AI credit scoring software simplifies lending by automating processes, analyzing alternative data (like utility payments and app usage), and delivering faster, data-driven decisions. It helps lenders reduce credit losses by 20–40%, improve efficiency, and boost revenue by 5–15%. For startups, gig workers, or thin-file borrowers, these tools evaluate creditworthiness where traditional methods fall short.

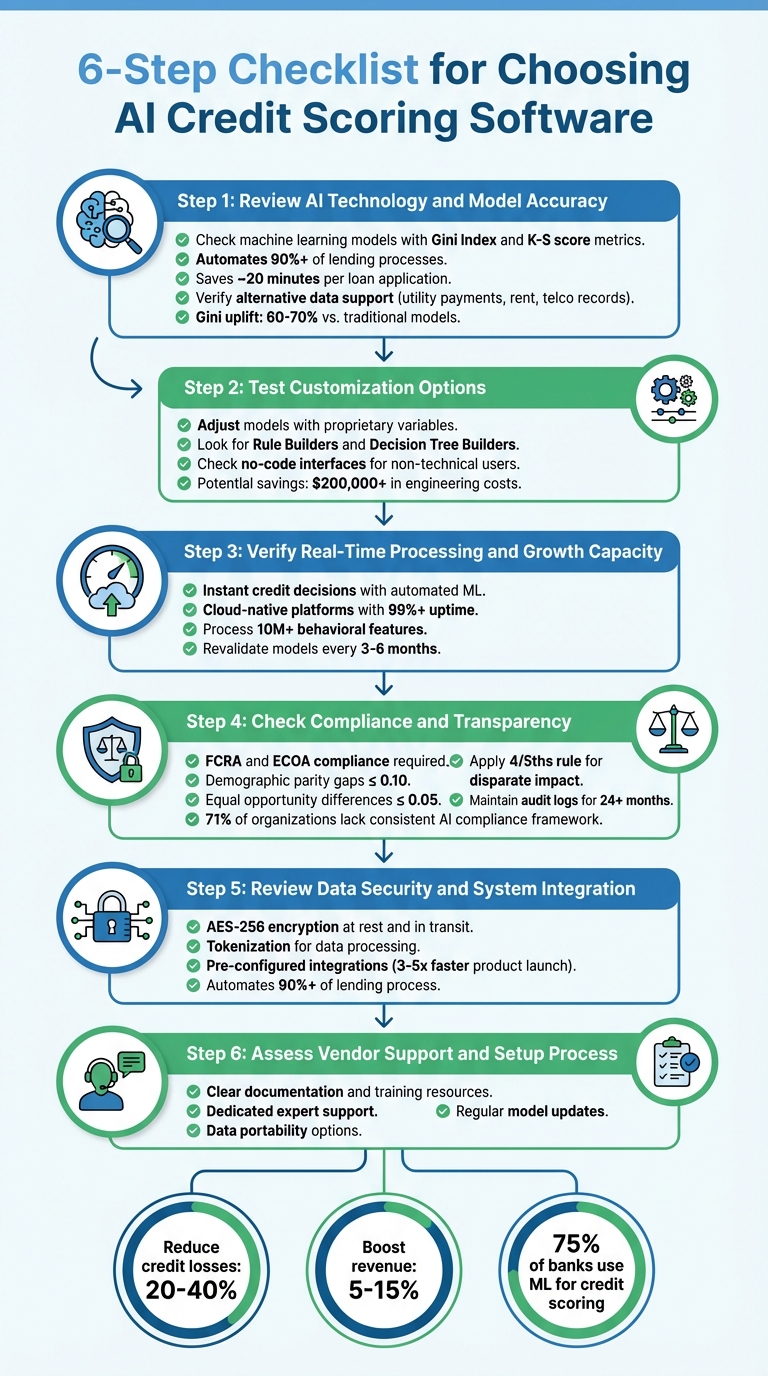

Here’s how to select the right AI credit scoring tool:

- AI Technology: Look for advanced machine learning models with high accuracy (e.g., Gini Index, K-S score) and real-time decision-making.

- Alternative Data: Ensure support for nontraditional data sources like rent, telco records, and behavioral patterns.

- Customization: Choose platforms that allow tailored models and no-code interfaces for non-technical users.

- Real-Time Processing: Opt for systems offering instant credit decisions and scalability via cloud-based infrastructure.

- Compliance: Verify adherence to FCRA and ECOA regulations, with tools to detect bias and provide clear explanations.

