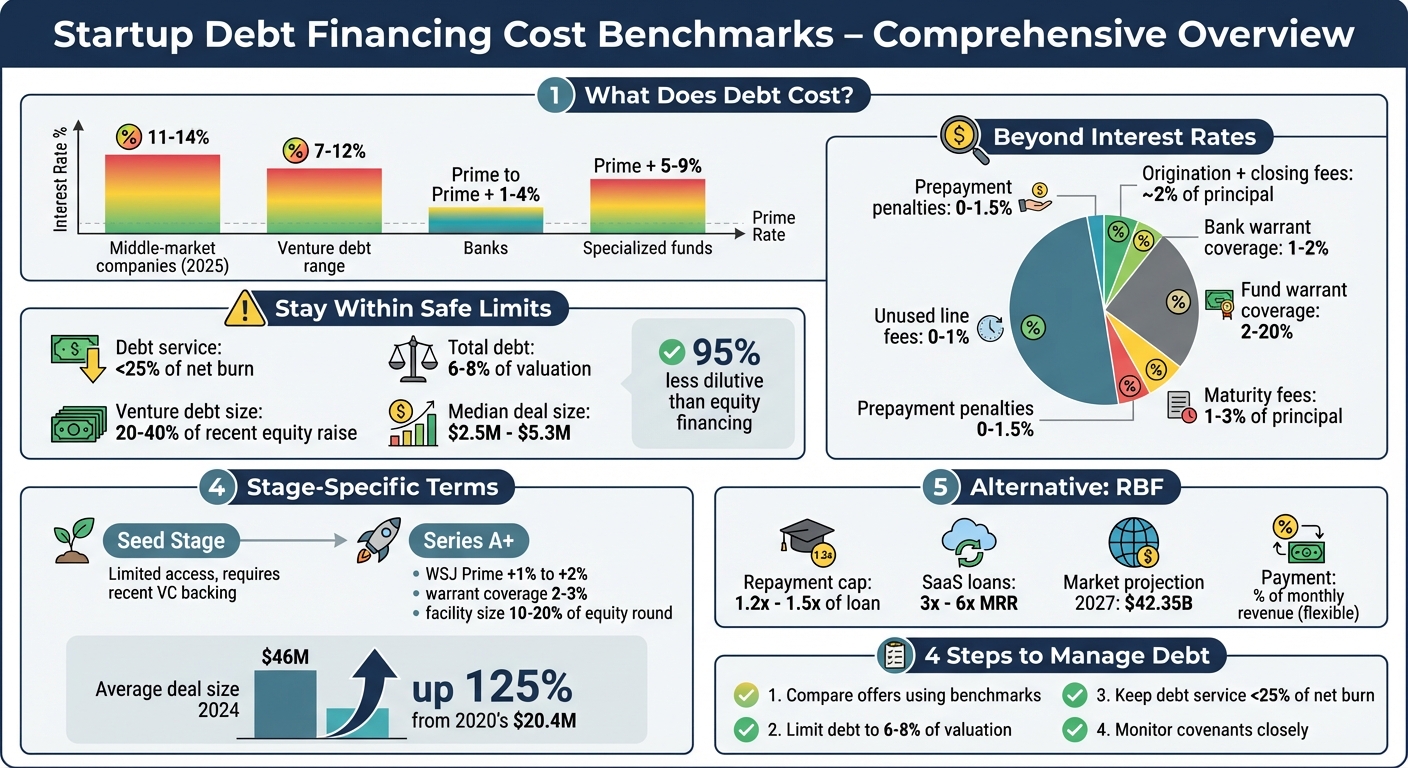

Debt financing can help startups grow without giving up equity, but it comes with repayment risks that affect cash flow and investor appeal. Here's what you need to know:

- Interest Rates: Borrowing costs for startups in 2025 ranged from 11% to 14% for middle-market companies. Venture debt rates typically fall between 7% and 12%, with specialized funds charging higher.

- Debt Limits: Experts recommend keeping debt service under 25% of net burn and total debt between 6% to 8% of your valuation.

- Hidden Costs: Fees, warrant coverage, and covenants can significantly increase the true cost of debt. For example, origination and closing fees often total 2% of the loan principal.

