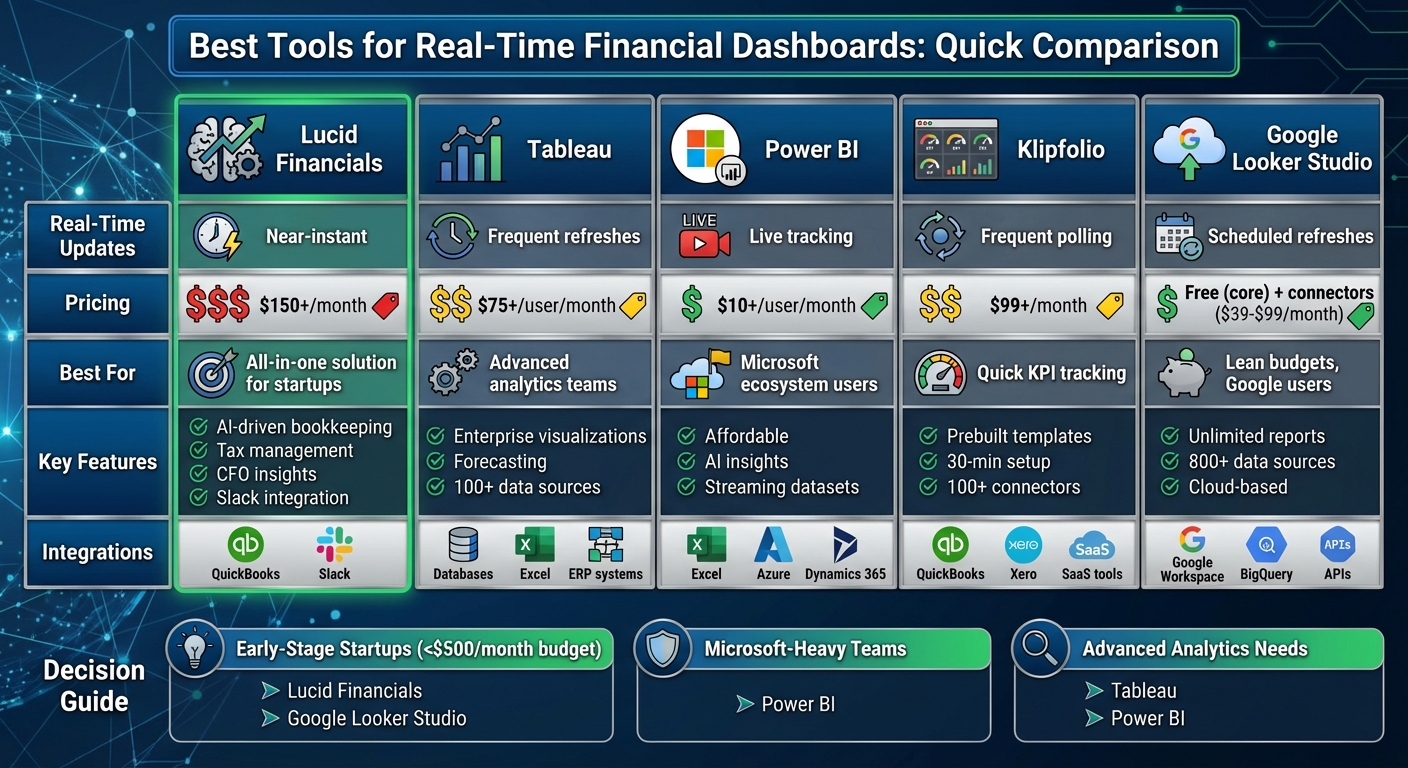

Real-time financial dashboards simplify tracking your startup's financial health by providing instant insights into cash flow, budgets, and KPIs. These tools save time, reduce errors, and help with quick decision-making. Here's a breakdown of five top options, their features, and pricing:

- Lucid Financials: Combines AI-powered bookkeeping, tax management, and CFO insights. Starts at $150/month. Integrates with QuickBooks and Slack for instant updates.

- Tableau: Focuses on advanced visualizations and live data connections. Pricing starts at $75/user/month. Works with databases, Excel, and ERP systems.

