Managing finances can be a huge challenge for startups. Manual bank reconciliation eats up hours, increases errors, and distracts from growing your business. AI-powered bank reconciliation automates this process, matching transactions quickly and accurately, so you can focus on building your startup.

Key Takeaways:

- Fast and Accurate Matching: AI processes up to 98% of transactions in seconds, reducing manual work.

- Real-Time Updates: Get an up-to-date view of your cash flow anytime, helping you make smarter decisions.

- Error and Fraud Detection: Automatically flags duplicates, missing transactions, or unusual activity.

- Cost Savings: Saves time and reduces the need for extra staff or expensive bookkeeping services.

Example: A small business reduced month-end reconciliation from days to minutes using AI. Tools like Lucid Financials offer solutions starting at $150/month, tailored for startups.

AI reconciliation isn't just faster - it helps you stay on top of your finances without the hassle of spreadsheets or manual reviews.

A.I. Agents for Finance Automation: Automate Bank Reconciliation | 3-Layers Transaction Matching

What is AI Bank Reconciliation?

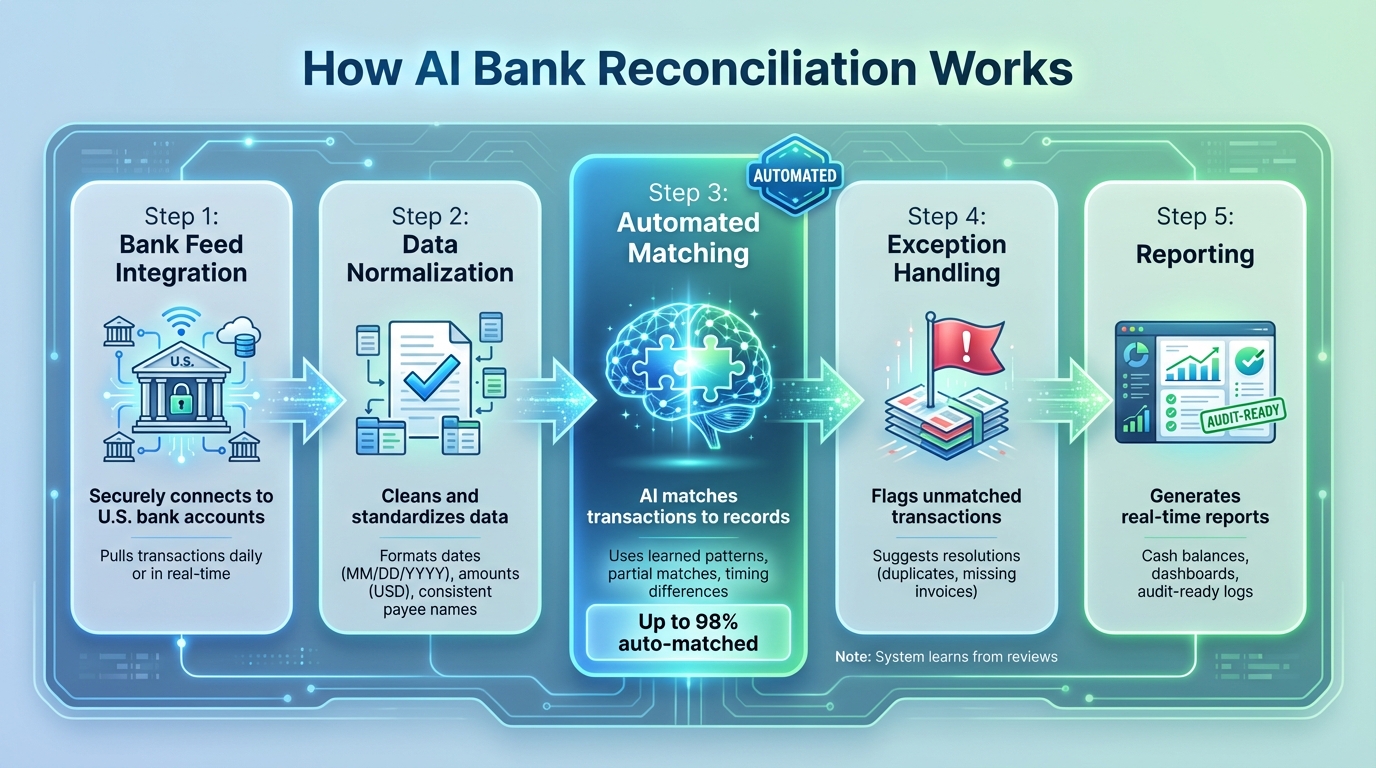

How AI Bank Reconciliation Works: 5-Step Automated Process

AI bank reconciliation leverages artificial intelligence and machine learning to automatically match bank transactions from live feeds or statements with your accounting records. By analyzing historical patterns, transaction descriptions, amounts, and dates, the system identifies matches and flags only the exceptions for human review. For startup founders, this means your records can be updated in minutes - no manual data entry required.