- Types of Debt: Common options include venture debt, revenue-based financing, equipment financing, bridge loans, and convertible notes, each with unique repayment terms and cost structures.

- Risk Factors: Startups with consistent cash flow, strong intellectual property, or recurring revenue are more attractive to lenders and face lower costs.

To manage debt effectively:

- Compare offers using benchmarks to negotiate better terms.

- Limit venture debt to 6–8% of valuation.

- Ensure debt service stays below 25% of net burn.

- Monitor financial covenants and communicate openly with lenders.

Debt can extend your runway if managed wisely, but exceeding benchmarks can lead to financial strain.

Startup Debt Financing Benchmarks: Rates, Limits, and Cost Breakdown by Stage

Common Types of Startup Debt Financing

Venture Debt: Features and Costs

Venture debt is a senior term loan designed for startups backed by venture capital. It works alongside equity funding, offering additional runway without reducing ownership stakes. Founders often turn to venture debt to bridge funding gaps or achieve growth milestones without further diluting equity. Typically, these loans range from 20% to 40% of the most recent equity raise, with median deals landing between $2.5 million and $5.3 million.

Interest rates for venture debt generally fall between 7% and 12%. Banks offer rates from Prime to Prime + 1–4%, while specialized funds charge slightly higher rates, ranging from Prime + 5–9%. Additionally, lenders often require warrant coverage as part of the deal. For banks, this typically means 1% to 2% of the loan value in warrants, while funds may ask for 2% to 20%. When you factor in closing and origination fees (usually around 1% each), the overall cost becomes clearer. Despite these expenses, venture debt is still 95% less dilutive than equity financing, making it a popular choice for founders looking to maintain ownership.

"Venture debt can significantly extend runway at a fraction of the cost of equity, preserving shareholder value and enabling the company to achieve key milestones." - Mike Devery, Head of Strategic Capital, Silicon Valley Bank

The venture debt market has experienced notable fluctuations. In 2024, U.S. venture debt deals reached a record $53.3 billion, reflecting a 94% increase from 2023. However, following the collapse of Silicon Valley Bank in 2023, deal volume dropped by 38% year-over-year. Lenders have since tightened their criteria, with due diligence processes now stretching beyond 12 weeks.

Now, let's dive into revenue-based financing, an alternative that aligns repayment with business performance.

Revenue-Based Financing

Revenue-based financing (RBF) offers startups a repayment model that adapts to their revenue flow. Instead of fixed monthly payments, you repay a percentage of your monthly revenue. This means when your revenue dips, your payment decreases too - providing flexibility that traditional loans can't offer. This structure works particularly well for startups with recurring but variable cash flow.

RBF doesn't rely on standard interest rates. Instead, lenders apply a repayment cap, typically between 1.2x and 1.5x of the loan amount. For example, borrowing $100,000 with a 1.3x cap means you'll repay $130,000 total, regardless of the repayment timeline. For SaaS companies, some lenders provide loans based on 3x to 6x Monthly Recurring Revenue (MRR). The RBF market is gaining traction, with projections estimating it will reach $42.35 billion by 2027. The trade-off? While you avoid fixed obligations, a portion of every revenue dollar goes toward repayment until the cap is met.

Other Debt Options for Startups

In addition to venture debt and RBF, startups have several other financing options to explore:

- Equipment financing: This allows startups to purchase physical assets, using the equipment itself as collateral.

- Bridge loans: These short-term loans provide a financial buffer when you're nearing key milestones but need a quick infusion of cash before the next equity round. However, they come with higher costs due to their short duration and elevated risk.

- Convertible notes: These instruments straddle the line between debt and equity. They start as loans but convert to equity during the next funding round. Because of this conversion feature, convertible notes typically carry lower interest rates compared to traditional debt. For SaaS startups with strong recurring revenue, lenders may offer loans based on 0.5x to 1x Annual Recurring Revenue (ARR), providing another option outside standard venture debt structures.

Cost of Debt Benchmarks by Stage and Risk

Benchmarks from Seed to Series B

For startups at the seed stage, securing debt can be a tough challenge. Lenders typically require a recent equity round - usually within the past six months - supported by a well-known venture capital firm. Even with these conditions, access to debt remains limited since early-stage companies often lack the revenue traction and product-market fit that lenders look for to feel confident.

