AI is changing how startups manage cash flow. It uses real-time data to improve accuracy, spot trends, and create flexible financial scenarios. Traditional methods, like spreadsheets, often fall short with outdated data and manual errors. AI fixes this by reducing forecasting errors by 20%-50% and enabling proactive financial planning.

Here’s a quick breakdown of how to get started:

- Use real-time data: Connect AI to bank accounts, CRMs, and accounting tools for accurate inputs.

- Leverage predictive models: AI uses historical data and trends to forecast future cash flow.

- Plan for scenarios: Test for best, worst, and base cases to prepare for financial shifts.

- Monitor anomalies: Set alerts for unusual cash flow changes, like overdue payments or rising expenses.

- Track key metrics: Tie forecasts to metrics like cash runway, DSO, and CAC for better decisions.

Platforms like Lucid Financials make this process easier with automation, real-time insights, and CFO-level support. By switching to AI-powered forecasting, startups can avoid cash shortages, reduce idle cash, and focus on growth.

Best Practices for AI Cash Flow Scenarios

Use High-Quality, Real-Time Data Inputs

Accurate forecasting with AI starts with feeding it high-quality, real-time data. Connect AI directly to your bank accounts, ERP systems, CRM platforms, and accounting tools using open banking APIs. This eliminates the manual errors and delays that can creep in with data entry. For instance, one fintech company identified revenue trends tied to Social Security schedules through real-time data feeds, while another provider automated forecasting entirely using these APIs. When your data is clean and up-to-date, AI models can quickly spot trends and provide timely insights .

Use AI for Predictive Modeling

AI thrives on predictive modeling, leveraging machine learning techniques like neural networks, random forests, and ensemble models to turn historical data into forward-looking insights . These models can analyze seasonal trends, external factors like GDP and interest rates, and even unstructured data from news articles using natural language processing. To get the best results, provide AI with 12–24 months of clean historical data to capture seasonal cycles effectively. Over time, AI systems refine their forecasts, helping founders stay ahead of unnecessary cash burn.

Once predictions are solid, the next step is to craft flexible scenario plans.

Create Multiple Scenario Plans

AI is particularly effective at generating multiple scenario plans, such as base, optimistic, and worst-case outcomes. By testing variables like delayed revenue, increased operating expenses, or unexpected funding gaps , you can identify potential risks and opportunities before they happen. Implement rolling forecasts - weekly updates for the next 13 weeks and monthly updates for the next year - to keep your strategies aligned with shifting market conditions .

Set Up Automated Anomaly Detection and Alerts

Real-time monitoring is just as important as predictive insights. AI can track live data streams to flag irregularities, such as sudden burn rate spikes or potential cash shortfalls, before they become critical. Automated alerts keep you informed at the right moment. For example, you can set notifications to trigger when cash balances drop below a certain level, receivables are overdue, or payroll deadlines approach. These alerts enable quick actions like shortening payment terms, adjusting inventory, or renegotiating vendor contracts to safeguard your cash flow.

Connect Forecasts with Key Startup Metrics

Tie your AI forecasts to essential startup metrics like cash runway, days sales outstanding (DSO), days payable outstanding (DPO), churn rate, customer acquisition cost (CAC), operating cash flow margin, and the cash conversion cycle . Driver-based modeling helps you understand how changes in these metrics impact your cash flow. For example, a five-day increase in DSO or a 2% jump in churn can directly affect your cash position. These insights produce boardroom-ready outputs, perfect for investor updates and fundraising pitches.

Using AI in Predictive Planning - A Case Study on Cashflow

Key Benefits of AI-Powered Platforms like Lucid Financials

AI-powered platforms, like Lucid Financials, take forecasting to the next level, delivering practical tools that streamline financial operations.

Real-Time Financial Insights

Lucid Financials connects seamlessly with Slack, offering instant access to forecasts, cash flow updates, and financial reports. You can ask questions like, "What's our runway?" or "How much did we spend last month?" and receive immediate answers from the AI, backed by expert input. This eliminates the need to wait for end-of-month reports or track down your accountant for updates. Plus, investor-ready reports are always at your fingertips, whether you're prepping for a board meeting or responding to due diligence requests. These real-time updates ensure your financial data is always current and ready to present.

Clean Books in 7 Days

Traditional bookkeeping can be a slow and tedious process, but Lucid Financials changes the game with AI-driven automation. It connects directly to your bank accounts and accounting systems, automatically categorizing transactions and flagging anything unusual for review. This allows for clean, up-to-date books in just seven days. Whether you're a startup switching providers or setting up your books for the first time, this quick turnaround eliminates the usual backlog. Once your books are in order, Lucid Financials provides additional tools like dynamic scenario planning and expert support to keep you on track.