Traditional reconciliation methods rely on rigid rules that often fail when vendors tweak payment descriptions or when timing differences occur. AI, on the other hand, adapts. For example, it can recognize that "GOOGLE*Cloud" and "Google Cloud Platform" refer to the same vendor, account for minor timing lags between credit card settlements and ledger entries, and improve its accuracy over time as it processes more transactions.

How It Works

AI bank reconciliation simplifies even the most complex transactions through a series of automated steps:

- Bank Feed Integration: The system securely connects to your U.S. bank accounts, pulling in new transactions daily or in real time.

- Data Normalization: Incoming data is cleaned and standardized - dates are formatted as MM/DD/YYYY, amounts appear in U.S. dollars, and payee names are consistent.

- Automated Matching: The AI compares each bank transaction to open invoices, bills, or journal entries. It uses learned patterns, like partial description matches and timing differences, to automatically match most transactions.

- Exception Handling: When the system encounters transactions it can’t confidently match - like a new SaaS subscription - it flags them for review. It might suggest, for instance, "possible duplicate" or "likely missing invoice." Over time, these reviews train the system to handle similar cases more accurately in the future.

- Reporting: Once reconciled, the tool generates up-to-date cash balances, dashboards, and audit-ready logs that detail every matched item and when it was processed.

Why Startups Need It

Startups deal with unique challenges that make AI reconciliation a game-changer. High transaction volumes combined with small teams can make manual reconciliation a logistical nightmare. Think frequent card charges, online subscriptions, or payouts from payment processors - all piling up quickly.

Manual reconciliation also struggles with inconsistent transaction descriptions and varying formats across payment platforms, which increases the risk of errors. And as your business grows, so do your transactions, making manual processes unsustainable without hiring more staff. AI tools can handle thousands - or even millions - of transactions in just minutes.

For early-stage startups with limited oversight, AI’s anomaly detection feature is another huge plus. It can flag unusual or unauthorized transactions early, preventing small issues from snowballing into major problems.

Key Benefits of AI Bank Reconciliation for Startups

Real-Time Financial Visibility

AI-powered reconciliation tools work continuously, pulling in data from bank feeds and ledgers to match transactions almost instantly. Instead of waiting for the month-end close, you get an up-to-date snapshot of your cash balance, burn rate, and accounts receivable. This real-time insight helps you make smarter decisions - like whether to move forward with a $50,000 ad campaign - by verifying your cash flow and incoming payments to avoid overspending.

These systems can process millions of transactions in just minutes, keeping your cash position updated throughout the day. They also highlight trends and anomalies, such as an unexpected increase in refunds or delayed customer payments. This allows you to fine-tune cash flow forecasts and stretch your runway. With this level of clarity, you can pivot quickly - adjusting budgets, renegotiating payment terms, or reallocating resources in days rather than weeks. Plus, this constant monitoring lays the groundwork for better error detection and overall financial security.

Error Reduction and Fraud Detection

Automated transaction matching slashes the risk of common errors, like mis-keyed amounts, duplicate entries, overlooked fees, or incorrectly categorized transactions. For startups handling thousands of card payments each month, AI can match over 90% of transactions within seconds. This leaves only a small number of exceptions for human review, significantly reducing the error rate compared to manual reconciliation using spreadsheets.

AI doesn’t stop at reducing errors - it actively scans for irregularities. It flags anything unusual, like unexpected vendor payments, repeated small charges to unknown merchants, out-of-hours transactions, or sudden spikes in activity. This constant vigilance helps catch potential fraud, internal misuse, or billing mistakes early, giving you the chance to act fast - whether that means freezing a card or disputing a suspicious charge.

Time and Cost Savings

Manual reconciliation can eat up 10–20 hours a month, especially as transaction volumes grow across multiple bank accounts and payment platforms. AI tools streamline the process by automatically importing bank feeds, matching most transactions, and flagging only the exceptions for review. In fact, these systems can match up to 98% of high-volume transactions automatically, freeing up your team to focus on higher-value tasks.

