AI is transforming how startups manage financial KPIs, helping founders make faster, data-driven decisions. Key takeaways include:

- Investors demand data-backed financial performance: Metrics like burn rate, revenue growth, and customer acquisition costs are critical for AI startups to secure funding.

- AI simplifies financial management: Tools automate reporting, provide real-time insights, and improve forecasting accuracy.

- Unique challenges for AI startups: Higher infrastructure costs and lower gross margins (50-60% vs. SaaS's 75%+) require careful KPI management.

- Key metrics to track: Burn multiple (<2x), CAC-to-LTV ratio (4:1 or better for AI startups), and runway (18-24 months).

- AI platforms like Lucid Financials: Automate bookkeeping, forecasting, and investor-ready reporting, saving time and ensuring accuracy.

AI tools bridge the gap between technical progress and financial outcomes, enabling startups to align growth strategies with investor expectations.

The KPI Revolution: Turning Data into Decisions Using AI - With Michael Schrage of MIT

Key Financial KPIs for Startups

Startups thrive by focusing on essential KPIs that act as the cornerstone for both survival and growth. These metrics are not just numbers - they guide critical decisions, especially when paired with AI tools that track performance and align financial goals with operational strategies.

Revenue Growth Rate and Burn Rate

The revenue growth rate measures how quickly a startup's revenue is increasing. For early-stage companies, venture capitalists often expect 100%+ year-over-year growth, signaling strong market traction. But growth alone isn't enough. Pairing it with your burn rate - the pace at which you're spending capital - gives a fuller picture of your financial health.

This pairing leads to the burn multiple, a key efficiency metric. Ideally, the burn multiple should stay under 2x, meaning you’re spending less than $2 for every $1 of new Annual Recurring Revenue (ARR) generated. A lower burn multiple indicates you’re scaling sustainably, while a higher one raises red flags about inefficiency.

Your burn rate also determines your runway, or how long your cash reserves will last. Most investors prefer startups to maintain 18-24 months of runway. For instance, if your burn rate is $100,000 per month, you’d need $1.8–$2.4 million in the bank to meet this standard.

"As we scaled, budgeting and cash flow became critical. Lucid's CFO services give us the visibility we need, while their bookkeeping and tax support keep everything accurate and stress-free. It's been a game-changer for our operations." - Luka Mutinda, Founder and CEO @Dukapaq

AI startups, in particular, face higher infrastructure costs, making it even more challenging to balance burn rate and runway.

Customer Acquisition Cost (CAC) and Lifetime Value (LTV)

The CAC-to-LTV ratio measures the sustainability of your customer acquisition strategy. A healthy ratio is 3:1 or better, meaning each customer should bring in at least three times the value it costs to acquire them.

For AI startups, this calculation is trickier due to higher infrastructure costs included in the cost of goods sold (COGS). Traditional SaaS companies often enjoy gross margins above 75%, but AI startups typically operate in the 50-60% range because of compute-heavy workloads. This means AI startups may need to aim for even higher LTV:CAC ratios, such as 4:1 or 5:1, to achieve profitability comparable to SaaS companies.

Investors closely track how this ratio evolves. Improvements often come as AI startups refine their model architectures and reduce compute expenses.

Gross Margin and Cash Flow Management

Gross margin is a critical indicator of profitability, showing how much revenue remains after covering the cost of delivering your service. It’s calculated as:

(Revenue – Cost of Goods Sold) / Revenue × 100

For AI startups, gross margin is a direct reflection of infrastructure costs. These businesses face unique challenges like cloud compute expenses, data storage fees, and licensing costs, which result in lower gross margins - typically 50-60%, compared to the 75%+ margins seen in traditional SaaS companies.

To improve gross margins, AI startups can optimize their model architectures, shift to more efficient infrastructure, or adjust pricing strategies to better align with delivery costs. Investors expect to see these margins improve over time as the company scales and fine-tunes its operations.

