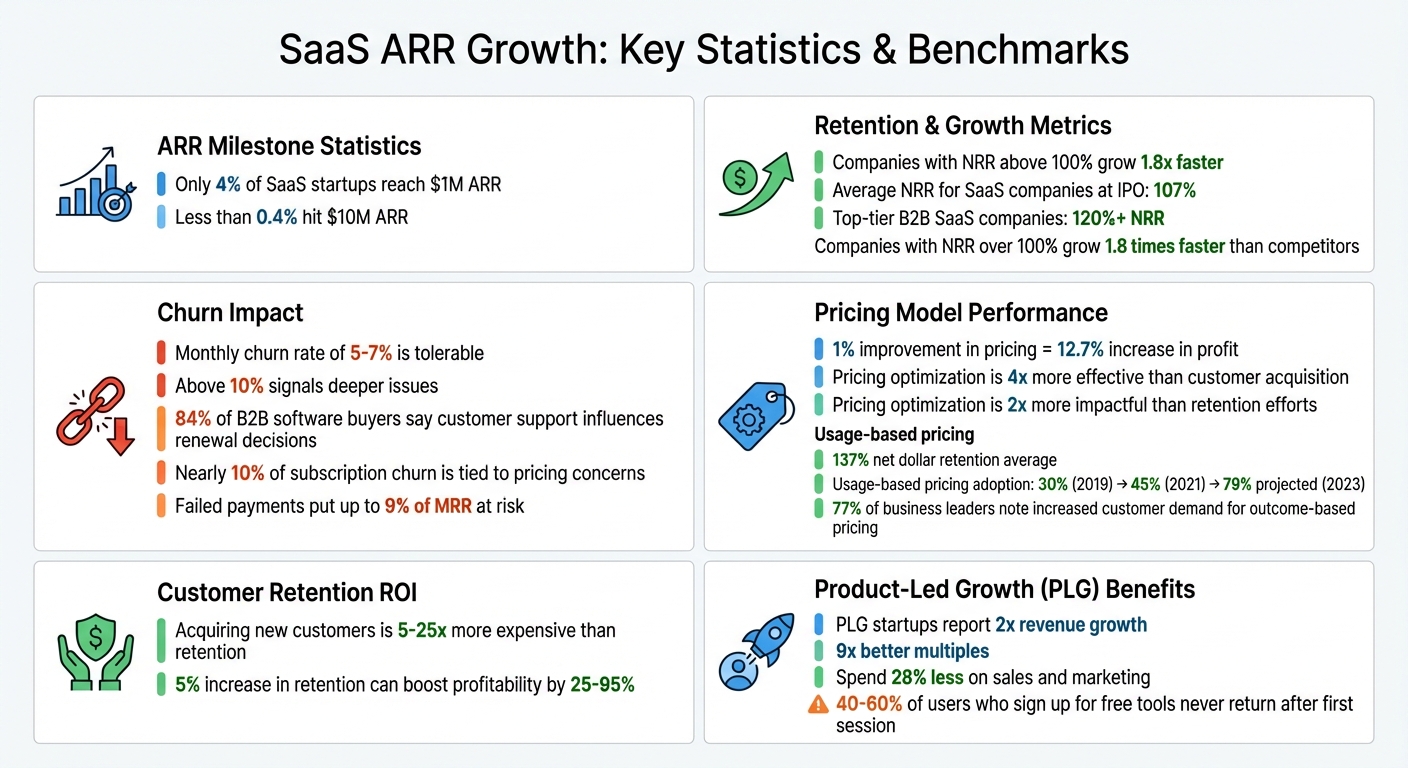

ARR (Annual Recurring Revenue) is the backbone of SaaS startups. It ensures predictable income, supports long-term planning, and is a key metric for investors. However, only 4% of SaaS startups reach $1M ARR, and less than 0.4% hit $10M ARR. To grow ARR, startups must focus on these areas:

- Retention: Reducing churn is critical. High churn can erode ARR, but improving retention and Net Revenue Retention (NRR) can drive growth. Example: Companies with NRR above 100% grow 1.8x faster.

- Pricing: Optimizing pricing models (fixed, usage-based, or hybrid) can unlock revenue potential. Usage-based models show 137% net dollar retention but require careful execution.

