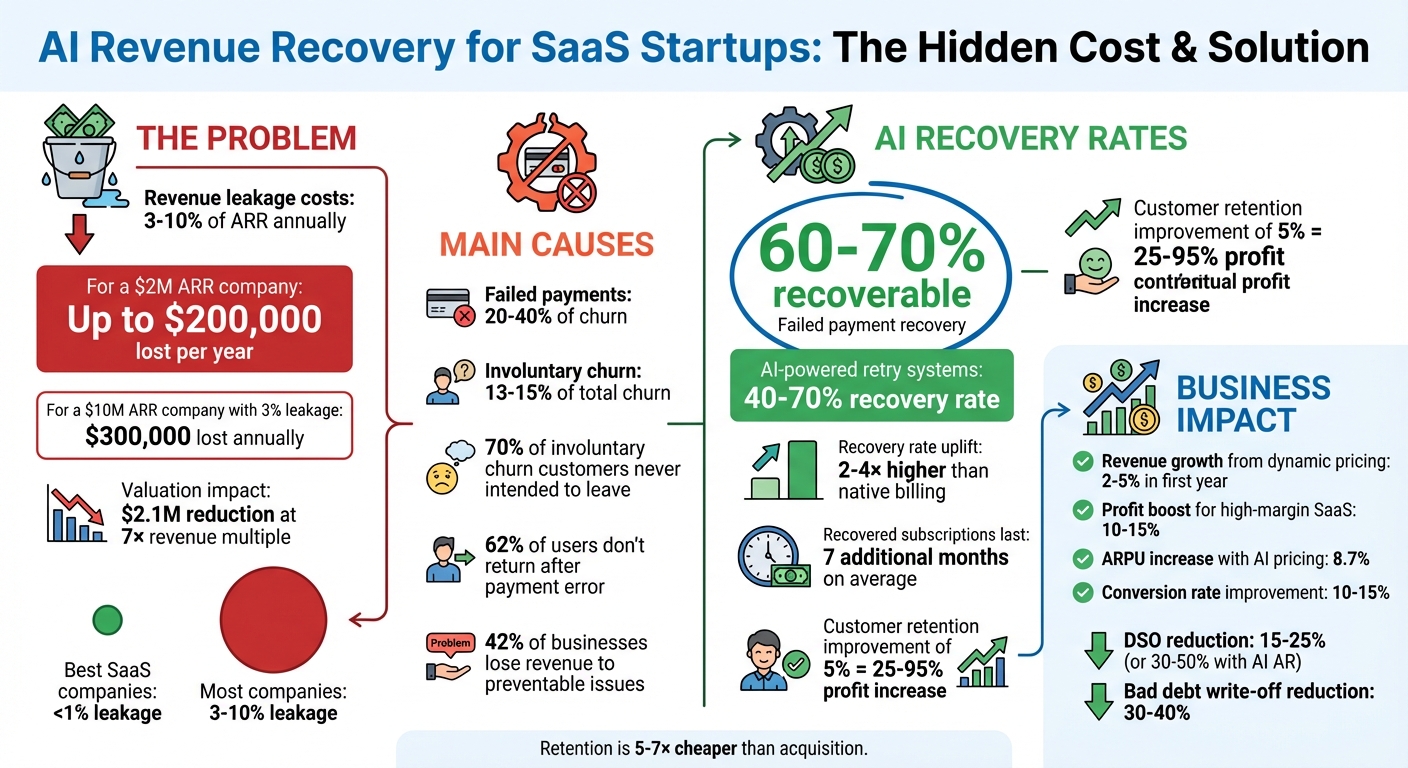

Revenue leakage costs SaaS startups 3–10% of their ARR annually, with common issues like failed payments, billing errors, and unbilled usage. For a $2M ARR company, this can mean losing up to $200,000 each year. The good news? AI can help recover lost revenue by automating retries for failed payments, aligning billing with contracts, and predicting churn to retain customers. These strategies not only plug leaks but also improve cash flow and investor confidence.

Key takeaways:

- Failed payments cause 20–40% of churn but AI can recover 60–70% of these.

- Billing errors like missed price increases or lingering discounts cut into profits.

