The cost of capital directly impacts how startups fundraise, manage debt, and grow over time. Here's the key difference:

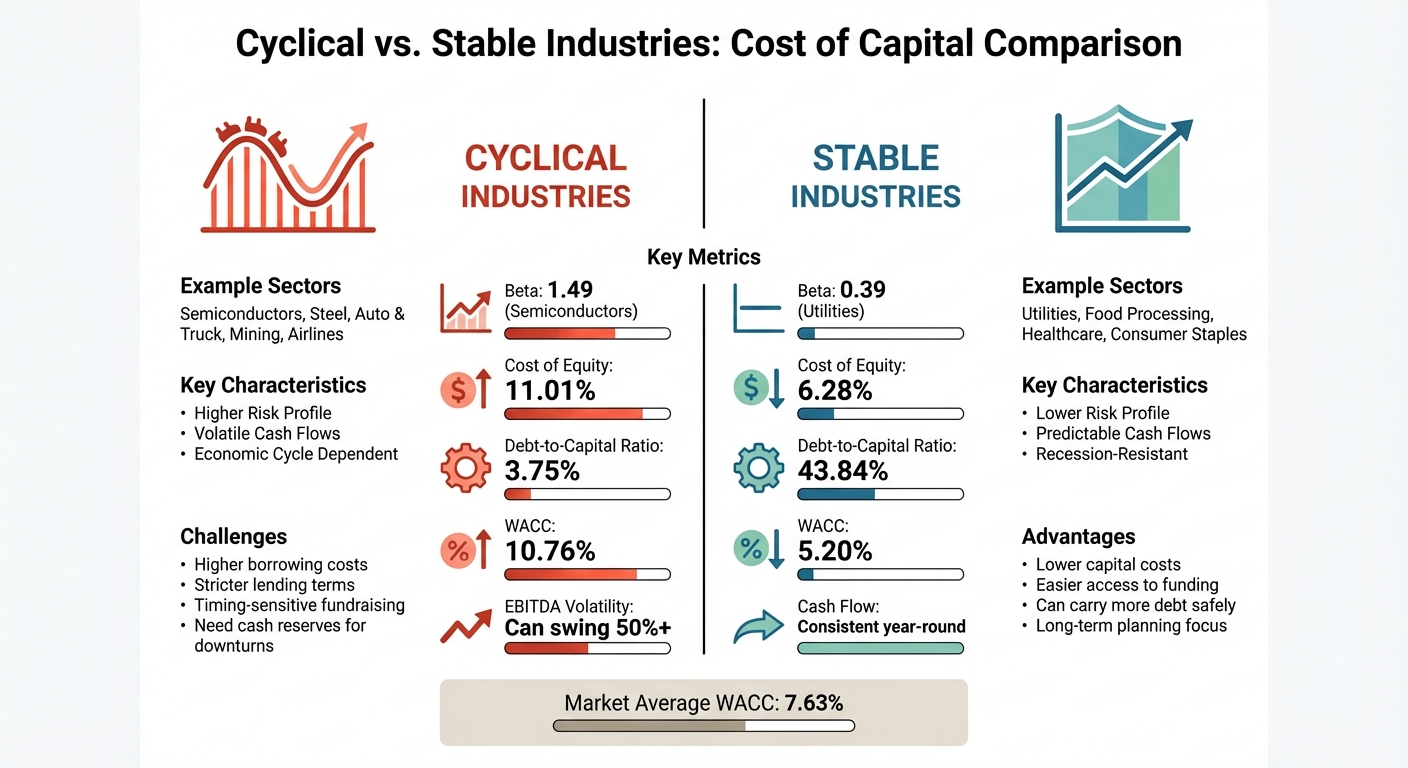

- Cyclical industries like steel, mining, and automotive face higher costs of capital due to volatile cash flows tied to economic cycles. These businesses must handle higher risks, fluctuating earnings, and stricter borrowing terms.

- Stable industries like utilities, healthcare, and grocery retail enjoy predictable cash flows, leading to lower capital costs and easier access to funding.

Key Takeaways:

- Cyclical industries have higher risk, higher betas, and steeper borrowing costs, requiring careful debt management and cash reserves for downturns.

- Stable industries benefit from lower risk, lower WACC, and steady funding opportunities, but must avoid over-leveraging.

- Debt-to-capital ratios: Stable industries often carry more debt (e.g., utilities at 43.84%) than cyclical ones (e.g., semiconductors at 3.75%).

- Fundraising timing is critical for cyclical startups due to market fluctuations, while stable startups can focus on long-term planning.