- Power BI: Affordable for Microsoft users, starting at $10/user/month. Offers live tracking, AI-powered insights, and strong integration with Excel and Azure.

- Klipfolio: Easy-to-use tool for startups needing quick KPI tracking. Pricing starts at $99/month. Connects to QuickBooks, Xero, and SaaS tools.

- Google Looker Studio: Free option with customizable dashboards. Works well with Google Workspace and BigQuery but may require paid connectors for real-time updates.

Quick Comparison:

| Tool | Real-Time Updates | Pricing | Key Features | Integrations |

|---|---|---|---|---|

| Lucid Financials | Near-instant | $150+/month | AI-driven, startup-focused, Slack-ready | QuickBooks, Slack |

| Tableau | Frequent refreshes | $75+/user/month | Advanced visualizations, forecasting | Databases, Excel, ERP systems |

| Power BI | Live tracking | $10+/user/month | Affordable, works with Microsoft tools | Excel, Azure, Dynamics 365 |

| Klipfolio | Frequent polling | $99+/month | Prebuilt KPIs, easy setup | QuickBooks, Xero, SaaS tools |

| Google Looker Studio | Scheduled refreshes | Free (core) + connectors ($39–$99/month) | Free dashboards, Google-integrated | Google Workspace, BigQuery, APIs |

Choose based on your needs: Lucid Financials is ideal for startups wanting an all-in-one solution. Tableau and Power BI suit teams needing advanced analytics, while Klipfolio and Google Looker Studio work well for lean budgets or simpler setups.

Real-Time Financial Dashboard Tools Comparison: Features, Pricing & Best Use Cases

Make an Incredible Finance KPI Dashboard with Power BI in 20 minutes

1. Lucid Financials

Lucid Financials is an AI-driven, full-service accounting platform tailored specifically for U.S. startups and rapidly growing businesses. It merges bookkeeping, tax management, R&D tax credits, and CFO-level insights into a single platform, offering real-time financial clarity and control.

Real-Time Capabilities

Lucid stands out by providing instant access to financial data, enabling founders to get answers to their financial questions on the spot. The platform ensures accurate bookkeeping within just seven days and delivers continuous updates on critical metrics like burn rate, cash flow, and runway. Its AI-powered tools also produce forecasts, board reports, and investor-ready documents without the delays of manual processes.

Aviv Farhi, Founder and CEO of Showcase, shares: "Lucid turned our bookkeeping and taxes from a headache into a simple, reliable process. Their CFO insights give us clarity to plan growth with confidence - it feels like having a full finance team on demand."

With Slack integration, users can query financial data instantly without switching between tools. This seamless feature enhances efficiency and sets the foundation for Lucid’s broader fintech solutions for startups.

Pricing (USD/Month)

Lucid keeps pricing straightforward with flat-rate plans starting at $150 per month per service tier. This eliminates the unpredictability of hourly billing and hidden charges.

Startup-Focused Features

Designed with startups in mind, Lucid offers tools and insights that cater to the unique challenges founders face during growth and fundraising. The platform provides industry benchmarks and key metrics, such as customer acquisition costs and valuation insights. It also handles complex tax scenarios specific to founders, including equity, grants, and multi-entity structures.

Refael Shamir, Founder and CEO of Letos, says: "With Lucid, bookkeeping, tax management, and credit claims become effortless. The platform saves us hours every month, and their expert team makes sure nothing slips through the cracks."

Lucid’s advanced features include scenario modeling and hiring plans based on real-time financial data. These tools empower founders to make informed decisions about scaling their teams and managing their runway effectively.

Integration Options

Lucid seamlessly integrates with popular accounting tools like QuickBooks, ensuring continuous data synchronization. Its AI-generated insights are paired with expert financial oversight, and the platform employs enterprise-grade security measures, including SOC 2 compliance, to protect sensitive data.

2. Tableau

Tableau is a leading platform for creating interactive data visualizations and dashboards. With its user-friendly drag-and-drop interface, finance teams can easily track key performance indicators - like revenue, expenses, cash flow, and profitability - without needing advanced technical skills.

