AI anomaly detection is transforming finance by identifying outliers and irregularities in real-time, far surpassing outdated rule-based systems. Here's why it matters:

- Fraud Prevention: AI flags suspicious transactions instantly, such as unusual vendor details or "impossible travel" scenarios. In 2024, the US Treasury recovered $1 billion in check fraud using machine learning.

- Compliance Monitoring: AI reduces false positives in anti-money laundering (AML) processes, cutting alerts by up to 65% while maintaining accuracy.

- Operational Efficiency: It automates reconciliation, audit preparation, and compliance, saving time and resources.

- Predictive Insights: AI forecasts risks, detects patterns like sequential invoices, and prevents errors in cash flow management.

With 85% of financial firms already using AI, its role in fraud detection, compliance, and risk management is reshaping financial operations. The global anomaly detection market is projected to grow to $14.59 billion by 2030, driving smarter, faster financial decisions.

3.2 AI for Fraud & Anomaly Detection

sbb-itb-17e8ec9

Fraud Prevention in Financial Transactions

AI-driven anomaly detection has completely reshaped how financial institutions identify fraud, moving beyond the limitations of static rules. Instead of taking weeks to uncover fraudulent activity during reconciliation, these systems can flag suspicious transactions in milliseconds - sometimes stopping fraud before funds even leave an account.

Real-Time Fraud Detection

Modern AI tools integrate behavioral analytics, geolocation, and device fingerprinting to create detailed profiles of normal activity for users, vendors, and departments. For example, American Express implemented advanced long short-term memory (LSTM) models to analyze transaction patterns, leading to a 6% improvement in fraud detection across the $1.2 trillion spent annually on its network. As American Express explains:

"Our fraud algorithms monitor, in real time, every American Express transaction around the world for more than $1.2 trillion spent annually, and we generate fraud decisions in mere milliseconds."

PayPal has also seen success, improving real-time fraud detection by 10% with continuous AI monitoring. Their system evaluates hundreds of factors simultaneously, including transaction frequency, IP addresses, device metadata, and even the time difference between a user's device clock and Coordinated Universal Time (UTC). This last detail can expose attempts to disguise a user's true location.

Geolocation monitoring plays a key role in detecting "impossible travel" scenarios. For instance, if a corporate card is used in New York at 9:00 AM and then in London at 9:15 AM, the system flags the activity as physically impossible. Similarly, if a payment request originates from an unfamiliar IP address that doesn’t align with an employee’s usual home or workplace data, it triggers an alert.

The sheer scale of data processed by platforms like Stripe further strengthens fraud detection. Stripe handles transactions from 90% of cards that have been used more than once on its network, giving its AI a robust dataset for identifying risks. If a fraud pattern emerges for one merchant, the system can quickly identify similar patterns among other merchants using merchant embeddings, even across different regions.

Fraud Case Study Examples

AI also excels at identifying more complex schemes like business email compromise (BEC) scams and duplicate invoice fraud. For instance, a mid-sized SaaS company using Zenstatement’s anomaly detection system flagged a fraudulent vendor bank update before any money was lost. The AI recognized the request as suspicious because it arrived outside of business hours and the beneficiary account metadata didn’t match the supplier’s historical records. Without this intervention, the fraud might have gone unnoticed until reconciliation weeks later - after the funds were irretrievable.

Organizations that adopt AI-based fraud controls report significant improvements, with reductions of 30% to 50% in undetected invoice fraud and duplicate payments. Unlike traditional systems that might flag a $50,000 invoice simply for exceeding a set threshold, AI can differentiate between routine transactions and anomalies. For example, a $50,000 invoice from a trusted supplier during normal business hours may not raise concerns, but a $15,000 invoice from the same supplier tied to a new bank account could signal fraud.

These advancements in fraud detection are also laying the groundwork for more effective compliance and regulatory monitoring systems.