- AI tools optimize retries, flag at-risk customers, and fine-tune pricing for better revenue capture.

Revenue Leakage Impact and AI Recovery Rates for SaaS Startups

E376:🎙️USING AI TO HELP RECOVER LOST ECOMMERCE REVENUE

sbb-itb-17e8ec9

What Is Revenue Leakage in SaaS Startups

Revenue leakage happens when there's a gap between the revenue you’ve earned and what you actually collect. It’s not about customers canceling or deals falling through - it’s about money that should be in your account but isn’t. Imagine money slipping through cracks in your billing system, month after month, without anyone noticing.

What makes this issue particularly tricky for SaaS startups is that it’s invisible. Unlike customer churn, which is easy to spot in your metrics, revenue leakage hides within disconnected systems and manual processes. For instance, your CRM might show a closed deal, and your product team might report healthy usage, yet somewhere between those systems and invoicing, revenue goes uncollected. As the team at LedgerUp explains:

"Revenue leakage is not primarily a finance problem - it is a systems architecture problem."

The subscription model makes things worse. If there’s a billing error, it repeats every cycle until fixed. For example, a three-month discount you forgot to remove can linger indefinitely, or an annual price increase in a contract might never get applied because it wasn’t set up in the billing system.

Here’s the impact: for a $10 million ARR company, a 3% leakage rate means losing $300,000 every year. And if you’re raising funds, that same leakage could slash your valuation by $2.1 million at a 7× revenue multiple. The best SaaS companies keep leakage below 1%, but most fall between 3% and 10%. That difference could determine whether your startup thrives or struggles to stay afloat. Let’s look at the root causes of this hidden loss.

Common Causes of Revenue Leakage

Failed payments are a major issue. Credit cards expire, funds are insufficient, or payments get declined - and without automated retries, customers who want to pay might drop off your books.

Contract and billing misalignment is another big factor. Sales teams often negotiate pricing tiers, discounts, or annual price increases, but if these details stay in a PDF or email rather than being properly entered into your billing system, mistakes happen. Mid-cycle upgrades might not be billed correctly, and price increases may never kick in.

Unbilled usage is a headache for companies with consumption-based pricing. If your engineering team tracks API calls or storage usage but that data doesn’t sync with invoicing, customers who exceed their limits or use premium features after downgrading might not get charged appropriately.

Missed expansion opportunities are another form of leakage. If a customer reaches their usage or seat limit but no one follows up to upsell them, you’re leaving money on the table. Companies that act on these signals within an hour are nearly seven times more likely to close the upsell than those who delay.

| Leak Point | What Happens | Example |

|---|---|---|

| Failed Payments | Credit card expires or declines; no retry logic | Customer with $500/month subscription churns due to expired card |

| Discount Creep | Temporary discount isn’t removed | 3-month 20% discount continues for 24 months, costing $2,400 |

| Unbilled Usage | Usage data doesn’t sync to billing | Customer uses 150% of API quota; only base plan invoiced |

| Missed Price Increases | Annual uplift isn’t applied | $100,000 contract should renew at $105,000, losing $5,000 |

| Overlooked Expansion | No upsell outreach for usage limits | Customer at 10-seat limit adds 5 users but pays for only 10 seats |

What Happens When You Ignore Revenue Leakage

The most immediate impact is simple: leaked revenue cuts directly into your profits. Since leakage isn’t tied to costs, every dollar lost is a dollar of profit gone. For startups with tight margins, losing 3% to 10% of ARR each year could mean the difference between staying afloat or running out of cash.

Over time, the damage compounds. During due diligence, investors will notice discrepancies between your sales figures and actual collections. A 3% leakage rate, combined with a 7× revenue multiple, could knock 21% off your enterprise value - potentially millions of dollars lost.

There’s also operational fallout. Finance teams end up wasting days trying to reconcile discrepancies. A typical five-day month-end close might stretch to 15 days as your CFO chases down missing invoices and resolves conflicting data. This delays reporting and slows decision-making.

Ignoring revenue leakage can also lead to audit and compliance issues. Weak controls around revenue recognition might result in qualified audit opinions, hurting your IPO readiness and scaring off institutional investors. Leakage can reduce EBITDA by 1% to 5%, a red flag for auditors.

