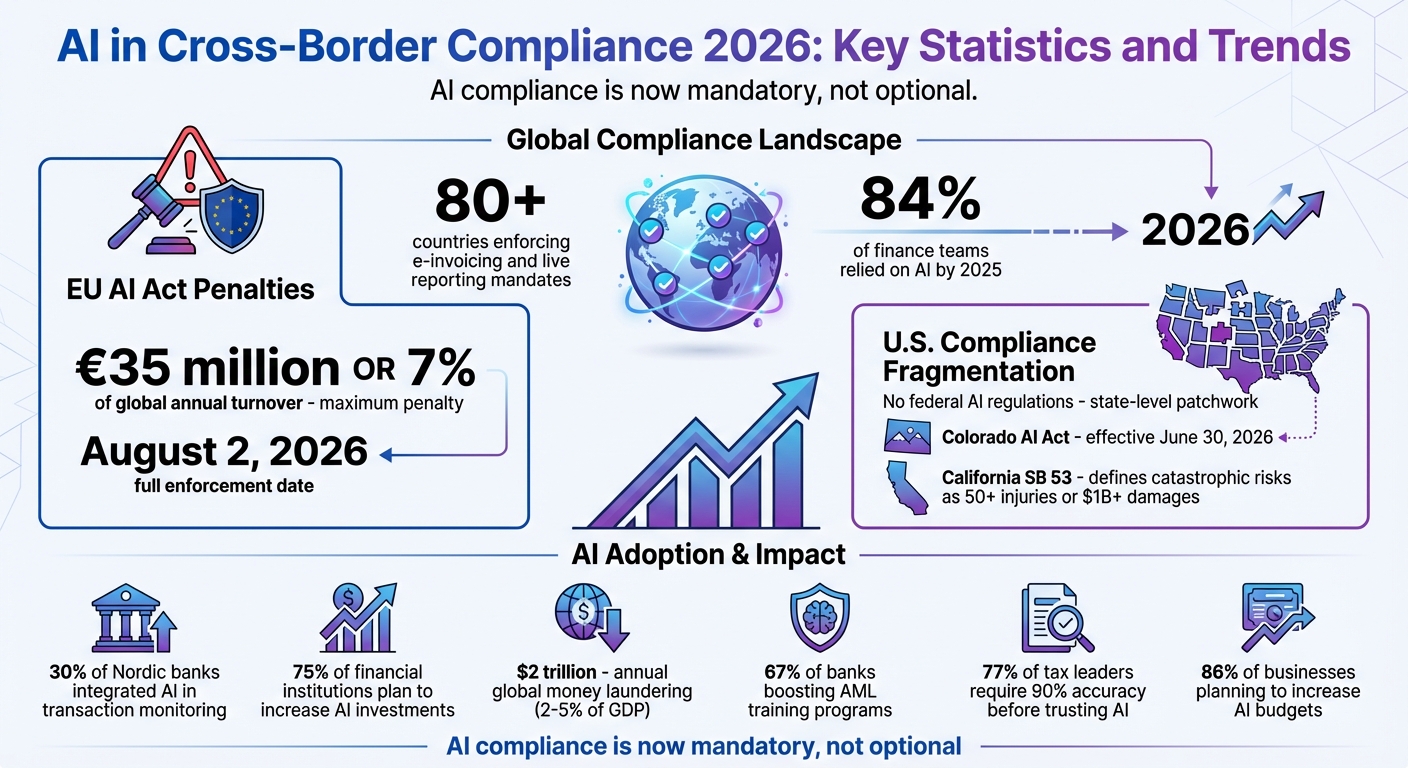

Managing cross-border compliance has become increasingly complex in 2026, with over 80 countries enforcing e-invoicing and live reporting mandates. AI is now critical for businesses to handle evolving regulations efficiently. Here's why:

- AI automates compliance by embedding jurisdiction-specific rules into workflows, enabling real-time transaction monitoring and flagging risks instantly.

- The EU AI Act introduces strict penalties for non-compliance, while the U.S. faces fragmented state-level AI regulations, complicating global compliance strategies.

- By 2025, 84% of finance teams relied on AI, reporting increased revenue and reduced costs.

- Predictive AI tools help businesses foresee compliance risks, adapt to global regulatory changes, and streamline reporting.

For startups, AI simplifies tax compliance, automates reporting, and supports global expansion. Tools like Lucid Financials integrate bookkeeping, tax management, and financial reporting for just $150 per month, making compliance less daunting and more efficient.

Adopting AI for compliance isn't optional anymore - it’s how businesses stay competitive and avoid hefty penalties.