The time saved translates directly into cost savings. With AI handling reconciliation, you may not need to hire additional staff or rely on expensive outsourced bookkeeping services. It also reduces financial losses from missed invoices, duplicate payments, or undetected fraudulent charges - issues that can add up quickly for startups operating on tight budgets. Over time, the improved accuracy and real-time updates can lower audit and tax prep costs while helping you avoid penalties from filing errors or late submissions.

How to Implement AI Bank Reconciliation in Your Startup

Select the Right Platform

Start by choosing a platform built with startups in mind - one that offers automated transaction matching and real-time dashboards. It should integrate effortlessly with your bank accounts and accounting software, while also learning from your historical data to improve accuracy over time. This eliminates the need to manually create complex rule sets.

For example, Lucid Financials combines AI-powered bank reconciliation with a suite of accounting services, including bookkeeping, tax filings, tax credits, and CFO support - all in one package. They promise clean books within seven days and offer pricing that starts at $150 per month, making it accessible for startups. Plus, it integrates directly with Slack, providing 24/7 support and instant access to investor-ready reports whenever needed.

Once you've selected a platform, the next step is connecting your financial data sources.

Set Up Data Integration

Securely link your U.S. bank accounts, payment processors like Stripe or PayPal, and accounting software such as QuickBooks using APIs. These integrations automatically import and standardize transaction data, ensuring it aligns with U.S. banking standards. This setup also simplifies handling multi-currency transactions by converting them into proper USD formats, like $1,234.56.

To start, focus on a pilot integration with your most active account - usually your primary checking account. This allows you to test the system’s accuracy and resolve any formatting issues between your bank and accounting software before scaling up.

Once your data is flowing smoothly, the focus shifts to monitoring and improving AI performance.

Monitor and Refine AI Performance

Keep an eye on AI-generated exceptions and provide prompt feedback, especially for unique cases like investor wire transfers or intercompany payments. This feedback helps the system adapt to your startup’s specific transaction patterns.

Leverage real-time dashboards to track reconciliation progress and identify trends. Weekly reviews of matching rules, guided by feedback from your team, can fine-tune the system. For complex scenarios that require context beyond the AI’s capabilities, maintain human oversight. Over time, these refinements reduce the number of manual exceptions, allowing your team to focus on strategic financial planning rather than tedious data entry tasks.

sbb-itb-17e8ec9

Best Practices for AI Bank Reconciliation

To make the most of AI-driven reconciliation, it's important to combine automation with thoughtful human oversight. Here’s how to strike that balance effectively.

Start with High-Volume Accounts

Begin by focusing on accounts with a high volume of transactions - like your Stripe or PayPal feeds, or a primary checking account that processes hundreds of daily deposits. Accounts handling over 500 transactions per week are ideal for training the AI to recognize recurring patterns, such as vendor payments, customer refunds, or intercompany transfers. This method ensures the system becomes proficient with common transaction types before tackling less active accounts.

This approach also allows you to spot potential issues early, such as sudden drops in match rates or unexpected spikes in exceptions. By addressing these problems upfront, you can refine the system before rolling it out more broadly. For example, one global manufacturer applied this strategy across more than 50 bank accounts, achieving real-time reconciliation and completely eliminating end-of-month bottlenecks.

Once these high-volume accounts are running smoothly, shift your focus to human review for handling complex or flagged transactions.

Maintain Human Oversight

Even with advanced automation, human review plays a crucial role in managing exceptions. While AI can handle the bulk of the workload, flagged issues - like anomalies, duplicate entries, or multi-currency mismatches - still require a human touch. Start by reviewing all flagged items, and over time, narrow your focus to high-risk areas, such as fraud alerts or uncleared deposits exceeding $10,000.

Think of the AI's suggested resolutions as a helpful starting point, but always apply your judgment to ensure accuracy. This approach not only maintains a clear audit trail but also allows your team to shift their focus from routine data entry to more strategic tasks.

Use Real-Time Reconciliation

Move away from monthly reconciliation batches and adopt continuous, real-time processing. This shift provides instant visibility into your cash position, allowing you to monitor balances and cash flow in real time. Real-time reconciliation can dramatically shorten financial close cycles - from weeks to mere minutes - offering the agility needed to navigate periods of rapid growth.

Lucid Financials: AI Bank Reconciliation Built for Startups

Lucid Financials takes the benefits of AI reconciliation and packages them into a solution designed specifically for startups, simplifying financial management in a way that’s both efficient and accessible.

This platform offers a full-suite accounting service powered by AI, combining bookkeeping, tax services, tax credit assistance, and CFO-level insights - all in one place. It even integrates with Slack, making it easy to get real-time answers to your financial questions.