By the time a startup reaches Series A or later stages, things start to shift. With established product-market fit and stronger revenue traction, lenders view these companies as less risky. At this stage, interest rates generally range from WSJ Prime +1% to +2%. Warrant coverage typically accounts for 2–3% of equity, and debt facility sizes often fall between 10% and 20% of the latest equity round. Some startups, depending on their risk profile and revenue model, can even secure facilities up to 20% to 40% of their most recent equity round, with debt levels commonly around 6–8% of the company’s valuation.

"The most common range of venture debt is six to eight percent of a company's last valuation. As a percentage of net burn, consider keeping debt service at less than 25%." - Dax Williamson, Market Manager, Silicon Valley Bank

The venture debt market has grown rapidly. By 2024, the average deal size hit $46 million, a sharp increase of 125% from $20.4 million in 2020. However, lenders now expect startups to have at least 12 months of organic runway before they’ll extend debt to lengthen it further. Additionally, debt service - covering both interest and principal - should remain under 25% of your net burn.

Knowing these stage-specific benchmarks helps startups understand how their risk profile influences the cost and terms of debt.

How Risk Profile Affects Debt Costs

Beyond the startup's stage, its risk profile plays a big role in shaping debt terms. Riskier companies face not only higher costs but also stricter access to debt. For SaaS and HaaS startups, predictable recurring revenue makes them more attractive to lenders. These companies typically operate within a leverage range of 0.5x to 1.0x of Annual Recurring Revenue (ARR). Experts recommend keeping total debt below 25% of the company’s valuation.

"An acceptable amount of leverage is around 0.5x to 1x debt to ARR. While many lenders may exceed this amount, we advise against it." - Mike Devery, Head of Strategic Capital, Silicon Valley Bank

Startups with strong intellectual property gain an edge by reducing risk. Defensible IP helps protect margins and shields companies from price wars. On the other hand, deep tech startups often face different benchmarks. Lenders tend to focus on gross profit rather than revenue for these companies, as their higher product costs and less predictable revenue streams make traditional metrics less reliable. Startups in tech sectors without tangible assets also face challenges, as lenders worry about repayment risks and lack of collateral.

Cash flow predictability is another critical factor. Startups with inconsistent or uncertain cash flows are seen as riskier, which can lead to higher costs or stricter debt terms. For these companies, demonstrating financial stability is key to securing more favorable debt options.

Calculating the Total Cost of Debt

Hidden Costs: Fees, Warrants, and Covenants

Understanding the total cost of debt goes far beyond just looking at the interest rate on a term sheet. While the stated interest rate might seem straightforward, the true cost of debt includes various hidden factors like fees, warrants, and covenants, which can significantly increase your overall financial burden. For instance, origination and closing fees typically amount to around 2% of the loan principal. That means a $1,000,000 loan could come with $20,000 in upfront costs before you even start paying interest. Additionally, maturity fees - charged at the end of the loan term - can add another 1% to 3% of the principal.

Warrant coverage, often misunderstood, is another key factor. It allows lenders to purchase equity at a pre-set price, with coverage rates usually ranging from 1% to 2% for bank-provided venture debt and 2% to 5% or more for specialized funds. In some cases, startups with higher risk profiles have faced double-digit warrant coverage rates. While warrants don’t require immediate cash, they dilute ownership when the company exits or raises new funding. As Lighter Capital explains:

"Debt warrants deliver a big upside when startups exit successfully. That small slice of equity with upside potential enables investors to offset some risk and provide debt capital at lower interest rates".

Covenants, though often overlooked, can also impose significant costs by restricting how you use your capital. For example, a negative pledge on intellectual property (IP) can prevent you from using your IP as collateral for future loans, limiting your financing options. Financial covenants, such as maintaining minimum revenue levels or cash balances, can trigger defaults even if you're making payments on time. The Arc Team advises:

"It's better to go with a cleaner term sheet that has fewer covenants... than one that has a slightly lower headline cost of capital".

