Navigating global markets is tough, especially for startups. Complex regulations, tax rules, and compliance requirements can overwhelm small teams. Missing a filing or breaching regulations can lead to serious penalties, fines, or even business shutdowns.

AI simplifies this process. It automates tasks like identity verification, transaction monitoring, and regulatory updates, helping startups save time, reduce errors, and cut costs. From faster onboarding to better fraud detection, AI-powered compliance tools allow startups to expand globally without adding unnecessary complexity.

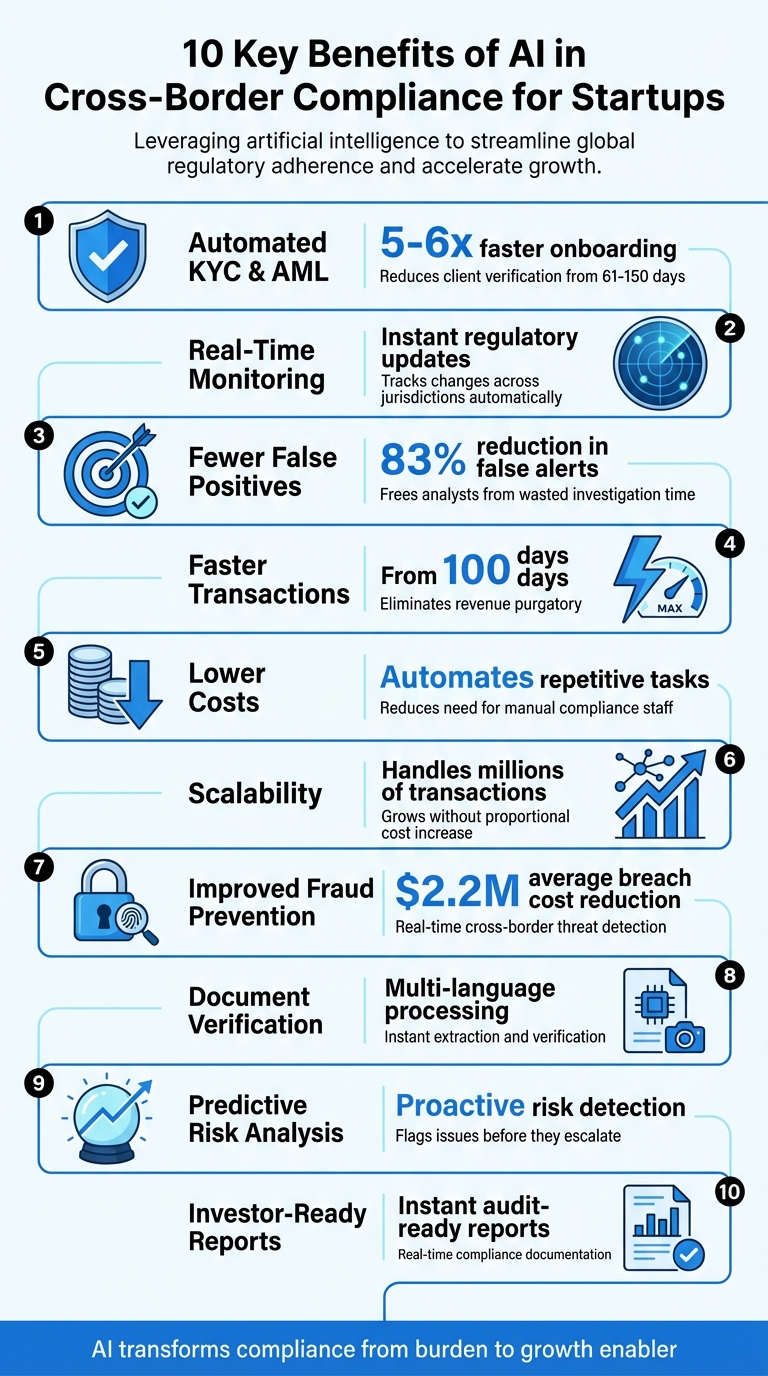

Key Takeaways:

- Automated KYC & AML: Speeds up identity checks and reduces onboarding delays.