Cash flow management is another critical area, especially for AI startups. Unlike traditional SaaS companies with relatively predictable expenses, AI startups deal with fluctuating costs tied to model training, compute infrastructure, and data partnerships. This unpredictability makes advanced forecasting essential. Successful cash flow management often involves scenario planning that accounts for variables like cost per prediction and changes in customer acquisition costs as models become more efficient.

Metrics like ARR per employee - with $200,000+ being a strong benchmark - help measure capital efficiency and operational health.

| KPI Category | Traditional SaaS | AI Startups | Key Difference |

|---|---|---|---|

| Gross Margin | 75%+ | 50-60% | Higher infrastructure costs |

| Burn Multiple | Under 2x | Under 2x | Same target, harder to achieve |

| LTV:CAC Ratio | 3:1 | 4:1 or 5:1 | Higher ratio needed due to lower margins |

These KPIs provide a framework to navigate the unique challenges AI startups face. In the next section, we’ll explore how AI tools can deepen financial insights and streamline decision-making.

How AI Improves Financial KPI Prioritization

Startups often find themselves drowning in data, unsure of which metrics matter most for their growth stage and business model. AI steps in to simplify this process, transforming the chaos into a structured system that highlights the most important KPIs and provides actionable insights - right when they’re needed.

Real-Time Data Analysis and Insights

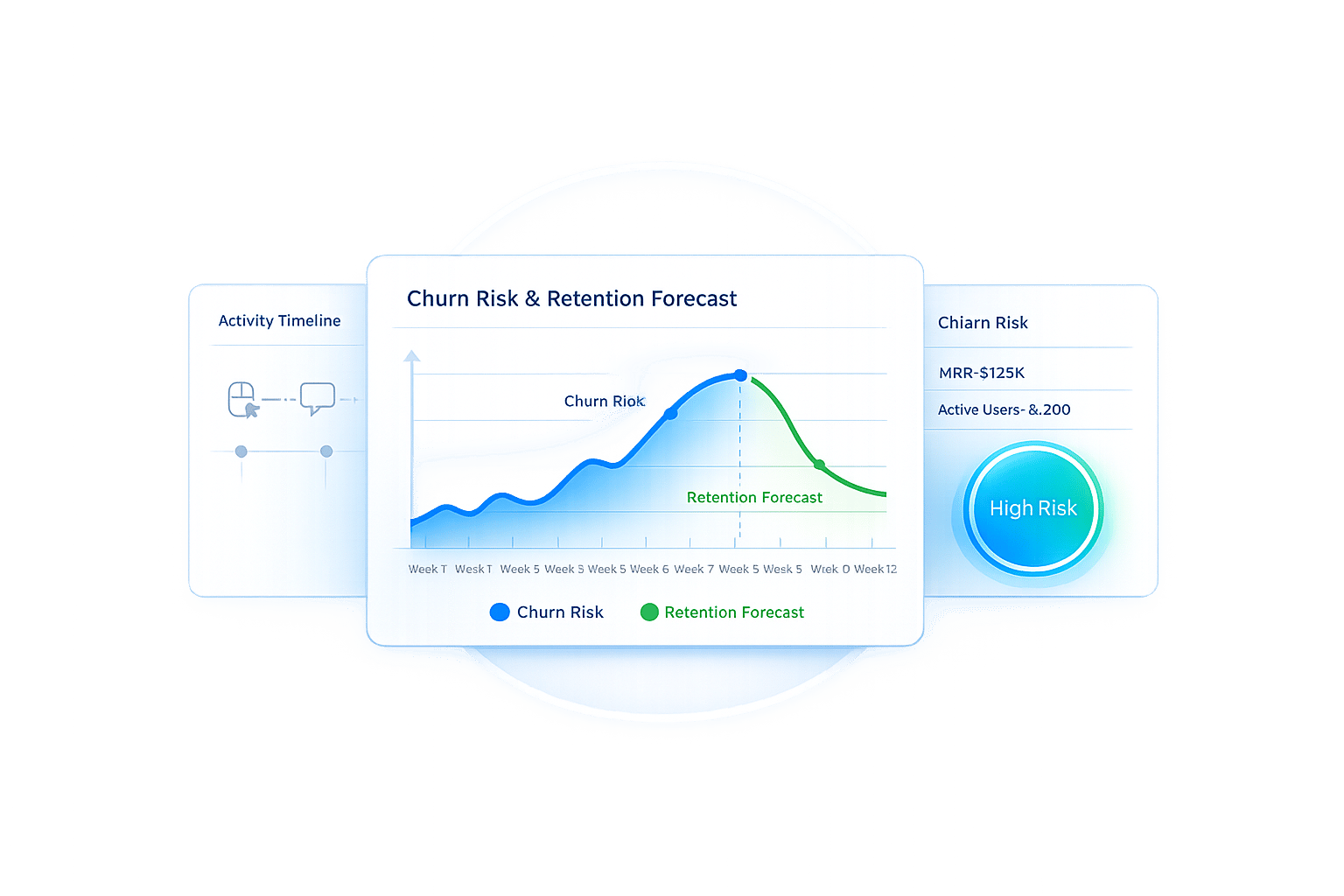

AI has the ability to process enormous amounts of financial data instantly, tracking key metrics like revenue growth, burn rate, and gross margin in real time. This immediate feedback helps founders detect trends, spot irregularities, and react quickly to risks or opportunities as they arise.

Take, for example, Monday Morning Metrics from Phoenix Strategy Group. This tool synchronizes financial data in real time, aligning technical achievements with financial outcomes for sharper insights. A startup can immediately see how recent product upgrades influence customer acquisition costs or reduce infrastructure expenses.

For AI startups, where cost structures can be complex, this real-time analysis becomes even more critical. It tracks fluctuating expenses like compute power, storage fees, and data licensing costs. If a startup optimizes its model architecture to lower inference costs, an AI-powered financial platform can instantly calculate how this impacts overall profitability and cash runway.