Other smaller fees can sneak up on you as well. For example, unused line fees on credit lines typically range from 0% to 1% of undrawn capital. Prepayment penalties, which can range from 0% to 1.5%, may apply if you decide to refinance or pay off your loan early. If you're using asset-backed loans to finance equipment or inventory, you’ll also need to cover the gap between the loan amount and the advance rate - usually 80% to 95% - with your own equity. These seemingly minor details can add up quickly.

How to Calculate All-In Debt Costs

To figure out your cost of debt before tax, you need to add up all annual interest payments and annualized fees, then divide that total by the outstanding debt. For example, a $500,000 loan at 8% interest generates $40,000 in annual interest. If there are also 2% fees ($10,000), the first-year all-in cost would be 10%. Over a three-year term, you’d amortize the fees across the loan’s life. This means ($40,000 + $3,333) ÷ $500,000 results in an annual cost of about 8.67%.

For profitable startups, the after-tax cost of debt is crucial, as interest payments are tax-deductible. To calculate this, multiply the pre-tax cost by (1 - tax rate). For instance, if the pre-tax cost is 8.67% and the corporate tax rate is 30%, the after-tax cost would be 8.67% × (1 - 0.30) = 6.07%. However, early-stage startups without taxable income can skip this adjustment since they can’t benefit from tax deductions without profits.

If you’re juggling multiple types of debt - such as venture debt, credit lines, or credit card balances - you’ll need to calculate a weighted average cost of debt. For example, if you have a $300,000 loan at 7% and a $200,000 loan at 10%, the weighted cost would be (0.6 × 7%) + (0.4 × 10%) = 8.2%. Alternatively, you can use the Internal Rate of Return (IRR) method to compare loan offers by modeling the total cash inflows and outflows over the loan’s term. These approaches help you get a clearer picture of your debt portfolio and manage costs more effectively.

sbb-itb-17e8ec9

How to Benchmark and Manage Debt Costs

Using Benchmarks to Negotiate Better Terms

Once you've identified debt benchmarks, you can use them to your advantage when negotiating with lenders. A great starting point is to secure at least two term sheets, creating competition among lenders. When you have multiple offers, benchmark data becomes a powerful tool for negotiation. For example, if one lender offers Prime + 7%, but market rates for your stage and risk profile are closer to Prime + 4% to 5%, you have solid evidence to push for better terms.

Don't stop at just the interest rate - negotiate every part of your debt package. If a lender proposes higher warrant coverage, such as 4%, when lower levels are more typical, you might counter by asking for a reduced interest rate or an extended interest-only period. If preserving cash flow is a priority, focusing on a 12- to 18-month interest-only period could be more impactful than haggling over a slight rate difference.

Additionally, prioritize clean term sheets with minimal covenants. For instance, avoiding restrictive clauses like negative pledges on intellectual property or all-asset liens may be more beneficial than accepting a slightly lower interest rate tied to tighter conditions. When benchmarking, consider not just the interest rate but also the credit spread over SOFR, which for institutional lenders in 2025 typically ranges from 400 to 600 basis points. Evaluate the entire package, including fees, warrants, and covenants.

Once you've secured favorable terms, the focus shifts to managing debt effectively.

Managing Debt While Maintaining Financial Health

To avoid overextending, keep venture debt within 6–8% of your valuation and ensure debt service stays below 25% of your net burn. If monthly payments exceed that 25% threshold, the loan could shift from being a runway extender to a financial burden. Dax Williamson, Market Manager at SVB, underscores the importance of planning:

"Having a well-defined roadmap and plan for your business will put you in the best position to manage debt and relationships with lending partners."

Another key metric to monitor is your Debt-to-Equity ratio. A rising ratio signals increasing reliance on borrowed funds, which can make future investors or lenders uneasy. If this figure exceeds 1.0, it’s a red flag. By tracking this ratio quarterly and comparing it with industry standards, you can stay informed about your financial standing. Additionally, maintaining a dashboard for critical financial covenants - like minimum liquidity thresholds and debt service coverage ratios - can help you avoid unintentional breaches that might lead to default.

Proactive communication with your lenders is equally important. If your business encounters challenges or misses milestones, notify your lenders early rather than waiting for a covenant breach. Lenders value transparency, and early discussions can lead to restructuring options or additional support. Building a strong relationship with your lender not only helps in times of need but also increases the likelihood of securing future financing.