- Customer Success: Proactive customer success programs help reduce churn and increase upsells. Example: Guided product tours or public roadmaps can improve retention.

- Automation: AI tools streamline ARR tracking, predict churn, and optimize pricing, enabling faster, data-driven decisions.

- Early-Stage Growth: Product-led growth (PLG) and community-building are cost-effective ways to scale under $3M ARR. Example: Canva and Calendly used freemium models and viral loops to grow rapidly.

Takeaway: SaaS startups need to focus on retention, pricing, customer success, and leveraging tools like AI to grow ARR sustainably while using creative strategies like PLG for early-stage growth.

SaaS ARR Growth Statistics: Retention, Pricing Models, and Key Metrics

3 SaaS Growth Strategies to Accelerate Your Path to $10M ARR

Improving Customer Retention to Grow ARR

Keeping your customers around is more than just good practice - it’s essential for protecting your revenue base. When customers churn, it’s like poking holes in a bucket you spent a fortune filling. Consider this: acquiring new customers is 5–25 times more expensive than keeping the ones you already have, and just a 5% increase in retention can boost profitability by 25–95%.

Net Revenue Retention (NRR) is a key metric that goes beyond tracking customer retention - it also measures revenue growth from upsells and cross-sells. By reducing churn and expanding existing accounts, your NRR can surpass 100%, meaning your business is growing even if you’re not bringing in new customers. To put this into perspective, the average NRR for SaaS companies at IPO is 107%, while top-tier B2B SaaS companies hit 120% or more.

The takeaway? Focusing on retention doesn’t just patch leaks in your ARR - it transforms challenges into opportunities for growth.

How Churn Affects ARR

Churn can quietly erode your ARR if left unchecked. A monthly churn rate of 5–7% is generally tolerable, but anything above 10% signals deeper issues, such as a mismatch between your product and market needs or poor onboarding. The stakes are high: 84% of B2B software buyers say excellent customer support influences their decision to renew, while nearly 10% of subscription churn is tied to pricing concerns.

It’s also crucial to differentiate between user churn and revenue churn. Losing a single enterprise customer paying $50,000 is far more damaging than losing ten smaller accounts. That’s why tracking revenue churn, which factors in the dollar value of lost accounts, provides a clearer picture of financial risk.

Creating Effective Customer Success Programs

To combat churn and push NRR higher, your customer success efforts need to evolve from reactive problem-solving to proactive revenue generation. For instance, MobileAction introduced guided product tours that reduced adaptation time by 32% and boosted NPS by 26%. Similarly, Airfocus launched a public roadmap that cut churn by 3%. Co-founder Malte Scholz highlighted how this transparency helped align product development with customer expectations.

"Product adoption is the main driver of retention. If no one uses the product - why would they renew?" - Ryan Seams, Head of CS and Services, Mixpanel

Here are some strategies that work:

- Streamlined onboarding: Help users quickly reach their "aha moment" where the value of your product clicks.

- Automated dunning management: Prevent involuntary churn caused by failed payments, which can put up to 9% of MRR at risk.

- Proactive engagement: Use AI-driven health scores to spot declining usage patterns months before customers consider canceling.

These approaches aren’t just theoretical. Companies like data.world have used proactive engagement to save 15% of ARR and eliminate customer churn entirely in just one quarter. Focusing on customer success isn’t just about keeping customers happy - it’s about securing and growing your bottom line.

Adjusting Pricing Models to Increase ARR

Fine-tuning your pricing strategy can be a game-changer for boosting annual recurring revenue (ARR). A well-optimized pricing model not only enhances revenue predictability but also opens doors to growth, complementing efforts to reduce churn and improve customer satisfaction. Here’s a compelling stat: a mere 1% improvement in pricing can lead to a 12.7% increase in profit. In fact, pricing optimization is four times more effective than customer acquisition and twice as impactful as retention efforts.

The right pricing structure depends on your business stage. Fixed pricing offers stability and predictability, which is great for forecasting and investor relations. On the other hand, usage-based pricing grows alongside your customers’ success but comes with challenges like revenue unpredictability and potential bill shock. Let’s dive deeper into these models to see how they align with your growth goals.