- Security & Integration: Confirm strong data encryption, secure connections, and seamless integration with existing systems.

- Vendor Support: Assess onboarding, training, and ongoing customer support.

6-Step Checklist for Choosing AI Credit Scoring Software

Step 1: Review AI Technology and Model Accuracy

Check Machine Learning and Predictive Analytics

AI credit scoring platforms are built on advanced technology that goes beyond traditional methods. These systems can detect subtle behavioral and financial signals that older, static models often miss. Unlike outdated systems that stick to rigid rules, modern AI models continuously improve their predictions through iterative learning. This means they get smarter as they process more data, all without needing manual updates.

When assessing software, ask for validation reports that include metrics like the Gini Index and K-S score. These numbers reveal how well the model separates high-risk borrowers from low-risk ones. AI-powered lending platforms also bring efficiency to the table, automating over 90% of lending processes. This reduces both human error and credit risk. Additionally, top vendors ensure high reliability, with cloud-based platforms offering over 99% uptime. On the operational side, AI credit scoring tools can save about 20 minutes per loan application compared to manual processes.

"AI credit scoring addresses traditional limitations by introducing more advanced, data-driven techniques. Instead of relying solely on static, historical data points, AI models can process vast amounts of diverse information in real time, spotting patterns and predicting behaviors more accurately."

- Laura Burrows, Author, Experian

It's also worth confirming whether the platform can utilize alternative data to improve its predictive capabilities.

Verify Alternative Data Support

For borrowers like gig workers, first-time applicants, or businesses with limited credit histories, alternative data can make a huge difference. Leading AI platforms analyze nontraditional data points such as utility payments, rent, telco records, and even mobile behavioral data like app usage patterns or typing rhythm. These insights are especially valuable when traditional credit bureau data is insufficient.

Using machine learning to analyze alternative data can boost predictive accuracy significantly, with Gini uplifts ranging from 60% to 70% compared to older risk models. For example, Atlas Credit, a small-dollar lender, nearly doubled its loan approval rates while cutting risk losses by up to 20% after adopting a machine learning-driven system with increased automation.

When evaluating software, pay attention to the quality of alternative data sources. Look at coverage (how well the data represents your target audience), specificity (the unique insights it provides), and orthogonality (whether it adds value beyond traditional credit scores). To ensure the system delivers real benefits, run parallel tests to compare how the alternative data improves performance over your current models.

Step 2: Test Customization Options

Adjust Models to Match Business Needs

Lenders often need models tailored to their unique requirements. The best AI credit scoring tools allow you to include proprietary variables like customer tenure, internal payment scores, and product usage data, alongside traditional metrics. Many modern decision engines come equipped with tools like "Rule Builders" and "Decision Tree Builders", making it possible to create custom credit risk rules, product strategies, and pricing models.

These platforms can be fine-tuned to meet specific goals, whether you're evaluating unsecured personal loans, supporting small business lending, combating fraud, or enhancing marketing segmentation. You can also develop "Standalone Scores" for thin-file applicants or use "Enhancements" to complement traditional bureau-based scores with alternative data. When assessing software, ensure it includes a "Variable Library and Builder" to design custom and derived variables tailored to your industry. It's essential to validate these customizations through parallel testing against your existing benchmarks.

"Having your own credit risk score is more accurate and more calibrated to your own business."

Check Usability for Non-Technical Users

After ensuring the software meets your customization needs, confirm that it’s user-friendly for all team members, including those without technical expertise. Look for platforms offering "Plug and Play" digital onboarding with visual product designers and workflow orchestration tools. These no-code interfaces empower non-technical users to adjust scoring logic, set cutoff thresholds for auto-approvals, and modify decision trees - all without writing a single line of code.

Choose platforms that automate adverse action codes to maintain compliance with regulations like FCRA and ECOA, even when non-technical users make adjustments. One fintech company reported saving over $200,000 in engineering costs by adopting a no-code AI risk decisioning platform. Additionally, check if the software includes features like a "model health index" or automated alerts to notify users when a customized model needs further refinement.

"LendAPI is a plug and play digital onboarding platform with a fully featured product designer, rules builder and a workflow orchestration platform that helps banks to launch their products within hours."

