

With AI, startups can rapidly assess the outcomes of various strategies, helping them stay flexible and ready for uncertainty. The result? Time saved and a more defined route toward steady growth.