Quick Comparison:

| Industry Type | Example Sectors | Beta | Cost of Equity | Debt-to-Capital | WACC |

|---|---|---|---|---|---|

| Cyclical | Semiconductors, Steel | 1.49 | 11.01% | 3.75% | 10.76% |

| Stable | Utilities, Food | 0.39 | 6.28% | 43.84% | 5.20% |

Understanding your industry’s characteristics helps you make smarter financial decisions, whether you're managing debt or timing fundraising efforts.

Cyclical vs Stable Industries: Cost of Capital Comparison

Session 18: Optimum Capital Structure - The Cost of Capital Approach

Cyclical vs. Stable Industries: Definitions

Understanding the difference between these two types of industries sheds light on how industry characteristics influence capital costs.

Cyclical Industries Explained

Cyclical industries are sectors where earnings tend to rise and fall in a repeating pattern, often tied to broader economic conditions. As David Wessels and Tim Koller from McKinsey & Company explain:

"A cyclical company is one whose earnings demonstrate a repeating pattern of significant increases and decreases."

Industries like steel, mining, airlines, energy, and automotive fall into this category. Their performance aligns closely with the state of the economy - revenues grow when GDP and consumer spending are on the rise but shrink sharply during economic downturns. For instance, the airline industry's performance mirrors macroeconomic trends, while the paper industry faces cycles driven by capacity constraints within the sector.

This volatility brings unique challenges. During economic booms, companies in these industries often overbuild capacity, which exacerbates the impact of downturns. Additionally, fluctuating product prices driven by shifting supply and demand make cash flow forecasting more complex. These factors increase the perceived risk for investors and lenders, leading to higher capital costs.

Stable Industries Explained

On the other hand, stable industries are characterized by consistent cash flows, regardless of short-term economic changes. These sectors provide essential goods or services that remain in demand even during recessions. Examples include utilities, healthcare, and consumer staples like food and pharmaceuticals.

The key feature of these industries is their reliability. Whether the economy is thriving or struggling, people still need electricity, prescription medications, and groceries. This stability simplifies valuation and reduces the level of risk perceived by investors. As Aswath Damodaran from NYU Stern points out:

"Cash flows that are riskier should be assessed a lower value than more stable cashflows... we use higher discount rates on riskier cash flows and lower discount rates on safer cash flows."

Because of their lower risk, companies in stable industries often have betas below one, meaning they are less exposed to market volatility. They also benefit from lower default spreads on debt. This predictability makes them a solid choice for long-term financial planning.

How Industry Type Affects Cost of Capital

The industry a company operates in plays a major role in determining its cost of capital - the rate it needs to offer to attract both investors and lenders. This cost is shaped by three main factors: the weighted average cost of capital (WACC), the pricing of debt, and the influence of economic cycles.

WACC and Industry Risk

WACC represents the overall risk profile of a company. As explained by Wall Street Prep:

"Higher perceived risk correlates to a higher required return (and vice versa). The challenge is how to quantify the risk. The WACC formula is simply a method."

At the heart of WACC is beta, a measure of how sensitive a company's stock is to market fluctuations. Industries with cyclical characteristics tend to have higher betas, which leads to higher equity costs compared to more stable industries. For example, as of January 2025, the market average WACC is 7.63%. However, there's a wide range depending on the industry - cyclical sectors like Semiconductors have a WACC as high as 10.76%, while more stable industries like Food Processing hover around 6.02%. This disparity in perceived risk directly impacts the terms lenders are willing to offer, which ties into the next point.

Debt Costs and Cash Flow Patterns

Companies with steady cash flows are rewarded with lower debt costs, as lenders view them as less risky. Aswath Damodaran highlights this relationship:

"The greater the perceived risk of default, the greater the default spread and the cost of debt."

For example, as of January 2025, General Utilities enjoys a debt cost of 5.08%, reflecting its stable financial position. In contrast, riskier industries like Metals & Mining and Auto & Truck face higher debt costs, around 6.41%, to account for their greater likelihood of default.

Economic Cycles and Capital Costs

Economic cycles add another layer of complexity to capital costs. During economic downturns, both equity and debt costs tend to rise as investors and lenders demand higher compensation for increased risk. McKinsey’s David Wessels and Tim Koller describe this challenge:

"Volatile earnings within the cycle introduce additional complexity into the valuation of these cyclical companies... future cyclicality will be important for financial solvency."

These fluctuations make it even more difficult for companies in cyclical industries to manage their cost of capital effectively.

sbb-itb-17e8ec9

What This Means for Startups

The type of industry your startup operates in shapes how you approach fundraising, manage cash, and plan for growth. Startups in cyclical industries deal with higher capital costs and unpredictable funding conditions, while those in stable sectors benefit from steadier access to capital. Each scenario demands its own strategy.

