Dynamic Resource Allocation and Traditional Budgeting are two distinct approaches to managing finances, especially for startups. Here’s the core difference:

- Traditional Budgeting: Focuses on fixed annual plans based on past data. It provides predictability but struggles with fast-changing environments.

- Dynamic Resource Allocation: Uses rolling forecasts and real-time financial insights to shift resources where they’re most needed. It’s better for companies facing rapid growth or market shifts.

Key takeaways:

- Startups in early stages or stable markets benefit from fixed budgets for simplicity and control.

- Scaling companies or those in volatile markets gain more from flexible, data-driven resource allocation.

- AI tools and financial guardrails are critical for implementing dynamic allocation effectively.

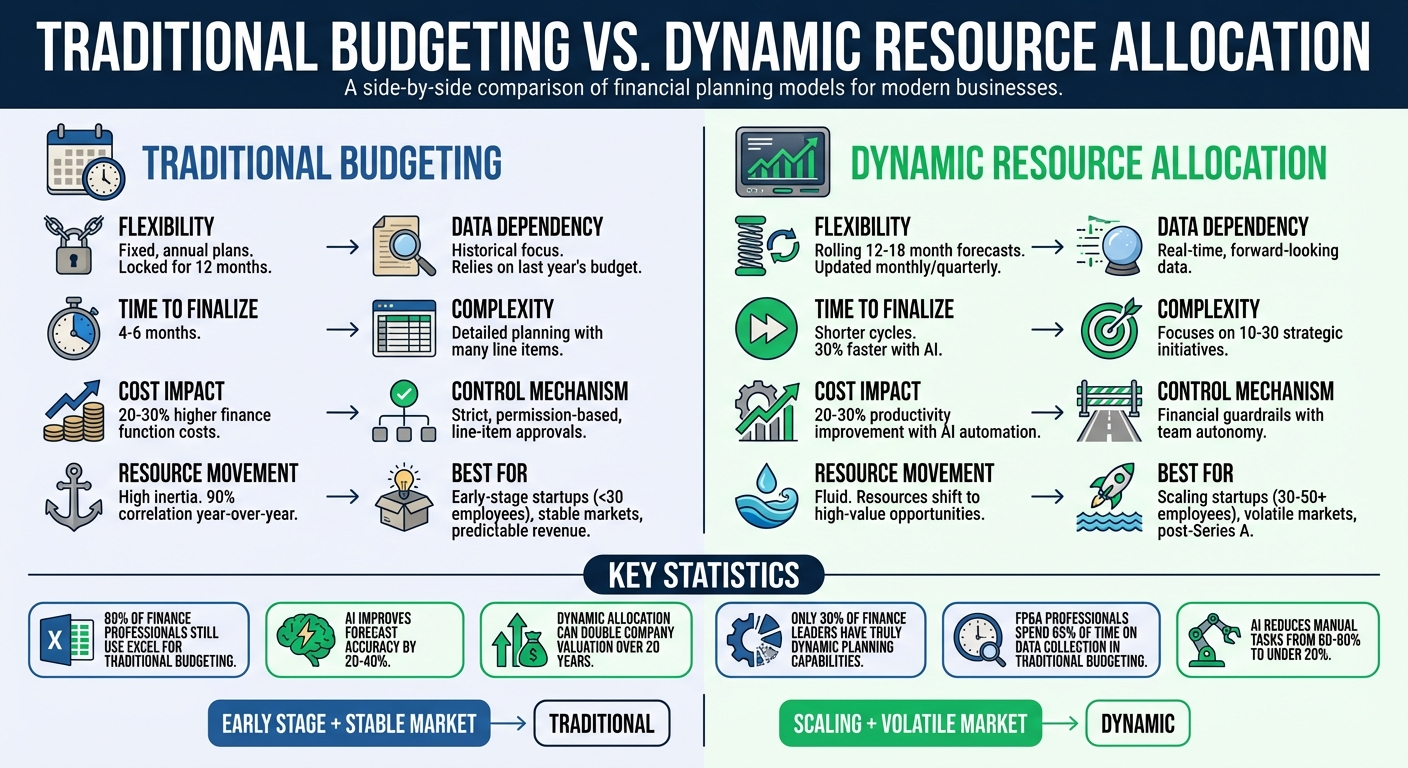

| Criteria | Traditional Budgeting | Dynamic Resource Allocation |

|---|---|---|

| Flexibility | Fixed, annual plans | Rolling, real-time adjustments |

| Data Dependency | Historical focus | Real-time, forward-looking |

| Time to Finalize | 4–6 months | Shorter cycles |

| Suitability for Startups | Early-stage, steady growth | Scaling, fast-changing markets |

Your choice depends on your startup’s stage, market dynamics, and ability to invest in tools for financial agility.