Compliance and Regulatory Processes

AI-powered anomaly detection is revolutionizing anti-money laundering (AML) and know-your-customer (KYC) compliance. In the U.S. alone, banks spend around $25 billion annually on AML processes, yet traditional rule-based systems often fall short, with false positive rates reaching a staggering 95%. This inefficiency not only drains resources but also leaves room for sophisticated criminals to evade detection.

Automating Compliance Monitoring

AI shifts compliance from periodic checks to continuous, real-time monitoring. Instead of relying on rigid thresholds, machine learning builds behavioral baselines tailored to each customer or entity. By understanding what "normal" looks like, the system flags unusual patterns that could signal money laundering.

For example, in 2024, a major multinational bank partnered with Oracle to deploy AI models for AML. In just six weeks, the system reduced alerts by 45% to 65% while still capturing 99% of suspicious activity reports previously identified by their rule-based system. This dramatic drop in false positives allowed compliance teams to focus their attention on genuine risks.

AI also supports "perpetual KYC", continuously updating risk profiles by monitoring transactions against sanctions lists, tracking changes in beneficial ownership, and scanning adverse media coverage. Instead of relying on annual manual reviews, the system ensures real-time updates. In 2024, financial institutions worldwide invested over $3.6 billion in AI-driven compliance technologies, with 30% of Nordic banks already using AI for transaction monitoring and 75% planning additional investments.

This real-time monitoring not only improves compliance but also simplifies audits, saving time and resources.

AI-Driven Audit Preparation

AI streamlines audits by reviewing every transaction - eliminating the need for manual sampling. It flags anomalies like duplicate invoices, missing approvals, or unusual journal entries, while also creating tamper-proof audit trails to document decision-making processes. Agentic GenAI, for instance, accelerates audit preparation by 40% and reduces compliance costs by 30%.

Generative AI further enhances efficiency by drafting detailed suspicious activity report (SAR) narratives. Explainable AI tools like SHAP and LIME ensure transparency by clarifying why specific transactions are flagged. This reduces the manual workload for regulatory filings while meeting the strict documentation standards required by agencies such as FinCEN and the OCC.

