AI segmentation is reshaping how startups grow revenue by using real-time customer behavior to create dynamic groups. Unlike outdated methods that rely on static traits or quarterly updates, AI processes hundreds of signals - like cart activity, discount sensitivity, and content preferences - to predict actions and adjust strategies instantly. This helps startups focus on high-value opportunities, reduce churn, and improve financial forecasting.

Key Takeaways:

- Real-Time Insights: AI analyzes live behavior, ensuring marketing and sales actions are timely and relevant.

- Efficient Resource Use: Predictive scoring identifies which customers to prioritize, saving time and budget.

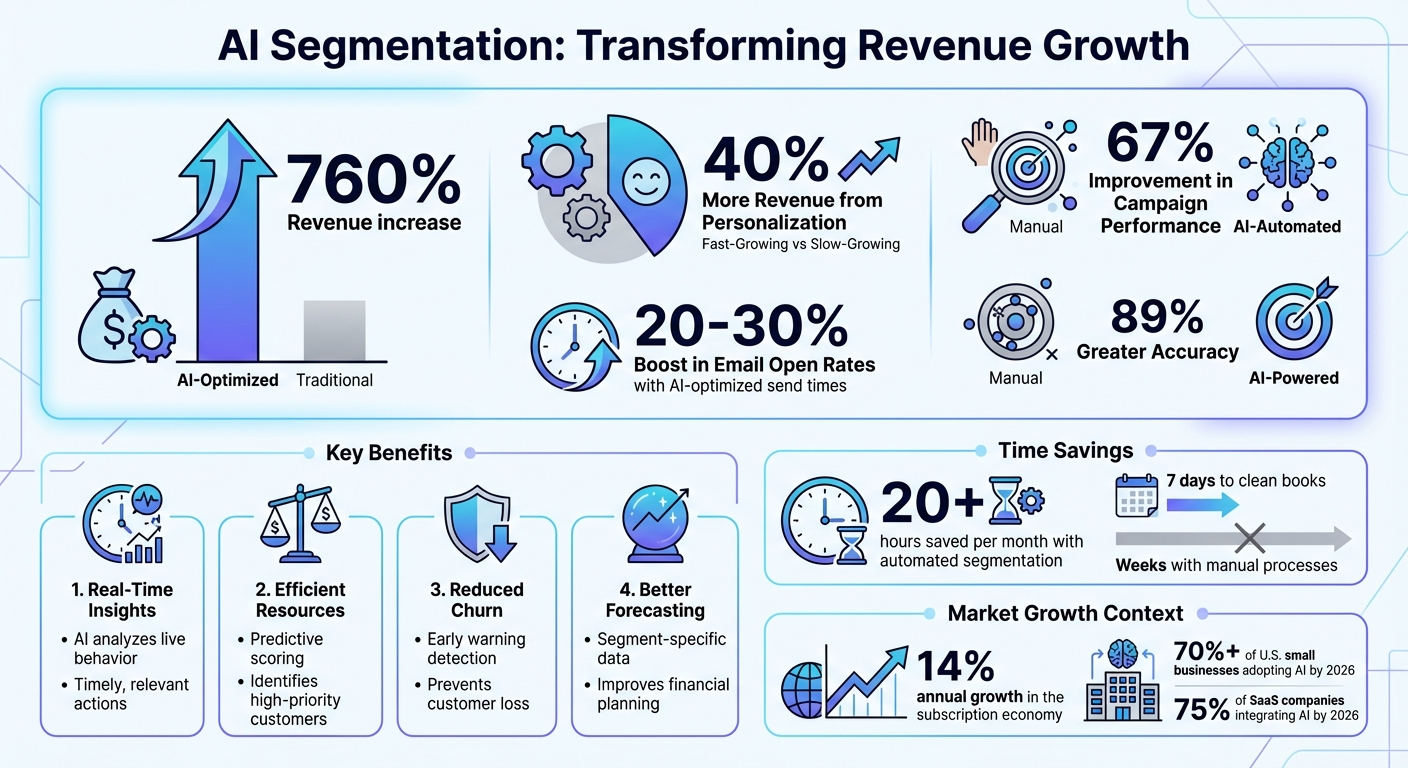

- Revenue Growth: Hyper-personalized campaigns can boost revenue by up to 760%.