Finally, billing errors can erode customer trust. If invoices include outdated discounts or incorrect charges, customers may dispute them, straining relationships and increasing voluntary churn. In fact, 42% of businesses lose revenue due to preventable issues like these.

These risks highlight why addressing revenue leakage is critical. The next section will explore how AI-driven solutions can help tackle these challenges effectively.

AI Strategies for Recovering Lost Revenue

AI doesn't just identify where revenue is leaking - it actively works to prevent and recover it using three key strategies. These approaches replace manual guesswork with precise automation, tackling the root causes at different points in the customer lifecycle. Let’s break down how these AI tools can seamlessly integrate into your systems.

Using AI to Predict and Prevent Customer Churn

AI can differentiate between voluntary churn (customers canceling intentionally) and involuntary churn (caused by payment failures), enabling tailored strategies for each scenario. By analyzing unstructured data - like emails, support tickets, and Slack messages - AI uncovers early signs of dissatisfaction.

Machine learning models spot red flags before a customer decides to leave. For example, a drop in login frequency, reduced feature usage, or even subtle tone changes in support communications can signal trouble. A major indicator? A sudden increase in contract inquiries. When customers request copies of their contracts or billing terms, it often suggests they’re preparing to exit.

| Churn Risk Indicator | Description | AI Action |

|---|---|---|

| Contract Inquiries | Requests for contract copies or terms | Flag as high-risk; alert Account Manager |

| Sponsor Changes | Champion leaves the company | Trigger outreach to new stakeholder |

| Pricing Friction | Spikes in questions about discounts/billing | Initiate intervention before next invoice |

| Sentiment Shifts | Changes in tone in support threads | Flag for Customer Success review |

By acting on these signals, businesses can proactively engage with customers and reduce churn risks before they escalate. Research shows that improving customer retention by just 5% can increase profits by 25%–95%. The trend is shifting toward AI systems that don’t just predict churn but take immediate action to resolve issues - without waiting for human intervention.

Recovering Failed Payments with Machine Learning

Involuntary churn, which accounts for 13%–15% of total churn, is a major challenge. But with the right AI tools, up to 70% of failed transactions can be recovered - a critical effort, as 62% of users don’t return after a payment error.

AI-powered retry engines replace rigid retry schedules with dynamic timing based on customer behavior, geography, and bank approval patterns. For instance, instead of retrying a payment every three days, machine learning can time retries to align with payday cycles for customers facing insufficient funds. AI also categorizes payment failures using ISO codes, distinguishing between temporary issues (like insufficient funds) and permanent ones (such as a stolen card), ensuring the right follow-up action is taken.

These systems recover between 40% and 70% of failed payments, with recovered subscriptions lasting an average of seven additional months. For example, in 2024, Churnkey analyzed data from 15 million subscriptions and 6 million failed payments, recovering $250 million in revenue for its clients. Similarly, Leonardo AI implemented a retry system that achieved a 40% recovery rate, significantly reducing involuntary churn.

AI also supports preemptive measures, like automated card updater services that refresh expired card details before a payment fails, and pre-dunning workflows that notify customers of potential issues early. As Slicker aptly puts it:

"AI shifts recovery from blunt-force retries to precision medicine for payments".

AI-Powered Pricing and Monetization

Dynamic pricing optimization is another area where AI shines. By analyzing real-time market conditions, customer behavior, usage data, and competitor pricing, machine learning enables businesses to adjust prices dynamically. Rather than applying blanket discounts, AI tailors discounts based on customer engagement data, ensuring they’re both effective and profitable.

AI also evaluates how customers use features to refine subscription tiers, helping maximize average revenue per user (ARPU). For instance, companies using AI-driven pricing tools, like those offered by Zuora, have reported an 8.7% increase in ARPU. Twilio uses similar algorithms to balance competitive pricing with maintaining healthy margins across different customer segments.

Businesses that adopt dynamic pricing strategies often see revenue growth of 2%–5% within the first year. For high-margin SaaS companies, these gains can translate to a 10%–15% profit boost. Additionally, AI-driven discount personalization can improve conversion rates by 10%–15% while safeguarding margins. AI even flags issues like repeated discounting or delayed approvals that could harm profitability.

