AI is transforming financial forecasting for startups by replacing outdated spreadsheets with faster, more accurate tools. These systems use real-time data and advanced techniques like machine learning and neural networks to help founders make better decisions about cash flow, hiring, and capital allocation.

Key Takeaways:

- Speed and Accuracy: AI cuts forecast update times by 90% and reduces errors by up to 50%.

- Scenario Modeling: Instantly test "what-if" scenarios, such as pricing changes or market shifts.

- Real-Time Insights: AI integrates with accounting systems, CRMs, and external market data for continuous updates.

- Startup Needs: With 42% of startups failing due to cash flow issues, precise forecasting is critical.

- Cost-Effective Solutions: Platforms like Lucid Financials offer AI-driven forecasting starting at $150/month.

AI allows startups to focus on strategy instead of manual data crunching. Whether you're planning your next hire or preparing for funding, these tools provide instant insights to guide your decisions.

How AI Is Revolutionizing Finance for Startups

AI Techniques Used in Scenario-Based Forecasting

AI isn't just one tool - it’s a collection of methods that work together to reshape how startups predict their financial future. These techniques provide startup founders with dynamic, data-driven insights to navigate financial uncertainties. By understanding these methods, founders gain clarity on why AI-driven forecasts can outshine traditional spreadsheets.

Machine Learning for Predictive Analytics

Machine learning (ML) models pull data from sources like accounting systems, ERPs, and market feeds. Unlike spreadsheets, which can only handle a limited number of variables, ML processes hundreds of internal and external factors at once, including economic indicators, industry trends, and even social media sentiment.

The real strength of ML lies in its ability to recognize patterns. It identifies complex relationships that might otherwise remain hidden, constantly comparing past predictions to actual results and fine-tuning itself over time. For example, organizations using AI have reported 57% fewer sales forecast errors. Additionally, 50% of companies using AI for forecasting achieved a 20% drop in overall forecast error.

Shaheen Dil, Managing Director at Protiviti, notes: "Machine learning allows analysts to detect, identify, categorize and predict trends and outcomes, resulting in an organization that is able to effectively compete in a big data world."

Unlike static numbers, ML models provide probabilistic forecasts. For instance, instead of saying revenue will be $500,000, they might predict a 65% chance that revenue will fall between $450,000 and $520,000. This approach gives founders a sharper understanding of risks. By 2024, about 28% of finance teams had already begun integrating machine learning into their planning.

While ML is exceptional at recognizing patterns, neural networks take forecasting a step further by analyzing sequential trends.

Neural Networks for Time-Series Analysis

Recurrent Neural Networks (RNNs) and Long Short-Term Memory (LSTM) networks are specifically designed to handle sequential data - like financial trends that evolve month after month. These models excel at identifying temporal dependencies and recurring patterns, such as seasonality, quarterly cycles, or holiday-driven spikes, which traditional methods often overlook.

Neural networks map non-linear relationships and, with architectures like DeepAR+, create probabilistic forecasts that are vital for scenario planning. AI-driven forecasting models using these techniques have been shown to reduce error rates by as much as 50% compared to manual methods.

Modern neural networks also integrate data from diverse sources. They combine structured numerical data with unstructured insights - like news articles, earnings calls, and market sentiment - to deliver a more complete view of a startup’s financial outlook. By 2028, it’s expected that 33% of enterprise software applications will feature agentic AI capable of planning, executing, and adapting financial forecasts autonomously.

With these advanced temporal models as a foundation, generative AI takes forecasting even further by simulating entirely new market conditions.

Generative AI for Scenario Planning

Generative AI transforms scenario planning by generating thousands of potential market scenarios. Large Language Models (LLMs) can analyze unstructured data - such as news articles, social media chatter, and regulatory filings - to gauge market sentiment and fold it into financial models.

This capability lets founders run instant "what-if" simulations. For example, they can evaluate how a shift in interest rates might interact with internal decisions like hiring pauses or pricing adjustments. In 2023, Goldman Sachs used generative AI for market stress testing, simulating over 20,000 scenarios daily, including situations with no historical precedent. In certain market segments, AI-powered sentiment analysis has improved forecast accuracy by 18% compared to traditional methods.