- Real-Time Monitoring: Tracks regulatory changes instantly, avoiding manual tracking.

- Fewer False Positives: Reduces wasted time on unnecessary alerts.

- Faster Transactions: Cuts processing times from months to days.

- Lower Costs: Automates repetitive tasks, reducing the need for extra staff.

- Scalability: Handles growth in transactions and jurisdictions without heavy overhead.

- Improved Fraud Prevention: Detects suspicious activities across borders in real time.

- Document Verification: Processes compliance paperwork quickly and accurately.

- Predictive Risk Analysis: Flags risks before they escalate, aiding smarter decisions.

- Investor-Ready Reports: Generates audit-ready compliance reports instantly.

Bottom line: AI turns compliance from a burden into a growth enabler, giving startups the tools they need to thrive in international markets.

10 Key Benefits of AI in Cross-Border Compliance for Startups

Sphere's $21M Series A: Nicholas Rudder on Building Cross-Border Compliance

1. Automated KYC and AML Screening

Expanding into international markets brings a whole new level of complexity to identity verification and AML (Anti-Money Laundering) screening. Traditional methods can drag on for 61 to 150 days per client and have already cost financial institutions a staggering $26 billion in fines. For startups, getting caught up in such inefficiencies - or worse, regulatory penalties - is simply not an option.

AI is changing the game. By leveraging Optical Character Recognition (OCR) and facial recognition technology, it streamlines document and identity verification. Instead of waiting weeks for background checks, startups can onboard customers 5 to 6 times faster, all while meeting strict regulatory requirements. AI systems scan millions of transactions against global watchlists - like OFAC, FBI, and Interpol - to identify suspicious activity that traditional rule-based systems might overlook.

Beyond just speeding up onboarding, AI ensures compliance remains intact through continuous monitoring. Known as Perpetual KYC (pKYC), this approach replaces outdated annual reviews with real-time updates. When a customer's risk profile shifts, AI refreshes their data and adjusts risk scores accordingly. This kind of proactive monitoring could have saved the Commonwealth Bank of Australia from its AUD 700 million fine (around $530 million USD) in 2018, which stemmed from failing to monitor transactions due to outdated tech.

AI also slashes the time required to investigate flagged cases. What once took analysts 2.5 hours per case can now be done in just 30 minutes. By autonomously reviewing alerts, pinpointing genuine risks, and summarizing cases, AI allows lean teams to manage higher volumes without the need for additional staff. This efficiency is critical, as 83% of organizations report analysts spend significant time dealing with false alerts. AI drastically reduces this burden, freeing up resources for more pressing tasks.

As Lucinity, a leader in compliance solutions, puts it:

"AI and Machine Learning are modern additions to KYC compliance solutions, helping improve productivity and save costs." - Lucinity

The benefits extend beyond efficiency. AI's ability to catch threats early can also reduce the average cost of a data breach by $2.2 million. For startups scaling into new markets, this means maintaining consistent compliance standards across jurisdictions while protecting both their reputation and bottom line.

2. Real-Time Regulatory Monitoring and Updates

For startups operating across multiple countries, staying on top of ever-changing regulations can feel like a constant uphill battle. Laws and compliance frameworks shift frequently, and relying on manual tracking methods is not only time-consuming but also prone to errors.

This is where AI steps in as a game-changer. By continuously scanning external regulatory sources in real time, AI systems can track updates from sanctions lists, news alerts, and transactional behavior patterns - and flag any relevant changes automatically. Gone are the days of manually refreshing government websites or juggling countless legal newsletters just to stay compliant. Instead, AI ensures startups are always informed, which strengthens their ability to identify risks early.