As Monetizely explains:

"AI-driven dynamic pricing represents the cutting edge of this evolution, allowing SaaS companies to optimize revenue in real time while delivering value that aligns perfectly with customer expectations".

How to Implement AI Tools for Revenue Recovery

Once you’ve identified revenue leakage and explored AI strategies to address it, the next step is putting those tools into action. But before diving in, it’s essential to have a solid foundation. Accurate order-to-cash data is key. As one industry expert wisely noted:

"If we had implemented AI before fixing our systems, it would have flagged everything as an anomaly".

Start by transforming messy transaction data into actionable insights. Gather 6–12 months of decline data (including error codes and timestamps) to establish a recovery baseline and spot recurring patterns. Audit this data to separate temporary issues, like insufficient funds (which make up 44% of declined payments), from permanent problems, such as expired cards.

Selecting the Right AI Tools

Choosing the right AI tools can make all the difference. Focus on solutions with native connectors and performance-based pricing to avoid data silos and ensure cost efficiency. Ideally, work with vendors that charge only for successfully recovered payments, aligning their success with yours.

The best tools go beyond basic retry logic. They analyze granular decline reasons and adapt retry strategies based on customer behavior, geography, and pay cycles. For instance, one pay-for-success model helped clients achieve recovery rates 2–4 times higher than those relying solely on native billing logic.

Adding AI to Your Current Systems

Integrating AI into your existing systems is best done in stages. Begin with data mapping to identify critical signals from billing platforms, CRM systems, payment processors, and usage logs.

| Integration Point | Primary Data Extracted | Purpose for AI Recovery |

|---|---|---|

| CRM (e.g., Salesforce) | Contract terms, renewal dates, deal modifications | Predict churn and uncover upsell opportunities |

| Billing (e.g., Stripe) | Invoices, payment status, usage metering | Automate retries and flag failed payments |

| ERP (e.g., NetSuite) | General Ledger, deferred revenue balances | Streamline journal entries and financial reporting |

| Usage Logs | Feature engagement, login frequency | Detect churn signals early, before cancellations occur |

Start with a pilot program targeting high-impact events like failed payments or sudden usage declines. This allows you to fine-tune alert thresholds without overwhelming your team. For example, a SaaS startup that unified its billing and revenue data saw a 25% drop in audit burden, launched pricing plans three times faster, and doubled its automated workflows.

Another effective tactic is proactive pre-dunning notifications. These alerts flag at-risk customers and prompt them to update payment methods before a failure occurs. This simple step can prevent many of the 10–15% of recurring payments that fail each month.

Once the integration proves successful, you can scale these systems to match your company’s growth.

Scaling AI as Your Company Grows

After validating your pilot results, expand your AI models to ensure recovery improvements keep pace with growth. Regular retraining of these models is crucial to account for changes like new pricing structures, contract updates, and evolving regulations. What works for 500 customers may not suffice for 5,000.

For global operations, consider multi-gateway routing. This approach uses AI to redirect failed payments to alternate gateways with higher approval rates for specific regions or card types. In one case study from 2025, an AI-driven solution achieved a 40% recovery rate by replacing standard billing logic with smarter retry systems.

Monitor recovery rate improvements weekly and refresh AI models quarterly to adapt to new card-issuer rules or economic shifts. Organizations that automate accounts receivable often see Days Sales Outstanding (DSO) reduced by 15–25% and bad debt write-offs cut by 30–40%.

Set guardrails to balance automation with oversight - for example, limit retries and require human approval for high-stakes actions like large refunds or account cancellations. As transaction volumes grow, scalable AI systems can also handle compliance checks, keeping your books audit-ready without adding headcount.

One standout example: a leading media company used AI-powered personalized paywalls and dynamic offers to achieve a 92% lift in conversions, a 118% boost in funnel progression, and a 78% increase in subscriber lifetime value. These results highlight the transformative potential of scaling AI thoughtfully and strategically.

Measuring Results and Best Practices

After successfully integrating AI into your processes, tracking performance is crucial for refining revenue recovery efforts. This step ensures that every phase of AI implementation - from initial predictions to full-scale operations - delivers continuous improvement.