- Financial Impact: AI segmentation aligns with revenue forecasts, improving decision-making and protecting margins.

Startups can integrate AI by collecting diverse data (e.g., product usage, financial metrics) and using tools that process it in real time. Testing and refining segments ensures campaigns are effective, while metrics like customer lifetime value (LTV) and churn risk guide continuous improvement. Combining AI-driven insights with financial tools creates scalable, predictable revenue streams.

AI Segmentation Impact on Revenue Growth: Key Statistics and Benefits

Problems with Traditional Segmentation Methods

Manual Segmentation Challenges

Traditional segmentation methods often force teams to choose between speed and precision, leading to missed opportunities. For instance, relying solely on Annual Recurring Revenue (ARR) tiers - such as categorizing accounts as small, medium, or large - oversimplifies customer potential. This approach treats a $5,000 account growing at 200% annually the same as a stagnant one, which can misdirect customer success teams toward less promising accounts while high-growth opportunities slip by unnoticed.

Manual processes also struggle to keep up with the sheer volume of data businesses deal with today. Each campaign demands time-consuming tasks like writing segmentation rules, exporting CSVs, syncing tools, and securing approvals. By the time these segments are refreshed, they’re already outdated. As Team Braze puts it:

Manual rules and quarterly 'segment refreshes' can't keep up. This means high-value customers can slip through generic journeys, churn risks can hide in broad lists, and whole pockets of opportunity stay buried in the data.

This outdated system leads to delays and missed insights, making it harder to respond to rapidly changing customer behaviors.

Another major flaw is that manual segmentation relies heavily on observable traits like age, location, or last purchase date, while ignoring deeper behavioral signals. These signals - such as how often a customer visits, their feature preferences, or their sensitivity to discounts - are critical for identifying who is likely to expand, churn, or respond to specific offers. Without this insight, teams miss opportunities for growth, leaving revenue on the table.

Impact on Revenue Growth

The financial consequences of outdated segmentation are hard to ignore. Companies with faster growth rates generate 40% more of their revenue from personalization compared to their slower-growing competitors. If segments are only refreshed quarterly, businesses risk operating with data that fails to reflect rapid changes in customer behavior. As Tredence warns:

Treating [customers] as static groups is similar to navigating with outdated maps. You will inevitably lose your way in the competitive marketplace.

This outdated approach can lead to significant losses. High-growth accounts may go unnoticed, marketing budgets are wasted on generic messaging, and churn risks are identified too late. Traditional batch models that update audiences once a day - or even less frequently - create blind spots for time-sensitive actions like cart recovery or onboarding milestones. These inefficiencies not only hinder revenue growth but also make it harder to stay competitive in a fast-moving market.

sbb-itb-17e8ec9

Maximize Revenue with AI Segmentation | Orita Demo

How AI-Powered Segmentation Drives Revenue Growth

AI segmentation uses real-time, behavior-based insights to quickly identify high-value customers, enabling businesses to act swiftly on opportunities or address potential risks.

Dynamic and Real-Time Segmentation

Unlike traditional segmentation that groups customers into fixed categories, AI adapts to the ever-changing nature of customer behavior. It processes live events, like cart abandonment or drops in usage, to immediately adjust customer segments. For example, if a high-value customer suddenly reduces their activity, they’re flagged as at risk and placed into a win-back strategy. This ensures your messaging stays relevant, reflecting current actions rather than relying on outdated data.

AI also reveals hidden patterns that manual methods often overlook. For instance, clustering models can identify micro-segments, such as "late-night mobile shoppers who purchase only after visiting pricing pages". These nuanced insights let you target customers with precision - offering discounts to low-intent users while providing product information to those ready to buy. Shifting from static to dynamic segmentation helps maximize revenue by tailoring strategies to real-time behavior.