Real-Time Capabilities

Tableau stands out for its ability to deliver real-time data visualizations, aligning perfectly with Lucid Financials' integrated approach. It connects to over 100 data sources, including SQL databases, Excel files, and cloud services, enabling live updates through incremental refreshes and live queries. This means finance teams can instantly analyze and visualize metrics across departments. Features like forecasting and statistical modeling further allow teams to predict cash flow and profitability trends. Plus, its mobile-friendly design ensures dashboards remain accessible on the go.

Pricing (USD/Month)

Tableau offers three pricing tiers, billed annually, to cater to different user needs:

- Creator: $75 per user per month

- Explorer: $42 per user per month

- Viewer: $15 per user per month

While there’s no free tier with full real-time functionality, startups might qualify for discounts through Salesforce's startup program.

Startup-Focused Features

Tableau’s intuitive interface and active community support make it easy for small finance teams to adopt. It’s built to handle large datasets, which is crucial for startups anticipating growth. Regular updates and strong governance tools ensure the platform adapts as your business evolves. Its enterprise-grade security safeguards sensitive financial data, making it ideal for preparing investor-ready reports. Tableau’s mix of simplicity and scalability makes it a top choice for startups needing real-time financial dashboards.

Integration Options

Tableau integrates smoothly with popular accounting tools like QuickBooks and Salesforce. It also supports API integrations for custom connections and allows exports to platforms like Excel or Power BI. This flexibility makes it easy to consolidate financial data into a unified dashboard for a comprehensive view of your company’s financial health.

3. Power BI

Power BI, Microsoft's business intelligence platform, transforms financial data into interactive dashboards, catering to startups' growing need for transparent, real-time financial insights. If your startup already uses Microsoft tools like Excel, Azure, or Dynamics 365, Power BI integrates effortlessly into your existing ecosystem. Its drag-and-drop interface makes it easy for finance teams to design dashboards without needing extensive technical expertise. Plus, it provides real-time insights tailored to the fast-paced demands of startups.

Real-Time Capabilities

Power BI ensures you stay on top of your financial data with features like streaming datasets and automatic page refresh. These allow you to connect to sources such as Azure Stream Analytics or REST APIs, enabling live tracking of key metrics like cash flow, revenue, expenses, and accounts receivable aging. For startups working with large datasets, the incremental refresh feature updates only the most recent transactions, keeping your dashboards responsive even with extensive data histories. The platform also incorporates AI-powered anomaly detection, helping you quickly identify unusual financial trends. Additionally, DirectQuery mode lets you pull real-time data directly from cloud services without the need for importing files first, ensuring up-to-date insights.

Pricing (USD/Month)

Power BI offers pricing plans that grow with your business:

- Power BI Pro: $10 per user per month (billed annually). Includes essential features like dashboard sharing and scheduled refreshes.

- Power BI Premium Per User: $20 per user per month. Adds advanced AI capabilities and handles larger datasets, making it ideal for scaling startups.

- Premium Per Capacity: Starting at $4,995 per month. Designed for enterprise-level needs, offering dedicated resources for unlimited refreshes and wider distribution capabilities.

While there's a free version available for building reports locally, it lacks the real-time sharing features crucial for collaborative financial dashboards.

Startup-Focused Features

Power BI's affordability makes it a great choice for small finance teams. Its DAX (Data Analysis Expressions) language supports advanced financial calculations, such as year-over-year growth, budget variance percentages, gross margin, burn rate, and runway. Pre-built templates simplify the creation of financial visuals like profit-and-loss statements and KPI cards. As your startup expands, Power BI scales seamlessly from individual users to comprehensive, multi-entity dashboards. Features like row-level security allow you to manage data access, ensuring that department heads, regional managers, or investors only see the information relevant to them. These capabilities make Power BI a practical tool for startups navigating financial growth.