This capability is especially crucial for startups in sectors like fintech, payments, and international trade. For example, AI can instantly cross-check sanctions data against a company’s customer records, allowing compliance teams to spot potential issues without the delays that come with manual reviews.

What makes this even more powerful is AI’s speed. Unlike traditional compliance processes that might take days or even weeks to adapt to new regulations, AI systems update in real time. This quick response not only helps startups close compliance gaps but also allows them to remain flexible as they venture into new markets.

3. Fewer False Positives in Risk Detection

Traditional rule-based systems often flag legitimate transactions as threats, leading to wasted time and resources chasing non-issues.

AI takes a smarter approach by learning from patterns rather than relying on rigid rules. It evaluates customer history and behavior to differentiate between actual risks and routine activities. This shift has proven effective across industries, with real-world examples showcasing its impact.

Take fintech company Holvi, for instance. With 40,000 customers operating in 18 currencies, Holvi successfully reduced false positives and enhanced risk detection accuracy during a period of rapid growth. This allowed their small team to manage scaling operations without being bogged down by excessive manual reviews.

The benefits of fewer false positives are clear: faster transaction processing, smoother day-to-day operations, and a lighter workload. For startups, this means more time to focus on growth. Meanwhile, AI’s continuous monitoring sharpens its understanding of risk, preventing isolated data points from triggering unnecessary alarms.

4. Faster Transaction Processing

When it comes to growth, speed is everything. Traditional compliance systems often create what experts call "revenue purgatory" - a frustrating delay where business relationships are established, but no money can flow. Onboarding a corporate client at a traditional bank takes, on average, 100 days, with 20% of that time consumed by KYC processes alone. For startups, that's three months of potential revenue stuck in limbo.

AI-powered systems are changing the game by accelerating these processes. By automating document verification and enabling real-time risk scoring, AI reduces timelines from months to mere days. Transactions that meet safety criteria are approved instantly, thanks to straight-through processing (STP) - a system where transactions flow without human intervention.

The benefits extend beyond speed. With 73% of companies still bogged down by manual tasks, AI-driven tools improve suspicious activity detection by 20–30%, making cash flow management smoother. For startups operating internationally, these platforms eliminate the need for salary pre-funding or upfront global payroll deposits, allowing businesses to keep more liquid capital on hand.

"The digital transformation that has revolutionized other aspects of financial services has barely touched compliance operations." - Tom Mendoza, Kaushik Subramanian, and Daniel Fraai, EQT Ventures

AI also offers scalability. It can handle the increasing volume and complexity of modern transactions without requiring a bloated compliance team. This allows startups to expand globally while keeping their back-office lean and focused on addressing genuine high-risk issues, rather than chasing down false positives flagged by outdated systems.

5. Lower Compliance Costs

For startups operating on tight budgets, managing compliance can feel like an uphill battle. Expanding into new markets often means dealing with a maze of local regulations, which traditionally requires hiring experts - tax advisors, legal consultants, and compliance officers. This approach can quickly drain resources. But AI changes the game by automating many of the repetitive, resource-heavy tasks that typically drive up costs.

With AI, you can cut down on these expenses. Tasks like reviewing transactions, reconciling data across different jurisdictions, and calculating taxes are handled automatically. AI systems can also screen for sanctions and flag unusual activities for further review. This means your team can focus on the high-risk cases that actually need human judgment, rather than wasting time on routine processes. As a result, businesses can scale operations globally without having to expand their compliance teams.

"AI can help businesses reduce the cost of compliance by automating repetitive tasks and reducing the need for manual intervention." - Avalara

The complexity of compliance is growing - 85% of business leaders report that it's become more challenging over the past three years. Hiring more staff to keep up isn't a sustainable solution. AI-powered platforms simplify the process by consolidating data from Finance, HR, and Legal into a single, unified view. This eliminates the need to manually reconcile inconsistent spreadsheets, especially for labor-intensive tasks like transfer pricing compliance.