This speed advantage means startups can make informed decisions in hours instead of weeks. Founders can quickly evaluate whether their current burn rate aligns with their growth goals or if spending adjustments are needed to extend their runway. This real-time capability also sets the stage for automated reporting and forecasting, making financial decision-making even more efficient.

Automated Reporting and Forecasting

Building on real-time insights, AI revolutionizes the way startups handle reporting and forecasting. By automating financial reporting, AI removes the manual labor involved and delivers predictive insights that traditional methods just can’t match. These tools collect, categorize, and analyze financial data automatically, generating polished, investor-ready reports and forecasts.

AI models use historical data, market trends, and operational variables to predict future performance with impressive accuracy. For startups dealing with shifting infrastructure costs or changing customer behaviors, this means forecasts they can actually rely on - unlike traditional spreadsheets.

Scenario planning becomes another game-changer with AI. These systems can simulate various growth scenarios and expense trajectories, helping founders prepare for uncertainty and allocate resources more effectively. For instance, a startup might model how different customer acquisition strategies impact its cash runway or explore how pricing adjustments could accelerate profitability.

AI’s automation also simplifies the reporting process during high-stakes moments. Lucid Financials, for example, delivers clean books in just seven days and provides always-on, investor-ready reports through Slack integration. This eliminates the last-minute scramble to prepare financial documents for board meetings or investor pitches.

"Lucid turned our bookkeeping and taxes from a headache into a simple, reliable process. Their CFO insights give us clarity to plan growth with confidence - it feels like having a full finance team on demand." - Aviv Farhi, Founder and CEO @Showcase

Better Decision-Making with AI

With automated insights and precise forecasting, AI bridges the gap between technical progress and financial outcomes, pinpointing the KPIs that truly drive growth and sustainability.

AI-powered platforms also provide instant access to industry benchmarks tailored to a startup’s sector and product. Metrics like Customer Acquisition Cost (CAC) and valuation are contextualized, helping founders understand not only their own numbers but also how they stack up against competitors.