Traditional Budgeting vs Dynamic Resource Allocation: Key Differences for Startups

How Traditional Budgeting Works

Fixed Allocations and Annual Cycles

Traditional budgeting follows a yearly cycle where company leaders set financial targets and allocate fixed amounts to each department. This process typically takes a top-down approach: executives determine overall revenue and spending goals, then distribute resources across departments like marketing, sales, engineering, and operations.

Most companies rely on incremental budgeting, adjusting last year’s numbers by a small percentage. For instance, if the marketing budget was $500,000 in 2025, it might increase by 5% in 2026 to account for inflation or growth, resulting in $525,000. While this method provides predictability, it often leads to what researchers call "resource inertia", where spending patterns remain 90% consistent year over year.

Despite advancements in planning tools, the budgeting process remains heavily manual. A striking 89% of finance professionals still use Excel to gather budget inputs. Department heads submit their requests via spreadsheets, which finance teams then consolidate - a task that can take one to three months. For example, in 2025, Prime Healthcare, a multi-billion-dollar business with 45 hospitals, adopted a structured annual budgeting cycle to enhance control and gain clearer insight into the company’s financial direction. While effective for creating predictability, this approach often struggles to adapt to rapidly changing markets.

Simplicity and Stability in Predictable Scenarios

Traditional budgeting works best for established companies operating in stable markets. When revenue trends are steady, and market conditions are predictable, the annual cycle provides a reliable framework for planning. Finance teams can set performance targets, allocate resources effectively, and control costs by defining strict departmental budgets.

This approach appeals to many organizations because of its simplicity. With fixed allocations set at the beginning of the year, approval processes are straightforward, and companies gain a consolidated view for planning investments and rewards. For businesses in mature industries with limited market disruption, this structure offers the stability and control needed to run efficiently.

Limitations in Fast-Paced, High-Growth Environments

For fast-growing startups, the same rigidity that provides stability can quickly become a hindrance. The primary challenge lies in its inability to keep up with rapid change: traditional budgeting relies on annual cycles, while scaling companies often need to adjust their strategies on a monthly or quarterly basis. As markets evolve, finalized budgets can become outdated before they’re fully implemented.

This rigidity can also prevent companies from capitalizing on emerging opportunities. Locked-in funds may not be reallocated to seize high-growth possibilities.

"Traditional budgeting at a scaling startup is like trying to predict exactly where you'll be standing a year from now in a hurricane".

Tom Wilson, CFO of a health tech unicorn, highlights this challenge with his vivid analogy.

The inefficiencies don’t stop there. Financial Planning and Analysis (FP&A) professionals reportedly spend 65% of their planning time collecting and cleaning data instead of focusing on insights that drive the business forward. Even more concerning, fewer than one-third of executives say their budgets align closely with their company’s latest strategic plans, creating a disconnect between financial resources and business priorities.

Traditional budgeting can also encourage counterproductive behaviors. Department heads may inflate their budget requests to anticipate cuts or adopt a "spend-it-or-lose-it" mindset at the end of the fiscal year to protect future allocations. In 2025, Speexx, a people development software company, addressed these inefficiencies by implementing a centralized platform that cut three weeks off their budgeting process and eliminated issues like spreadsheet version control.

sbb-itb-17e8ec9

How Dynamic Resource Allocation Works

Flexibility Through Rolling Forecasts

Dynamic resource allocation steps away from the traditional, rigid annual budget and embraces a continuous planning cycle that reacts to real-time business conditions. Instead of sticking with fixed 12-month allocations, many startups rely on a rolling 12–18 month forecast, updated monthly or quarterly. This approach ensures that when markets shift or new opportunities arise, adjustments can be made immediately - no need to wait for the next budget cycle.

What sets this method apart is its separation of forecasting, target setting, and resource allocation. By keeping these processes independent, finance teams avoid the pitfalls of forcing unrealistic targets into forecasts or holding back resources based on outdated assumptions.