Cyclical Startups: Challenges and Strategies

Startups in cyclical industries - like semiconductors, automotive, or commodities - experience significant ups and downs in capital costs. Investors in these sectors often demand higher returns to compensate for the risks, and lenders factor in the possibility of cash flow disruptions during downturns.

In these industries, EBITDA can swing dramatically - sometimes by 50% or more. To navigate this, focus on long-term fundamentals, even during challenging times. Build up cash reserves during profitable periods so you can invest strategically when the market dips. Keep your peak debt at levels you can manage under worst-case cash flow scenarios. Companies that spend wisely during downturns often outperform competitors.

Planning should be based on long-term trends rather than short-term market changes. Establish a "structure line" by analyzing historical industry volumes and market share to understand where your business stands within the cycle. When evaluating investments, focus on mid-cycle returns, avoiding decisions driven by temporary earnings spikes.

Having real-time data is a game-changer during rapid market shifts. Tools like Lucid Financials are designed to help cyclical startups manage these challenges. With AI-powered forecasting, you can generate "what-if" scenarios using live data. For instance, when early signs of a downturn appear, you can model the potential impact on cash flow and runway directly through Slack, triggering pre-approved cost-saving measures before your margins take a hit. The platform also lets you stress-test your capital structure under different economic scenarios.

On the other hand, startups in stable industries operate under a different set of dynamics.

Stable Startups: Advantages and Key Considerations

Startups in stable industries - like food processing, utilities, healthcare, or essential services - enjoy a more predictable financial environment. These businesses typically have steady cash flows, which lower both equity and debt costs. A reduced weighted average cost of capital (WACC) means better borrowing terms and less pressure from equity investors. Unlike their cyclical counterparts, stable startups don’t need to stockpile cash for downturns, allowing them to reinvest consistently and focus on long-term growth instead of reacting to short-term market changes.

However, disciplined financial management is still crucial. Compare your WACC to similar companies in your sector to ensure you’re raising capital efficiently. Use your dependable cash flows to secure lower-cost debt, taking advantage of tax benefits that can further reduce capital expenses.

Even in a stable business, taking on too much debt can create risks. As finance expert Aswath Damodaran explains:

"The equity in a safe business can be rendered risky, if the firm uses enough debt to fund that business."

For startups in stable industries, the challenge lies in maintaining disciplined growth and smart capital allocation. Just because funding is easier to access doesn’t mean it should be deployed carelessly. The real value comes from investing in projects that consistently deliver returns above your cost of capital.

Capital Structure Comparison: Cyclical vs. Stable

Leverage and Financing Differences

Startups in stable industries often carry higher debt levels due to their predictable cash flows, while cyclical startups generally keep leverage low to manage risk.

In stable industries, predictable revenue streams make it easier for businesses to support higher debt. For example, as of January 2025, General Utilities maintain a debt-to-capital ratio of 43.84%, and Food Processing companies hold 26.75%. These steady cash flows reassure lenders, leading to more favorable borrowing terms.

On the other hand, cyclical startups tend to limit their debt. Industries like Semiconductors operate with a debt-to-capital ratio of just 3.75%, while Auto & Truck companies stand at 18.30%. The reason? Cyclical businesses face significant earnings volatility. During economic downturns, cash flows might not cover debt obligations, putting the company at risk. To avoid this, these startups must ensure their debt remains manageable even in tough times.

Here’s a snapshot of capital structure metrics as of January 2025:

| Industry Type | Industry Name | Beta | Cost of Equity | D/(D+E) (Leverage) | Cost of Capital (WACC) |

|---|---|---|---|---|---|

| Cyclical | Semiconductors | 1.49 | 11.01% | 3.75% | 10.76% |

| Cyclical | Steel | 1.06 | 9.17% | 20.57% | 8.17% |

| Cyclical | Auto & Truck | 1.62 | 11.57% | 18.30% | 10.34% |

| Stable | Utility (General) | 0.39 | 6.28% | 43.84% | 5.20% |

| Stable | Food Processing | 0.47 | 6.63% | 26.75% | 6.02% |

| Stable | Beverage (Soft) | 0.57 | 7.04% | 16.48% | 6.59% |

Notice the stark contrast in Beta values, which measure systematic risk. For instance, Semiconductors have a Beta of 1.49, indicating higher volatility, while Food Processing sits at just 0.47. This higher risk translates into higher costs of equity and, ultimately, a greater Weighted Average Cost of Capital (WACC).

For cyclical startups, the key takeaway is to stress-test your leverage. Ensure that debt levels remain sustainable even during earnings slumps. Stable startups, while more flexible, should also avoid overburdening themselves with debt, as excessive leverage can introduce unnecessary risk.