For AI startups, demonstrating the connection between technical advancements and financial results is crucial - especially when dealing with investors. Venture capitalists now expect startups to present clear, data-driven links between technical achievements and financial KPIs. For example, when a startup improves its model accuracy, AI platforms can immediately show how this leads to higher customer lifetime value or reduced churn rates.

AI also fosters better team alignment by making KPIs accessible and meaningful to both technical and business teams. Engineers can see how infrastructure improvements boost gross margins, while sales teams gain clarity on how acquisition strategies impact unit economics. With real-time visibility into burn rate and runway, teams can make proactive adjustments based on predictive models that reveal the long-term effects of their decisions.

In doing so, AI shifts startups from reactive cost-cutting to forward-thinking financial management, ensuring that every strategic move is aligned with sustainable growth.

sbb-itb-17e8ec9

Using AI in Financial Planning

For startups, incorporating AI into financial planning can be a game-changer. By automating repetitive tasks and seamlessly integrating with existing workflows, AI enables precise and efficient financial operations. The focus should be on selecting platforms that not only handle routine processes but also provide the advanced analytics modern investors expect. This approach builds on the benefits of automated reporting, making financial decision-making smoother and more effective.

AI-Powered Financial Platforms

The best AI financial platforms simplify operations by consolidating multiple functions into one intelligent system. Instead of juggling separate tools for bookkeeping, taxes, and strategic planning, startups can rely on a single platform. A great example of this is Lucid Financials, which combines bookkeeping, tax services, tax credits, and CFO-level support into a unified, AI-powered solution designed specifically for startups and fast-growing companies.

This approach delivers immediate, tangible benefits. For instance, platforms like Lucid can generate financial records in just seven days, significantly boosting management efficiency. Tasks like transaction matching, reconciliation, and categorization are handled automatically, while experienced professionals review the AI-generated outputs to ensure accuracy and compliance.

With pricing starting at $150 per month, these platforms are designed to scale with a startup's growth, making advanced financial management accessible even for early-stage companies.

Integration with Business Operations

The real strength of AI in financial planning lies in its ability to integrate seamlessly with a startup's existing tools and workflows. For example, Slack integration allows founders to access real-time financial insights directly within their primary communication platform.

This means founders can instantly check metrics like burn rate, runway, or cash flow projections without switching applications. The AI provides immediate answers based on up-to-date data, while human experts remain available for more complex strategic questions. This 24/7 accessibility transforms financial planning into an ongoing, data-driven process rather than a periodic task.

For startups, especially those in AI, this real-time access is crucial. For example, if infrastructure costs unexpectedly rise or a model optimization reduces compute expenses, an integrated platform can instantly calculate the financial impact. This allows founders to make informed operational decisions without delay.

"Lucid turned our bookkeeping and taxes from a headache into a simple, reliable process. Their CFO insights give us clarity to plan growth with confidence - it feels like having a full finance team on demand." - Aviv Farhi, Founder and CEO @Showcase

These platforms also support scenario planning tailored to the unique challenges of AI startups. They can model various growth trajectories while accounting for fluctuating infrastructure costs, training expenses, and the unpredictable nature of AI development. This capability is especially important when venture capitalists expect burn multiples under 2x and ARR per employee of $200,000 or more.

Investor-Ready Financial Reporting

Beyond streamlining workflows, AI-powered platforms ensure startups are always prepared for investor scrutiny. They simplify the preparation of board meetings, investor updates, and fundraising pitches by maintaining always-on, investor-ready reporting.

These systems go beyond basic financial statements, offering detailed forecasting models that highlight improving unit economics over time. For example, AI can generate financial plans illustrating best-case, worst-case, and actual scenarios, enabling quick decision-making during critical fundraising moments.

For AI startups, this capability is vital in meeting investor expectations. Demonstrating clear links between technical progress and financial outcomes is key. When a startup improves model accuracy or reduces inference costs, AI platforms can instantly show how these advancements impact customer lifetime value, gross margins, and overall profitability.

Automating compliance reporting is another major advantage. With AI startups facing $200,000–$500,000 in annual compliance costs for Series A/B companies, platforms that streamline compliance and maintain audit trails provide immense value. This is especially important as due diligence timelines now take 30–45 days longer for AI startups due to increased scrutiny of governance systems.