Fixed Pricing vs. Usage-Based Pricing

Fixed pricing is ideal when predictable ARR is a priority. It’s straightforward, easy for customers to budget, and simplifies the sales process. However, it can limit revenue potential, especially when heavy users consume more resources than they pay for, which can chip away at your gross margins.

Usage-based pricing, on the other hand, often delivers higher returns. Companies using this model see an average net dollar retention of 137% as revenue scales. It ensures heavy users pay their fair share while allowing smaller customers to start with lower costs and increase their spending as they grow. However, unpredictability remains a key drawback - over 90% of users cite a lack of revenue consistency as a concern.

The growing adoption of usage-based pricing reflects its appeal. In software, usage-based pricing rose from 30% in 2019 to 45% in 2021, with projections hitting 79% by 2023. Lee Kirkpatrick, former CFO of Twilio, highlighted its success:

"Twilio was one of the pioneers of usage-based pricing... The company grew from $15M in ARR to more than $1B with this model, consistently achieving better than 130% net dollar retention".

For businesses seeking a middle ground, a hybrid model - combining a base fee with variable usage - can be a smart choice. This approach ensures a minimum spend while capturing additional revenue as customers scale. To make this work, audit your value metrics to ensure you’re charging for what truly reflects customer value. Additionally, if customers consistently approach 80–90% of their tier limits, it’s a natural opportunity to upsell them to a higher plan.

Moving to Outcome-Based Pricing

Another emerging approach is outcome-based pricing, where revenue is tied directly to customer results. Instead of billing for usage or seats, this model charges based on tangible outcomes, such as resolved tickets, completed transactions, or measurable savings. It’s gaining traction, with 77% of business leaders noting increased customer demand for this model.

Take Intercom’s “Fin AI” agent as an example: it charges $0.99 per resolved ticket, with no fee if a human agent steps in - ensuring customers only pay when actual labor is saved. Similarly, Stripe charges a percentage only on successful transactions, avoiding fees for unused capacity or downtime.

Transitioning to outcome-based pricing requires careful planning. Start by defining measurable outcomes tied to your product’s value. Build systems to track these outcomes in real time, ensuring transparency with customers. To ease the transition, consider grandfathering existing customers under their current plans while introducing the new model to new sign-ups. You can also mitigate risks by setting caps and floors - like monthly maximums and minimum commitments - to prevent bill shock for customers and reduce financial uncertainty for your business.

While the potential rewards are substantial, there are trade-offs. For instance, usage-based pricing models have been shown to extend sales cycles by 29% compared to seat-based models in 2023. To navigate this, many startups begin by piloting outcome-based pricing with a small group of customers, refining the approach before rolling it out more broadly.

sbb-itb-17e8ec9

Using AI and Automation for ARR Tracking

Relying on manual spreadsheets and disconnected systems often delays reporting - sometimes by days or even weeks. For SaaS startups striving for rapid growth, these delays can mean missed chances to address churn, optimize pricing, or boost expansion revenue. By eliminating the lag and inaccuracies of manual reporting, AI tools directly address these challenges, providing clarity on churn, pricing inefficiencies, and overall financial health. With AI-powered solutions, data flows seamlessly between your CRM, billing platform, and accounting software, offering real-time insights into key metrics like MRR, ARR, churn rate, CAC, and CLV.

AI systems bring speed, precision, and scalability to the table. Machine learning ensures forecasts stay relevant by adapting to new data, avoiding outdated assumptions. Automated revenue recognition simplifies complex ASC 606 compliance, reducing the risk of costly errors or fines while freeing your finance team to focus on growth strategies. These tools enable a more proactive and continuous approach to ARR management.

Real-Time ARR Monitoring with AI Tools

AI analytics give you instant access to your financial metrics by pulling live data from integrated systems. This means you can see, in real time, how new bookings, upgrades, downgrades, or churn are affecting your ARR. Automated alerts notify you of budget deviations or unusual churn patterns as they happen, allowing you to intervene before small issues escalate.

Predictive analytics take it a step further by identifying customers who may be at risk of churning or those who show strong potential for upsells. AI also helps optimize pricing by analyzing market trends and customer behavior, pinpointing the most effective pricing tiers and feature bundles. For startups using usage-based or hybrid billing models, automation simplifies the tracking of consumption data, eliminating manual errors in accounts receivable.

