Startups in 2025 face intense pressure to stay financially precise and fast. Relying on outdated tools like spreadsheets won’t suffice anymore. AI-driven portfolio insights take over by:

- Monitoring financial data in real time to catch issues before they escalate.

- Forecasting and scenario planning to test decisions like hiring or budget cuts in minutes.

- Generating investor-ready reports instantly, ensuring you're always prepared for board meetings or funding rounds.

Platforms like Lucid Financials integrate with your systems, cleaning up your books and automating repetitive tasks. These tools let startups track burn rate, runway, and revenue dynamically, helping founders focus on growth while maintaining financial clarity. AI insights are no longer optional - they’re a must for startups aiming to secure funding and scale efficiently.

What Makes Up AI Portfolio Insights

AI portfolio insights go beyond being just fancy dashboards - they're built on three essential components that work together to provide a well-rounded financial overview. By turning raw data into actionable insights, AI helps startups make quicker and smarter decisions. These three elements transform numbers into meaningful strategies, paving the way for informed decision-making.

Live Data Integration

AI tools link directly to accounting platforms through APIs, removing the hassle of manual spreadsheet updates or waiting for month-end reports. Metrics like cash flow, burn rate, and revenue are updated in real time as transactions occur.

Instead of relying on overnight batch processing, many platforms now connect to over 150,000 data sources, providing near-instant updates. This means you can monitor portfolio performance dynamically without manual effort. When AI pulls live data from sources like bank accounts, payment processors, and accounting software, you're always working with the freshest information.

For startups, this real-time integration is a game changer. Imagine checking your runway on a Tuesday afternoon and confidently making a hiring decision by Wednesday morning. Tools that gather unstructured data from emails and files and turn it into structured insights allow founders to track key metrics in real time and identify potential issues early.

Once real-time data is flowing securely, the focus shifts to forecasting and planning for the future.

Automated Forecasting and Scenario Planning

AI doesn’t stop at reporting the past - it looks ahead and helps you test different possibilities. Automated forecasting uses historical data and current trends to create financial projections, while scenario planning lets you explore "what if" situations before making critical decisions.

For instance, AI can simulate how hiring more engineers might affect your runway or predict the impact of losing a major client next quarter. What used to take 40 hours of research can now be done in minutes. By analyzing reports and news, AI can even flag risks or provide buy/sell recommendations. This forward-looking approach helps startups address potential problems before they arise, protecting financial health.

AI also identifies patterns that might go unnoticed in traditional spreadsheets and continuously updates projections as new data comes in. For the 2025–2026 funding cycles, this ensures your financial forecasts remain accurate and up-to-date when shared with investors.

Reports Ready for Investors

Gone are the days of scrambling before board meetings - AI can automatically generate reports tailored for investors. By pulling live metrics, AI ensures accuracy and creates clear visualizations of key data, such as ROI tracking and lifecycle stages, making it easier to build transparent fundraising decks.

With $5.7 billion raised by AI-related companies in January 2025 alone, investor expectations have risen dramatically. Platforms like Lucid Financials can produce board-ready reports and investor-grade forecasts with just one click, ensuring you're always prepared for fundraising discussions and due diligence. When your reports update automatically as your business evolves, you're ready to tackle tough investor questions at any moment.