- LendAPI

Step 3: Verify Real-Time Processing and Growth Capacity

Test Real-Time Data Processing

Real-time processing and scalability are essential for ensuring your credit scoring system runs efficiently as your business grows. Your software should provide instant credit decisions without requiring manual intervention. Modern platforms achieve this by leveraging automated machine learning to approve or deny applicants in real time, eliminating delays caused by manual reviews. The most advanced systems go a step further by continuously updating risk scores as new data becomes available - whether it’s changes in payment behavior, exposure levels, or external signals - triggering immediate updates to maintain accuracy.

Precision at scale is non-negotiable. Cloud-native platforms are designed to process massive datasets without compromising accuracy. These systems utilize advanced machine learning models capable of analyzing over 10 million behavioral features, uncovering patterns that traditional methods often miss.

"Real-time credit scoring continuously evaluates customer risk as new data becomes available. Changes in payment behavior, exposure levels, or external signals trigger immediate score updates."

- Emagia Staff

To ensure long-term reliability, opt for systems that include automated validation and tools for monitoring model health. These features help detect data drift and performance anomalies. Additionally, look for vendors offering stress-testing capabilities and guidelines for revalidating models every 3–6 months to adapt to changing market conditions. Real-time precision ensures your system can handle growing transaction volumes without losing its edge.

Confirm Scalability

While real-time processing ensures accuracy, your system must also scale effortlessly to support business growth. As your operations expand, your credit scoring software must seamlessly handle increasing transaction volumes and a growing customer base. Cloud-based, serverless architectures are ideal for this, as they automatically adjust resources to match real-time demand. This ensures steady performance even during traffic surges, without requiring manual infrastructure tweaks or costly IT upgrades.

"To support a highly available network, all components scale automatically... the solution is modular and can scale with user adoption."

- AWS Guidance for Credit Decisioning

Verify that the vendor employs a robust cloud infrastructure with tools like application load balancers and real-time monitoring solutions such as Amazon CloudWatch. These features help track and optimize system performance. In fact, around 79% of organizations now prioritize advanced analytics powered by AI and machine learning to maintain their competitive edge.

GCredit DEMO: AI in Credit Scoring for Data-Driven Decision Making and Accurate Predictions

Step 4: Check Compliance and Transparency

Accuracy and customization are critical, but compliance and transparency take things a step further by ensuring AI tools operate responsibly and meet the expectations of both users and regulators.

Verify Bias Detection and Regulatory Compliance

Your software must align with key regulations like the FCRA and ECOA. These laws demand clear and specific reasons for credit denials. As Rohit Chopra, Director of the Consumer Financial Protection Bureau, emphasized:

"Creditors must be able to specifically explain their reasons for denial. There is no special exemption for artificial intelligence".

It's also essential to test for disparate impact - when seemingly neutral models unintentionally affect protected groups unequally. The software should use fairness metrics, such as demographic parity (with gaps no greater than 0.10) and equal opportunity differences (ideally ≤ 0.05 for "good payer" predictions). Regulators often rely on the "4/5ths rule", flagging a disparate impact if the selection rate for a protected group is less than 80% of the rate for the highest-scoring group.

Vendors should identify Less Discriminatory Alternatives (LDAs) that achieve business goals while reducing bias. The software must also avoid using "informational proxies", like spending habits or geographic data, which can indirectly correlate with protected characteristics such as race, gender, or age. To ensure regulatory compliance, demand audit logs that track model versions, features, and thresholds for at least 24 months.

Once compliance measures are in place, the next step is ensuring transparency through clear and accessible decision-making explanations.

Review Explainability Features

Transparency isn't just a best practice - it's a regulatory requirement. Your software must provide clear, understandable explanations for every credit decision, leveraging Explainable AI (xAI) tools. These explanations should cater to different audiences: technical teams validating the model, legal teams ensuring compliance, regulators overseeing practices, and customers seeking clarity on credit denials.

Look for software that offers both global explanations (how the model works overall) and local explanations (specific reasons for individual decisions). Techniques such as SHAP, LIME, and partial dependence plots are particularly useful. Additionally, the system should automatically generate adverse action notices that comply with ECOA.

Test whether these tools genuinely help non-technical stakeholders understand decisions. As Bradley Arant Boult Cummings LLP pointed out:

"Lenders need to have a much deeper understanding of the technologies that they're using rather than just a surface-level familiarity, and adverse action notices need to provide as specific information as possible".