Scenario Modeling and CFO Support

Lucid Financials goes beyond bookkeeping by offering AI-powered scenario modeling and CFO-level forecasting. The platform generates multiple cash flow projections - base, optimistic, and worst-case scenarios - while testing variables like delayed revenue, hiring plans, or unexpected costs. You can analyze how different decisions affect your cash position and runway. Alongside these tools, Lucid Financials offers seasoned CFO support via Slack, combining advanced analytics with human expertise. This approach not only improves accuracy but also strengthens cash management strategies. Companies leveraging AI like this report an average net interest benefit of $1.04 million from better cash management.

sbb-itb-17e8ec9

Comparison of Forecasting Methods

AI vs Traditional Cash Flow Forecasting Methods Comparison

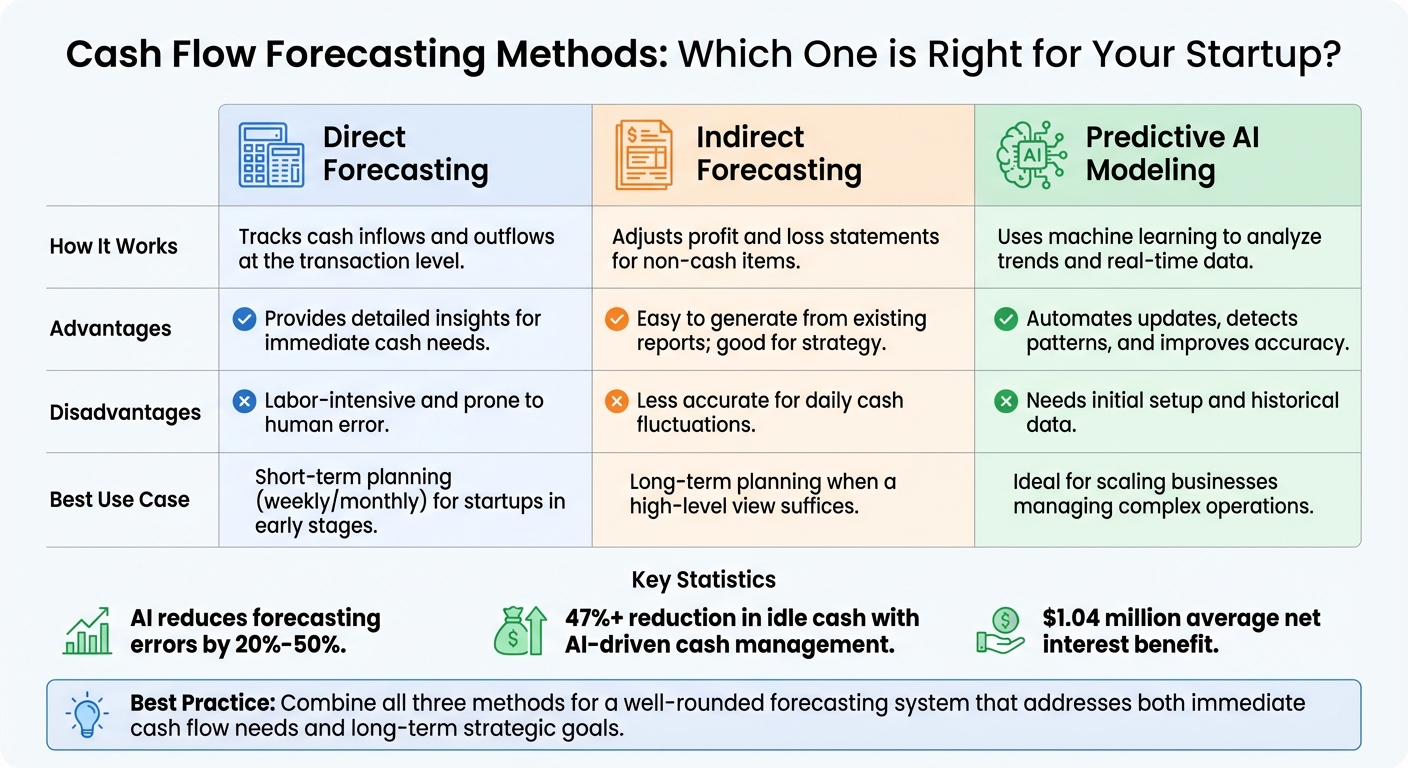

Choosing the right forecasting method depends on where your startup stands, the resources you have, and the level of accuracy you need. Below, we break down direct, indirect, and AI-driven approaches to help you decide which one suits your business operations best.