"As we scaled, budgeting and cash flow became critical. Lucid's CFO services give us the visibility we need, while their bookkeeping and tax support keep everything accurate and stress-free. It's been a game-changer for our operations." - Luka Mutinda, Founder and CEO @Dukapaq

These platforms also provide industry benchmarks for key metrics like CAC and valuation, helping startups measure their performance against standards such as the 3:1 CLV to CAC ratio favored by VCs.

Future Trends in AI-Driven Financial KPI Management

AI is transforming financial management, especially for startups, by revolutionizing how they monitor, analyze, and act on their financial KPIs. As this technology continues to evolve, several trends are emerging that promise to reshape financial planning and investor relations for growing companies. These trends build on the benefits of real-time insights and seamless integration, paving the way for smarter financial management.

Predictive Cash Flow and Forecasting Models

AI-driven predictive models are becoming more advanced, going beyond basic trend analysis. They now offer risk-aware scenario modeling, which helps startups navigate their unique challenges. These systems can instantly create financial plans that include best-case, worst-case, and actual scenarios, allowing founders to make quick, informed decisions.

For startups, especially AI-focused ones, managing cash flow can be tricky due to fluctuating infrastructure costs and unpredictable development cycles. Modern predictive tools take into account factors like seasonal changes, market fluctuations, and industry-specific expenses to deliver accurate runway projections.

These tools don’t just crunch numbers - they also provide concise narratives that highlight potential cash flow issues before they become critical. By making financial forecasting easier to understand, even for non-financial team members, these models help align technical and business strategies.

Integrated Business Intelligence Solutions

The next wave of AI-powered platforms is moving beyond traditional financial tools, evolving into business intelligence ecosystems that combine financial, operational, and strategic data. These platforms now feature real-time anomaly detection, which flags irregularities and opportunities as they happen.

Standardized KPI taxonomies are becoming a key feature, making it easier for startups to benchmark against industry norms and present consistent metrics to investors. This is increasingly important as investors expect real-time, comparable data across their portfolio companies.

Integration capabilities have also improved significantly. These platforms can now pull data from accounting software, CRM systems, and operational tools into a single source of truth. This eliminates the need for manual data consolidation and reduces errors in financial reporting.

One standout feature is cross-portfolio benchmarking, which allows startups to compare their KPIs with similar companies at the same growth stage. This insight helps founders identify areas where they might be overspending or underinvesting, providing valuable context for strategic decisions.

Real-time anomaly detection is another game-changer. These systems can flag unexpected patterns in spending, revenue, or operational metrics and notify founders immediately. For instance, if customer acquisition costs suddenly spike or gross margins drop, the platform can highlight these changes and even suggest possible causes. As startups increasingly seek tailored solutions, modular AI systems are emerging as the next step, adapting to specific business challenges.

Customizable AI for Startup Needs

AI solutions are becoming more flexible and tailored to meet the diverse needs of startups at different growth stages. Instead of a one-size-fits-all approach, platforms now offer customizable dashboards, industry-specific KPI templates, and workflows that adapt as a company evolves.

Take Lucid Financials as an example. This platform allows startups to customize their financial management tools to suit their specific needs. Whether a company is in its pre-seed stage or approaching Series C, the AI evolves alongside the business, ensuring insights remain relevant and actionable.

Customization also extends to compliance and regulatory requirements, which are increasingly important for startup valuations. Many AI platforms now include compliance modules that track regulatory changes and ensure audit readiness. Considering that Series A/B companies often face compliance costs ranging from $200,000 to $500,000 annually, these features can be a significant time and cost saver.

AI is also getting smarter at delivering personalized insights. By learning from a startup’s business model and industry, these platforms can offer recommendations that are more relevant. For example, an AI system designed for a SaaS company will prioritize different metrics than one tailored for a hardware or marketplace business.