Personalized Campaigns at Scale

AI makes hyper-personalization achievable on a massive scale, automating the selection of the best journeys, creatives, and offers for millions of customers simultaneously. Brands have reported a 760% increase in revenue when campaigns are highly segmented and AI-optimized. Additionally, companies with faster growth rates generate 40% more revenue from personalization compared to slower-growing peers.

Predictive intent targeting enhances this further by identifying customers "likely to buy" or "likely to upgrade" based on probability scores. This allows businesses to tailor their incentives: high-intent users might need only a small nudge, while low-intent users could benefit from more aggressive promotions. AI can even optimize email send times, boosting open rates by 20-30% by delivering messages when recipients are most likely to engage.

Better Decision-Making with Predictive Insights

AI doesn’t just improve engagement - it refines decision-making by shifting focus from past customer behavior to future outcomes. Predictive analytics assigns scores for outcomes like churn risk, advocacy potential, or expansion likelihood, helping allocate resources more effectively. For instance, a $5,000 account growing at 200% annually deserves more attention than a stagnant account. AI helps distinguish where to apply high-touch support versus automated solutions.

Churn prevention becomes proactive rather than reactive. AI detects early warning signs - such as reduced logins, decreased feature usage, or ignored emails - and triggers interventions before customers leave. Health scores, categorized into tiers like Thriving (90-100), Healthy (70-89), At-risk (50-69), and Critical (<50), guide teams in prioritizing outreach and crafting urgency-specific messages. This forward-looking strategy safeguards customer lifetime value, addressing issues before they escalate.

How to Implement AI Segmentation

AI segmentation can be set up quickly if you focus on outcomes first. Instead of diving into all available data, start by defining clear business goals - like reducing churn or boosting expansion rates among specific customer tiers. This ensures that every piece of data you gather has a purpose and aligns with your objectives.

Data Collection and Preparation

For AI models to uncover patterns that manual analysis might miss, they need diverse data inputs. Focus on collecting four key types of data:

- Product usage: Metrics like login frequency and feature adoption.

- Financial metrics: Information such as annual recurring revenue (ARR) and payment reliability.

- Relationship health: Indicators like support ticket history and NPS scores.

- Firmographic details: Data about company size, industry, and other organizational traits.

The goal is to connect these data streams - sourced from your CRM, website analytics, and customer platforms - so AI can analyze customer behavior in real time. For example, if a customer’s login activity drops and their overall engagement declines, the system should automatically flag them as a potential churn risk.

However, the quality of your data matters more than sheer volume. Set up protocols to remove duplicates, validate entries, and ensure real-time synchronization across platforms. As Hazel Raoult, Marketing Manager at PRmention, explains:

AI can sift through massive amounts of data in real-time, far beyond what manual analysis could achieve.

That said, outdated or error-filled data can undermine these advantages. For many startups, refreshing data monthly strikes a good balance - it keeps insights current without overreacting to daily changes. Once you’ve cleaned and integrated your data, you’re ready to choose tools that can process it in real time.

Selecting the Right AI Tools and Techniques

With your data organized and ready, the next step is selecting the right tools and techniques. Different AI methods serve different purposes. For example:

- K-means clustering: Identifies natural groupings in your customer base, such as users who engage during specific times or after visiting pricing pages.

- Classification models: Answer binary questions, like whether a customer is likely to churn.

- Predictive scoring: Ranks customers by probability, helping you prioritize high-intent leads for premium campaigns.

When evaluating AI tools, focus on three essential features:

- Seamless integration with your existing tech stack.

- Real-time data processing (not just daily batch updates).

- Clear interpretability, so your team understands why customers are placed in specific segments.

The ideal tool should empower your marketing team to activate segments independently, without constant reliance on data scientists. Start with simple setups - using first-party data combined with one additional factor, like customer health scores or behavioral data - before scaling to more complex, multi-dimensional models.

Testing and Activating Segments

Once you’ve selected your tools, test your segments before rolling them out broadly. Use A/B testing to validate your approach. For instance, create 3–5 core segments and test different engagement strategies. You might compare whether at-risk customers respond better to personal outreach calls or automated discount emails. Automated segmentation has been shown to improve campaign performance by 67% while saving over 20 hours per month.