Direct forecasting focuses on tracking individual cash inflows and outflows, such as vendor payments or customer receipts. This method is perfect for short-term planning when you need a clear picture of what’s coming in and going out of your bank account. However, as your business grows, this approach can become time-consuming due to the frequent manual updates it requires.

Indirect forecasting takes a different route by adjusting your profit and loss statement to account for non-cash items like depreciation. It’s a great tool for long-term planning because it uses existing financial reports to provide a broader view. That said, it’s less effective for managing the daily cash flow fluctuations that startups often face.

Predictive AI modeling uses machine learning to analyze historical data, real-time inputs, and market trends. Unlike manual methods, AI delivers continuous, real-time forecasts and reduces errors by 20%-50%. This makes it particularly useful when combined with direct and indirect methods to handle increasing complexity as your company scales.

Forecasting Methods Comparison Table

| Method | How It Works | Advantages | Disadvantages | Best Use Case |

|---|---|---|---|---|

| Direct Forecasting | Tracks cash inflows and outflows at the transaction level | Provides detailed insights for immediate cash needs | Labor-intensive and prone to human error | Short-term planning (weekly/monthly) for startups in early stages |

| Indirect Forecasting | Adjusts profit and loss statements for non-cash items | Easy to generate from existing reports; good for strategy | Less accurate for daily cash fluctuations | Long-term planning when a high-level view suffices |

| Predictive AI Modeling | Uses machine learning to analyze trends and real-time data | Automates updates, detects patterns, and improves accuracy | Needs initial setup and historical data | Ideal for scaling businesses managing complex operations |

Combining these methods creates a well-rounded forecasting system that addresses both immediate cash flow needs and long-term strategic goals. Startups using AI-driven cash management report an average 47%+ reduction in idle cash, which translates to approximately $1.04 million in net interest benefits. This hybrid approach strikes a balance between short-term precision and big-picture planning - key components of a dynamic financial strategy for growing businesses.

Conclusion and Key Takeaways

AI-driven cash flow forecasting is a game-changer for startups, helping them sidestep cash shortages and make smarter financial moves. By cutting forecasting errors by 20%-50%, AI enables better cash management, reducing idle cash and avoiding unexpected shortfalls.

Blending AI insights with human expertise creates a dynamic financial system. AI takes care of data crunching and pattern recognition, while your team focuses on making strategic decisions to drive growth. This balance ensures a seamless integration of technology and human judgment, setting the stage for platforms that bring these capabilities together.

Take Lucid Financials, for example. This platform delivers real-time insights and automation, offering clean books in just seven days, Slack-based forecasts, and CFO-level insights - all without the hefty CFO price tag. With AI-powered automation and expert oversight on every output, you’re never left guessing.

Moving away from manual spreadsheets to AI-powered forecasting frees up your team to focus on the bigger picture - whether it’s hiring plans, securing funding, or weathering economic challenges. Real-time, accurate cash flow visibility gives you the clarity and confidence to act decisively and steer your business in the right direction.

FAQs

How does AI enhance the accuracy of cash flow forecasting compared to traditional methods?

AI-driven cash flow forecasting takes accuracy to a new level by analyzing real-time data, spotting trends, and adjusting predictions automatically. This approach removes the typical mistakes that come with manual spreadsheets, offering sharper insights into your business's financial condition.

With AI, startups can enjoy forecasts that are often 15–20% more accurate compared to traditional methods. This level of precision empowers founders to make smarter, more confident choices when managing their cash flow.

What are the advantages of using real-time data for AI-powered cash flow forecasting?

Using real-time data lets AI keep cash flow forecasts updated with the most current information, making financial planning more accurate and flexible. This helps businesses respond quickly to changes, make timely decisions, and proactively address potential cash flow issues.

For startups and growing companies, real-time insights mean a clearer view of trends, earlier identification of risks, and the ability to act on opportunities. By working with the latest data, you can shift your energy toward strategic growth while trusting that your financials are on solid ground.

How does AI help startups plan for different cash flow scenarios?

AI-powered financial planning gives startups a fast and efficient way to model different cash flow scenarios - whether things go better than expected or take a turn for the worse - without the hassle of managing complex, time-consuming spreadsheets. By processing real-time data from financial, operational, and market sources, AI ensures projections remain up-to-date as new factors emerge, like changes in customer behavior or pricing adjustments.

This technology doesn’t just crunch numbers - it also flags potential risks, such as liquidity gaps, and runs automated "what-if" scenarios. For instance, startups can test how revenue growth or cost changes would impact their cash flow, burn rate, or runway. These insights allow founders to make smarter calls about fundraising, budgeting, or even shifting business strategies. Plus, with real-time reporting and alerts, teams can stay on top of financial challenges, ensuring everyone is ready to adapt when needed.