How Lucid Financials Supports ARR Growth

Lucid Financials stands out as a platform that blends automation with expert financial oversight. It integrates seamlessly with your existing tools, providing real-time ARR tracking, automated forecasts, and cash flow insights - all accessible directly through Slack. Instead of waiting for quarterly reviews, Lucid delivers instant updates on metrics like burn rate and the financial impact of hiring decisions.

The platform also generates board-ready reports and runs "what-if" scenario models with just one click, keeping you ready for fundraising or due diligence at any moment. Whether your ARR is $150,000 or climbing past $3 million, Lucid adapts to your growth stage. Importantly, it doesn’t replace your finance team - it enhances their capabilities. Every output is verified by experts to ensure accuracy and compliance, turning your financial data into a powerful strategic tool rather than a routine monthly task. For founders navigating growth, Lucid transforms financial management into a competitive advantage.

Growing ARR in Early-Stage SaaS Startups

For early-stage SaaS startups, growing ARR (Annual Recurring Revenue) requires a creative approach that balances cost-efficiency with scalability. When your ARR is under $3 million, every dollar matters. Traditional sales teams can be pricey, and most startups at this stage are still working to solidify product-market fit. This is where strategies like product-led growth (PLG) and community-driven efforts come into play. These methods let your product and users take center stage, creating growth engines that operate 24/7. Let’s dive into how building a PLG engine can be a game-changer for early-stage ARR growth.

Building a Product-Led Growth Engine

Product-led growth turns the traditional sales model upside down. Instead of relying on sales reps to drive revenue, the product itself takes the lead in acquiring and converting users. This approach has proven to deliver impressive results - PLG startups report twice the revenue growth, nine times better multiples, and spend 28% less on sales and marketing while achieving similar growth milestones.

The secret lies in reducing friction for users. Between 40% and 60% of users who sign up for free tools never return after their first session. That’s why onboarding must immediately deliver value. The goal is to guide users to their "aha moment" - the point when they truly grasp the value of your product.

Take Canva as an example. Now valued at over $40 billion (as of 2025), Canva’s freemium model and built-in virality made design tools accessible to everyone, not just professionals. CEO Melanie Perkins shared their philosophy:

"We made the product the centerpiece of our growth strategy from day one. By focusing on making design accessible to everyone, we created natural word-of-mouth that powered our early growth without massive marketing budgets".

Another standout example is Calendly, an automated scheduling tool. By 2021, it had reached $85 million in ARR and a $3 billion valuation, fueled by what they call an "intrinsic virality loop." Every time a user sends a scheduling link, it introduces the product to new potential users. This kind of loop scales effortlessly with usage and costs nothing to maintain.

To replicate this, design your product to create similar growth loops. Add "Powered by" branding to your interface, include collaborative features that encourage users to invite others, or offer shareable outputs that naturally spread your brand. The most successful PLG companies also shift their focus from traditional Marketing Qualified Leads (MQLs) to Product Qualified Leads (PQLs) - users who show buying intent through actions like reaching usage limits or inviting teammates.

Using Community and Low-Cost Growth Tactics

In addition to PLG, leveraging low-cost community strategies can supercharge your growth. When budgets are tight, building a strong community becomes a powerful advantage. One effective approach is building in public - sharing your journey, including metrics, roadmaps, and even failures. This openness fosters trust and turns users into invested stakeholders.

Launch strategies also play a critical role. A well-planned Product Hunt launch can bring in over 1,000 users in a single day with minimal expenses. Pair this with free tools like calculators or templates that address specific pain points, and you’ll create multiple entry points for potential customers. For instance, HubSpot scaled to $1 billion in ARR by 2021 using an inbound marketing strategy. They reported that 33% of their customers came from word-of-mouth and 13% from their blog, enabling growth without a proportional increase in sales staff.

Collaborating with micro-influencers - those with 1,000 to 10,000 followers in your niche - can also be highly effective. These partnerships build trust within targeted communities at a fraction of the cost of traditional advertising. Additionally, creating dedicated spaces like Facebook groups allows your most engaged users to connect, share tips, and advocate for your product.

Key Takeaways for ARR Growth

Growing Annual Recurring Revenue (ARR) involves managing several key factors effectively. One of the biggest drivers is retention. Companies with a Net Revenue Retention (NRR) over 100% grow 1.8 times faster than their competitors. To achieve this, focus on keeping your customers engaged and satisfied. Start with excellent onboarding, offer proactive support, and provide regular updates that highlight the value your product delivers.