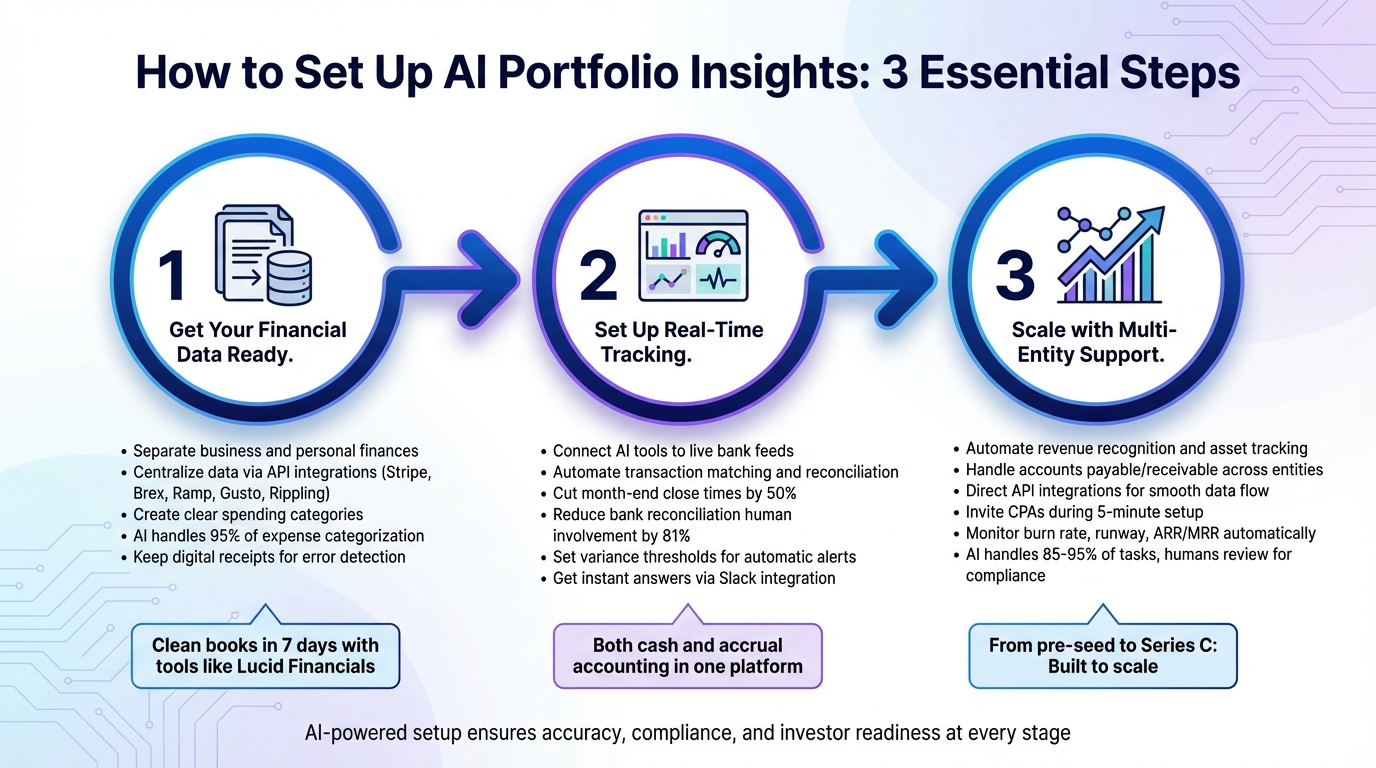

How to Set Up AI Portfolio Insights

3-Step Guide to Setting Up AI Portfolio Insights for Startups

Getting AI portfolio tools up and running starts with clean data, connected systems, and scalable processes. Here’s how to prepare your financial data, establish real-time tracking, and ensure your tools can grow with your business.

Getting Your Financial Data Ready

Before you can rely on AI tools, your financial data needs to be well-organized. Start by separating your business and personal finances - open a dedicated business bank account from day one. This simple step prevents headaches during fundraising and due diligence.

Next, centralize your data by integrating tools like Stripe, Brex, Ramp, Gusto, and Rippling through APIs. Create clear spending categories (e.g., marketing, payroll, software), and let AI handle up to 95% of future expense categorization.

"Clean books aren't just a compliance requirement. They're the foundation of investor readiness, tax savings, and understanding your company's burn rate and runway."

– Kevin A. Thomas, Founder, Omniga

If you’re migrating from legacy systems like QuickBooks, use read-only integrations to pull in historical financial statements and trial balances. Keep digital copies of receipts for AI-driven error detection. Tools like Lucid Financials can clean up your books in just seven days, giving you a strong starting point for AI-powered insights without lengthy delays.