Risk Management and Predictive Insights

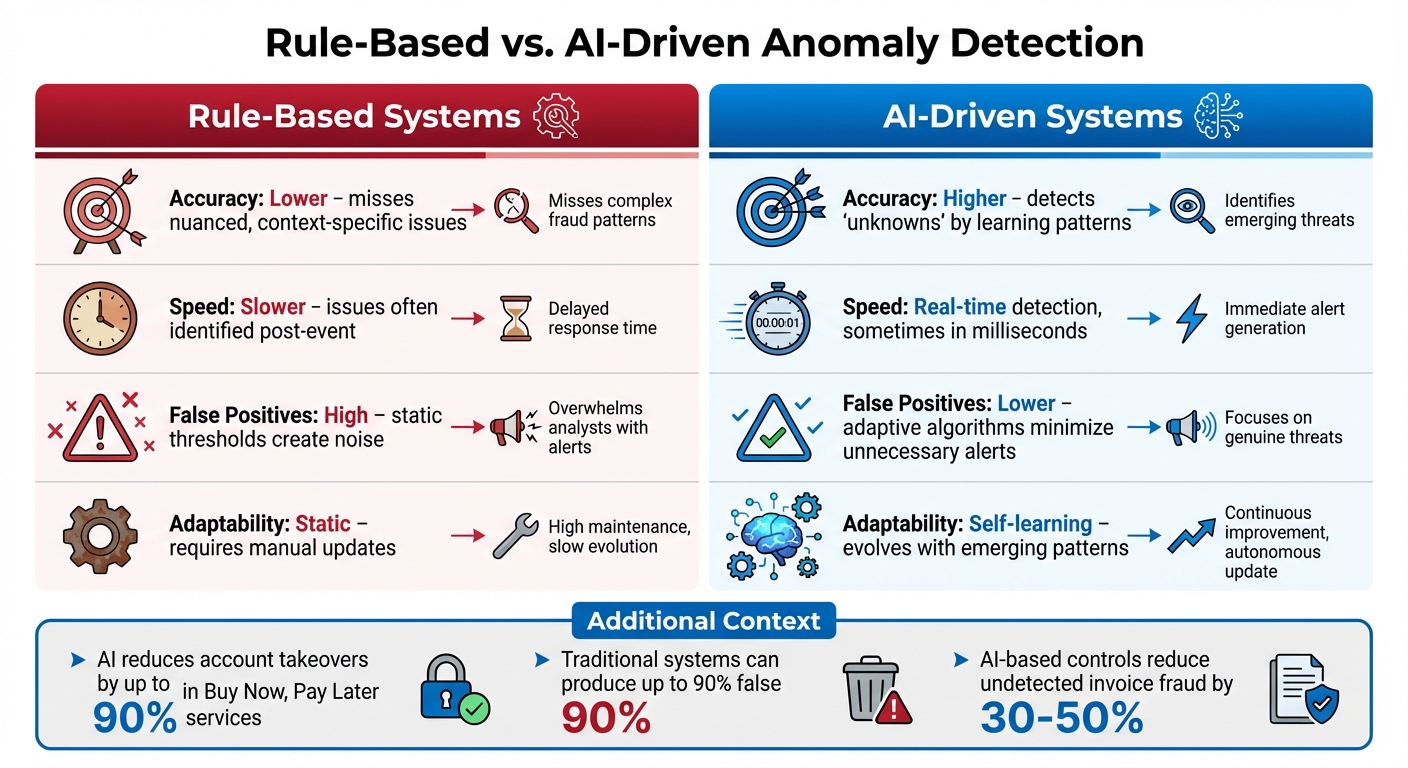

Rule-Based vs AI-Driven Anomaly Detection Systems in Finance

AI has transformed risk management by introducing predictive insights that go beyond traditional fraud detection and compliance measures. Unlike static systems that may flag issues weeks after they occur, AI identifies potential problems in real time. Instead of relying on rigid rules - like flagging any invoice over $50,000 - AI develops behavioral baselines by analyzing what’s typical for specific times, departments, and vendors. This allows it to catch subtle anomalies that static systems often overlook, such as sequential invoices with slight differences or transactions happening outside normal business hours. This shift highlights the contrast between rule-based systems and AI-driven models.

Rule-Based vs. AI Systems

The contrast between traditional rule-based methods and AI-powered systems is stark. Rule-based approaches depend on fixed thresholds, which often result in high false positive rates. For instance, a $60,000 invoice might be completely normal in one scenario but suspicious in another. AI systems, on the other hand, adapt by learning trends - such as seasonal fluctuations - and dynamically adjusting their sensitivity.

| Feature | Rule-Based Systems | AI-Driven Systems |

|---|---|---|

| Accuracy | Lower; misses nuanced, context-specific issues | Higher; detects "unknowns" by learning patterns |

| Speed | Slower; issues often identified post-event | Real-time detection, sometimes in milliseconds |

| False Positives | High; static thresholds create noise | Lower; adaptive algorithms minimize unnecessary alerts |

| Adaptability | Static; requires manual updates | Self-learning; evolves with emerging patterns |

AI-powered solutions significantly enhance risk management by improving the detection of irregularities, such as vendor payment anomalies and expense reimbursement issues. For instance, in Buy Now, Pay Later services, AI has reduced account takeovers by as much as 90%.

Building on these capabilities, AI also excels in offering predictive insights to mitigate future risks.

Predictive Risk Models

AI doesn’t just detect current anomalies - it forecasts potential risks by integrating real-time data, historical patterns, and metadata. By combining diverse data streams, such as network activity and financial transactions, AI identifies potential anomalies before they escalate into significant issues. For example, it can monitor network traffic to detect unauthorized data transfers or breach attempts. In cash flow management, AI identifies mismatched debits, out-of-sequence payments, or incorrect postings, reducing the need for last-minute reconciliations. One company reported a 35% improvement in detection accuracy after consolidating regional ERP data into a unified system.