A good starting point is evaluating your recovery rate uplift. This metric reflects the percentage of failed payments or lost revenue your AI system recovers compared to manual methods or static rule-based systems. AI-powered recovery often achieves rates 2–4 times higher than native billing systems. For example, if your baseline recovery rate was 20%, AI could potentially boost it to 40–80%.

Another critical metric is the involuntary churn rate, which tracks customers lost due to payment issues or billing errors, rather than voluntary cancellations. Across SaaS industries, involuntary churn typically accounts for 13–15% of total churn, and a staggering 70% of these customers never intended to leave. For instance, a global streaming platform reduced involuntary churn by 38% using an AI retry engine, increasing Annual Recurring Revenue (ARR) by $4 million. Similarly, a beauty-box subscription service used AI predictive scoring for pre-dunning outreach, achieving an impressive 91% payment recovery rate.

Another key indicator is Days Sales Outstanding (DSO), which measures how quickly you convert invoices into cash. Companies using AI for accounts receivable often see DSO reductions of 30–50%, cutting average payment cycles from 42 days to around 25–35 days. Keep an eye on your collection rate (aiming for 97% or higher) and bad debt rate (targeting less than 1%). Considering that retaining an existing subscriber through recovery is 5–7 times cheaper than acquiring a new one, calculating the ROI of recovery becomes straightforward: compare the cost of your AI tools to the revenue recovered and the savings in Customer Acquisition Cost (CAC) from retaining customers.

For best practices, ensure data hygiene by properly mapping customer IDs and gateway response codes. Poor data quality can undermine AI performance, leading to ineffective model training. Establish guardrails, like setting maximum retry limits, and equip your Finance team with a KPI dashboard that includes real-time alerts for Customer Success. Use versioned logic to safeguard historical data. As Dave Bor, Director of Content at Leapfin, aptly stated:

"The future of the Finance team is architectural. Move from manual operations to system design that scales with product velocity".

To reduce risk, consider pay-for-success models, where AI vendors charge only a percentage of successfully recovered revenue. This approach guarantees a positive ROI and aligns vendor goals with your outcomes. Additionally, analyze recovery rates by customer segment - Enterprise versus SMB - to pinpoint where AI delivers the most value. Let AI handle high-volume, low-complexity failures, while reserving more complex cases for human intervention.

Lucid Financials: AI-Powered Financial Management for Revenue Recovery

When it comes to reducing revenue loss, having specialized AI tools for churn prediction and payment recovery is important - but they can only be as effective as the financial systems they rely on. Issues like delayed reconciliations, misclassified transactions, or outdated data often hide revenue leaks. That’s why real-time, accurate financial management is a must-have foundation for any revenue recovery strategy. This is where Lucid Financials steps in.

Lucid Financials simplifies financial management by combining bookkeeping, tax services, tax credits, and CFO support into a single platform tailored for startups and fast-growing SaaS companies. Unlike traditional accounting methods that depend on monthly closes and manual processes, Lucid’s AI works continuously - processing transactions, matching payments, and flagging anomalies in real time. This ensures you have the clean, actionable data needed to uncover and recover lost revenue.

How Lucid Financials Supports Revenue Recovery

Lucid’s AI streamlines transaction reconciliation across payment gateways and subscription platforms. It identifies anomalies like failed payment retries that went unrecorded, excessive refunds, or untracked account downgrades. Additionally, its real-time forecasts and cash flow projections reveal discrepancies early, enabling you to address issues like billing errors or involuntary churn before they escalate.

The platform also delivers AI-powered forecasts and cash flow insights based on subscription data. This makes it easier to spot when actual revenue starts to drift from expected recurring revenue. Think of it as an early warning system, helping you act before small issues snowball. With Lucid, you can have clean financial books in just seven days, allowing you to seize recovery opportunities without delay.

Lucid even integrates a Slack-based AI assistant for quick insights. Need to know your current MRR or how many payments failed this month? Just ask, and you’ll get immediate answers - no need to wait for month-end reports. For deeper analysis, Lucid’s finance experts review AI-generated data to ensure accuracy and provide strategic advice on closing revenue gaps.

By delivering clear financial data in real time, Lucid not only helps recover lost revenue but also strengthens investor confidence.