For streamlined debt management, tools like Lucid Financials can be invaluable. These platforms offer real-time dashboards to monitor key metrics, helping you stay on top of your financial health and make informed decisions.

Key Takeaways

Summary of Main Points

Debt benchmarks can give you a clear picture of what you should expect to pay for startup financing. The all-in cost is what really matters - this includes not just the interest rate but also factors like warrants, origination fees, closing costs, and legal expenses. These details are critical when comparing offers. In today’s 2025 market, companies in a strong position generally face borrowing costs between 11% and 14%, with spreads ranging from 400 to 600 basis points over benchmark rates like SOFR.

Your company’s risk profile plays a big role in determining pricing. Banks usually offer lower rates but come with stricter terms and warrant coverage of 1–2%. On the other hand, venture debt funds charge higher rates, with warrant coverage often hitting 2–5% or more. The U.S. tech venture debt market is expected to reach $14–16 billion in 2024, accounting for about 10% to 15% of the total venture capital market.

Another key factor is the tax shield effect. Since interest payments are typically tax-deductible, your effective after-tax cost of debt is usually lower than the stated rate. While this tax benefit makes debt financing more appealing, keep in mind that covenant-heavy structures can introduce additional compliance costs and operational challenges.

Next Steps for Founders

Use these benchmarks to refine your debt strategy and make smarter financial decisions.

Start by calculating your all-in debt costs, factoring in every fee and warrant. Compare your numbers to industry benchmarks for companies at your stage and risk level. If your borrowing rate is higher than the benchmarks, it’s time to renegotiate.

Run financial models that include at least a 20% capital buffer to ensure you can manage debt even if growth slows. To stay on the safe side, limit venture debt to 6–8% of your company’s valuation and keep debt service costs under 25% of your net burn. Keep in mind that securing venture debt can take three months or longer, so start planning early.

For better financial oversight, consider tools like Lucid Financials. Their platform offers real-time dashboards and CFO-level insights, helping you monitor key financial ratios, stay on top of covenant compliance, and make informed decisions about your debt strategy.

Understanding Venture Debt with BlackSoil | StartUpCentral

FAQs

What hidden costs should startups consider when taking on debt financing?

When startups consider debt financing, it’s important to keep an eye on the less obvious costs that can add up quickly. For starters, interest payments can vary widely depending on the loan terms. On top of that, there are often additional expenses like origination fees, legal fees, and administrative costs that need to be factored in.

Some debt agreements might also include warrants or other clauses that could result in equity dilution, impacting ownership down the line. Repayment terms can sometimes be more complicated than they seem, potentially causing unexpected financial pressure if not managed carefully. Startups need to thoroughly review and understand all aspects of their debt agreements to avoid costly surprises later.

How does a startup's risk level impact its debt costs and terms?

Startups' risk levels significantly influence the cost and terms of their debt. Lenders evaluate aspects like early-stage development, unpredictable revenue, or a short operational track record to measure risk. When a startup is seen as riskier, it typically faces higher interest rates, tighter repayment terms, and may need to meet extra conditions like covenants or warrants to balance the lender's risk.

Conversely, startups with lower risk - characterized by steady revenue, a proven business model, or solid collateral - often qualify for lower interest rates and more lenient debt terms. Strengthening your risk profile through consistent revenue growth, operational reliability, or providing collateral can help ease borrowing costs and make debt more manageable.

What makes revenue-based financing a better option than traditional loans for startups?

Revenue-based financing gives startups a flexible and founder-friendly way to secure funding without the rigid structure of traditional loans. Instead of fixed monthly payments, this approach ties repayments to a percentage of your revenue. That means when your earnings dip during slower months, your payments decrease too, easing cash flow pressures and offering much-needed breathing room.

One of the standout perks? You don’t have to give up equity. Founders can maintain full ownership and control of their business. On top of that, the total repayment is capped at a pre-agreed multiple of the loan amount, offering clear terms and making financial planning more predictable. This funding method works particularly well for startups with consistent revenue streams, as it aligns repayment with performance. It’s a way to grow sustainably without unnecessary financial stress.