Applications in Accounting and Treasury Operations

AI anomaly detection has shifted accounting and treasury operations from being reactive to proactive, allowing finance teams to address issues as they arise rather than after the fact. This approach not only prevents month-end surprises but also ensures real-time oversight, which is particularly beneficial for startups and rapidly growing companies. With instant alerts identifying critical discrepancies, teams can tackle problems before they escalate.

Real-Time Alerts for Financial Irregularities

AI systems are adept at spotting cash flow issues and reconciliation problems as they happen. They can detect unmatched transactions, unauthorized account activity, out-of-sequence payment batches, and entries posted to incorrect cost centers. For instance, if a vendor unexpectedly changes their bank account or submits an invoice outside normal business hours, the system flags it immediately - no waiting for an audit.

These AI tools integrate with platforms like Slack or Microsoft Teams to deliver real-time alerts. Imagine an expense report showing a fuel charge far above the usual amount or duplicate receipts appearing across different reports - finance teams get notified instantly. These alerts come with clear explanations, making it easier to identify suspicious activity and reduce risks like invoice fraud or duplicate payments.

Startup Financial Planning

AI doesn’t just catch errors; it also supports strategic financial planning, which is critical for startups and high-growth companies. Accurate, real-time data is essential for forecasting cash runway and preparing investor reports, and AI ensures that errors don’t distort these vital numbers.

For example, automated matching engines can instantly link payments to invoices, removing the need for manual reconciliation. One multinational logistics company consolidated payment data from multiple regional systems into one unified platform, achieving a 35% boost in detection accuracy. This level of precision eliminates the chaotic "reconciliation fire drills" that can disrupt planning efforts.

AI also excels at spotting subtle errors that manual reviews might overlook. For example, recording revenue in dollars instead of thousands could skew profit margins or tax filings. By analyzing historical data, AI establishes behavioral norms for departments, vendors, and time periods, flagging deviations without relying on fixed thresholds that often trigger false alarms. Companies using these tools have reported a 30% improvement in anomaly detection accuracy, allowing them to allocate more resources to growth rather than fixing data errors.

Emerging Use Cases and Trends in 2026

As we look to 2026, financial institutions are taking AI-powered anomaly detection to the next level. Moving beyond basic fraud detection, they are adopting multi-agent AI frameworks, where specialized agents - such as Web Research, Institutional Knowledge, and Cross-Checking agents - collaborate to validate and interpret anomaly alerts. These agents pull data from sources like news reports, press releases, and historical trends, streamlining a process that previously relied heavily on manual intervention. This evolution opens the door for advanced tools like Graph Neural Networks (GNNs), which excel at uncovering hidden fraud networks.

Graph Neural Networks (GNNs) are proving to be game-changers in detecting fraud patterns that traditional systems often miss. By analyzing hidden connections among accounts, vendors, and payment behaviors, GNNs can identify over 600 distinct fraud patterns across various payment channels. Some institutions have reported up to a 90% reduction in account takeovers for Buy Now, Pay Later services. A notable example occurred in early 2024 when a finance worker at a multinational firm in Hong Kong fell victim to a deepfake video call. The scam featured AI-generated versions of the company’s CFO and other staff, leading to 15 fraudulent transactions totaling $25 million before being uncovered.

The concept of adaptive fraud evolution is also reshaping how banks tackle threats. Traditional rule-based systems, which rely on fixed thresholds to flag suspicious transactions, are being replaced by Automated Deep Behavioral Networks (ADBNs). These self-learning systems create real-time, individualized user profiles and adapt instantly to new criminal tactics, eliminating the need for manual rule updates.

AI is also extending its influence into cross-border compliance monitoring. Multi-entity compliance systems are becoming essential for organizations operating internationally. By late 2025, around 30% of Nordic banks had integrated AI into their transaction monitoring processes, with 75% planning further investments. For example, the Danish Business Authority uses AI to analyze over 230,000 financial statement filings annually, flagging fraud and material errors in real time, far outpacing manual reviews. These "RiskOps" platforms ensure consistent risk management across global regions, addressing the blind spots that often result from siloed systems.