The real win here is the ability to redirect those savings into growth initiatives. By lowering the "cost of doing business", startups can channel more resources into developing products, acquiring customers, and expanding into new markets. This not only extends their financial runway but also strengthens their competitive edge, making global expansion and innovation more achievable.

6. Scalable Compliance for Global Growth

Expanding into new markets or managing a surge in transaction volume can push traditional compliance systems to their breaking point. Usually, scaling compliance means hiring more officers and manually adjusting processes to meet various regulatory demands. But with AI-driven systems, your compliance infrastructure grows alongside your business - handling increased complexity without requiring a proportional increase in staff or costs. This adaptability ensures that compliance keeps pace with your global expansion.

AI systems leverage machine learning to monitor transactions across multiple regions seamlessly. As your transaction volume jumps from thousands to millions, every payment or customer interaction is automatically checked against the relevant regulations. Tasks like anti-money laundering (AML) checks and sanctions screenings are handled automatically, reserving human intervention for high-risk cases. This approach ensures operations remain efficient, even as complexity grows.

Startups can scale to serve tens of thousands of customers, manage cross-border payments in various currencies, and operate in multiple regions - all without needing to significantly expand their compliance teams. AI-native solutions excel at handling sanctions screenings across jurisdictions, reducing money laundering risks from instant payments, and identifying new fraud patterns as they emerge.

Additionally, these systems can automatically escalate reviews, flag suspicious activity, or even pause transactions when necessary. By consolidating data from different regions and keeping up with regulatory changes, AI-powered compliance tools shield your startup from potential violations as you expand globally.

AI-driven compliance not only simplifies global growth but also keeps overhead costs in check.

sbb-itb-17e8ec9

7. Better Fraud Prevention Across Borders

Handling cross-border payments comes with its own set of challenges, especially when it comes to fraud. Fraudulent invoices and intricate money laundering schemes often slip through the cracks when transactions move across multiple countries and currencies. Manual processes simply can't keep up with the scale and sophistication of these schemes.

This is where AI-powered systems shine. They can detect fraud patterns in real time, even across different jurisdictions. By analyzing transaction flows, spotting fake invoices, and automatically screening payments against sanctions lists, AI tools offer a level of vigilance that manual reviews can't match. These systems monitor cross-currency transactions for red flags - things like unusual routes, sudden spikes in amounts, or recurring suspicious activity. This constant oversight not only protects your funds but also helps you stay compliant with regulations.

Why is this so important? Because failing to catch fraud can lead to serious consequences, such as hefty fines or even losing your operating license. As Stripe puts it:

"Expansion without compliance guardrails is a high-risk move"

AI-driven fraud detection serves as your first line of defense, catching issues before they snowball into regulatory disasters.

Beyond spotting fraud, centralizing your data strengthens compliance efforts. By closing gaps between disconnected systems, AI models can identify inconsistencies and anomalies that might otherwise go unnoticed. This unified view also simplifies audits and regulatory checks, making it easier to prove your compliance procedures are up to par.

And here's another key advantage: real-time alerts. Instead of discovering fraudulent transactions days or weeks later during reconciliation, AI systems can block them before they're completed. This immediate action not only protects your cash flow but also ensures smoother operations, avoiding the delays that often come with overly cautious manual reviews.

8. Automated Document Verification

Managing compliance across borders often means dealing with a mountain of paperwork. When these documents come from various countries, each with its own language and format, manual verification can quickly become a slow, costly, and error-prone process.

This is where AI steps in to simplify the chaos. Using natural language processing, AI can extract crucial details - like names, dates, amounts, and compliance markers - from documents, regardless of their language or format. It then cross-checks this information against sanctions lists and regulatory databases. This level of automation transforms what was once a tedious task into a streamlined process.

Take Holvi, for example. This FinTech company, which serves 40,000 customers across Europe and handles payments in 18 different currencies, relies on AI-driven compliance to verify documents against multiple sanctions regimes.