Finally, ensure the vendor provides thorough documentation, such as Model Cards, that detail the model's intended use, limitations, and training data sources. With 71% of organizations reportedly lacking a consistent AI compliance framework, robust explainability tools can protect against regulatory fines and build trust with customers.

sbb-itb-17e8ec9

Step 5: Review Data Security and System Integration

Once compliance and transparency are squared away, the next step is to focus on safeguarding sensitive data and ensuring your systems work together seamlessly. These two elements are crucial for protecting financial data and maintaining efficient credit decision-making. Even the most accurate AI model can cause headaches and risks if these areas are neglected.

Verify Data Security Measures

Your AI credit scoring software will handle highly sensitive information, such as Social Security numbers, transaction histories, and income details. To keep this data secure, encryption is a must - both at rest and in transit. Using AES-256 encryption and secure communication protocols is a good starting point. Tokenization can also help by allowing the system to process information without exposing actual data values.

On top of encryption and tokenization, ensure the platform includes features like audit trails for regulatory compliance, strong data governance policies, and access controls. These measures help keep sensitive information both accurate and protected throughout its lifecycle. And don’t stop there - make sure these security practices extend to every system the software integrates with.

Test Integration with Existing Systems

Modern AI credit scoring platforms should integrate easily with your current tools, such as accounting software, CRM systems, and financial management platforms. Many top-tier solutions come with pre-configured integrations tailored to your industry, which can significantly reduce the time it takes to launch new credit products - sometimes by three to five times faster. Additionally, advanced automation tools can handle over 90% of the lending process, reducing errors and lowering credit risks.

Look for vendors that give you the flexibility to add integrations or tweak workflows on your own, without having to rely on long vendor updates. As Davide Spitale, Founder of Kit Lean Technologies SRL, explained:

"With GiniMachine, we can automate the scoring process and provide inclusive SME assessment to increase their credit rating with our application CfoRobot".

Finally, don’t overlook security during integration. The software should use encrypted connections and secure protocols to protect transaction histories and income details as they move between systems. This ensures that sensitive information remains safe even during data exchanges.

Step 6: Assess Vendor Support and Setup Process

Once you've ensured the platform meets your security and integration needs, it's time to look at the vendor's support and setup process. Even the most advanced AI credit scoring tool can fall short without reliable vendor assistance. As Guru Sethupathy, Founder of FairNow, aptly says:

"A great AI tool is only effective if your team can use it properly and it can grow with your business".

Review Onboarding and Setup Support

A smooth onboarding process is essential. This includes clear documentation, comprehensive training resources, and guidance for aligning all stakeholders. The goal? Seamlessly transition from testing to full-scale operation.

Ask vendors for detailed documentation, a breakdown of implementation costs (like training and integration), and access to training materials. During product demos, have the vendor walk you through real-world scenarios - whether it’s managing inbound leads or generating performance reports. This ensures the platform can handle your specific needs. While some platforms claim quick deployment, don’t just take their word for it. Check with existing customers to confirm these claims. Preparing in this way ensures you're set up for success once the system is live.

Evaluate Customer Support Options

Good onboarding is just the beginning. Ongoing customer support is vital to keeping the system running at its best. Post-implementation, you’ll need a vendor that offers more than a generic support hotline. Look for dedicated experts who can assist with credit scoring and technical needs.

Ensure the vendor provides regular model updates to adapt to changing market conditions and offers clear data portability options, like standard export formats. Strong, responsive support ensures the platform continues to deliver value long after implementation.

Integration with Lucid Financials

Enhanced Financial Insights

By integrating your AI credit scoring tool with Lucid Financials, you bring together advanced risk assessment and real-time financial data, creating a powerful combination for smarter decisions. While the credit scoring tool evaluates risk and creditworthiness, Lucid provides the live financial data needed to make those evaluations practical and actionable.

Lucid's AI-driven bookkeeping supplies up-to-date balance sheets, income statements, and cash flow data - exactly the kind of real-time inputs credit scoring models thrive on. Unlike relying on outdated financial snapshots, Lucid ensures your assessments reflect your current financial health. This is especially valuable for startups with limited credit history, where traditional scoring methods often fall short. As Julie Lee from Experian highlights:

"Machine learning models can now quickly incorporate your internal data, alternative data, credit bureau data, credit attributes and other scores to give you a more accurate view of a consumer's creditworthiness".

Lucid also offers built-in CFO support to complement the AI tools. While the AI handles the heavy lifting of analyzing numbers, finance professionals step in to interpret the results and provide actionable insights. This human-in-the-loop approach ensures you don’t just get a score - you get the context behind it. For instance, if your credit scoring software flags a potential cash flow issue, Lucid's CFO team can immediately step in, simulate scenarios, adjust forecasts, and recommend next steps, all communicated seamlessly via Slack.