A flexible pricing model can also naturally increase ARR. Nick Franklin, Founder & CEO of ChartMogul, explains it best:

"How can your business achieve negative churn? By building a pricing model that has an expansion loop within it. This is the only sustainable way to get to negative churn".

When your customers grow, your ARR increases automatically - no need for constant contract renegotiations.

Technology plays a crucial role in managing ARR with precision. AI-powered tools can eliminate guesswork by offering real-time insights into performance. These systems can automate revenue recognition, predict churn before it happens, and even simulate pricing changes based on actual customer behavior. This allows your team to focus on scaling the business instead of getting bogged down with manual tasks.

For early-stage startups, product-led growth and community-building strategies can yield significant results without requiring a massive budget. Let your product sell itself by incorporating features like virality loops, freemium models, and seamless onboarding that quickly guide users to their "aha moment." These approaches, when paired with sound financial management, create a strong foundation for ARR growth.

Speaking of financial management, clarity is non-negotiable. You can’t optimize what you can’t measure. Tools like Lucid Financials provide founders with real-time ARR tracking, automated compliance, and investor-ready reports - backed by expert guidance. Clean financials and accurate metrics make it easier to make smart, growth-focused decisions.

FAQs

What are the best ways for SaaS startups to reduce churn and grow ARR?

Reducing churn is a critical step for SaaS startups looking to boost their Annual Recurring Revenue (ARR). The journey begins with creating a smooth and engaging onboarding experience that quickly demonstrates the value of your product. When users see the benefits early on, they’re more likely to stick around.

It’s equally important to keep your product evolving. Regular updates that address customer needs show you're listening and committed to improving their experience. Pair this with proactive support - solving issues before they grow into bigger problems can make a huge difference.

Listening to your customers is key. Use surveys or direct conversations to gather feedback and, more importantly, act on it. This not only improves satisfaction but also strengthens trust. Additionally, offering flexible pricing and ensuring your billing process is straightforward can align better with customer preferences, making them feel valued.

Don’t overlook the power of data. Subscription analytics can help you spot users who might be on the verge of leaving. Reaching out to them with tailored solutions can re-engage them and show you care about their success. By consistently focusing on customer success, you’re not just reducing churn - you’re building lasting loyalty.

What are the pros and cons of using a usage-based pricing model for SaaS startups?

A usage-based pricing model - where customers only pay for what they use - has several perks for SaaS startups. It lowers the barrier to entry by reducing upfront costs, making it easier to attract new users and encourage early adoption. Customers can start with a small commitment and gradually spend more as they discover greater value in the product. This approach not only increases customer loyalty but also enhances their lifetime value. Since the pricing directly reflects usage, it fosters transparency, builds trust, and helps businesses stand out in crowded markets. For startups experiencing rapid growth, this model can naturally drive ARR growth as customer usage expands.

That said, this pricing strategy isn’t without its hurdles. To make it work, you need precise metering, real-time analytics, and automated billing systems to avoid errors and ensure invoices are accurate and easy to understand. Revenue can also become less predictable, which complicates cash flow management and financial forecasting - especially when there are sudden spikes or drops in usage. Additionally, setting up a reliable tracking system can be complex, particularly when ensuring compliance with GAAP revenue recognition standards. That’s where Lucid Financials can help. By integrating seamlessly with your billing data, it delivers real-time insights and investor-ready financials, allowing you to focus on scaling your business while leaving the number crunching to us.

What role does product-led growth play in boosting ARR for early-stage SaaS startups?

Product-led growth (PLG) is a game-changer for early-stage SaaS startups aiming to grow their annual recurring revenue (ARR). By positioning the product as the core engine for customer acquisition, engagement, and expansion, startups can draw in users, convert them into paying customers, and drive upgrades or expansions - all while keeping customer acquisition costs in check.

This strategy doesn’t just boost revenue faster; it strengthens user retention and builds loyalty, paving the way for scalable ARR growth. What makes PLG so effective is its focus on aligning the product’s value with what customers need, delivering tangible outcomes without leaning heavily on traditional sales-driven methods.