Generative AI doesn’t just crunch numbers - it also creates narrative outputs. It can draft executive summaries that explain complex scenario analyses in plain language, making it easier for founders to communicate insights to investors or board members. By 2028, Gartner predicts that 50% of organizations will move away from traditional, bottom-up forecasting methods in favor of AI-driven approaches.

Benefits and Challenges of AI-Driven Forecasting

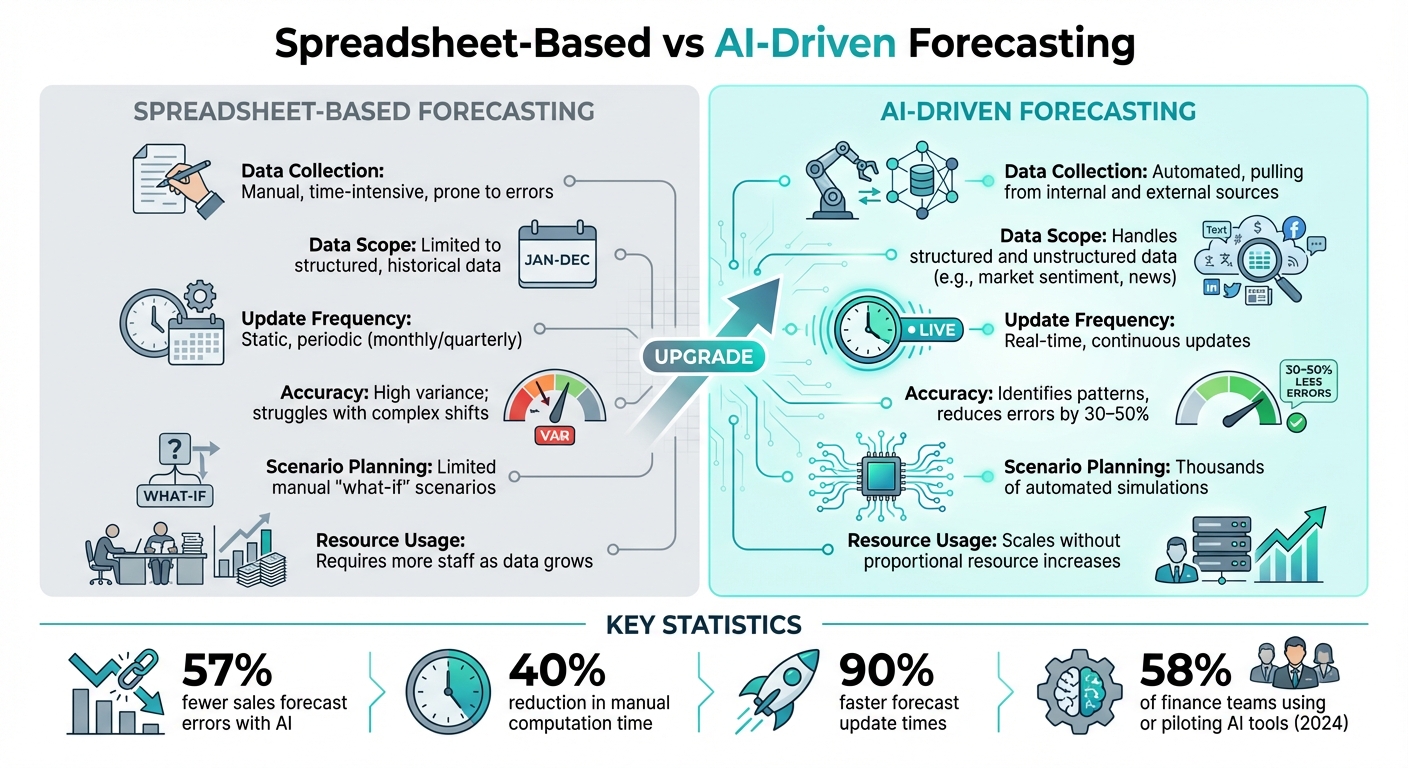

AI-Driven vs Spreadsheet-Based Financial Forecasting Comparison

AI-driven forecasting is transforming the way startups approach financial predictions. By moving beyond static spreadsheets, AI offers dynamic, real-time insights that can redefine decision-making. However, as with any innovation, it comes with its own set of challenges.