Why SaaS Startups Trust Lucid Financials

SaaS startups face unique financial challenges - multiple revenue streams, subscription tiers, usage-based billing, and rapid scaling. Lucid’s AI is built specifically to handle these complexities. It automatically categorizes SaaS-specific transactions and maintains investor-ready reporting that clearly showcases metrics like ARR, churn rates, and unit economics.

With its all-in-one approach, Lucid eliminates the need for juggling multiple tools. Bookkeeping, tax planning, and forecasting all work seamlessly together, with AI ensuring consistency across the board. Starting at $150 per month with flat, predictable pricing, Lucid is designed to fit early-stage budgets without the surprise costs of hourly billing. For startups preparing to raise capital, Lucid provides board-ready reports at the click of a button, ensuring your financials are always ready for investor scrutiny - especially when it comes to revenue metrics and recovery plans.

Conclusion

Revenue leakage can quietly undermine SaaS startups, with failed transactions alone making up 70% of all passive churn in the industry. Without AI-powered systems to address these issues, the losses can snowball, cutting into margins, shaking investor trust, and stifling growth. Here’s the upside: strategies like predictive churn modeling, machine learning-based payment recovery, and dynamic pricing can help reclaim revenue that might otherwise be lost. For instance, AI-driven payment recovery solutions have been shown to recover up to 50% of terminally failed transactions, turning lost opportunities into fuel for growth.

However, even the most advanced AI tools depend on accurate and timely financial data. If your financial records are outdated, transactions are misclassified, or cash flow insights are unclear, the effectiveness of these tools is compromised. This is why real-time financial management is critical. Lucid Financials offers a solution tailored for SaaS startups, combining AI-powered bookkeeping, tax services, and CFO support. With features like clean books delivered in just seven days, real-time Slack-based updates, and on-demand investor-ready reports, Lucid ensures you have the clarity to act quickly and recover revenue before it impacts your runway.

AI-first SaaS companies are already seeing 4–5x higher revenue per employee compared to traditional SaaS businesses. This efficiency stems from reduced customer acquisition costs and viral product adoption, proving that combining a strong financial foundation with AI-driven recovery tools is the key to thriving in today’s competitive landscape. By integrating specialized AI tools with a solid financial base like Lucid, you’re not just patching leaks - you’re building a smarter, more scalable business that attracts investor confidence and operates efficiently.

Switching to AI-powered revenue recovery isn’t just a good idea - it’s a necessity. It’s how modern SaaS startups protect their margins, extend their runway, and achieve sustainable growth. Start by securing your financial data, then leverage AI to transform lost revenue into new opportunities for growth. Don’t wait - take action today.

FAQs

How do I calculate our revenue leakage rate?

To figure out your revenue leakage rate, you’ll need to compare what you should have earned to what you actually collected. Start by subtracting your actual collected revenue from your expected revenue, then divide that result by the expected revenue.

Here’s the formula:

(Expected Revenue - Actual Revenue) / Expected Revenue

This calculation reveals the percentage of revenue slipping through the cracks, often due to things like billing mistakes or unbilled services. For SaaS companies, this can add up - on average, they lose around 3–5% of their annual recurring revenue (ARR) to leakage.

What data do I need before using AI for payment recovery?

Before diving into AI for payment recovery, it’s crucial to first collect and analyze essential data about your customers’ payment behaviors. This includes their payment history, how often they make payments, and any recurring issues that lead to failed transactions. Take a close look at failure rates, break down customer segments, and review the effectiveness of previous recovery strategies.

To make AI-driven recovery efforts work, you’ll also need real-time access to critical data. This means having up-to-date information on invoice statuses and customer communication records. Using APIs that connect your banking, CRM, or accounting systems can provide this data, allowing AI tools to predict potential failures and automate recovery processes with precision.

How can I prevent unbilled usage in usage-based pricing?

To avoid unbilled usage in a usage-based pricing model, focus on three key areas: accurate event capture, automated billing, and real-time monitoring. Leveraging AI-powered detection tools can pinpoint billing errors, system inconsistencies, or contract misalignments that might result in missed charges. Consistent tracking of consumption and ongoing oversight are essential to ensure precise billing and reduce the risk of revenue loss.