Beyond debt considerations, WACC plays a critical role in shaping how and when startups raise funds.

WACC and Fundraising Timing

The Weighted Average Cost of Capital (WACC), which represents the combined cost of debt and equity, heavily influences fundraising strategies. As the data shows, cyclical industries face much higher WACCs compared to stable ones. For example, Software (Internet) startups operate with a WACC of 11.10%, while General Utilities enjoy a much lower WACC of 5.20%. The market average lands at 7.63%.

For cyclical startups, timing fundraising efforts is crucial. Investors often focus on current earnings rather than long-term trends. As a result, businesses can be overvalued during peak earnings or undervalued during downturns. This creates a challenging paradox: valuation multiples shrink during periods of strong earnings and expand during weaker ones as investors anticipate a return to the average.

"In cyclical sectors, you need conviction in your long-term fundamentals to avoid overreacting during short-term downturns." – Executive at a major oil and gas company

Approximately 80% of investors in cyclical sectors are short-term traders with holding periods of only two to three years. Their focus on quick returns means that raising funds is often easier during periods of strong performance, even if valuations aren’t optimal. Researchers describe this behavior as a "50-50 path" - a mix of perfect foresight and complete uncertainty about industry cycles.

Stable startups, by contrast, face less pressure from market timing. Thanks to their predictable cash flows, they can plan fundraising efforts around strategic milestones rather than reacting to market conditions.

When calculating WACC for fundraising, it’s essential to account for normalized profit levels that reflect long-term trends rather than current highs or lows. For cyclical startups, adopting a multiple-scenario approach - balancing "normal cycle" and "new trend" scenarios - can provide investors with a clearer understanding of the company’s risk profile. This helps avoid raising funds under unfavorable conditions.

Conclusion

The ups and downs of industry cycles play a big role in determining your startup's ability to survive and grow, especially when it comes to managing capital costs. Startups in cyclical industries face unique challenges - cash flows that fluctuate with economic conditions often lead to higher discount rates and stricter debt constraints. On the other hand, startups with steady, predictable revenues can take advantage of lower capital costs and greater financial flexibility.

When planning your finances, it's crucial to focus on mid-cycle norms rather than short-term performance. Using scenario-based forecasting that considers a range of possible outcomes can help you prepare for uncertainties. For cyclical startups, this means stress-testing debt against worst-case cash flow scenarios, not just the highs, to ensure you're prepared for economic downturns.

To navigate these complexities, real-time financial management tools can be game-changers. Tools like Lucid Financials offer automated through-cycle scenario modeling and instant insights delivered via Slack. These features simplify bookkeeping, provide continuous investor updates, and give founders the ability to focus on execution without losing sight of financial discipline - a key factor that separates resilient startups from those that falter during tough times.

FAQs

Why is the cost of capital different for cyclical and stable industries?

Cyclical industries often grapple with a higher cost of capital because their earnings and cash flows tend to fluctuate significantly. This volatility makes them a riskier bet for investors. To offset the uncertainty, investors typically expect higher returns.

On the flip side, stable industries enjoy a lower cost of capital thanks to their steady and predictable cash flows. This consistency lowers the perceived risk, making these industries more appealing to investors who are willing to accept lower returns. For startups weighing opportunities in these sectors, grasping these distinctions is key.

How can startups in cyclical industries manage higher capital costs effectively?

Startups operating in cyclical industries can weather the storm of higher capital costs by sticking to a few smart strategies. One of the most effective is building up cash reserves during boom times, creating a financial safety net for when the economy slows down. Another key move is keeping low leverage during strong economic cycles to reduce dependency on debt and maintain flexibility.

In addition, scenario-based planning can help prioritize investments that deliver the most value with the least risk during downturns. Timing is also crucial - aligning equity or debt issuances with favorable market conditions can secure capital at lower costs while avoiding excessive dilution or high-interest burdens.

By remaining disciplined and forward-thinking, startups in these industries can better navigate financial challenges and position themselves to capitalize on opportunities, even in tough economic climates.

Why do companies in stable industries often take on more debt than those in cyclical industries?

Companies operating in stable industries often carry higher levels of debt. Why? Their steady cash flow and lower risk of default make borrowing a more practical option. Lenders see these businesses as safer bets, which means they can secure loans with lower interest rates - a win-win for both parties.

On the flip side, companies in cyclical industries deal with earnings that swing with the economy. This unpredictability increases the risk of default, making it harder (and often more expensive) to take on debt. To navigate these ups and downs, such companies tend to lean on equity financing and keep their debt levels relatively low, ensuring they’re better prepared for economic downturns.