Advantages Over Spreadsheet-Based Forecasting

Switching from spreadsheets to AI isn't just about automating tasks - it's about uncovering insights that were previously out of reach. AI systems pull data from ERPs, CRMs, and even external market feeds, delivering real-time predictions instead of outdated monthly snapshots. This allows founders to respond immediately to changes rather than waiting for quarterly updates.

The leap in accuracy is hard to ignore. Take Jarsy, Inc., for example. In 2024, they adopted AI forecasting and cut manual computation time by 40%. Co-founder Chunyang Shen explained:

"Our finance team spends 40% less time with AI forecasting compared to manual work. This saves time and leaves us with more time and effort to make key business decisions instead of doing computations".

Across industries, the impact is clear - 57% of CFOs report fewer sales forecast errors after implementing AI.

AI also handles complexity far better than traditional methods. While spreadsheets falter with just a handful of variables, AI models can process hundreds at once, factoring in everything from economic trends to social media sentiment. The result? A 30% to 50% reduction in forecasting errors compared to manual approaches.

Scalability is another game-changer. As startups grow, spreadsheets often require more personnel to manage increasing data demands. AI, on the other hand, scales seamlessly, analyzing granular details - like individual SKUs or departmental data - without adding headcount.

Here’s how the two approaches compare:

| Feature | Spreadsheet-Based Forecasting | AI-Driven Forecasting |

|---|---|---|

| Data Collection | Manual, time-intensive, prone to errors | Automated, pulling from internal and external sources |

| Data Scope | Limited to structured, historical data | Handles structured and unstructured data (e.g., market sentiment, news) |

| Update Frequency | Static, periodic (monthly/quarterly) | Real-time, continuous updates |

| Accuracy | High variance; struggles with complex shifts | Identifies patterns, reduces errors by 30–50% |

| Scenario Planning | Limited manual "what-if" scenarios | Thousands of automated simulations |

| Resource Usage | Requires more staff as data grows | Scales without proportional resource increases |

AI adoption is accelerating. By 2024, 58% of finance teams were using or piloting AI tools, up from 37% the previous year. The payoff is clear: nearly 60% of companies using AI in finance reported revenue growth, with 10% seeing gains of over 10%.

Despite these breakthroughs, challenges remain that require thoughtful solutions.

Common Challenges and Solutions

While the benefits are compelling, startups need to navigate certain obstacles. The biggest? Data quality. A staggering 35% of CFOs identify poor data quality as their top challenge. AI models are only as good as the data they’re fed. Issues like inconsistent categorization, incomplete records, or siloed information can derail forecasts. To address this, startups should prioritize robust data governance, standardizing collection and categorization processes early on.

Another challenge lies in the cost and complexity of integrating AI with legacy systems. Teams often need time to trust the outputs, and there’s a risk of over-relying on AI while overlooking qualitative factors like regulatory changes or strategic pivots. A smart way to ease into AI is by starting small - perhaps piloting a cash flow forecast for one business unit. Running AI alongside traditional methods can also help teams build confidence and fine-tune the system.

Human oversight remains essential. As Rami Ali, Senior Product Marketing Manager at NetSuite, puts it:

"The point is not replacing human judgment, but augmenting finance teams' expertise with AI's ability to process vast datasets and identify subtle patterns".

For startups wary of building custom AI models, many accounting platforms now offer AI-enabled tools that integrate seamlessly, eliminating the need for costly, proprietary solutions.

sbb-itb-17e8ec9

Implementing AI Forecasting with Lucid Financials

Lucid Financials makes it easier for startups to transition from outdated spreadsheets and manual processes to more efficient, AI-powered forecasting. Designed specifically for startups, Lucid offers a full-stack accounting platform that combines bookkeeping, tax services, and CFO-level forecasting into a single solution.