The "Beyond Budgeting" movement has been a strong advocate for this change. Bjarte Bogsnes, Chair of the Beyond Budgeting Roundtable, explains it well:

"The bank is always open. You can always forward a project for approval. 'Yes' or 'no' depends on the quality of the project and our capacity to fund it."

This mindset eliminates the rush to spend budgets before the fiscal year ends. Instead, projects can be proposed and funded at any time, based on their merit.

The Role of AI and Data Integration

AI takes adaptive forecasting to the next level. Using what Boston Consulting Group calls "dynamic steering", AI combines algorithms, data automation, and driver-based models to enable businesses to make agile adjustments in real time. This technology speeds up planning cycles by 30% and improves forecast accuracy by as much as 40%, thanks to its ability to process both internal and external data.

Here’s a real-world example: A global industrial goods manufacturer saw its forecasting accuracy jump by 50% after implementing an AI-driven system. By analyzing internal data alongside external market signals, the system predicted demand and revenue more effectively. AI tools also track consumer behavior, supply chain changes, and competitor actions, ensuring forecasts stay aligned with current conditions.

The benefits go beyond speed and precision. Traditionally, finance teams spend 60% to 80% of their time on repetitive tasks like data extraction and reconciliation. AI automation slashes this to under 20%, allowing finance professionals to focus on strategic work rather than endless spreadsheet updates. Tools like Lucid Financials integrate with operational systems, offering real-time insights into runway, spending patterns, and performance metrics - accessible through platforms like Slack.

Driver-based models are at the heart of effective AI integration. These models link financial metrics directly to operational drivers, such as labor costs, production volumes, and customer acquisition expenses. Leaders can instantly assess the financial impact of changes without waiting for the next forecast cycle or relying on manual calculations.

Combining Agility with Financial Discipline

While flexibility is key, dynamic allocation also enforces accountability. Instead of relying on rigid, detailed line-item controls set a year in advance (ex-ante control), this method focuses on ex-post control through real-time reporting and performance tracking. Finance teams establish clear guidelines that allow departments to operate independently while staying within set boundaries.

The 80-20 principle is often applied here: finance teams concentrate planning efforts on the most critical profit and loss drivers, recognizing that 80% of outcomes typically stem from 20% of causes. This targeted approach keeps the focus on what truly matters without wasting time on minor expenses.

A centralized data platform acts as the "single source of truth", ensuring consistency across all teams. With everyone working from the same standardized metrics, there’s no room for conflicting data or rogue spreadsheets. This transparency shifts decision-making from reactive to proactive, enabling finance teams to spot potential issues or opportunities before they escalate.

This system allows resources to flow toward initiatives that deliver real value, rather than being trapped in rigid departmental budgets. For instance, if a product team identifies a pressing opportunity to gain market share, they can request funding immediately, backed by solid data. There’s no need to wait for months or force the project into an outdated budget structure.

Traditional Budgeting vs. Dynamic Resource Allocation

Comparison Table of Key Criteria

Now that we've broken down how each method operates, let's compare them side by side. The differences highlight what each approach prioritizes and how they address the challenges of managing a startup's resources.

| Criterion | Traditional Budgeting | Dynamic Resource Allocation |

|---|---|---|

| Flexibility | Rigid; resources are locked in place for 12 months with fixed annual allocations. | Highly adaptable; uses rolling 12–18 month forecasts updated monthly or quarterly. |

| Data Dependency | Primarily relies on historical data and last year's budget. | Utilizes real-time data and focuses on key value drivers. |

| Complexity | Requires detailed planning with many line items. | Centers on 10–30 strategic initiatives and value streams. |

| Time Efficiency | Can take 4–6 months to finalize, though top companies may complete it in 4 weeks. | Faster cycles, with AI-driven tools cutting planning time by up to 30%. |

| Cost Impact | Leads to 20–30% higher finance function costs due to inflexible processes. | Reduces overhead as AI automation improves productivity by 20–30%. |

| Control Mechanism | Relies on strict, permission-based, line-item approvals. | Uses financial guardrails, enabling teams to pivot within predefined parameters. |

| Resource Movement | High inertia; spending shows a 90% correlation year-over-year. | Fluid; resources shift to high-value opportunities as they arise. |

| Suitability for Startups | Struggles to keep pace with rapid pivots and market volatility. | Ideal for scaling and quick iteration in dynamic environments. |

These criteria highlight the fundamental differences between the two approaches, paving the way for a closer examination of how they influence operations.

Dynamic resource allocation often delivers stronger shareholder returns and supports higher long-term growth, though aligning budgets with strategy can still be a challenge.