Key Features for Startups

Lucid Financials stands out by delivering accurate, up-to-date books within just seven days. The platform uses automated transaction matching across your bank accounts and can generate investor-ready reports on demand. Transactions are processed in real time, with the AI flagging anomalies or duplicates for human review. This means you’re always ready for fundraising, board meetings, or due diligence without the last-minute scramble.

"Lucid turned our bookkeeping and taxes from a headache into a simple, reliable process. Their CFO insights give us clarity to plan growth with confidence - it feels like having a full finance team on demand."

- Aviv Farhi, Founder and CEO at Showcase

How Lucid Financials Simplifies Reconciliation

Lucid’s reconciliation process is built for speed and accuracy. By integrating directly with your bank feeds, the platform continuously matches transactions while identifying errors, duplicates, and potential fraud risks. This eliminates the need for tedious manual reviews. For businesses with high transaction volumes, Lucid’s AI learns recurring patterns, reducing manual involvement by up to 90%. Any flagged exceptions are reviewed by financial experts, ensuring nothing slips through the cracks.

"With Lucid, managing bookkeeping, taxes, and claiming tax credits is effortless. The platform saves us hours every month, and their expert team makes sure nothing slips through the cracks."

- Refael Shamir, Founder and CEO at Letos

This blend of advanced AI and professional oversight ensures reconciliation is not only fast but also compliant. By removing inefficiencies, the platform enables startups to focus on growth, all while keeping costs manageable.

Transparent Pricing Tailored for Startups

Lucid Financials offers straightforward pricing designed with startups in mind. Plans start at $150 per month, with no hidden fees or hourly charges. This flat rate includes everything: AI-powered reconciliation, bookkeeping, monthly financial close, reporting, and real-time Slack support. As your business grows, Lucid scales with you, offering services like multi-entity support, tax assistance, and CFO-level forecasting - all without the expense of hiring additional in-house finance staff.

Conclusion

AI-powered bank reconciliation offers startups an incredible opportunity to streamline their financial operations with unmatched speed and accuracy. It delivers instant insights that enable quicker, more informed decisions about cash flow, hiring, and growth strategies.

By automating manual processes and reducing the risk of human error, startups can operate with greater efficiency and focus on what truly matters - driving their business forward. The transition from manual, error-prone reconciliation to AI-driven automation transforms how finances are managed. No more tedious data entry or stressful month-end reconciliations. Instead, AI takes care of matching transactions, identifying anomalies, and spotting potential fraud risks, freeing up your team to concentrate on strategic initiatives.

This approach not only reduces costs and errors but also scales effortlessly as your business grows. The real question isn’t whether AI can improve your reconciliation process - it’s how soon you’ll embrace it to gain the efficiency and competitive advantage your startup needs.

Lucid Financials combines all these benefits into one platform designed specifically for startups. With features like clean books delivered in just seven days, real-time Slack support, and investor-ready reporting on demand, it’s a comprehensive solution that ensures speed, accuracy, and clarity. Starting at $150 per month, Lucid Financials gives you the tools to maintain accurate, compliant financial records while focusing on scaling your business.

Now is the time to embrace AI reconciliation and lay a solid financial foundation for sustainable growth.

FAQs

How does AI make bank reconciliation more accurate for startups?

AI simplifies bank reconciliation for startups by automating transaction matching, cutting down on human errors and saving valuable time. It works by cross-referencing bank statements with accounting records in real time, allowing discrepancies to be flagged and addressed promptly.

This technology ensures startups maintain accurate, current financial records, keeping them prepared for investors and compliant - without the burden of manual reconciliation.

How does AI-powered bank reconciliation help startups save money?

AI-driven bank reconciliation streamlines the tedious process of matching transactions, cutting down on the hours spent manually cross-checking records. By automating this task, startups can reduce labor costs and avoid expensive errors that could lead to delays or financial missteps. With quicker and more precise reconciliation, businesses can allocate their time and resources toward scaling operations and maintaining smooth, efficient financial management.

How does AI-powered bank reconciliation uncover errors and fraud?

AI-powered bank reconciliation simplifies the process of spotting errors and uncovering potential fraud by automatically aligning transactions from your bank statements with your accounting records. It swiftly identifies discrepancies, such as missing or duplicate entries, and brings unusual activities to your attention for further review.

This system operates in real time, enabling you to resolve issues quickly and keep your financial records accurate. By automating these tasks, startups can save valuable time, minimize manual mistakes, and maintain trust in the accuracy of their financial data.