AI-powered investor matching simplifies fundraising by connecting startups with investors who align with their goals. Using machine learning, these tools analyze your startup’s profile - like industry, funding stage, and location - and assign Match Scores (30–100) to rank potential investors. This approach saves time, improves outreach efficiency, and increases the likelihood of finding the right backers.

Key Benefits:

- Time Savings: Cuts prospecting time by up to 65%, identifying top matches in minutes.

- Better Matches: Focuses on investors with recent activity and relevant portfolios.

- Pitch Readiness: Evaluates pitch decks and flags gaps to improve investor appeal.

- Higher Success Rates: Boosts response rates to 30–40% with targeted outreach.

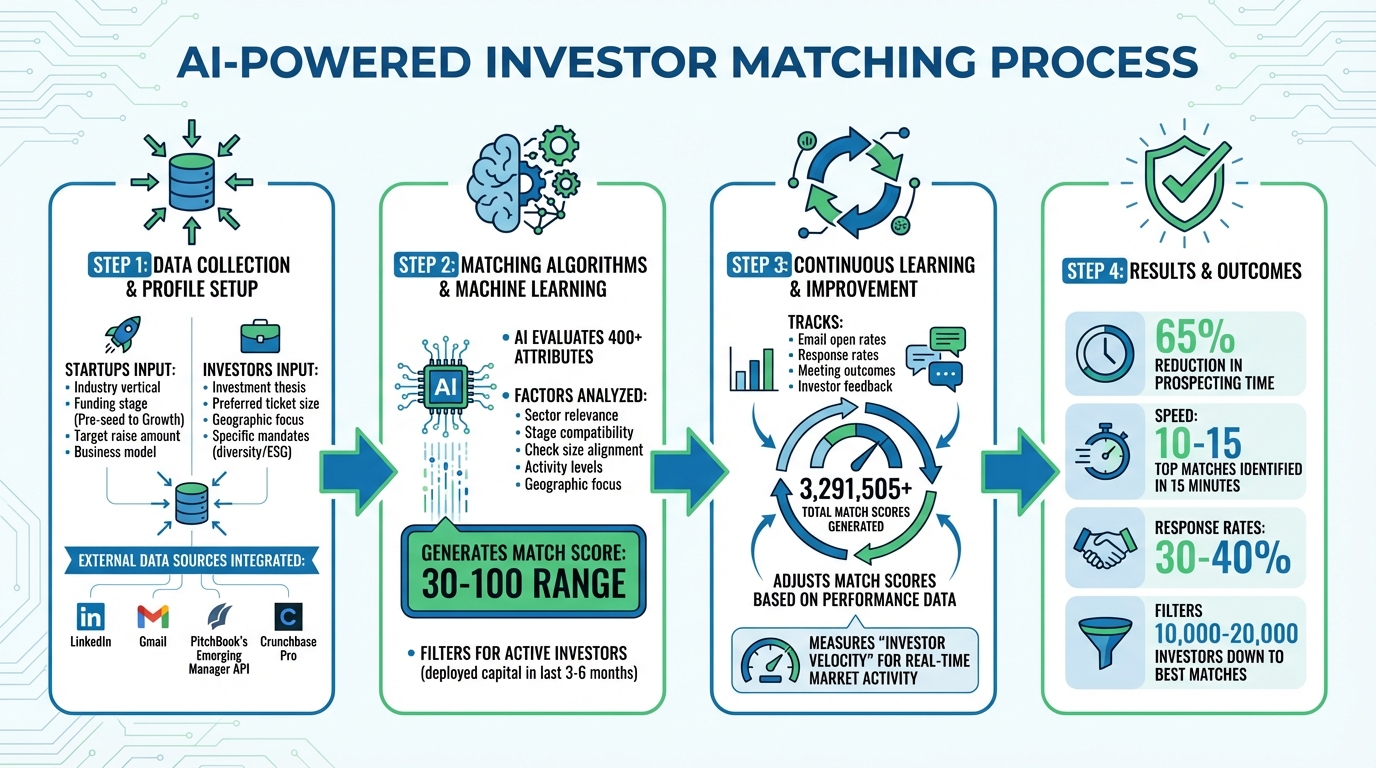

How It Works:

- Data Collection: Startups and investors provide details like funding goals, sector focus, and deal history.