To avoid confusing or conflicting messaging, ensure your segments are mutually exclusive and set up automated rules to dynamically adjust customers based on their real-time behavior. As Kuma advises:

Let AI predict 'who' and 'when,' while your team defines 'why,' 'what,' and 'how'.

This balance between human strategy and AI’s precision - offering 89% greater accuracy than manual methods - can significantly enhance your segmentation efforts.

Connecting Segmentation Insights with Financial Planning

Aligning Revenue Streams with Financial Forecasts

AI-driven segmentation is reshaping how businesses approach financial forecasting. By analyzing real-time customer behavior and purchase histories, companies can create detailed revenue models for each segment. For example, in a tiered SaaS business with pricing ranging from $19 to $199 per month, segmenting customers by lifetime value can reveal upsell opportunities that could scale monthly recurring revenue (MRR) from $10,000 to $100,000 within a year. This method ties forecasts to specific metrics like customer acquisition cost (CAC) payback periods and gross margins. Traditional SaaS gross margins typically hover between 70% and 85%, but AI-heavy products often see margins drop due to infrastructure expenses consuming up to 75% of revenue.

This segmentation also supports "what-if" scenario modeling, such as forecasting revenue under usage-based pricing models that charge between $0.10 and $2.00 per generation. With predictions that 75% of SaaS companies will incorporate AI into core processes by 2026, relying on segment-specific data instead of broad averages can significantly reduce forecasting errors.

Companies like Zendesk and Notion demonstrate the value of this approach. Zendesk uses hybrid pricing strategies, while Notion integrates AI as a core feature, both stabilizing margins despite the high costs of AI infrastructure. These refined, segment-focused forecasts allow startups to align their financial planning with the dynamic nature of their business, integrating seamlessly with real-time financial management tools.

Using Lucid Financials for Real-Time Clarity

Turning accurate forecasts into actionable insights requires a financial system that keeps pace with evolving customer data. Lucid Financials bridges this gap by integrating directly with segmentation data and delivering real-time updates on segment revenue, runway projections, and cash flow through Slack.

Lucid simplifies financial processes by producing clean books in just seven days while generating investor-ready insights aligned with customer segmentation. For instance, if a high-LTV segment shows strong upsell potential, Lucid's AI-powered forecasting models the impact on your runway, taking AI infrastructure costs into account. It also tracks critical metrics like revenue per user (with leading AI startups averaging $3.48 million per employee), gross margins, CAC payback periods, and churn rates.

This level of real-time clarity is essential in a subscription-based economy growing 14% annually, where over 70% of U.S. small businesses are expected to adopt AI by 2026. Lucid Financials combines bookkeeping, tax services, and CFO support into one intelligent platform, connecting customer insights directly to financial planning. Instead of relying on cumbersome spreadsheets, Lucid delivers instant, data-backed answers straight to Slack, making financial management faster and more intuitive.

Measuring the Success of AI Segmentation Strategies

Key Metrics to Monitor

Tracking the right metrics is essential for turning customer insights into meaningful revenue opportunities. Here are some key indicators to assess the performance of AI-driven segmentation:

- Customer Lifetime Value (LTV) Predictions: These projections estimate the revenue potential of different customer groups, helping shape strategies for acquisition and retention.

- Predictive Churn Risk Scores: By identifying customers who show early signs of disengagement, teams can take proactive steps to keep them engaged.

- Purchase Likelihood Scores: These scores rank users based on their likelihood to make a purchase or upgrade, allowing teams to focus on prospects with the highest intent.

- Milestone Progression: Tracking a customer’s journey - from their first purchase to becoming a loyal advocate - can reveal where friction points might be slowing progress.

These metrics not only validate the effectiveness of segmentation but also provide insights for fine-tuning strategies over time.

Continuous Optimization with AI

Customer behaviors change constantly, and static segmentation methods don’t keep up. That’s why AI-powered systems stand out - they adapt in real-time, adjusting segments based on behavioral signals like clicks, session durations, or cart abandonment. Instead of waiting for quarterly updates, AI refreshes classifications instantly, making it far more responsive than traditional methods.