Looking ahead, the most effective AI financial tools will be those that grow alongside startups, offering increasingly advanced insights while maintaining the simplicity and speed that early-stage companies need. Striking the right balance between power and usability will define the future of AI-driven financial management.

Conclusion

AI-powered KPI prioritization is reshaping the way startups approach finance, bringing greater clarity, efficiency, and opportunities for growth. In today’s fast-paced and challenging financial environment, this shift is more important than ever.

Research highlights that AI allows startups to make decisions up to 100 times faster, all while maintaining accuracy. With challenges like tight gross margins and increasing compliance costs, relying on manual processes is no longer practical.

Take Lucid Financials as an example. This platform transforms financial operations into a strategic advantage by automating tasks such as bookkeeping, tax management, and CFO services. Plus, it offers real-time insights through Slack integration, letting founders focus on scaling their businesses.

"Lucid turned our bookkeeping and taxes from a headache into a simple, reliable process. Their CFO insights give us clarity to plan growth with confidence - it feels like having a full finance team on demand." - Aviv Farhi, Founder and CEO @Showcase

With real-time access to crucial KPIs like burn rate, customer acquisition cost, and lifetime value, startups can make quick, well-informed decisions. This alignment of financial insights with technical milestones strengthens investor confidence and supports long-term growth.

AI-powered financial tools also help startups link technical advancements to financial results. For instance, showing how model improvements reduce customer acquisition costs or how better infrastructure enhances gross margins can make a compelling case for continued investment.

As regulatory scrutiny adds 30–45 days to due diligence timelines, adopting AI for financial management has become a necessity. By connecting technical progress with financial outcomes, startups not only meet investor expectations but also ensure steady, sustainable growth.

To succeed in an ever-changing market, startups need to embrace AI-driven platforms for real-time, comprehensive financial management.

FAQs

How can AI help startups with high infrastructure costs manage their burn rate and extend their runway?

Startups often face the challenge of managing high infrastructure costs while trying to stretch their financial runway. This is where AI steps in as a game-changer. By processing financial data in real time, AI can spot spending trends, pinpoint inefficiencies, and offer clear recommendations to better allocate resources. This helps startups cut unnecessary expenses while still focusing on growth.

Platforms like Lucid Financials take it a step further with sophisticated forecasting tools. These tools allow founders to simulate various financial scenarios, giving them a clearer picture of potential cash flow issues. With this insight, they can adjust strategies ahead of time, staying aligned with their financial goals without jeopardizing their runway.

What challenges do AI startups face in managing a healthy CAC-to-LTV ratio compared to traditional SaaS companies?

AI startups often deal with unique hurdles when it comes to balancing their Customer Acquisition Cost (CAC) with Lifetime Value (LTV). Unlike traditional SaaS businesses, these startups often face steep upfront expenses. Why? Because they need to invest heavily in areas like data acquisition, model development, and infrastructure - pushing CAC higher. On top of that, the intricate nature of AI solutions often means longer sales cycles and more effort spent educating potential customers, which only adds to the cost.

When it comes to LTV, the picture isn’t much easier. AI startups can find it challenging to maintain steady, long-term customer relationships. The tech landscape evolves quickly, and staying ahead requires constant innovation - something that can make retention tricky.

To tackle these issues, AI startups can sharpen their go-to-market strategies, focus on creating scalable solutions, and use tools like Lucid Financials. These tools provide real-time financial insights, helping startups make smarter, data-driven decisions to navigate these challenges effectively.

How does AI help startups improve financial forecasting and prioritization of key metrics?

AI-powered platforms such as Lucid Financials are transforming how startups handle financial forecasting. These tools take the guesswork out of managing finances by automating intricate processes and delivering real-time insights. With features that simplify expense tracking, cash flow monitoring, and trend analysis, they empower founders to make quicker, more informed decisions.

By incorporating AI, startups can focus on the most critical key performance indicators (KPIs), ensuring resources are used wisely. This precision becomes especially important for growing businesses, helping them create smarter budgets, provide clearer investor reports, and build a foundation for long-term financial stability.