- Matching Algorithms: AI evaluates 400+ attributes to calculate Match Scores.

- Continuous Learning: Tracks outreach metrics to refine future matches.

By focusing on precision and preparation, AI-powered tools streamline the fundraising process, helping startups connect with investors who are more likely to invest.

How to Find Investors & Funding the SMART Way with Startups.com (Expectations vs. Reality)

sbb-itb-17e8ec9

How AI-Powered Investor Matching Works

How AI-Powered Investor Matching Works: 4-Step Process

Data Collection and Profile Setup

The process kicks off with startups and investors providing key details about themselves. Founders input information such as their industry vertical, funding stage (ranging from Pre-seed to Growth), target raise amount, and business model. On the other hand, investors share their investment thesis, preferred ticket size, geographic focus, and any specific mandates, like diversity or ESG criteria.

These platforms don’t just rely on user-provided data. They also pull in external data from sources like LinkedIn, Gmail, PitchBook's Emerging Manager API, and Crunchbase Pro. This helps track investment histories and network connections, building detailed profiles for both parties. Once these enriched profiles are ready, the AI engine works quickly to calculate the best matches.

Matching Algorithms and Machine Learning

After gathering the data, the AI engine evaluates around 400 different attributes - including sector relevance, stage compatibility, check size alignment, activity levels, and geographic focus - to create a Match Score, typically ranging from 30 to 100. By analyzing historical investment patterns, the system identifies investor preferences across stage, sector, and geography. It also highlights investors who have a proven track record of funding similar companies.

To save founders from wasting time on inactive leads, the system filters for active investors - those who have deployed capital in the last 3 to 6 months.

Continuous Learning and Improvement

The system doesn’t stop refining itself after the initial matches. By integrating tools like Gmail and LinkedIn, it tracks email open rates, response rates, and other outreach metrics to identify what’s working. It also factors in meeting outcomes and investor feedback to improve its recommendations. One platform has already generated over 3,291,505 unique match scores, constantly improving its predictive accuracy.

Another key feature is the tracking of "Investor Velocity", which measures how likely an investor is to make a deal within a specific timeframe. This real-time data helps adjust match scores to reflect current market activity. Jason Kirby, Managing Partner at Thunder, highlights the system’s fairness:

Our match scores keep the system honest and open for unlikely matches to level the playing field

.

Key Features of AI-Powered Investor Matching

Automated Sourcing and Screening

AI platforms sift through databases of 10,000–20,000 investors, including venture capital firms, angel investors, and accelerators, to pinpoint those actively deploying funds. These tools can filter thousands of potential investors and narrow them down to 10–15 top matches in just 15 minutes. They also find "stage specialists" - investors who allocate at least 40% of their portfolio to seed rounds.

What sets these tools apart is their ability to aggregate data from sources like news articles, LinkedIn, and deal histories. This approach uncovers "hidden" investors, such as family offices and boutique funds, that are often overlooked in mainstream databases. Hillary Lin, Co-Founder & CEO of Elevate X Health, shared her experience:

Flowlie's investor database helped us find the ideal investors for our round. The automated discovery saved us at least 100 hours of manual research and verification.

Additionally, the screening prioritizes investors who have deployed capital within the last 3–6 months, helping founders focus on active funds and avoid wasting time on inactive ones.

Once the initial matches are identified, predictive due diligence takes the process a step further by analyzing your pitch deck against proven funding benchmarks.

Predictive Due Diligence

Before reaching out to investors, AI evaluates your pitch deck using insights from thousands of successful funding rounds. It generates Investor Readiness Scores, identifying gaps in areas like market size estimates, financial projections, or go-to-market strategies. By highlighting these issues early, founders can address potential red flags and strengthen their pitch.