AI doesn’t just stop there - it flags documents that require closer scrutiny, allowing compliance teams to prioritize high-risk cases. This makes workflows more efficient and ensures critical issues get the attention they deserve.

For startups aiming to expand globally, automated document verification is a game-changer. It speeds up onboarding for international customers, smooths out cross-border payment processing, and ensures compliance across various jurisdictions - all without the need to bring on a huge team of document reviewers.

9. Predictive Risk Analysis for Investments

Startups often tackle compliance only after problems arise, but AI flips this script. By continuously scanning both external data and internal risk indicators, AI predicts potential compliance issues before they escalate. This shift from reacting to anticipating gives founders a valuable edge when navigating investments in unfamiliar markets. It’s a game-changer for making well-informed decisions.

AI-powered predictive analytics shines a light on risks that might otherwise stay hidden. It can identify specific clients, suppliers, locations, or transactions that pose higher compliance challenges. As PwC puts it:

"Think of this input as a flashlight (versus a control) to help you uncover potential problems not on your radar."

Rather than relying solely on static, interview-based risk assessments, startups can now monitor risk signals in real time, staying ahead of potential issues.

One standout application is the concept of a virtual regulator. Before stepping into a new market, AI can analyze past regulatory decisions to evaluate your business plans. This lets you test your strategies early, helping to avoid costly compliance missteps and wasted resources.

AI also enables scenario planning through synthetic data generation. By creating realistic datasets, it can simulate the effects of geopolitical shifts or policy changes. This capability is especially crucial for startups operating in fast-changing environments.

Predictive risk analysis redefines compliance. It’s no longer just a reactive expense but a strategic tool. By uncovering risks early and modeling different scenarios, startups can make quicker, smarter investment choices while steering clear of regulatory pitfalls.

10. Investor-Ready Compliance Reports

AI takes compliance reporting to a whole new level, making it a game-changer for startups navigating cross-border operations. When you're seeking funding or preparing for due diligence, investors expect clear evidence that your operations meet regulatory standards. Traditional methods of creating compliance reports are time-consuming and prone to delays, often leaving companies scrambling to meet deadlines. AI flips the script by generating detailed, audit-ready compliance reports instantly, aligning with both investor expectations and regulatory demands across multiple regions.

With AI-driven tools, real-time data from your transactions, risk assessments, and screening processes are seamlessly compiled into comprehensive reports. These systems are designed to meet the regulatory requirements of various jurisdictions, allowing startups to create standardized documentation without starting from scratch for each market. This not only saves time but ensures consistency and accuracy across all reports.

The benefits for fundraising are hard to overstate. For example, JPMorgan Chase's AI initiatives have demonstrated how reducing false positives can lead to more precise reporting, directly aiding investor due diligence. When your compliance reports are always up-to-date and ready to share, you cut down on last-minute chaos, speed up decision-making, and build trust with potential investors.

AI also simplifies the complexities of multi-jurisdictional compliance. Instead of juggling separate reports for each country, AI generates unified documents that address all relevant regulations simultaneously. This real-time, automated reporting ensures continuous transparency, a feature especially valuable for fintech startups or companies managing intricate international operations.

Having compliance reports ready at a moment’s notice transforms due diligence into a strategic advantage. It’s not just about ticking regulatory boxes - it's about showcasing operational excellence and a proactive approach to risk management, qualities that resonate with savvy investors. This capability is a cornerstone of how companies like Lucid Financials leverage AI to streamline compliance and build investor confidence.

How Lucid Financials Uses AI for Startup Cross-Border Compliance

Lucid Financials integrates AI compliance tools directly into your existing workflows, making cross-border operations smoother and more efficient. Real-time access to your financial records is essential, and Lucid's AI steps up by scanning and extracting key data from compliance documents automatically. This eliminates the need for tedious manual reviews, reduces errors in financial records, and ensures your books are always clean and audit-ready - all while supporting scalable, real-time compliance.