Lucid's AI-Driven Forecasting Features

Lucid’s AI analyzes a wide range of internal and external data - such as cash flow, sales figures, customer acquisition costs, bank transactions, website analytics, operational metrics, market trends, industry benchmarks, and economic indicators. This enables the platform to deliver forecasts with up to 95% accuracy for accounts receivable and accounts payable. Compared to manual methods, Lucid reduces forecasting errors by 20%-50%.

Using machine learning, the platform identifies patterns, filters out irrelevant data, and uncovers insights that may otherwise go unnoticed. Founders can access these insights through Slack integration, where they can ask questions about runway, expenses, or performance and receive instant, AI-generated answers. The platform also provides real-time "what-if" scenario modeling. For more complex situations, Lucid’s finance team is available to offer expert advice directly within the same Slack workflow.

Lucid simplifies fundraising preparation by generating investor-ready reports with a single click. Unlike traditional services that only provide monthly updates, Lucid continuously refreshes financial data, ensuring founders always have access to the most up-to-date information.

How Lucid Supports Startup Founders

Lucid blends automation with human oversight to address common challenges in AI implementation. Every forecast and report generated by the platform is reviewed by a dedicated finance team to ensure accuracy and compliance, alleviating concerns about trust and data quality.

The platform integrates seamlessly with tools like QuickBooks, banking apps, and payroll systems, automating data collection and maintaining consistency across financial records. Founders don’t need to worry about custom integrations or additional staff to manage the technology. Lucid’s AI speeds up the onboarding process, delivering clean books within seven days and automating tasks like transaction matching and reconciliation.

Pricing starts at $150 per month, with straightforward flat-rate plans and no hidden fees. There are three tiers to choose from:

- Bookkeeping: AI-powered reconciliation and monthly financial close.

- Tax: Founder-focused filings, including R&D credit optimization.

- CFO/Fundraising: AI-generated forecasts, scenario modeling, and board-ready reports.

All plans include real-time Slack support and are designed to scale with businesses from pre-seed to Series C, eliminating the need to switch platforms as the company grows. For startups grappling with data quality issues, integration challenges, or the need for human guidance, Lucid delivers advanced AI capabilities without the hassle of building or managing custom systems. This combination of cutting-edge AI and expert support creates a reliable solution for financial forecasting.

Practical Applications and Future Trends

How Startups Use AI Forecasting Today

Startups are moving away from relying on static, monthly Excel reports and embracing continuous, real-time forecasting powered by AI. These advanced systems automatically adjust as new data comes in, allowing founders to perform instant cash flow stress tests, plan hiring strategies, and generate investor-ready reports on demand. Instead of waiting for quarterly reviews, decisions can now be made in real-time. This shift has been a game-changer for finance teams, which previously spent up to 90% of their time consolidating data. Now, they have more bandwidth for strategic analysis and high-level decision-making.

"In 2020, the finance team's window to the world was still the monthly Excel pack. In 2025, it's the blinking cursor in a chat thread." - Georgi Ivanov, Senior Communications Manager, Payhawk

AI forecasting tools are also integrating into platforms like Slack, enabling seamless collaboration. Founders can now ask about key metrics - like runway, expenses, or performance - and get instant, actionable insights without waiting for manually prepared reports. This real-time accessibility is transforming how teams work together and make decisions.

As these tools continue to evolve, their capabilities are set to redefine the role of AI in financial planning.

What's Next for AI Forecasting

AI forecasting is quickly becoming a strategic cornerstone for decision-making. By 2028, half of all organizations are expected to replace traditional bottom-up forecasting with AI-driven models. Gartner also predicts that by 2027, 15% of everyday business decisions could be made autonomously. These systems are poised to go beyond predictions, acting as "Action Agents" that not only detect market shifts but also plan and execute responses - all within the tools founders already use.