This proactive approach not only boosts credibility but also increases the likelihood of securing meetings with investors. After refining your pitch, advanced fit analysis ensures you’re connecting with the most compatible investors.

Advanced Fit Analysis

AI goes beyond basic filters to provide Match Scores (ranging from 30 to 100) by analyzing factors such as an investor's portfolio history, recent investment activity, and alignment with your company’s focus. This level of analysis helps distinguish between investors who are merely familiar with your sector and those who actively prioritize it. For seed-stage startups, this insight is invaluable, especially when identifying investors with a track record of leading funding rounds - a key factor in securing an anchor investor.

The platform also identifies warm introduction paths within your network, turning cold outreach into more effective connections. Interestingly, about 20% of the variability in match scores comes from your startup's "Company Score", which helps level the playing field for startups outside traditional networks.

Benefits for Startups

AI-powered matching offers startups a range of practical advantages that can make a real difference in their fundraising efforts.

Time Savings and Efficiency

AI-driven tools slash prospecting time by up to 65%, cutting hours of manual research down to just 15 minutes to identify 10–15 top investor matches. Instead of sifting through thousands of potential investors, startups get a streamlined, targeted list, taking the guesswork out of the process. This kind of precision also boosts targeted outreach, with response rates reaching an impressive 30–40%. As Vahid Fakhr, Founder and CEO of Evalyze, aptly states:

Founders should spend more of their time building and less of their time guessing which investors to contact next

.

By speeding up the process and removing inefficiencies, startups can focus more on growth while also improving their reputation in the market.

Stronger Credibility

Efficiency isn't the only advantage - credibility gets a boost too. Before you even begin outreach, AI evaluates your pitch deck using data from over 8,000 successful funding applications. It provides an investor-readiness score, pinpointing gaps in areas like market sizing, financial projections, or go-to-market strategy. This ensures your pitch is polished and professional.

Take Swiipr Technologies, for example. In 2024, this fintech startup used AI-driven tools to identify investors aligned with their goals, ultimately raising $7.6 million in Series A funding. Similarly, Ivent Pro secured $500,000 in seed funding by leveraging AI to connect with investors who were a perfect fit for their niche sector. These stories highlight how a data-driven approach can make a pitch more compelling to potential backers.

Better Investor Alignment

AI doesn't just help you find investors - it helps you find the right investors. By analyzing portfolio history, recent activity, and sector focus, AI pairs startups with backers who genuinely align with their industry and growth stage. It can even differentiate between investors who occasionally dabble in a sector and those who dedicate at least 25% of their portfolio to similar companies.

This level of precision ensures you're not just securing funding but building meaningful partnerships with investors who understand your mission and can provide valuable connections and guidance. These partnerships can be instrumental in driving long-term success.

How to Get Started with AI-Powered Investor Matching

Getting started is straightforward: create a detailed profile, define the type of investor you need, and ensure your financials are ready for investor scrutiny. By following these steps, you can set yourself up for accurate and effective investor matching.

Step 1: Set Up Your Profile

Your profile is the backbone of the matching process. The more detailed it is, the better the AI can align you with the right investors. Include key information such as your industry sector (e.g., SaaS, Fintech, ClimateTech), funding stage (Pre-Seed, Seed, Series A, etc.), target funding goal, and geographic focus. Upload essential documents like your pitch deck and business plan, and add details like your business model, founder background, and relevant industry tags to refine the matching process.

For an added edge, link your professional accounts to help facilitate warm introductions. Advanced platforms often use over 20 filters - ranging from check size preferences to historical investment trends - to fine-tune potential matches.

Step 2: Specify Your Ideal Investor

Clarity is key when defining your ideal investor. Focus on those who specialize in your funding stage rather than generalists who invest across multiple stages. Be clear about your desired check size, keeping in mind that most investors write checks that are 1% to 2% of their total fund size.

You’ll also want to define your geographic preferences and sector focus. Look for investors who not only understand your industry but dedicate a significant portion of their investments to it. Additionally, prioritize those who have been active recently - investors who have made at least one deal in the past three to six months are more likely to engage. If you need a lead investor, target those with a proven track record of leading funding rounds.