Traditional budgeting typically funds departments through detailed line items, while dynamic allocation channels funds into cross-functional value streams aimed at specific customer outcomes and strategic goals. This shift reduces silos and ensures that capital is directed to areas with the most impact.

Another key difference lies in how each method handles uncertainty. Traditional budgets are prone to "resource inertia", where spending patterns from the previous year heavily influence current plans. On the other hand, dynamic models reserve 5% to 20% of the total budget for unexpected opportunities and market shifts.

Decision-making also sets these approaches apart. Traditional budgeting involves lengthy approval processes for any deviations, which can slow down responsiveness. Dynamic allocation, however, employs financial guardrails that empower teams to pivot independently. This reduces decision timelines from weeks to days, allowing startups to act quickly on emerging opportunities. This agility aligns with the earlier discussion on the advantages of dynamic resource allocation for scaling startups.

For startups looking to adopt a more agile financial approach, tools like Lucid Financials offer AI-powered insights and real-time reporting, making it easier to implement dynamic resource allocation.

This comparison makes it clear: startups need to choose the method that best fits their growth stage and the demands of their market dynamics.

Rolling Budgets for Startups Explained | CFO Reveals How to Manage Cash Flow & Growth

Pros and Cons of Each Approach

Following our detailed comparison, let’s take a closer look at the strengths and challenges of each budgeting method.

Pros and Cons of Traditional Budgeting

Traditional budgeting provides stability and control by setting fixed cost limits, giving teams a predictable framework to operate within. This method is particularly useful for organizations with steady revenue and growth patterns. For early-stage startups with limited resources, its simplicity can be a major advantage - you don’t need advanced data systems or a specialized finance team to manage it effectively.

However, traditional budgeting has its downsides. One major critique is "artificial precision" - while detailed line items might look exact, they often fall apart when the market shifts. This rigidity can lead to inefficiencies, such as higher finance function costs and outdated spending patterns that fail to adapt to strategic changes. For startups that need to pivot frequently, this creates a disconnect between financial plans and actual business needs.

Another issue is that the process can encourage unproductive behaviors. Funds often get locked into outdated initiatives, while emerging opportunities go unfunded simply because they weren’t anticipated during the annual planning cycle. This lack of flexibility can stifle innovation and limit a company’s ability to respond to changing circumstances.

Pros and Cons of Dynamic Resource Allocation

Dynamic resource allocation, on the other hand, offers flexibility and adaptability. By using rolling forecasts and financial guardrails instead of rigid budgets, this approach allows teams to reallocate resources quickly to seize new opportunities without waiting for annual approvals. Companies that embrace this method often see better shareholder returns and higher long-term valuations compared to those that stick with traditional budgeting.

But this approach isn’t without its challenges. It requires robust data systems and advanced AI tools to avoid unnecessary complexity. Additionally, it depends on having a well-informed team that understands the financial guardrails and can make smart decisions within them. Internal politics can also pose a problem, as some managers may resist resource shifts that could reduce their control or influence.

Interestingly, only 30% of finance leaders believe their organizations have truly dynamic financial planning capabilities today. For startups, the real question isn’t whether dynamic allocation is better in theory - it’s whether your company has the data infrastructure, technology, and organizational readiness to implement it effectively. These factors play a critical role in determining which budgeting approach aligns best with your current stage and goals.

Which Approach Is Right for Your Startup?

Your startup's growth stage, market dynamics, and team structure play a big role in determining the best budgeting approach. By considering the strengths and limitations of different methods, you can align your financial strategy with your current needs and future goals.

Traditional Budgeting for Early-Stage Stability

If your startup is in its early stages, with fewer than 30 employees and predictable revenue streams, traditional budgeting can be a practical choice. This method works well when your focus is on clear, measurable goals - like hitting $100,000 in monthly recurring revenue or extending your financial runway to 18 months.

Why does it work? Early-stage startups often lack the data systems or financial teams needed for more complex approaches. Traditional budgeting keeps things simple: set fixed spending limits for each department, check progress monthly, and maintain tight cost controls. For founders still working on product-market fit, this approach minimizes the risk of overspending while keeping financial management straightforward.

As your startup grows and financial complexities increase, you’ll need to transition to a more flexible system.

Dynamic Resource Allocation for Scaling and Volatility

Once your startup surpasses 30–50 employees or secures a Series A round, dynamic resource allocation becomes essential. This approach is particularly useful when market conditions shift rapidly, and decision-making processes slow down your ability to act.