AI in Cross-Border Compliance 2026: Key Statistics and Trends

Cross-Border Data Transfers in 2025: Regulatory Changes, AI Risks, and Operationalization

Major Compliance Trends Driven by AI in 2026

In 2026, three major regulatory shifts are reshaping cross-border compliance. The EU AI Act, fully enforced as of August 2, 2026, marks the end of voluntary governance, introducing penalties of up to €35 million or 7% of global annual turnover for non-compliance. This law applies to any AI system operating within EU borders, regardless of where the company is based, compelling global businesses to adhere to EU standards. High-risk systems - such as those used in recruitment, credit scoring, and critical infrastructure - must now meet strict requirements, including conformity assessments, detailed technical documentation, and mandatory human oversight. These stringent EU rules are setting the tone for varying approaches in the United States.

In contrast, the U.S. lacks federal AI regulations, leading to what some call a "compliance splinternet". Individual states are creating their own laws with differing requirements. For example, Colorado's AI Act, effective June 30, 2026, addresses algorithmic discrimination in critical areas like housing and employment, enforcing a "duty of reasonable care" on developers and users of AI. Meanwhile, California's SB 53, signed in October 2025, mandates annual transparency reports for advanced AI models and explicitly defines "catastrophic risks" as incidents causing injury to 50 or more people or resulting in damages exceeding $1 billion. Unlike the EU's unified framework, these state-specific regulations add complexity to compliance strategies. As McKenzie Semrau from Airia highlights:

"The question is no longer whether to build AI compliance programs, but how quickly you can implement robust governance frameworks that satisfy increasingly divergent global requirements".

To navigate these challenges, many companies are adopting a "unified governance" strategy. This involves building compliance systems that first meet the EU's rigorous standards and then tailoring them to less regulated markets. This global approach reflects the growing importance of aligning with stringent obligations to maintain trust and market access.

The move from optional to mandatory governance makes 2026 a landmark year for enforcement. Adam Shnider, EVP at Coalfire, emphasizes this shift:

"Compliance is no longer a back-office function. It has become a strategic imperative for trust, resilience, and competitive advantage".

This transformation requires collaboration across various teams - data scientists, legal experts, privacy officers, and engineers - working together instead of in isolation. Companies that fail to adapt face not only financial penalties but also the risk of losing customer trust and access to key markets. Next, we’ll explore AI tools designed for real-time compliance monitoring to help operationalize these new demands.

AI Tools for Real-Time Compliance Monitoring

AI platforms are reshaping compliance monitoring by analyzing transaction patterns as they happen. These systems adapt dynamically, tweaking detection thresholds to distinguish between routine business activities and potential compliance risks.

Real-Time Transaction Monitoring and Risk Alerts

AI-powered transaction monitoring is constantly scanning cross-border payments, flagging irregularities before they can escalate into regulatory breaches. Using advanced machine learning, these tools close detection gaps by refining monitoring rules for greater accuracy. AI clustering further enhances this process by grouping users based on behavior and risk levels, allowing compliance teams to zero in on high-risk entities.

By 2025, 30% of Nordic banks had already integrated AI into their transaction monitoring, and 75% of financial institutions planned to increase their AI investments to improve these capabilities. Additionally, 43% of banking professionals believe AI will play a major role in improving fraud detection and anti-money laundering (AML) efforts. Considering that global money laundering is estimated to account for 2% to 5% of global GDP - up to $2 trillion annually - the need for effective monitoring tools is immense.

A case in point is Project Mandala, which incorporated jurisdiction-specific requirements like sanctions screening directly into transaction protocols. The Bank for International Settlements highlighted the project’s goals:

"Project Mandala's overarching objective is to increase the efficiency, transparency, and speed of large-value cross-border transactions without compromising the quality and soundness of regulatory checks."

Such advancements are paving the way for automated reporting systems that further streamline compliance processes.

Automated Reporting and Regulatory Updates

AI is also revolutionizing regulatory reporting by automating the creation of reports. These systems compile transaction data into standardized formats, and automated Suspicious Activity Report (SAR) generation extracts critical details from flagged transactions. This reduces manual errors and ensures timely submissions. Generative AI even crafts detailed case narratives to speed up risk assessments.

As compliance systems shift from static to dynamic models, organizations are investing more in staff training and strategic planning. For instance, 67% of banks are boosting training programs focused on advanced AML detection techniques alongside adopting AI tools. The market is also evolving, with financial institutions moving away from single-vendor solutions toward ecosystems of specialized AI providers that offer tools tailored to specific regulatory needs.

For startups managing multiple compliance requirements, tools like Lucid Financials integrate real-time financial reporting through platforms like Slack, seamlessly aligning compliance efforts with overall financial performance.

But AI doesn’t just automate - it predicts and prevents issues before they arise.