Setting Up AI Tools for Real-Time Tracking

Once your data is clean and organized, it’s time to activate real-time monitoring. Connect your AI tools to live bank feeds so every transaction is automatically matched and reconciled - eliminating the need for manual monthly reconciliations. Modern AI accounting systems can cut month-end close times in half and reduce human involvement in bank reconciliations by 81%.

Set up variance thresholds to flag unusual expenses or anomalies automatically. For instance, if software costs suddenly spike, you’ll get an instant alert. Lucid Financials integrates with platforms like Slack, allowing you to ask questions such as "What’s our current runway?" and receive instant AI-generated answers. For more complex needs, human experts are always available.

Streamline tasks like handling invoices and receipts by sending them via email or snapping photos on your phone - AI tools will automatically capture and categorize the data. The best systems provide both cash accounting for daily decisions and accrual accounting for investor reports, all within the same platform.

Supporting Multi-Entity and Scaling Startups

As your business grows, your AI systems need to scale with it. From pre-seed to Series C, advanced AI-led accounting tools can manage complex needs like automating revenue recognition, tracking fixed assets, and handling accounts payable and receivable across multiple entities. Direct API integrations ensure data flows smoothly without delays caused by intermediary tools.

During the initial five-minute setup, invite CPAs or tax experts to configure the system properly for future audits and fundraising. Automate monitoring of critical metrics like cash burn, runway, and ARR/MRR - key figures that investors prioritize during funding rounds.

Use a "permissioned AI" approach, where AI drafts financial statements and human experts, like CPAs or bookkeepers, review them for GAAP compliance and tax accuracy. This method allows AI to handle 85% to 95% of repetitive tasks while reserving human expertise for advisory work. Lucid Financials operates on this model, blending AI efficiency with human oversight to keep your processes accurate and compliant as your company scales.

Using AI Insights to Drive Growth

Once your AI systems are up and running, the real value lies in turning the insights they generate into action. AI takes raw data and transforms it into practical insights that help you make quicker, smarter decisions - decisions that directly fuel growth. These insights can help startups streamline operations, uncover tax savings, and improve how they communicate with investors.

Spotting and Acting on Financial Patterns

AI excels at processing large, complex datasets to uncover trends and potential problems that traditional analysis might overlook. With real-time, up-to-date data, AI can flag issues before they spiral out of control. For instance, it can alert you when your burn rate rises unexpectedly or when expenses surpass budget limits. Predictive analytics go a step further, allowing you to make proactive adjustments - whether that’s refining cash flow, trimming unnecessary expenses, or reallocating budgets more effectively.

For example, AI can help optimize cash flow by pinpointing and cutting wasteful spending right away. If it detects that your marketing budget isn’t delivering the expected results, you can shift those funds to higher-performing channels in just days instead of weeks. Tools like Lucid Financials even deliver these alerts directly in Slack. You could ask, “What’s causing our increased burn this month?” and instantly get a detailed breakdown, enabling you to act quickly before your cash reserves dwindle.

Finding Tax Credits and Managing Founder Finances

AI tools integrate seamlessly with your financial systems to uncover overlooked tax credits and streamline founder-specific finances. These tools can reduce R&D and general administrative costs while accurately tracking expenses to ensure eligibility for R&D tax credits. They also handle unique founder scenarios - like equity compensation, grants, multi-entity setups, and specialized deductions - by identifying risks and opportunities early on.

Startups running lean operations with the help of AI often achieve higher revenue per employee. In fact, these teams tend to be 40% smaller than their competitors, largely because AI automates tasks like compliance and fraud detection. It flags irregularities and unsustainable practices before they escalate into regulatory issues. With Lucid Financials, you get AI-powered insights combined with expert tax support, ensuring that you capture every credit available while maintaining compliance as your business grows.

Improving Forecast Accuracy for Investors

AI doesn’t just stop at spotting patterns and tax efficiencies - it also enhances financial forecasting, which is crucial for building investor confidence. Investors demand reliable projections, and AI delivers by continuously learning from your company’s data. Over time, machine learning refines these forecasts, making them increasingly accurate with each funding round, board meeting, or strategic shift.