For example, slow approvals can cost you valuable opportunities. A marketplace startup in 2024 tackled this issue by replacing centralized expense approvals (e.g., requiring VP sign-off for purchases over $5,000) with a decentralized model. Using financial guardrails and real-time dashboards, they cut decision timelines from weeks to just a few days.

Dynamic allocation requires the right tools and expertise. Platforms like Lucid Financials offer AI-driven forecasts, real-time financial updates through Slack, and automated scenario modeling. These tools allow you to adjust resources quickly based on current data, ensuring your financial strategy stays flexible and aligned with investor expectations. Combining advanced technology with experienced finance professionals ensures your startup can adapt to change while staying on track.

Conclusion

Deciding between traditional budgeting and dynamic resource allocation isn't about choosing one over the other - it’s about aligning your financial approach with your startup’s specific needs and stage of growth. Traditional budgeting provides structure and control, making it a solid choice for startups in steady, predictable environments. It's particularly effective for early-stage companies aiming to stretch their runway and meet defined milestones. That said, as mentioned earlier, rigid budgets can leave businesses vulnerable when faced with rapid change.

As your company scales - typically around Series A or when your team grows beyond 30–50 employees - dynamic resource allocation becomes crucial. Research shows that companies adept at reallocating resources achieve stronger shareholder returns and can double their valuation compared to less flexible competitors over two decades. Additionally, AI-driven tools are reshaping this approach, speeding up planning cycles by 30% and improving forecast accuracy by 20–40%. However, this method demands robust data systems, clear financial boundaries, and a mindset shift from control to strategic adaptability.

AI-powered platforms like Lucid Financials make this transition smoother by automating key financial processes. These tools handle data reconciliation, create rolling forecasts, and send real-time alerts via Slack, all while delivering clean books in just seven days. With investor-ready reports available on demand and scenario modeling simplified, you can skip the hassle of building complex spreadsheets. AI takes care of the technical heavy lifting, while experienced finance professionals ensure compliance and accuracy, freeing you to focus on high-level strategic decisions.

FAQs

What are the key advantages of dynamic resource allocation for growing startups?

Dynamic resource allocation gives startups the ability to pivot quickly in response to market shifts, capitalize on emerging opportunities, and handle unexpected expenses. By regularly adjusting budgets, founders can direct spending toward the areas that yield the best returns, driving growth and keeping funding timelines on track.

This method also sharpens forecasting accuracy and minimizes waste. With AI-powered predictive models, startups can make better demand and cost estimates while trimming operational costs. This means resources can be distributed more effectively. Startups that actively reallocate resources often see stronger growth and achieve higher long-term value compared to their competitors.

In essence, dynamic resource allocation equips startups with the speed, accuracy, and assurance they need to scale efficiently and win over investors.

How does AI improve dynamic resource allocation for startups?

AI is transforming how startups manage their resources, turning raw data into actionable insights that drive faster and more accurate decisions. By using predictive models, businesses can analyze historical trends and market signals to forecast resource needs with pinpoint accuracy. This means startups can anticipate staffing changes, inventory requirements, or marketing adjustments before potential problems arise. On top of that, optimization algorithms help determine the most effective strategies for allocating resources, ensuring maximum ROI while dynamically adjusting budgets as conditions shift.

AI’s ability to process real-time data adds another layer of agility. For example, it can quickly identify anomalies like unexpected spikes in customer acquisition costs or disruptions in the supply chain. Based on these insights, it can recommend reallocations to minimize errors and keep operations running smoothly. Tools like Lucid Financials integrate AI to offer rolling budgets, scenario planning, and automated alerts, keeping founders and investors in the loop at all times. The result? Faster decisions, lower operational costs, and accelerated growth - making AI an essential asset for scaling startups.

When is the right time for a startup to switch from traditional budgeting to dynamic resource allocation?

When a startup's growth starts to outstrip the constraints of traditional annual budgets, it might be time to switch to dynamic resource allocation. This shift often becomes necessary during times of rapid expansion, frequent market shifts, or when financial adjustments are required more than a couple of times a year.

Dynamic resource allocation provides the flexibility to adapt quickly to new opportunities or unexpected challenges. If your startup is facing notable changes in revenue, costs, or market conditions, adopting this more flexible approach can help keep your resources aligned with your goals as they evolve.