Integration Options

Power BI connects with over 100 data sources, including QuickBooks, Xero, Salesforce, SQL databases, and major ERPs like SAP and Oracle. Its tight integration with Microsoft tools - Excel, Teams, SharePoint, and OneDrive - means you can embed financial dashboards directly into your existing workflows. For more specific needs, you can build custom connections using APIs or export dashboards to other formats. This flexibility ensures Power BI fits seamlessly into your startup's operations while streamlining financial processes.

sbb-itb-17e8ec9

4. Klipfolio

Klipfolio is a cloud-based dashboard platform tailored for startups needing real-time financial insights without the hassle of complex, enterprise-level tools. Its intuitive drag-and-drop interface allows users to build dashboards in under 30 minutes. Plus, pre-built KPI templates make tracking key metrics - like monthly recurring revenue, burn rate, and cash runway - straightforward. With connections to over 100 data sources, Klipfolio pulls live data directly from your accounting systems, offering immediate access to critical financial insights.

Real-Time Capabilities

Klipfolio updates financial data every minute, ensuring you always have the latest numbers at your fingertips. Whether you're monitoring cash flow, tracking daily revenue, or reviewing accounts receivable aging, there's no need to wait for scheduled reports. Push notifications and automated alerts highlight anomalies, such as sudden expense increases or unexpected revenue drops, enabling quick action. With built-in connectors for platforms like QuickBooks and Xero, your dashboards stay current without manual intervention.

Pricing (USD/Month)

Klipfolio’s pricing is designed to grow with your startup:

- Starter Plan: $99 per month (billed annually). Includes up to 3 users, 10 dashboards, and essential real-time updates with limited data source connections.

- Growth Plan: $249 per month. Offers unlimited dashboards, advanced integrations with over 100 data sources, and custom metrics - perfect for startups scaling their financial tracking.

- Enterprise Plans: Starting at $500+ per month, pricing is customized based on your data volume and user needs.

All plans come with a free trial, so you can test the platform before making a commitment.

Startup-Focused Features

Klipfolio’s mobile-responsive design ensures you can access dashboards from anywhere, making it ideal for busy founders and finance teams. Its user-friendly interface means even non-technical users can create investor-ready reports in days instead of weeks. You can share dashboards directly via Slack, keeping your team aligned on financial performance. Additionally, metrics are automatically formatted in USD, simplifying reporting and analysis.

Integration Options

Klipfolio connects seamlessly with popular tools like QuickBooks, Xero, Google Sheets, Salesforce, and SQL databases, allowing real-time access to profit-and-loss statements, balance sheets, and forecasts. Custom REST API connectors make it easy to sync with ERPs like NetSuite, eliminating the need for manual data exports. For startups using services like Stripe, Klipfolio enables you to merge revenue data with accounting records for a complete financial picture.

5. Google Looker Studio

Google Looker Studio (formerly known as Google Data Studio) is a free, cloud-based tool designed to help startups create interactive financial dashboards. Its biggest draw? The core product is entirely free, offering unlimited reports, viewers, and data sources - a great fit for startups keeping an eye on their budgets. With its easy-to-use drag-and-drop interface, you can quickly build dashboards to track key metrics like cash flow, burn rate, or monthly recurring revenue. Plus, it’s flexible enough to work with various data sources, offering real-time insights depending on your setup.

Real-Time Capabilities

The speed of Looker Studio’s real-time updates depends on your data source. For example, if you’re using Google BigQuery, dashboards can refresh within minutes of new transactions being posted, giving you nearly real-time financial visibility. On the other hand, connections to tools like Google Sheets or third-party platforms such as QuickBooks and Xero typically update on a set schedule (usually every 15–60 minutes) based on your connector plan. While it’s not true streaming data, this update rate works well for startups tracking daily revenue, expense patterns, or accounts payable. You can even set up automatic refresh schedules and share dashboards via URL or email PDFs on a recurring basis.

Pricing (USD/Month)

The standard version of Looker Studio is free and includes unlimited users, reports, and data sources. For more advanced needs, Looker Studio Pro offers enterprise features starting at around $5,000/month. Most startups stick with the free plan, only incurring additional costs for optional third-party connectors. For example, services like Supermetrics or Dataddo, which pull data from platforms like QuickBooks, Stripe, or Xero into Looker Studio, typically range from $39 to $99/month for basic plans with scheduled data refreshes.