AI-powered startups at the seed stage often secure valuations 20% higher than their peers, with that premium jumping to 60% by Series B. This is partly because these startups demonstrate stronger financial discipline and data-driven decision-making. AI also helps reduce time-to-market by 5% and boosts product manager productivity by 40%, giving you tangible metrics to present to investors. With tools like Lucid Financials, you can update forecasts with a single click, ensuring your financial projections are always accurate, current, and aligned with the key performance indicators investors care about most.

sbb-itb-17e8ec9

Scaling AI Tools with Your Startup

As your startup grows, your AI tools must evolve to match your expanding needs. What worked for a small team of five may no longer suffice when managing multiple entities and navigating complex funding scenarios. Modern AI tools are designed to grow with you, handling increased complexity without requiring a complete overhaul. Let’s dive into how these tools adapt to your startup’s journey.

How AI Tools Grow with Your Business

AI tools are not just static solutions - they evolve alongside your business operations. For example, as your startup expands from a single entity to multiple subsidiaries or even international operations, AI systems can consolidate and monitor all entities seamlessly. Many tools also provide portfolio insights across various stages - development, piloting, and production - helping you track costs and benefits. This ensures you avoid overspending on low-impact projects and focus on initiatives with the highest return on investment (ROI).

On the technical side, advanced AI platforms can process massive amounts of data in near-real-time, pulling from thousands of sources. This is particularly valuable as your transactions, entities, and data points grow exponentially. For instance, Lucid Financials is built to handle multi-entity structures from the outset, automatically consolidating financial data across your organization while preserving granular details for each subsidiary. As your data scales, these tools refine forecasts and generate more accurate alerts, keeping your operations running smoothly.

Preparing for 2025-2026 Funding Patterns

The funding environment for AI-driven startups remains strong, but standing out in 2025-2026 will require more than just having AI on your resume. Investors are increasingly focused on transparency and measurable ROI. Startups must demonstrate how their AI initiatives translate into tangible business outcomes.

To meet these expectations, you’ll need to monitor costs like training, infrastructure, and maintenance while tracking measurable results such as revenue growth or cost savings. Tools that aggregate this data for real-time performance tracking can provide the metrics investors demand during due diligence. With Lucid Financials, for example, you can generate investor-ready forecasts that clearly show how your AI investments impact the bottom line. This level of clarity and accountability can give you an edge in funding rounds, where data-backed proof of value is becoming a non-negotiable.

Using Real-Time Alerts to Stay Informed

As your startup scales, staying ahead of financial risks becomes more challenging. Real-time alerts can be a game-changer, helping you identify potential issues before they escalate. AI systems continuously analyze historical data and market conditions, flagging anomalies in cash flow, expense trends, or performance metrics. This proactive approach is invaluable when you’re managing multiple priorities and don’t have time to manually review every detail.

Some platforms take this a step further by automating insights from emails and files, delivering structured data within seconds. Others monitor external risks and enable quick portfolio adjustments, cutting down manual analysis time by up to 80%. For instance, Lucid Financials integrates with Slack, allowing you to ask questions like “Why did our burn rate increase this week?” and receive immediate, detailed answers without disrupting your workflow. These real-time alerts ensure you stay informed and maintain financial clarity, no matter how complex your operations become - from seed funding to Series C and beyond.

Conclusion

AI-driven portfolio insights have reshaped how startups handle their financial operations. Tasks like consolidating data, creating forecasts, and preparing investor reports - once time-consuming and tedious - can now be completed in mere minutes. This shift not only improves clarity and speeds up decision-making but also frees up time for founders to focus on scaling their businesses. In today’s challenging funding landscape, moving from reactive number-crunching to proactive financial planning is no longer optional.

The numbers back this up. In January 2025 alone, AI-related companies raised $5.7 billion. With such high stakes, investors now demand clear ROI and transparent financial tracking. Some AI tools have drastically cut research time, going from 40 hours to near-instant analysis, processing data from up to 60,000 stocks and over 150,000 sources. This level of efficiency has become a baseline requirement for competitive startups.