This integration doesn’t just improve risk assessments; it also simplifies financial management, making it easier to tackle day-to-day operations with confidence.

Simplified Financial Workflows

Lucid's API-first design ensures that credit scoring data flows directly into your financial dashboard, removing the need for manual exports and creating a unified workflow for bookkeeping, tax preparation, and investor reporting. Michele Tucci from Credolab explains:

"Seamless integration allows the solution to integrate seamlessly into your workflow, saving time and reducing operational friction".

For startups, this consolidation is a game-changer. When your credit scoring tool connects with Lucid's platform, risk assessments automatically feed into cash flow projections, and runway calculations update in real time. This means you can keep tabs on your financial health without juggling multiple tools. With real-time updates to cash flow and investor-ready reports, you’re better equipped to make decisions about growth, hiring, and fundraising - all with less hassle.

Conclusion

When selecting AI credit scoring software, focus on six critical factors: AI capabilities, customization, scalability, compliance, security, and vendor support. Look for software with accurate AI models, real-time processing, and the ability to grow with your needs. It must also adhere to regulatory standards, offering transparent, explainable decisions and robust tools to detect and address bias.

The best solutions combine advanced AI features with seamless financial integration. These elements not only improve efficiency but also strengthen compliance and risk management. For instance, approximately 75% of banks now use machine learning for credit scoring, early warnings, and pricing, leading to noticeable gains in revenue, reduced credit losses, and streamlined operations.

Compliance with regulations like the FCRA and ECOA is essential. Your software should clearly explain credit denials with specific reasons, avoiding vague or generic responses, to meet Equal Credit Opportunity Act standards.

For startups, AI credit scoring can be a game-changer for managing risk and driving growth. Integrating with platforms like Lucid Financials takes this a step further by offering real-time financial data that feeds directly into credit assessments. This integration creates a unified view of your financial health, enabling quicker, smarter decisions for lending and fundraising while keeping your finances investor-ready.

Ultimately, choose software that strikes the right balance between automation and human oversight, provides clear audit trails, and integrates smoothly with your existing systems. This approach reduces workflow friction and positions your business for long-term success.

FAQs

How does AI credit scoring software evaluate creditworthiness using alternative data?

AI credit scoring software evaluates a person’s creditworthiness by examining alternative data - information that goes beyond the usual credit report details. This might include behavioral trends, transaction records, device-related metadata, and other unique data points that provide a clearer picture of someone’s financial habits and repayment capabilities.

Using machine learning algorithms, the software uncovers intricate patterns and connections within this data that traditional credit models often overlook. This enables lenders to assess individuals who may not have an extensive credit history, offering a more inclusive way to extend credit. At the same time, it streamlines the process, delivering quicker, more precise, and tailored lending decisions.

What compliance factors should I consider when selecting AI credit scoring software?

When selecting AI credit scoring software, staying compliant with U.S. federal and state regulations is a must. A good starting point is to assess transparency. It's crucial for lenders to understand how AI models handle data and arrive at their decisions. For instance, the Consumer Financial Protection Bureau (CFPB) now expects lenders to provide clear and specific reasons for credit decisions. Avoid generic explanations like "insufficient income" if the actual issue lies elsewhere.

Another critical aspect is fair lending compliance. Regular testing of AI models is necessary to ensure they don’t unintentionally create disparities among protected groups. This involves actively monitoring for discriminatory outcomes and keeping detailed records of the decision-making process. Such documentation not only ensures compliance but also prepares you for regulatory reviews.

By prioritizing transparency, fairness, and meticulous documentation, you can select software that not only meets legal standards but also earns the trust of your customers.

How can AI credit scoring software be tailored to meet your business needs?

AI credit scoring software can be fine-tuned to match your business needs by adjusting its models, data inputs, and evaluation criteria. This flexibility ensures the system aligns with the specific demands of your industry, captures customer behavior trends, and addresses unique risk profiles. For instance, you can incorporate data points that are particularly relevant to your operations, boosting the precision and relevance of credit assessments.

Another key aspect of customization is ensuring the software integrates smoothly with your current systems, like loan origination platforms, while adhering to regulatory requirements. By prioritizing features such as transparency and accuracy, the software can seamlessly support your operational objectives and improve the quality of your credit decisions.