Startup-Focused Features

If your team already uses Google Workspace, Looker Studio integrates seamlessly with tools like Google Sheets, Google Analytics, Google Ads, and BigQuery. It also offers prebuilt templates tailored to common financial metrics, such as profit-and-loss statements, SaaS dashboards tracking monthly recurring revenue and churn, and cash runway visualizations. These templates are easy to customize with filters for date ranges, departments, or cost centers. Numbers are automatically formatted in USD (e.g., $1,234.56), and dates follow the MM/DD/YYYY format. Since dashboards are hosted in the cloud, your team can access them from any device. You can even embed reports directly into websites or internal portals, making it simple to keep stakeholders in the loop.

Integration Options

Looker Studio supports connections to over 800 data sources through a mix of Google’s native connectors and third-party tools. For financial dashboards, common setups include linking BigQuery tables with data from accounting platforms like QuickBooks, Xero, or NetSuite, as well as billing systems like Stripe or Chargebee. This is often facilitated by ETL services such as Fivetran, Airbyte, or Stitch. If your finance systems run on databases like MySQL, PostgreSQL, or Cloud SQL, Looker Studio can connect directly to them too. Many startups also pair Looker Studio with platforms like Lucid Financials, which helps maintain clean, investor-ready records. By exposing this data via BigQuery or APIs, you can create real-time dashboards that build on reliable financial data.

Pros and Cons

This section breaks down the strengths and limitations of each tool, helping you weigh their value for real-time financial dashboards in U.S. startups. Each option has its own advantages and compromises, tailored to different needs.

Lucid Financials is a standout choice for startups needing an all-in-one finance solution. It combines AI-driven bookkeeping, tax services, and CFO support with Slack integration, delivering instant insights like burn rate, runway, and investor-ready reports. However, it’s more focused on accounting and CFO tasks than on offering the highly customizable visualization options found in dedicated BI tools.

Tableau excels in creating robust, enterprise-level visualizations and handling complex financial models with detailed drill-downs. The downside? Setting up real-time pipelines often requires significant engineering resources and comes with higher licensing costs, which can be tough on early-stage budgets.

Power BI is a natural fit for teams already using Microsoft tools like Excel, Azure, or Dynamics 365, thanks to its seamless integration and incremental refresh capabilities. That said, configuring direct query modes for real-time updates can be tricky, especially for teams not operating within the Microsoft ecosystem.

Klipfolio offers a lightweight, cloud-first approach with prebuilt connectors for quick KPI tracking, making it ideal for founders who need fast access to metrics like cash flow and revenue. However, it lacks the depth of advanced analytics and GAAP reporting that larger enterprise tools provide.

Google Looker Studio is appealing for its free or low-cost entry point and smooth integration with Google Workspace tools like Sheets and BigQuery. While great for lean startups on tight budgets, it struggles with performance issues when handling large datasets or numerous users. Additionally, its security features and multi-entity modeling capabilities are more limited compared to enterprise-grade platforms.

For startups needing fast, real-time insights, these trade-offs can help pinpoint the best fit for your operational needs. The table below summarizes how each tool performs across key dimensions:

| Tool | Real-Time Capabilities | Pricing | Startup Features | Integrations |

|---|---|---|---|---|

| Lucid Financials | Excellent – AI-powered platform with near real-time updates in Slack | Starting at $150/month | Built specifically for startups | QuickBooks, Slack, workflow automation |

| Tableau | Good – Live connections and near real-time dashboards with frequent refreshes | $–$$ | Ideal for complex financial models | Databases, data warehouses, Excel, ERP/GL systems, cloud tools |

| Power BI | Good – Direct query and incremental refresh options for frequent updates | $ (Pro tier); additional Azure/SQL costs | AI-driven insights and custom visuals | Microsoft tools like Excel, Azure, Dynamics 365 |

| Klipfolio | Good/Basic – API-based connectors with frequent polling | $ | Prebuilt KPI libraries for SaaS metrics | Cloud accounting and SaaS tools |

| Google Looker Studio | Basic – Connector refresh behavior; near real-time for BigQuery, scheduled for others | Free (core); connectors $39–$99/month | Prebuilt templates for SaaS and financial dashboards | 800+ native and third-party data sources |

When considering total costs, it’s worth noting that Lucid Financials combines software and professional services, potentially replacing the need for separate accountants, tax preparers, and some FP&A roles. On the other hand, tools like Tableau and Power BI often require dedicated data teams to set up and maintain real-time pipelines. Klipfolio and Google Looker Studio come with lower upfront costs but may involve ongoing expenses for managed connectors, data storage, and the time needed to maintain financial models.