Step 3: Review and Act on AI Matches

Once matches are generated, review them carefully based on their relevancy scores, which typically range from 30 to 100. Focus on high-scoring matches for your initial outreach, as these are most likely to align with your profile. Use the insights provided - like portfolio trends, recent investments, and sector focus - to craft personalized outreach strategies.

High-precision targeting can lead to impressive results, with open rates of 40–60% and response rates of 15–25%. Historically, in a campaign targeting 200 investors, about one-third may not respond, one-third might pass, and the final third could agree to a meeting. Concentrating your efforts on the most promising matches increases the likelihood of success. Once you’ve narrowed your list, ensure your financials are ready to back up your outreach.

Step 4: Prepare Your Financials

Before reaching out, make sure your financials are polished and ready for investor review. Your financial model should clearly outline projections, burn rates, and exit strategies. Since investors spend less than three minutes reviewing a pitch deck, your financial highlights need to be concise and easy to understand. Accurate and up-to-date financial data adds credibility to your profile and builds trust with potential investors.

This is where Lucid Financials can make a big difference. Their AI-powered bookkeeping service delivers clean financial records in just seven days, along with real-time reporting and board-ready investor reports that can be generated with a single click. With seamless Slack integration, Lucid Financials provides instant access to key metrics like runway and burn rate - exactly the kind of details investors will ask about. Starting at $150 per month, the platform also offers AI-powered forecasts, cash flow insights, and scenario modeling to keep your financials organized and ready for due diligence. Considering that 10% to 20% of second meetings could lead to a term sheet and a deep-dive financial review, having your numbers in order from the start can make all the difference.

Conclusion

AI-powered investor matching reshapes seed fundraising by reducing prospecting time by 65%. Instead of spending weeks on research and sending countless cold emails, startups can now focus on connecting directly with investors who are actively looking to deploy capital. This shift from a scattershot strategy to precise targeting significantly boosts the odds of closing a funding round by aligning with stage-specific investors.

However, success still depends on thorough preparation. Having complete profiles, clearly defined investor criteria, and well-organized financials is essential to instill confidence in potential investors.

This is where tools like Lucid Financials come in. Lucid simplifies financial management by offering clean books in just seven days, real-time Slack updates, and instant, board-ready investor reports. With features like AI-driven forecasts, runway tracking, and scenario modeling - all starting at $150 per month - you’ll have the financial transparency investors expect, whether it’s your first pitch or during due diligence.

While AI tools can identify the right investors in as little as 15 minutes, they can’t fix disorganized finances. Combining precise investor targeting with polished, investor-ready reporting not only speeds up the fundraising process but also builds credibility and ensures alignment with the right partners.

FAQs

How does AI help startups connect with the right investors?

AI plays a key role in streamlining the investor matching process by sifting through massive datasets, such as investor preferences, funding histories, and startup profiles. This level of analysis leads to highly precise matches, cutting down on wasted time and improving the odds of finding the perfect partnership.

By automating repetitive tasks like due diligence and enabling tailored outreach on a large scale, AI allows startups to connect with investors more efficiently. This translates to quicker engagement, stronger connections, and improved chances of securing the funding they need.

How does AI match startups with the right investors?

AI simplifies the process of connecting startups with investors by analyzing important elements like industry focus, business stage, funding goals, geographic location, and investor preferences. It also looks at historical investment trends and assesses how well a startup's characteristics match an investor's interests.

By using this data, AI makes it easier for startups to find investors who are the best fit for their goals and vision, saving time and effort for both parties.

How can startups prepare their financials for AI-powered investor matching?

To get ready for AI-powered investor matching, startups need to ensure their financial records are accurate, well-organized, and updated regularly. Bringing all financial data into one centralized system can help maintain clarity and consistency.

Tools like Lucid Financials can make this task easier by offering real-time reports and benchmarks that are ready for investors. With tidy records and continuous reporting, you’ll be in a strong position to demonstrate your financial health and attract the right investors with ease.