Predictive Compliance and Trend Analysis

Modern AI tools go beyond reacting to compliance issues - they predict them. Predictive analytics and risk scoring models analyze both historical and real-time data to foresee compliance risks. These systems actively monitor global regulatory updates, flagging new obligations in real time and mapping them to internal policies so companies can adapt quickly.

By early 2026, every surveyed organization had plans to incorporate agentic AI into their operations, with the global market for such tools expected to hit $10.86 billion that year. However, challenges remain - 29% of organizations cite cross-border AI data transfers as a key vulnerability, and only 36% have full visibility into where their data is processed. Alarmingly, just 22% validate data before feeding it into AI training pipelines, even though research shows that as few as 250 corrupted documents can compromise an entire model.

Grant Ostler, Industry Principal at Workiva, underscores the importance of a forward-looking approach:

"To be truly effective, GRC functions like internal audit, compliance and risk management must shift from backward-looking compliance functions into objective-focused, forward-thinking intelligence engines."

For startups aiming for global expansion, adopting AI-native compliance strategies that unify governance, risk, and compliance data with financial and IT systems can be a game-changer. This approach turns compliance from a tedious back-office task into a driver of faster market entry, stronger investor trust, and sustainable growth across borders.

sbb-itb-17e8ec9

How Startups Can Use AI for Cross-Border Compliance

For startups looking to expand internationally, compliance can quickly become a major hurdle. Handling tax filings, staying updated on regulatory changes, and maintaining investor-ready books can drain resources. AI-powered platforms are changing the game by helping founders navigate these challenges, turning potential roadblocks into opportunities for efficiency and growth. Let’s dive into how AI can simplify tax compliance, enable instant reporting, and support global expansion.

Managing Multi-Entity Tax Compliance with AI

Operating across multiple countries brings a host of tax challenges - intercompany transactions, transfer pricing rules, and Country-by-Country Reporting (CbCR) requirements can overwhelm even seasoned finance teams. AI tools can track revenues, costs, profits, and exchange rates in real time, flagging inconsistencies before they escalate into audit risks.

Fragmented data is a significant obstacle to effective tax strategies, with 34% of tax executives citing the lack of a unified data strategy as their top concern. AI platforms address this by integrating data from various global systems, eliminating the need for manual reconciliation. These tools also support disciplined documentation, allowing startups to simulate pricing adjustments and operational changes through "what-if" modeling. As PwC highlights:

"AI's impact extends beyond process speed - it helps enable disciplined documentation, consistent decisioning, and proactive risk management".

This capability transforms the complexity of regulatory requirements into streamlined processes.

Take Lucid Financials, for example. This platform combines AI-powered bookkeeping, multi-entity tax compliance, and R&D credit optimization into a single system. It handles federal and state filings, equity-related tax scenarios, and liability tracking, ensuring clean books that are always investor-ready. For startups juggling multiple jurisdictions, this means fewer errors, faster financial closes, and the ability to scale operations without increasing headcount.

Real-Time Financial Reporting via Slack

When it comes to decisions affecting runway, hiring, or fundraising, speed is everything. AI-driven financial platforms now integrate with tools like Slack, giving founders the ability to query key metrics - burn rates, cash flow, or compliance status - through a simple chat interface. This "ChatOps" approach turns financial data into an ongoing conversation, where AI provides instant answers, and human experts step in for deeper analysis when needed.

The adoption of AI in finance is skyrocketing - 84% of finance and tax teams now use AI, up from 47% in 2024. Among the benefits, 63% report improved efficiency, while 58% see better accuracy. For startups, this translates to fewer audit surprises, faster responses to investor questions, and early detection of issues like unexpected VAT liabilities or currency fluctuations.

Lucid Financials takes this a step further by embedding forecasting and scenario analysis directly into Slack. Founders can ask, "What’s our runway if we hire three engineers next quarter?" and get AI-generated forecasts updated in real time based on live data. This is crucial as tax authorities in countries like Australia and Norway increasingly use AI to flag irregularities. With 77% of tax leaders requiring 90% accuracy before fully trusting AI for tax processes, combining automation with expert oversight ensures startups can act quickly without risking compliance issues.

These tools also help lay the groundwork for long-term growth.

Preparing for Global Expansion with AI

Expanding internationally means dealing with new tax systems, data transfer laws, and reporting requirements - often with limited resources. AI tools can automate time-consuming tasks like VAT research (used by 37% of teams), tax return preparation (47%), and managing e-invoicing mandates. Beyond automation, startups need to consolidate financial operations onto a single platform that supports multi-currency workflows and provides a clear, enterprise-level view.

Before entering a new market, startups should establish an "automation approval board" with representatives from Finance, IT, and Compliance to oversee AI implementation. Start with a pilot program for a specific workflow, then scale gradually, retraining AI models quarterly. Additionally, ensure AI vendors meet security standards like SOC 2 Type II compliance and offer features like single sign-on (SSO) and multi-factor authentication (MFA).