To combat synthetic identity fraud, financial institutions are turning to document forensics capable of performing over 500 forgery and tampering checks on digital onboarding documents. When paired with behavioral biometrics - which track typing speed, swipe patterns, and device usage - these tools can quickly identify suspicious activity. Additionally, generative AI is being used to automate the creation of detailed case narratives and Suspicious Activity Reports (SARs), cutting manual workloads by as much as 80% while maintaining compliance with regulatory standards.

Conclusion

AI-driven anomaly detection has become a game-changer in finance. Companies employing AI-based controls have seen a 30–50% drop in undetected invoice fraud and duplicate payments. Meanwhile, the US Treasury Department recovered $1 billion in check fraud during fiscal 2024 using machine learning techniques. With financial fraud costing the global economy over $5 trillion annually, the urgency to adopt advanced solutions has never been greater.

Unlike traditional rule-based systems - which can produce up to 90% false positives - AI takes a proactive approach. It continuously learns and identifies subtle anomalies in real time. Renata Miskell from the US Treasury highlights this advantage:

"Fraudsters are really good at hiding. They're trying to secretly game the system. AI and leveraging data helps us find those hidden patterns and anomalies and work to prevent them."

This shift doesn’t just combat fraud; it also improves everyday financial operations, creating a more resilient and efficient framework.

AI’s impact extends far beyond fraud detection. For companies experiencing growth, AI simplifies compliance monitoring and slashes manual tasks by as much as 80%, all while scaling effortlessly to handle increasing transaction volumes. It transforms finance from a reactive, backward-looking function into a forward-thinking strategic asset. Businesses gain real-time insights into cash flow, runway, and risk exposure, empowering them to make smarter decisions.

To maximize these benefits, it’s crucial to choose tools that combine intelligent automation with human expertise. For example, Lucid Financials offers a comprehensive platform that merges AI-driven bookkeeping, tax services, and CFO support. It promises clean books in just seven days, on-demand investor-ready reports, and real-time alerts for financial irregularities - all paired with Slack-based support from seasoned professionals.

Adopting AI-powered financial tools isn’t just about keeping up - it’s about staying ahead. These solutions ensure businesses remain competitive, compliant, and in full control of their financial future.

FAQs

How does AI anomaly detection help prevent financial fraud?

AI-powered anomaly detection plays a critical role in preventing financial fraud by examining extensive datasets in real-time to spot irregular patterns or deviations that could signal fraudulent behavior. This technology enhances precision, minimizes false alarms, and speeds up the process of identifying potential threats.

With AI, companies can tackle risks head-on, simplify compliance processes, and protect the reliability of their financial systems. This approach not only conserves time and resources but also strengthens stakeholder confidence by securing sensitive financial information.

What advantages does AI offer for compliance monitoring compared to traditional methods?

AI has transformed compliance monitoring by processing enormous data sets in real time and spotting intricate anomalies that older, rule-based systems might overlook. This means fewer false alarms and a sharper, more efficient way to detect potential fraud or regulatory concerns.

With AI, businesses can simplify compliance workflows, cut down on manual tasks, and keep pace with ever-changing regulations. The result? Time savings and stronger trust in financial reporting and legal compliance.

How does AI help manage financial risks with predictive insights?

AI is transforming how financial operations handle risk by leveraging machine learning to spot anomalies, identify patterns, and analyze data in real-time. These systems can sift through massive amounts of financial data to flag irregularities - like unexpected transactions or behavior that deviates from the norm - that could indicate risks such as fraud, compliance breaches, or operational mistakes.

By analyzing historical data, AI tools can also anticipate potential risks, giving businesses the chance to address issues before they escalate. On top of that, real-time monitoring and alerts enable organizations to react swiftly to emerging threats, minimizing losses and maintaining compliance. This efficient, data-driven approach not only improves decision-making but also reinforces financial risk management strategies.