However, speed is meaningless without accuracy. The most effective AI tools combine automation with human expertise to ensure your financial data is clean, forecasts are dependable, and reports meet investor expectations. Take Lucid Financials, for example: they deliver clean books in just seven days, provide real-time Slack support for immediate questions, and offer always-on, investor-ready reporting. This blend of technology and professional oversight ensures startups can maintain high standards while scaling.

Of course, growth introduces its own complexities. Scaling often brings challenges like managing multiple entities, navigating tax credits, handling founder equity, and maintaining dynamic cash flow. AI portfolio tools adapt to these demands, allowing startups to scale without adding unnecessary headcount or slowing down operations. Predictive analytics further enhance readiness, helping startups seize opportunities and stay prepared for their next funding round.

AI portfolio insights have gone from being a nice-to-have to an essential tool for modern startups. Whether you’re gearing up for a new funding round or striving for greater financial clarity, the right AI-powered solutions give you the control and confidence to stay ahead.

FAQs

How can AI-powered portfolio insights help startups make smarter financial decisions?

AI-powered portfolio tools give startups a dynamic, real-time view of their financial health by turning raw data into meaningful insights. By analyzing structured data like bank transactions and invoices, alongside unstructured data such as market trends, AI can uncover patterns, flag unusual activity, and calculate critical metrics like cash flow, burn rate, and runway - all without the need for manual intervention. This means founders can spot potential risks early, like unexpected expenses or revenue shortfalls, while also producing investor-ready reports that align with compliance requirements.

But it's not just about speed. AI also brings depth to decision-making with advanced forecasting and scenario modeling. It can quickly simulate "what-if" scenarios - like adjusting hiring plans, pricing strategies, or funding levels - and reveal how these changes might impact cash flow and profitability. These insights help startups make smarter choices about resource allocation, control costs, and prioritize growth. In many cases, startups see measurable returns on investment within months, as AI transforms financial management into a strategic tool for faster, more confident decision-making.

How can startups prepare their financial data for AI-powered insights?

To get your financial data ready for AI-driven insights, start by making sure your records are well-organized and accurate. Gather all your accounting, payroll, banking, and payment data into a single platform, and resolve any inconsistencies. Ensure transactions are correctly categorized, use the U.S. date format (MM/DD/YYYY), and display amounts in dollars with standard thousand separators (e.g., $1,000.00).

Next, focus on standardizing your chart of accounts and connecting your bookkeeping software and bank feeds via APIs. This allows real-time data syncing, breaking down silos and ensuring the AI system always has the most up-to-date information. Then, define the key metrics you want to monitor - such as monthly recurring revenue (MRR), burn rate, cash runway, or customer acquisition cost (CAC) - and link these metrics to the relevant data fields. Automating data refresh cycles will ensure your insights stay current without requiring constant manual updates.

By organizing your financial data and integrating your systems, AI tools like Lucid Financials can effortlessly provide actionable insights, flag anomalies, and generate investor-ready reports - all without the need for manual intervention.

How do AI tools grow with a startup’s financial needs as the business scales?

AI-powered finance tools are built to grow with your startup, handling the increasing challenges that come with scaling. In the early stages, they take care of the basics - bookkeeping, tracking expenses, and monitoring cash flow. Plus, they offer real-time dashboards that highlight crucial metrics like your runway and burn rate, keeping you in the loop at all times.

As your business expands - whether you're adding revenue streams, hiring more team members, or gearing up for funding rounds - these tools step up their game. They pull together data from accounting systems, payroll, and banks to provide dynamic forecasts and quick scenario analyses. They can spot anomalies, assess risks, and even create investor-ready summaries, all while keeping your financial management costs under control.

What makes these tools even more powerful is their ability to learn and improve over time. They can suggest budget tweaks, simulate "what-if" scenarios, and help you make smarter decisions about resource allocation. Whether you're managing a $500,000 seed round or navigating a multi-million-dollar Series C, AI transforms from a task automator to a key player in your financial strategy.