The future of AI forecasting will see systems pulling in real-time external data, like macroeconomic trends, market news, and customer sentiment, alongside internal metrics. This will allow forecasts to adapt dynamically to changing conditions. Startups will also benefit from more detailed insights, such as department-level or SKU-level analysis, which were once too complex for smaller teams to handle. Companies leveraging AI in their planning processes are already seeing forecasting cycles that are 30% faster and accuracy improvements of 20% to 40%.

As these advancements continue, the role of the CFO will shift dramatically. Instead of focusing on reporting, CFOs will take on a more strategic leadership role, using AI to proactively guide decisions and drive growth. This evolution will fundamentally reshape how businesses approach financial planning and strategy.

Conclusion

AI-powered forecasting is changing the game for startups, replacing clunky spreadsheets with real-time models that adapt to your business needs. This shift lets founders focus on scaling their companies instead of getting bogged down in endless number crunching. For finance teams, it means spending less time consolidating data and more time on strategic analysis and making smarter decisions.

The impact is clear: startups using AI in their financial processes report measurable boosts in accuracy and efficiency. Nearly 60% of these companies have experienced revenue growth, with 10% seeing increases of over 10%. These aren't just small wins - they're the difference between constantly reacting to problems and proactively avoiding them.

With AI, founders gain instant access to scenario testing, detailed cash flow insights, and investor-ready reports whenever they need them. The heavy lifting - data collection, pattern recognition, and updates - happens in the background, freeing you to focus on the bigger picture. Success starts with clean data, selecting tools that align with your workflow, and balancing automation with human judgment.

Take Lucid Financials, for example. They show how AI-driven tools can bring clarity to your finances. With advanced forecasting, Slack-based support, and streamlined books in just a week, founders can get the insights they need without adding extra staff or unnecessary complexity. Whether you're planning your next hire, preparing for a funding round, or analyzing your runway, AI delivers actionable insights quickly.

The future of forecasting is already here, reshaping how startups approach financial planning. The real question isn't whether to embrace AI - it's how fast you can integrate it into your operations to stay ahead.

FAQs

How does AI enhance financial forecasting accuracy and efficiency for startups?

AI is reshaping financial forecasting by processing real-time data, uncovering patterns that often go unnoticed, and cutting errors - sometimes by up to 50%. What once required hours or even days with traditional methods can now be done in minutes, delivering instant updates that help startups respond quickly to shifting financial conditions.

By automating tedious tasks and offering sharper insights, AI frees up founders to concentrate on strategic decisions instead of getting bogged down in spreadsheets. The result? More accurate forecasts and always-ready, up-to-date financial reports tailored for investors.

What challenges do startups face with AI-driven financial forecasting, and how can they address them?

Startups face three major hurdles when using AI for financial forecasting: data quality, model accuracy, and team adoption. AI systems thrive on clean, real-time data, but many startups still rely on outdated spreadsheets or disconnected tools. By integrating AI directly with platforms like bank accounts, payroll systems, and accounting software, startups can improve data accuracy and reduce the risk of errors.

Keeping forecasts accurate over time is another challenge, especially as market conditions shift. Startups should zero in on key factors like revenue and expenses, regularly update both best- and worst-case scenarios, and set alerts to flag unusual trends. These practices help ensure forecasts stay relevant and trustworthy.

The final hurdle? Getting teams to trust and effectively use AI-driven insights. Combining AI tools with expert financial advice can make predictions more actionable and tailored to the business. For instance, platforms like Lucid Financials simplify this process by blending real-time data, automated tracking, and professional support, enabling founders to make informed decisions and focus on scaling their businesses.

How does generative AI improve financial scenario planning for startups?

Generative AI is transforming how startups approach financial scenario planning. It allows for the rapid creation and updating of multiple "what-if" scenarios, including best-case, worst-case, and base-case projections. By processing live financial data in real time, it highlights potential risks and makes it easier for founders to test different outcomes without hassle.

This technology empowers startups to act quickly and make well-informed decisions. With the ability to adjust strategies on the spot, businesses can stay ready to tackle financial challenges or seize new opportunities as they arise.