With 92% of tax professionals anticipating that Pillar Two global minimum tax rules will increase cross-border disputes and 87% expecting GenAI to streamline audit resolutions, startups that integrate AI into their compliance processes will be better positioned to handle these challenges. Platforms like Lucid Financials, with pricing starting at $150 per month, make advanced AI-driven compliance accessible even for early-stage companies. By consolidating bookkeeping, taxes, and CFO support into one intelligent system, startups can focus on growth while leaving the regulatory complexities to AI.

Conclusion

By 2026, staying on top of cross-border compliance will demand smarter systems that can anticipate and address risks before they escalate. AI is no longer just a "nice-to-have" for finance teams - it’s become a core part of how businesses operate. For startups with global ambitions, the clock is ticking. Companies that hesitate to adopt AI-driven compliance solutions risk being outpaced by competitors who can adapt more quickly, scale efficiently, and keep up with ever-changing regulations.

The regulatory environment is becoming more stringent, especially with the EU AI Act set to be fully enforced by August 2026. The penalties for non-compliance are steep, making it clear that regulatory adherence is no longer optional. As McKenzie Semrau from Airia aptly states:

"The era of voluntary AI governance is ending. As we move through 2026, technology leaders face a fundamentally different regulatory landscape - one where compliance is no longer optional, penalties are substantial, and the stakes have never been higher."

Despite the advancements in AI, trust remains a significant hurdle. A striking 77% of tax leaders say they need at least 90% accuracy before they can fully rely on AI for essential processes. This highlights why adopting AI for compliance isn’t just about technology - it’s about building confidence and gaining a competitive edge.

The best approach? Start small and scale thoughtfully. Begin by automating routine tasks like data entry, then gradually expand into more complex areas like tax planning and risk management. Focus on maintaining clean, reliable data, set up governance teams that span multiple departments, and choose platforms that blend automation with expert oversight. With 86% of businesses planning to increase their AI budgets within the next year and U.S. AI infrastructure investments projected to hit $425 billion by 2026, it’s clear the momentum is unstoppable.

For startups, AI-powered platforms like Lucid Financials offer an accessible way to streamline compliance and financial management. At just $150 per month, this system integrates bookkeeping, multi-entity tax compliance, and CFO-level support, all while providing real-time updates through Slack. This kind of tool helps founders tackle complex regulations while conserving time and resources. In 2026, the companies that succeed will be those that transform compliance from a burden into a strategic advantage, building trust and driving sustainable growth.

FAQs

How can AI help startups manage cross-border compliance more effectively?

AI is a game-changer for startups dealing with cross-border compliance, simplifying complicated processes and cutting down on manual mistakes. It can keep track of and adjust to regulatory updates across different countries in real time, helping businesses stay on top of compliance without needing constant supervision. This minimizes the risk of penalties and makes global operations far easier to manage.

On top of that, AI-driven tools enhance fraud detection accuracy, streamline reporting across multiple jurisdictions, and can slash compliance costs by as much as 30-50%. With capabilities like automated transaction monitoring and regulatory mapping, startups can handle the growing demands of compliance while keeping their focus on scaling and innovation.

How will the EU AI Act impact global businesses?

The EU AI Act sets the stage for a new era of AI regulation, introducing strict rules that businesses worldwide will need to follow - especially those operating in or targeting the EU market. As the first of its kind, this framework categorizes AI systems by risk level, placing the most stringent requirements on high-risk systems. These systems must meet tough standards for transparency, human oversight, and reliability. The clock is ticking, as key provisions will start rolling out in August 2026, leaving companies with a limited timeframe to adjust their operations.

One crucial aspect of this Act is its extraterritorial reach. Even businesses based outside the EU aren’t off the hook - if their AI systems are sold or used within the EU, compliance is mandatory. Failure to meet these regulations could bring hefty penalties and reputational harm, making adherence non-negotiable for any company aiming to stay competitive. Beyond the immediate legal implications, this Act is likely to influence global AI practices, encouraging businesses to align with EU standards to secure market access and remain relevant in the evolving landscape.

How do predictive AI tools help businesses manage compliance risks effectively?

Predictive AI tools are transforming how businesses manage compliance risks. By analyzing vast datasets - like transaction records, regulatory updates, and behavioral patterns - these tools can flag potential issues before they become major problems. Spotting unusual activities early allows teams to take action proactively, minimizing the risk of escalation.

What’s more, AI systems track regulatory changes almost in real-time. This helps organizations adjust swiftly and steer clear of penalties. By shifting compliance from a reactive task to a more strategic, forward-thinking process, predictive AI not only simplifies navigating complex regulations but also boosts overall efficiency.