Beyond data extraction, Lucid simplifies daily compliance tasks with its Slack integration. Founders can easily ask for transaction statuses, risk assessments, or financial data and get instant responses from Lucid's AI. Need deeper insights? The human finance team is just a message away, seamlessly stepping in through the same channel. This approach keeps everything under continuous oversight without adding unnecessary distractions.

Lucid’s seven-day book cleanup feature uses AI to automate transaction matching and reconciliation across multiple entities and currencies. This rapid transaction matching enables quick generation of compliance reports, whether for due diligence or regulatory inquiries. The AI takes care of enforcing policies and preparing for audits, giving you real-time oversight and reducing the risk of compliance violations.

The platform also offers investor-ready reporting on demand, extending its capabilities to compliance documentation. With just one click, Lucid generates board-ready compliance reports that reflect up-to-date operations thanks to real-time financial data updates. No more scrambling to compile last-minute reports.

What truly sets Lucid apart is its blend of advanced automation and human expertise. While AI accelerates tasks like document verification and risk assessment, experienced professionals ensure every output meets regulatory standards, maintaining both efficiency and precision.

Conclusion

AI is reshaping the way startups tackle cross-border compliance. What once required large teams and weeks of manual effort can now be handled in real time, with significantly lower costs. This isn't some distant vision - it's happening today, as AI tools streamline compliance processes across borders. The result? Startups can channel their energy into growth instead of getting bogged down by regulatory challenges.

For startups, speed and cost-efficiency are crucial. AI slashes compliance costs while accelerating tasks like transaction processing, document verification, and regulatory tracking. It also scales effortlessly, managing multiple currencies and jurisdictions as businesses expand, all without the need to grow headcount.

As compliance becomes more seamless, the right platform can combine automation with reliability. Tools like Lucid Financials’ AI take on the heavy lifting in bookkeeping and compliance, while experts ensure every detail is accurate. With Lucid, you’ll have clean books in just seven days, real-time updates via Slack, and investor-ready reports whenever you need them.

Delaying compliance in global markets can introduce unnecessary risks. Startups excelling in these markets are already leveraging AI-powered platforms to make compliance faster, more affordable, and scalable. Lucid offers this advantage without the complexity or expense of traditional methods. By embracing AI-driven compliance, you can position your business for global growth.

Set up a compliance system that accelerates growth instead of holding it back.

FAQs

How can AI help startups save money on global compliance costs?

AI offers startups a powerful way to cut compliance costs by automating tedious tasks like monitoring real-time regulatory updates and analyzing rules across different jurisdictions. With tools powered by natural language processing (NLP), AI can produce precise reports in a fraction of the time, slashing expenses by 30–50% and cutting reporting time by as much as 80%.

By taking over manual processes, AI not only reduces the chance of errors and fraud but also gives startups peace of mind about staying compliant. Plus, it frees up valuable resources, allowing teams to concentrate on scaling their business.

How does AI help prevent cross-border fraud for startups?

AI has transformed fraud prevention in cross-border transactions, boosting detection accuracy by up to 60%. With real-time monitoring, it allows startups to spot suspicious activities swiftly while cutting down on false alarms.

On top of that, AI streamlines compliance by automating intricate processes, reducing both costs and the chances of human error. This means startups can dedicate more energy to scaling their business while keeping fraud prevention and compliance systems strong.

How does AI enhance the speed and accuracy of compliance reporting for startups?

AI makes compliance reporting much easier by taking over tedious tasks like gathering data and creating reports. This can cut reporting time by as much as 80%, potentially saving your team up to 8 hours each week - time that can be redirected toward strategic planning and growth initiatives.

On top of saving time, AI also boosts accuracy. Built-in error-checking and validation tools help reduce manual mistakes, improving reporting precision by around 40%. Plus, with real-time updates on regulatory changes, your startup can stay on top of compliance requirements without breaking a sweat, even as the rules shift.