For startups prioritizing quick insights and minimal setup hassle, platforms like Lucid Financials - which merge accounting and dashboarding - offer the fastest route to real-time visibility. Meanwhile, general-purpose BI tools are better suited for startups that need highly customized visualizations built on a structured data foundation.

Conclusion

Choosing the right dashboard depends on your startup's stage and what you need now versus in the future. If you're in the early-stage, pre-seed, or seed phase with a tight budget (under $500/month for finance tools), it's often a trade-off between spending cash on expert-backed automation or dedicating founder time to setting up cheaper tools. For non-technical founders who need instant, reliable data, Lucid Financials offers a practical solution. Starting at $150/month, it combines AI-powered bookkeeping, tax services, and CFO support, all accessible via Slack. This can often be more cost-efficient than hiring a part-time bookkeeper and purchasing separate business intelligence software.

For established startups, advanced reporting features become a priority. Venture-backed companies requiring GAAP financials, real-time budget tracking, and board-ready reports will find Lucid Financials a strong fit. It reduces internal finance overhead while providing always-on dashboards. Alternatively, startups with in-house expertise might pair tools like Power BI or Tableau with an advanced accounting system for more sophisticated analysis. However, this approach comes with higher upfront costs and ongoing maintenance. Many high-growth startups start with an integrated platform and layer in enterprise BI tools later as their data needs evolve.

For bootstrapped service businesses or small SaaS companies focused on cash flow and profitability, complex consolidation tools may not be necessary. An outsourced finance stack like Lucid Financials can handle everything, offering U.S.-style financial statements, cash runway tracking, and automated reporting. Teams with some technical skills might supplement this setup with additional tools, though this approach requires more time from the owner.

When auditability and governance are critical, integrating accounting with dashboard data builds trust and credibility. A solution that combines professional accountants, CFO oversight, systematic documentation, and automated dashboards is often more reliable than ad-hoc spreadsheets during due diligence processes.

To make the right choice, start by defining your key metrics - such as runway, MRR, gross margin, and burn rate. Next, determine who needs access to the data and assign responsibilities for managing it. Focus on tools that integrate deeply with your accounting systems rather than getting distracted by flashy visualizations. For most U.S.-based startups moving quickly, the best platform will be the one that provides accurate, real-time insights with minimal setup hassle, delivering the best return on investment.

FAQs

What are the main advantages of using real-time financial dashboards for startups?

Real-time financial dashboards give startups an instant snapshot of their financial health, enabling quicker and smarter decision-making. By monitoring cash flow, expenses, and overall finances as they happen, startups can swiftly address challenges or seize new opportunities.

These tools also bring greater precision to forecasting, simplify operations, and boost transparency - an asset when discussing progress with investors. With essential financial data readily available, startups can concentrate on scaling their business with clarity and confidence.

How does the pricing of financial dashboard tools compare?

Pricing for financial dashboard tools varies widely. Many platforms follow tiered subscription models, often beginning at $150 per month, while others might offer custom plans or pricing based on usage.

Lucid Financials sets itself apart by offering a blend of affordability and a robust range of services. These include bookkeeping, tax assistance, and CFO-level insights. Tailored for startups and rapidly growing businesses, it provides an all-in-one solution that simplifies financial management, allowing you to concentrate on scaling your business without getting bogged down by the numbers.

What is the best tool for integrating with existing accounting systems?

Lucid Financials makes connecting with various accounting systems a breeze, offering smooth integration that helps you keep your financial processes running efficiently and in sync.

The platform delivers real-time updates and reliable reporting, so your financial data is always current and easy to access. By simplifying financial management, Lucid Financials lets you spend less time worrying about numbers and more time focusing on growing your business.