AI also uses data from conversions and A/B testing to refine audience splits and probability thresholds. For example, if a "high-intent" segment underperforms, the AI can recalibrate the criteria defining that group. This ensures resources are directed toward segments that deliver better results.

Setting clear goals is another critical step in training AI models. Defining outcomes like "complete a purchase within 14 days" or "reduce churn risk for top-tier customers" helps the AI focus on the most relevant signals.

The rise of agentic segmentation highlights AI’s growing ability to go beyond simply categorizing audiences. These systems can suggest new audience groups, recommend journey modifications, and propose creative offers - drawing on insights from past campaigns. Human oversight remains essential, but the AI takes on much of the heavy lifting, freeing teams to focus on strategic decisions.

Conclusion

AI-driven segmentation has shifted from being a nice-to-have to an absolute must for startups looking to scale revenue effectively. By grouping customers dynamically based on behavior rather than static demographics, AI enables hyper-personalized campaigns, accurate predictions of customer actions, and smarter resource allocation. With the subscription economy growing at 14% annually and over 70% of U.S. small businesses planning to adopt AI technologies by 2026, the race to implement these capabilities is heating up.

The most effective strategy combines AI segmentation with a multi-layered revenue model. This often includes acquiring users through freemium options, generating steady income via tiered subscriptions (ranging from $19 to $199 per month), and catering to high-value customers with premium services. Thanks to behavioral insights, many AI startups have reached $10,000 to $100,000 in monthly recurring revenue within their first year. This layered approach ensures financial stability and scalability.

Still, segmentation is only as valuable as its application to financial planning. That’s where Lucid Financials comes in. By offering AI-powered bookkeeping, CFO support, and real-time Slack updates, Lucid Financials bridges the gap between segmented revenue insights and accurate forecasting. Startups can have clean books in just seven days and investor-ready reports that reflect true performance across customer segments - an essential feature when AI infrastructure costs can eat up to 75% of revenue.

Ongoing measurement is equally critical. Keep a close eye on metrics like revenue per user, monthly recurring revenue growth, CAC payback rates, and gross margins (aiming for 70–90% in SaaS models). With 75% of SaaS companies expected to adopt AI for process automation by 2026, the ability to scale efficiently without ballooning costs will separate the leaders from the laggards.

The path forward is straightforward: adopt AI segmentation now, leverage tools for real-time insights, and track essential metrics consistently. This approach equips startups to build predictable, high-margin revenue streams while others falter with outdated strategies.

FAQs

What data do I need to start AI segmentation?

To get started with AI segmentation, the key is to work with high-quality customer data that showcases behaviors and interactions - think website activity, purchase trends, and engagement stats. Pulling data from tools like CRM, sales platforms, and marketing systems helps you gain a well-rounded understanding. Begin by focusing on just one data category and make sure it’s implemented effectively. It’s better to have accurate, reliable data than an overwhelming amount. And don’t forget - ethical data practices are crucial for building trust and creating precise, adaptable customer segments.

How do I keep segments real-time without messy data?

To keep your customer groups precise and relevant, take advantage of AI-driven segmentation tools that analyze live behavioral data continuously. By connecting dependable data sources - like CRMs, transaction platforms, and accounting systems - you can automate integration processes and minimize errors. Use machine learning algorithms to ensure your segments are dynamically updated as new data comes in. Additionally, make it a priority to monitor your data pipelines regularly to maintain quality and avoid inconsistencies. This approach ensures your segments remain actionable and current at all times.

How do I tie AI segments to forecasts in Lucid Financials?

To link AI-driven segments with forecasts in Lucid Financials, start by making sure your segmentation data is up-to-date and accurately represents your customer groups. Leverage the platform's integration tools to merge this data into your financial models. This approach provides insights into how different customer segments influence revenue, cash flow, and other critical metrics. With real-time updates, you can adjust forecasts on the fly, enhancing precision and enabling smarter financial decision-making.